1040 Line 30 Worksheet

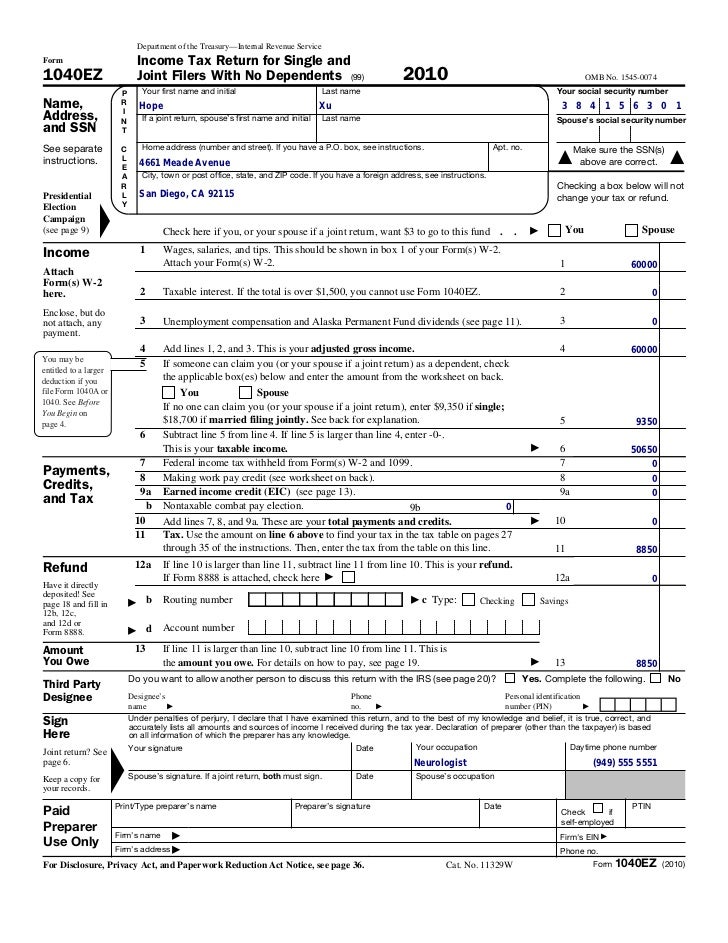

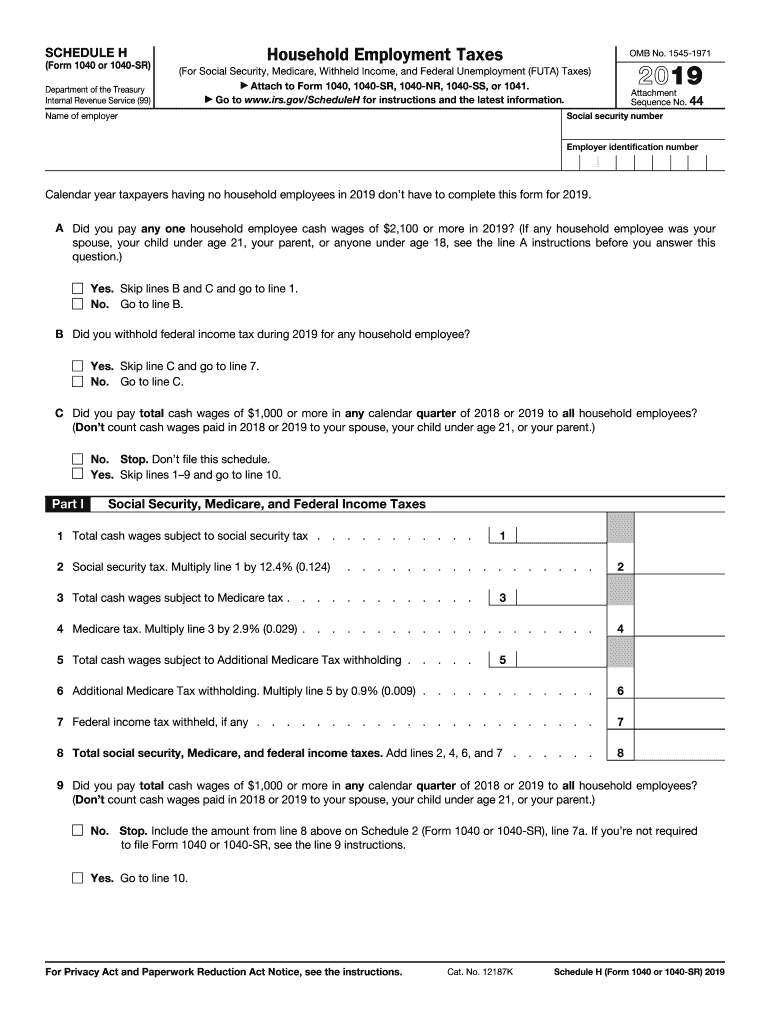

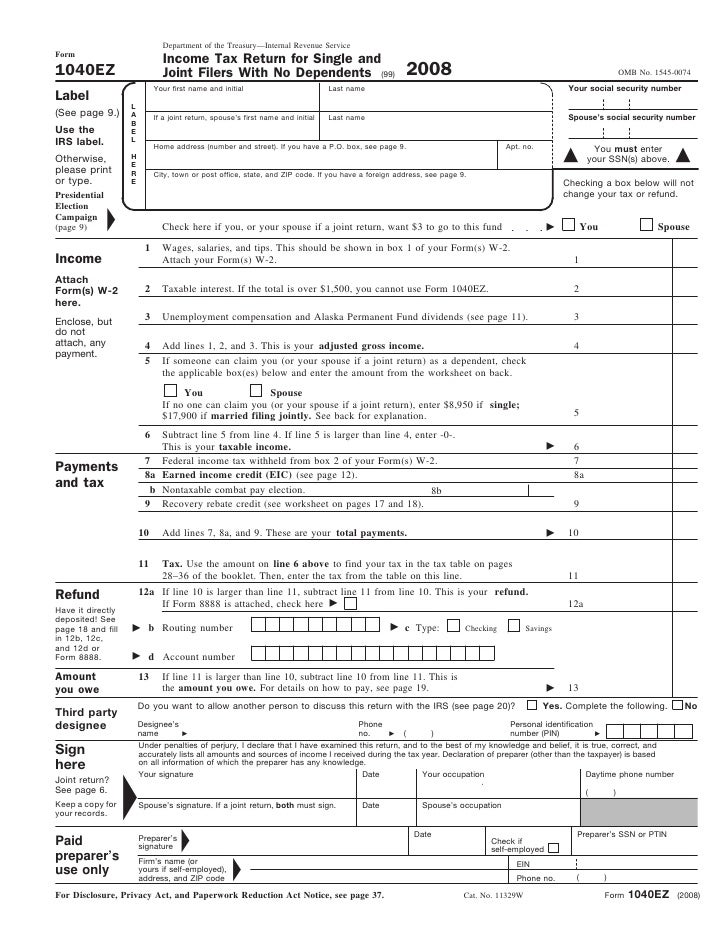

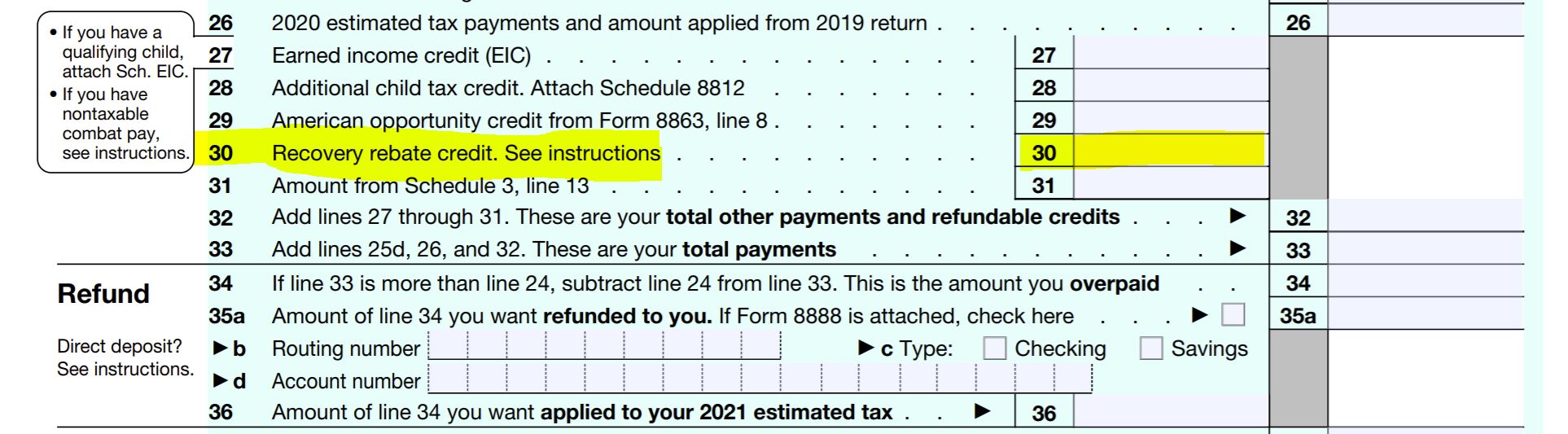

1040 Line 30 Worksheet - This is a math pdf printable activity sheet with several exercises. Web line 10 on the 940 states: Web method worksheet in the instructions to figure the amount to enter on line 30. Web number line 30 to 40 worksheet for kindergarten children. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. If some of the taxable futa wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax. Web if yes is your answer to the above question, enter zero on line 3 and continue to line 4. Look for line 30 on your 1040 tax form. Else use the format given below to calculate the value for line 3. Web this video demonstrates how to enter the recovery rebate credit for form 1040 line 30, how to view the recovery rebate credit worksheet, and how to. Web to determine whether you are an eligible individual or the amount of your recovery rebate credit, complete the recovery rebate credit worksheet in the. Subtract line 30 from line 29. You will record the amount. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020.. It has an answer key attached on the. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. Web the credit will be reported on form 1040, schedule 3, line 30. Web see the instructions for line 30, form 1040, to find out if the taxpayer. Web if yes is your answer to the above question, enter zero on line 3 and continue to line 4. Subtract line 30 from line 29. It has an answer key attached on the. Web see the instructions for line 30, form 1040, to find out if the taxpayer can take this credit and for definitions and other information needed. Look for line 30 on your 1040 tax form. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. Web method worksheet in the instructions to figure the amount to enter on line 30. • if a profit, enter on both. Web to determine whether you. Call the irs first if you owe and can’t pay your tax bill. Web the credit will be reported on form 1040, schedule 3, line 30. Worksheets are 2021 instruction 1040, 33 of 117, 2021 instructions for schedule 8812,. Web line 10 on the 940 states: Web see the instructions for line 30, form 1040, to find out if the. Call the irs first if you owe and can’t pay your tax bill. Web line 30 of the form 1040 is calculated based on entries the taxpayer has entered for the amounts received for eip1 (economic impact payment #1) and eip2. Web to determine whether you are an eligible individual or the amount of your recovery rebate credit, complete the. Web method worksheet in the instructions to figure the amount to enter on line 30. Worksheets are 2021 instruction 1040, 33 of 117, 2021 instructions for schedule 8812,. Web see the instructions for line 30, form 1040, to find out if the taxpayer can take this credit and for definitions and other information needed to fill out this. Web the. Web see the instructions for line 30, form 1040, to find out if the taxpayer can take this credit and for definitions and other information needed to fill out this. The recovery rebate credit amount, if any, is calculated using the recovery rebate credit. Else use the format given below to calculate the value for line 3. Web number line. If some of the taxable futa wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax. Web number line 30 to 40 worksheet for kindergarten children. File online | file early | file for. This is a math pdf printable activity sheet with several exercises. Else use the format given below to calculate the. This is a math pdf printable activity sheet with several exercises. Web stimulus and your taxes faq: File online | file early | file for. Line 10 on form 940 for 2018 applies to our situation (3 corporate officers on payroll are not subject to state unemployment tax). Worksheets are 2021 instruction 1040, 33 of 117, 2021 instructions for schedule. Web stimulus and your taxes faq: You will record the amount. Else use the format given below to calculate the value for line 3. The recovery rebate credit amount, if any, is calculated using the recovery rebate credit. Subtract line 30 from line 29. 31 net profit or (loss). Worksheets are 2021 instruction 1040, 33 of 117, 2021 instructions for schedule 8812,. It has an answer key attached on the. Web if yes is your answer to the above question, enter zero on line 3 and continue to line 4. File online | file early | file for. Web to determine whether you are an eligible individual or the amount of your recovery rebate credit, complete the recovery rebate credit worksheet in the. Web this video demonstrates how to enter the recovery rebate credit for form 1040 line 30, how to view the recovery rebate credit worksheet, and how to. Look for line 30 on your 1040 tax form. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. This is a math pdf printable activity sheet with several exercises. Web see the instructions for line 30, form 1040, to find out if the taxpayer can take this credit and for definitions and other information needed to fill out this. • if a profit, enter on both. Call the irs first if you owe and can’t pay your tax bill. Line 10 on form 940 for 2018 applies to our situation (3 corporate officers on payroll are not subject to state unemployment tax). Web method worksheet in the instructions to figure the amount to enter on line 30. File online | file early | file for. Worksheets are 2021 instruction 1040, 33 of 117, 2021 instructions for schedule 8812,. Else use the format given below to calculate the value for line 3. Web this video demonstrates how to enter the recovery rebate credit for form 1040 line 30, how to view the recovery rebate credit worksheet, and how to. You will record the amount. Web line 10 on the 940 states: 31 net profit or (loss). The recovery rebate credit amount, if any, is calculated using the recovery rebate credit. Web the credit will be reported on form 1040, schedule 3, line 30. If some of the taxable futa wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax. Web method worksheet in the instructions to figure the amount to enter on line 30. Look for line 30 on your 1040 tax form. • if a profit, enter on both. Web if yes is your answer to the above question, enter zero on line 3 and continue to line 4. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. Web to determine whether you are an eligible individual or the amount of your recovery rebate credit, complete the recovery rebate credit worksheet in the.10 40 ez

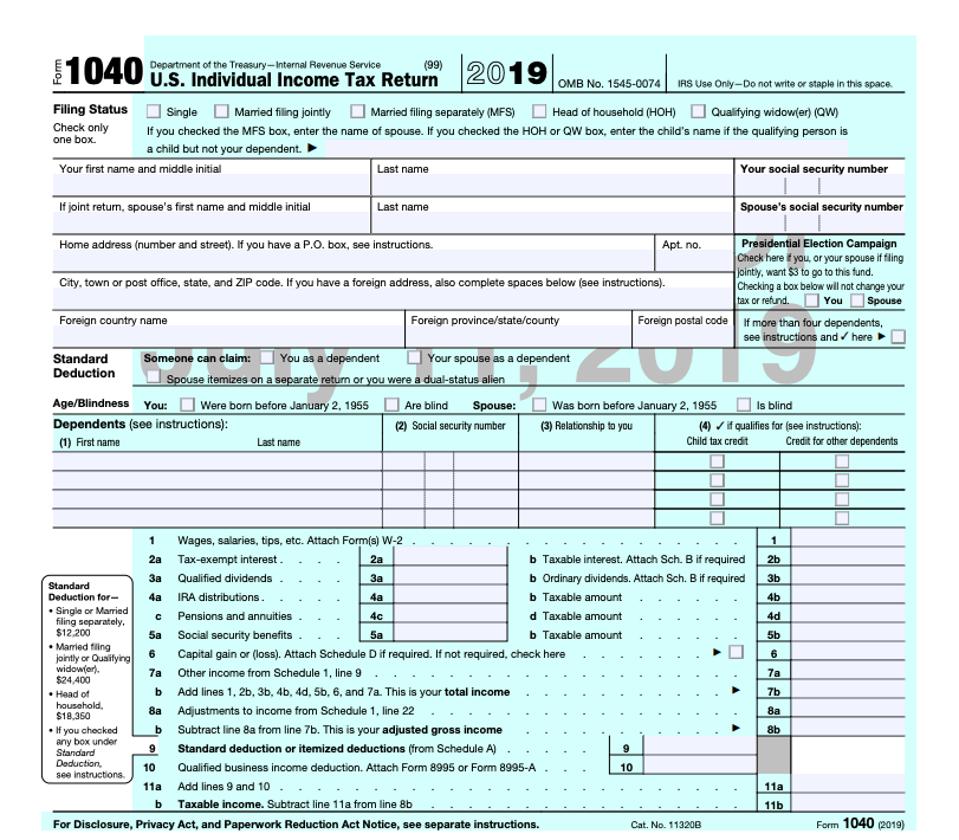

Irs 1040 Form Online / IRS Form 1040 Schedule 3 Download Fillable PDF

Line 30 1040 treet¢ents

Form 1040EZ For filers with no dependents and taxable less

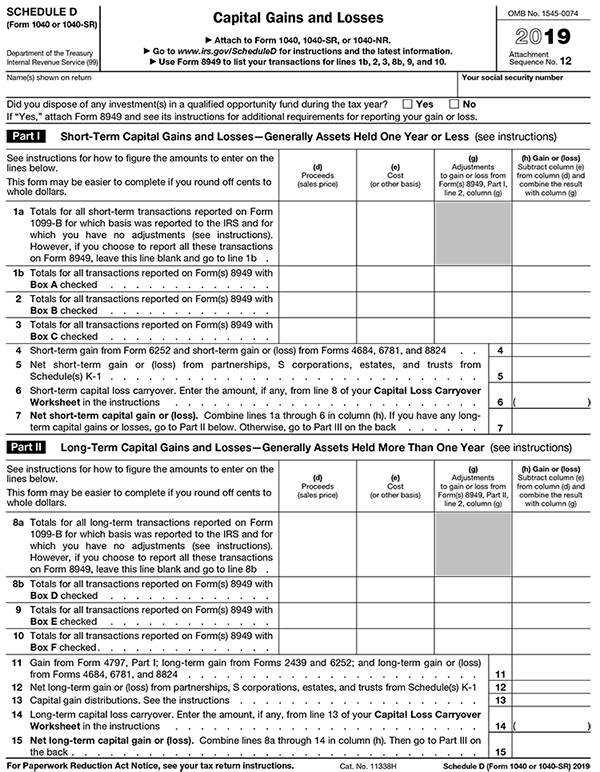

Form 1040 Qualified Dividends And Capital Gain Tax Worksheet

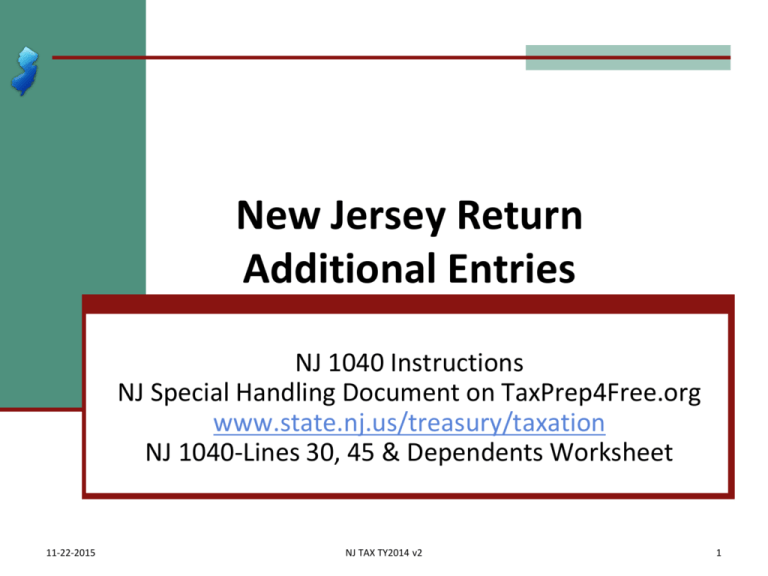

NJ 1040, Line 30

Everything Old Is New Again As IRS Releases Form 1040 Draft Financial

Irs 1040 Form 2019 / The irs introduced a new 1040 form for seniors in

Tools for Managing Your Finances During the COVID19 Pandemic Karen

INTERESTING STUFF 21 February 2020 TIME GOES BY

Subtract Line 30 From Line 29.

It Has An Answer Key Attached On The.

Call The Irs First If You Owe And Can’t Pay Your Tax Bill.

Line 10 On Form 940 For 2018 Applies To Our Situation (3 Corporate Officers On Payroll Are Not Subject To State Unemployment Tax).

Related Post: