1040 Ss Worksheet

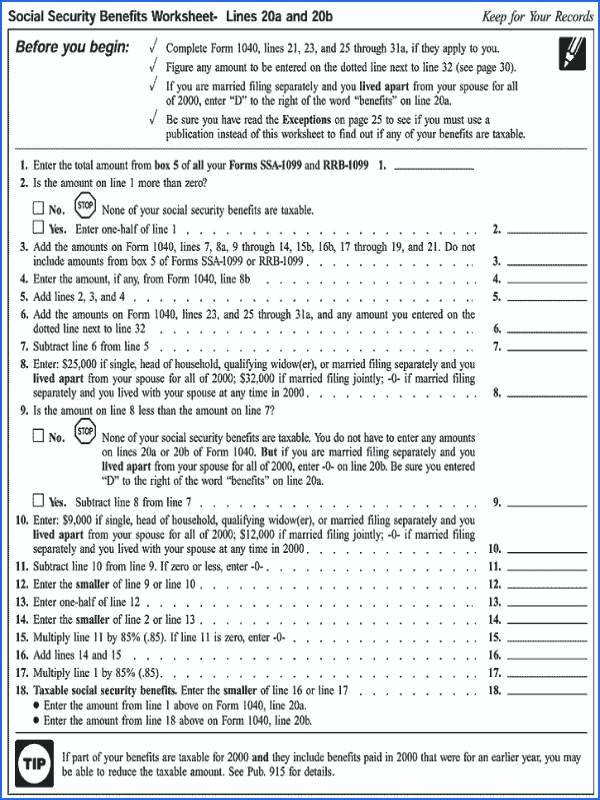

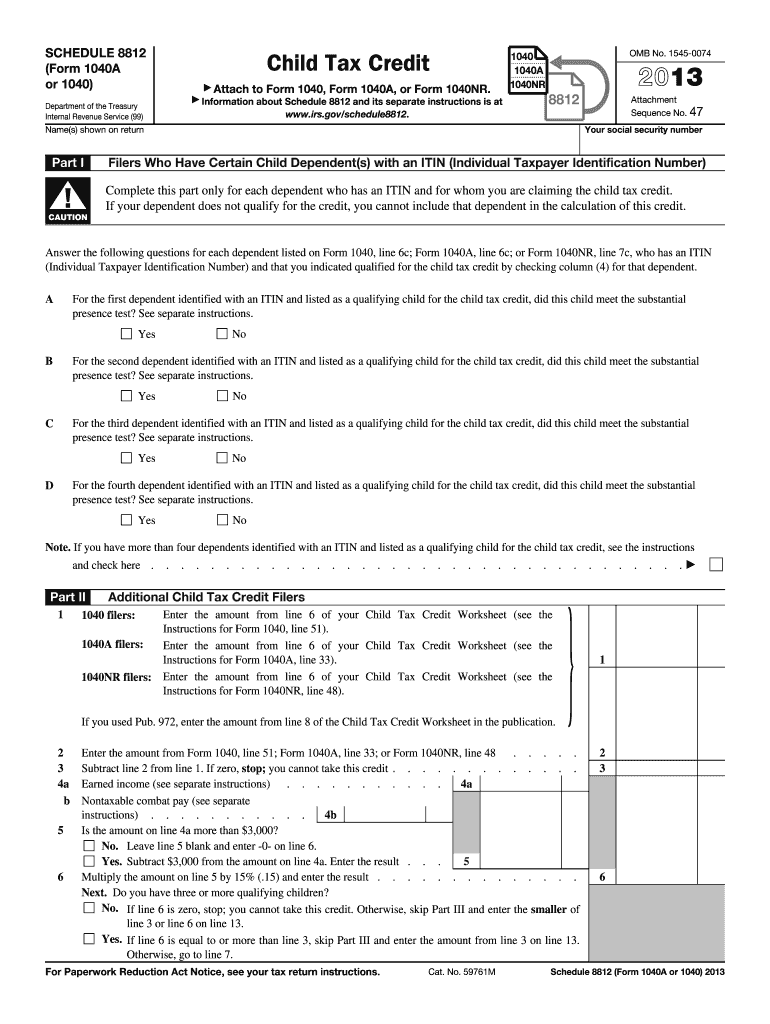

1040 Ss Worksheet - Use this calculator to compute. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. To determine this amount, the irs provides. Calculating taxable benefits before filling out this worksheet: Also, your qualifying child must have an ssn valid for. Web social security taxable benefits worksheet (2022) worksheet 1. Do not use this worksheet if any of the. First, find the total amount of your benefits. The reportable social security benefit is calculated using the worksheet below and entered. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Ask the taxpayer about the receipt of either of these benefits. To determine this amount, the irs provides. Social security benefit adjustment worksheet. Web fill online, printable, fillable, blank social security taxable benets worksheet (2020) form. Web luckily, this part is easy. Use this calculator to compute. Ask the taxpayer about the receipt of either of these benefits. Web fill online, printable, fillable, blank social security taxable benets worksheet (2020) form. Then, on form 1040, you will write the total amount. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. This also affects you if you are single and use the tax reduction worksheet. Web social security taxable benefits worksheet (2022) worksheet 1. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Social security benefit adjustment worksheet. Also, your qualifying child must have an ssn valid for. Web fill online, printable, fillable, blank form 1040 social security benefits worksheet irs 2018 form. If your income is modest, it is likely that none of your social security benefits are taxable. Do not use this worksheet if any of the. Then, on form 1040, you will write the total amount. Ask the taxpayer about the receipt of either of. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. As your gross income increases, a. Use this calculator to compute. Do not use this worksheet if any of the. To determine this amount, the irs provides. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Web fill online, printable, fillable, blank social security taxable benets worksheet (2020) form. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Ask the taxpayer about the receipt of. Web social security taxable benefits worksheet (2022) worksheet 1. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. If your income is modest, it is likely that none of your social security benefits are taxable. Web the intake and interview sheet lists social security and railroad retirement benefits. Web fill online, printable, fillable, blank form 1040 social security benefits worksheet irs 2018 form. Use fill to complete blank online irs pdf forms for free. If your income is modest, it is likely that none of your social security benefits are taxable. Use this calculator to compute. Web your taxable social security (form 1040, line 6b) can be anywhere. To determine this amount, the irs provides. Use fill to complete blank online others pdf forms for free. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Web fill. Web social security taxable benefits worksheet (2020) before filling out this worksheet: Use fill to complete blank online irs pdf forms for free. If your income is modest, it is likely that none of your social security benefits are taxable. Use this calculator to compute. Ask the taxpayer about the receipt of either of these benefits. Do not use this worksheet if any of the. Web fill online, printable, fillable, blank form 1040 social security benefits worksheet irs 2018 form. Web social security taxable benefits worksheet (2022) worksheet 1. This also affects you if you are single and use the tax reduction worksheet. Then, on form 1040, you will write the total amount. Ask the taxpayer about the receipt of either of these benefits. Web luckily, this part is easy. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. As your gross income increases, a. Social security benefit adjustment worksheet. Use fill to complete blank online others pdf forms for free. The reportable social security benefit is calculated using the worksheet below and entered. Web social security taxable benefits worksheet (2020) before filling out this worksheet: Calculating taxable benefits before filling out this worksheet: Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Web fill online, printable, fillable, blank social security taxable benets worksheet (2020) form. First, find the total amount of your benefits. If your income is modest, it is likely that none of your social security benefits are taxable. To determine this amount, the irs provides. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Web social security taxable benefits worksheet (2022) worksheet 1. Social security benefit adjustment worksheet. Use this calculator to compute. Ask the taxpayer about the receipt of either of these benefits. Calculating taxable benefits before filling out this worksheet: Web luckily, this part is easy. Use fill to complete blank online irs pdf forms for free. To determine this amount, the irs provides. Use fill to complete blank online others pdf forms for free. Web fill online, printable, fillable, blank social security taxable benets worksheet (2020) form. Do not use this worksheet if any of the. Web fill online, printable, fillable, blank form 1040 social security benefits worksheet irs 2018 form. Also, your qualifying child must have an ssn valid for. As your gross income increases, a. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Web social security taxable benefits worksheet (2020) before filling out this worksheet:2018 1040 Social Security Worksheet « Easy Math Worksheets

Federal Tax 1040ez Worksheet Universal Network

Social Security Worksheet For Taxes Master of Documents

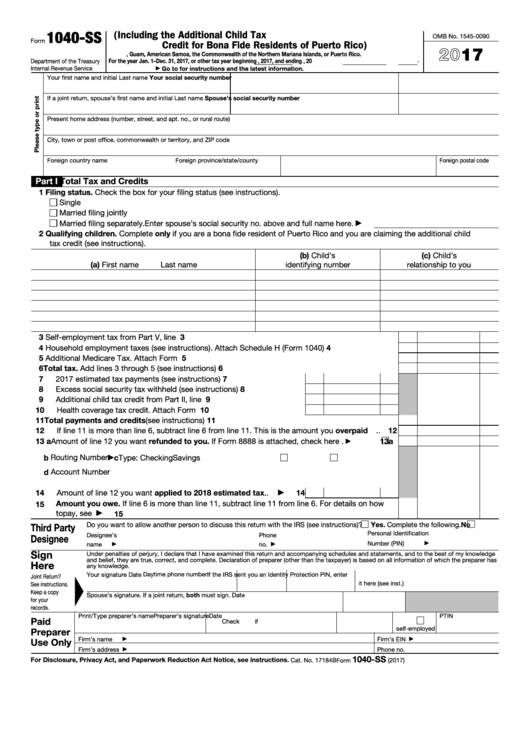

Fillable Form 1040Ss U.s. SelfEmployment Tax Return (Including The

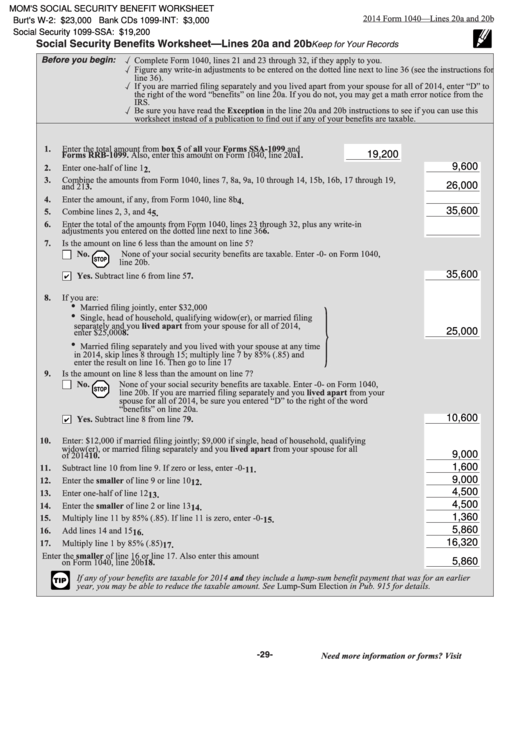

Fillable Form 1040 Social Security Benefits Worksheet Lines 20a And

20++ Social Security Benefits Worksheet 2019

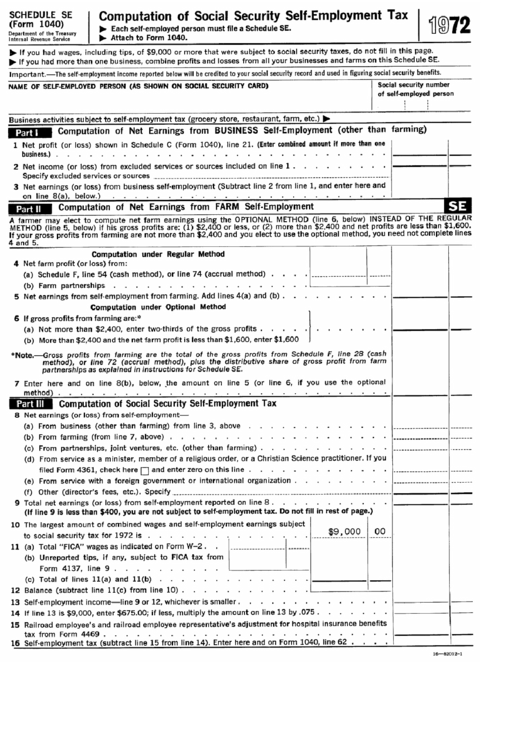

Schedule Se (Form 1040) Computation Of Social Security Self

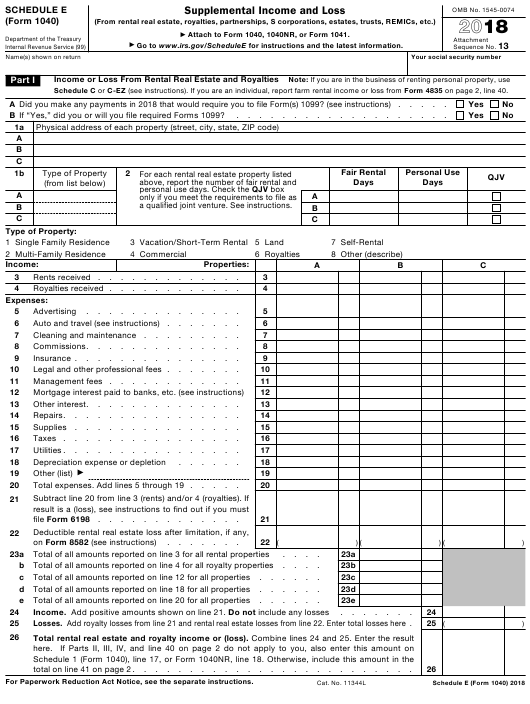

Fillable Irs 1040 Form / IRS Form 1040 Schedule E Download Fillable PDF

2018 Form 1040 Social Security Fillable Worksheet 1040 Form Printable

1040a Instructions Social Security Benefits Worksheet Worksheet Fun

If Your Income Is Modest, It Is Likely That None Of Your Social Security Benefits Are Taxable.

This Also Affects You If You Are Single And Use The Tax Reduction Worksheet.

First, Find The Total Amount Of Your Benefits.

Web The Reportable Social Security Benefit Is Calculated Using The Worksheet Below And Entered On Step 4 Of The Ia 1040.

Related Post: