1040A Capital Gains Worksheet

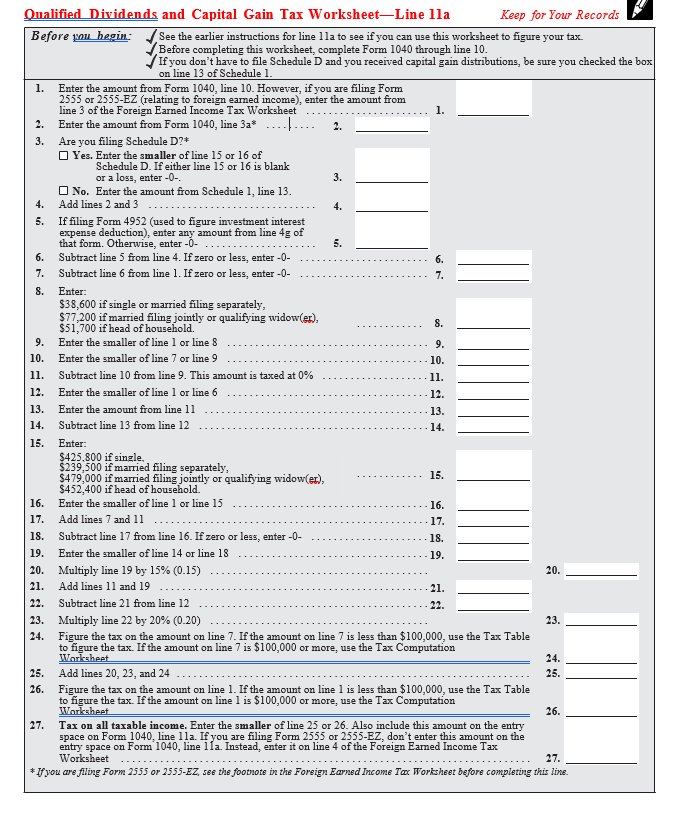

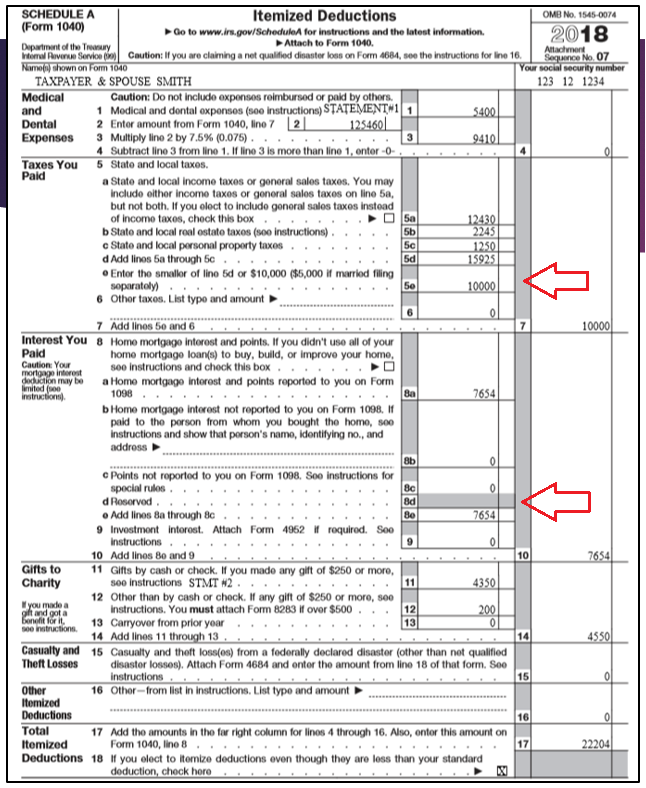

1040A Capital Gains Worksheet - Enter the smaller of line 25 or line 26. Web deduct capital expenses and special care expenses for disabled persons. Web social security taxable benefits worksheet (2022) worksheet 1. Calculating taxable benefits before filling out this worksheet: The worksheet is part of form. Web use fill to complete blank online irs pdf forms for free. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Individual income tax return (line 10.) using the qualified dividends and. Web if you do not have to file schedule d and you received capital gain distributions, be sure you checked the. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Examples of medical and dental payments you can include in calculating your total medical. Web use the qualified dividends and capital gain tax worksheet in the instructions for form. Calculating taxable benefits before filling out this worksheet: Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. The worksheet is part of form. Enter the smaller of line 25 or line 26. All forms are printable and downloadable. Web social security taxable benefits worksheet (2022) worksheet 1. For tax year 2019, the 20% rate applies to amounts. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Web use fill to complete blank online irs pdf forms for free. Web investors who sold stocks, bonds, options, or other securities will have. All forms are printable and downloadable. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. If the amount on line 1 is $100,000 or more, use the tax. Calculating taxable benefits before filling out this worksheet: Web deduct capital expenses and special care expenses for disabled persons. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web use fill to complete blank online irs pdf forms for free. Web to figure the tax. You can find them in the form 1040 instructions. Individual income tax return (line 10.) using the qualified dividends and. Once completed you can sign your fillable form or send for signing. Web if you do not have to file schedule d and you received capital gain distributions, be sure you checked the. The worksheet is part of form. Examples of medical and dental payments you can include in calculating your total medical. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. For tax year 2019, the 20% rate applies to amounts. You can find them in the form 1040 instructions. Enter the smaller of line 25 or line 26. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web if you do not have to file schedule d and you received capital gain distributions, be sure you checked the. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet. All forms are printable and downloadable. Web social security taxable benefits worksheet (2022) worksheet 1. You can use a worksheet that you. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: You can use a worksheet that you. For tax year 2019, the 20% rate applies to amounts. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. You can find them in the form 1040 instructions. Web the tax computation for line 16 of form 1040 can be calculated in. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web if you do not have to file schedule d and you received capital gain distributions, be sure you checked the. All forms are printable and downloadable. Calculating taxable benefits before filling out this worksheet: You can find them in the form 1040 instructions. Enter the smaller of line 25 or line 26. Once completed you can sign your fillable form or send for signing. Web social security taxable benefits worksheet (2022) worksheet 1. Web to figure the tax. Web investors who sold stocks, bonds, options, or other securities will have to prepare form 8949 sales and other dispositions of capital assets and schedule d (form 1040). Web deduct capital expenses and special care expenses for disabled persons. Examples of medical and dental payments you can include in calculating your total medical. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. For tax year 2019, the 20% rate applies to amounts. The worksheet is part of form. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web use fill to complete blank online irs pdf forms for free. You can use a worksheet that you. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: You can use a worksheet that you. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web investors who sold stocks, bonds, options, or other securities will have to prepare form 8949 sales and other dispositions of capital assets and schedule d (form 1040). The worksheet is part of form. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. Calculating taxable benefits before filling out this worksheet: Web to figure the tax. Individual income tax return (line 10.) using the qualified dividends and. Web if you do not have to file schedule d and you received capital gain distributions, be sure you checked the. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. Examples of medical and dental payments you can include in calculating your total medical. Web social security taxable benefits worksheet (2022) worksheet 1. Enter the smaller of line 25 or line 26. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Once completed you can sign your fillable form or send for signing.Qualified Dividends and Capital Gain Tax Worksheet 1040a

Capital Gains Worksheet 1040a Livinghealthybulletin

Qualified Dividends and Capital Gain Tax Worksheet 2019

1040 Qualified Dividends And Capital Gains Worksheet Promotiontablecovers

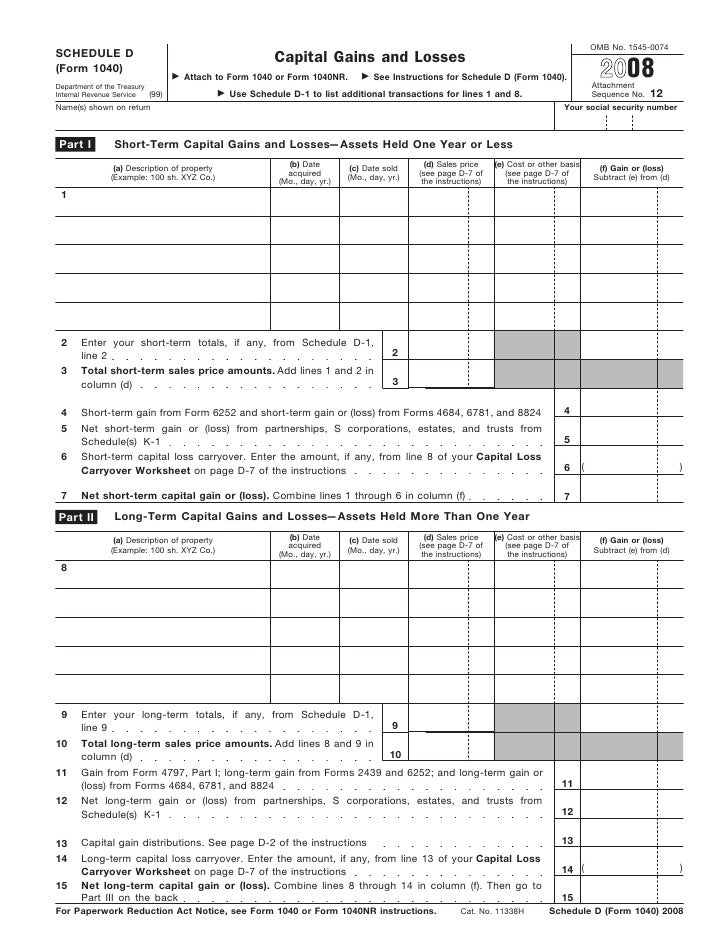

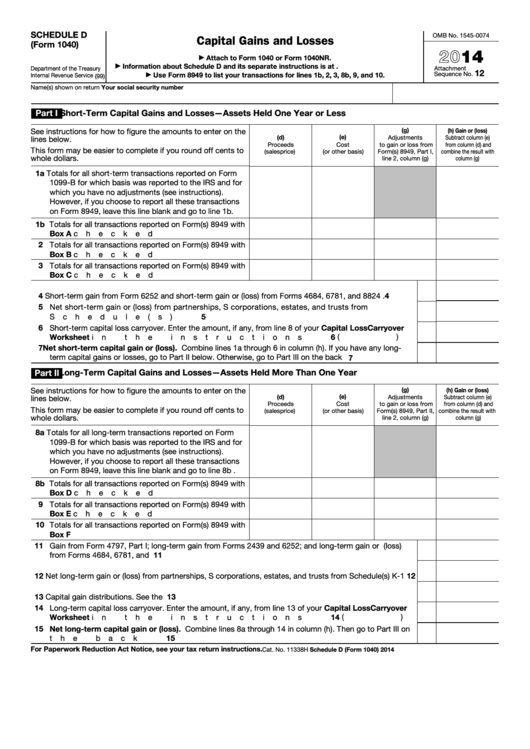

Form 1040, Schedule DCapital Gains and Losses Worksheet Template Tips

Qualified Dividends And Capital Gains Worksheet 1040a Worksheet

2014 Form 1040 Capital Gains Worksheet Worksheet Resume Examples

2018 Irs Form 1040 Qualified Dividends And Capital Gain Tax Worksheet

Fillable Schedule D (Form 1040) Capital Gains And Losses 2014

Qualified Dividends And Capital Gains Worksheet 1040a Worksheet

All Forms Are Printable And Downloadable.

Web Report Your Qualified Dividends On Line 9B Of Form 1040 Or 1040A.

Web Deduct Capital Expenses And Special Care Expenses For Disabled Persons.

You Can Find Them In The Form 1040 Instructions.

Related Post: