1099-Nec Worksheet Schedule C

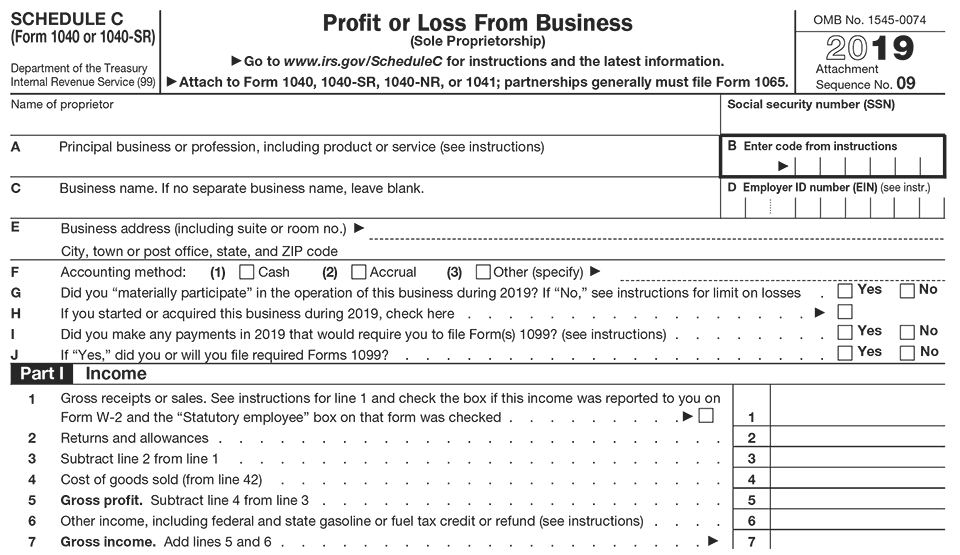

1099-Nec Worksheet Schedule C - Web if you do not already have a schedule c in your return, follow the prompts and enter the information about your work/business for which you received the form. Web hickman & hickman, pllc. Web a schedule c is one of the most important tax forms to complete for a business owner or sole proprietor. After your calculation of expenses and income, the. It's from the same company and in the amount as in tax year 2020. In the double click to link to: Do verify that the recipient’s taxpayer id is correct. In the select schedule screen select an existing. If the taxpayer has more than one business, you must use a separate schedule c for each. Link the information from the. If the taxpayer has more than one business, you must use a separate schedule c for each. It's from the same company and in the amount as in tax year 2020. Do verify that the recipient’s taxpayer id is correct. In the double click to link to: Web if you do not already have a schedule c in your return,. Link the information from the. It's from the same company and in the amount as in tax year 2020. In the select schedule screen select an existing. In the double click to link to: Do verify that the recipient’s taxpayer id is correct. Web a schedule c is one of the most important tax forms to complete for a business owner or sole proprietor. It's from the same company and in the amount as in tax year 2020. If the taxpayer has more than one business, you must use a separate schedule c for each. Web hickman & hickman, pllc. Do verify that. Web we would like to show you a description here but the site won’t allow us. Web hickman & hickman, pllc. Web if you do not already have a schedule c in your return, follow the prompts and enter the information about your work/business for which you received the form. In the select schedule screen select an existing. Web a. Web we would like to show you a description here but the site won’t allow us. It's from the same company and in the amount as in tax year 2020. Web if you do not already have a schedule c in your return, follow the prompts and enter the information about your work/business for which you received the form. In. Web a schedule c is one of the most important tax forms to complete for a business owner or sole proprietor. If the taxpayer has more than one business, you must use a separate schedule c for each. It's from the same company and in the amount as in tax year 2020. Do verify that the recipient’s taxpayer id is. After your calculation of expenses and income, the. Web if you do not already have a schedule c in your return, follow the prompts and enter the information about your work/business for which you received the form. In the double click to link to: Do verify that the recipient’s taxpayer id is correct. Web we would like to show you. If the taxpayer has more than one business, you must use a separate schedule c for each. Web we would like to show you a description here but the site won’t allow us. In the select schedule screen select an existing. It's from the same company and in the amount as in tax year 2020. Link the information from the. Web hickman & hickman, pllc. Web we would like to show you a description here but the site won’t allow us. Link the information from the. It's from the same company and in the amount as in tax year 2020. In the double click to link to: Web hickman & hickman, pllc. In the select schedule screen select an existing. If the taxpayer has more than one business, you must use a separate schedule c for each. It's from the same company and in the amount as in tax year 2020. Web a schedule c is one of the most important tax forms to complete for a. After your calculation of expenses and income, the. Do verify that the recipient’s taxpayer id is correct. It's from the same company and in the amount as in tax year 2020. In the double click to link to: Link the information from the. Web hickman & hickman, pllc. Web we would like to show you a description here but the site won’t allow us. Web if you do not already have a schedule c in your return, follow the prompts and enter the information about your work/business for which you received the form. Web a schedule c is one of the most important tax forms to complete for a business owner or sole proprietor. If the taxpayer has more than one business, you must use a separate schedule c for each. In the select schedule screen select an existing. In the double click to link to: If the taxpayer has more than one business, you must use a separate schedule c for each. After your calculation of expenses and income, the. Link the information from the. Web a schedule c is one of the most important tax forms to complete for a business owner or sole proprietor. Web we would like to show you a description here but the site won’t allow us. In the select schedule screen select an existing. Web hickman & hickman, pllc.What Does Schedule C Mean On 1099 Nec Paul Johnson's Templates

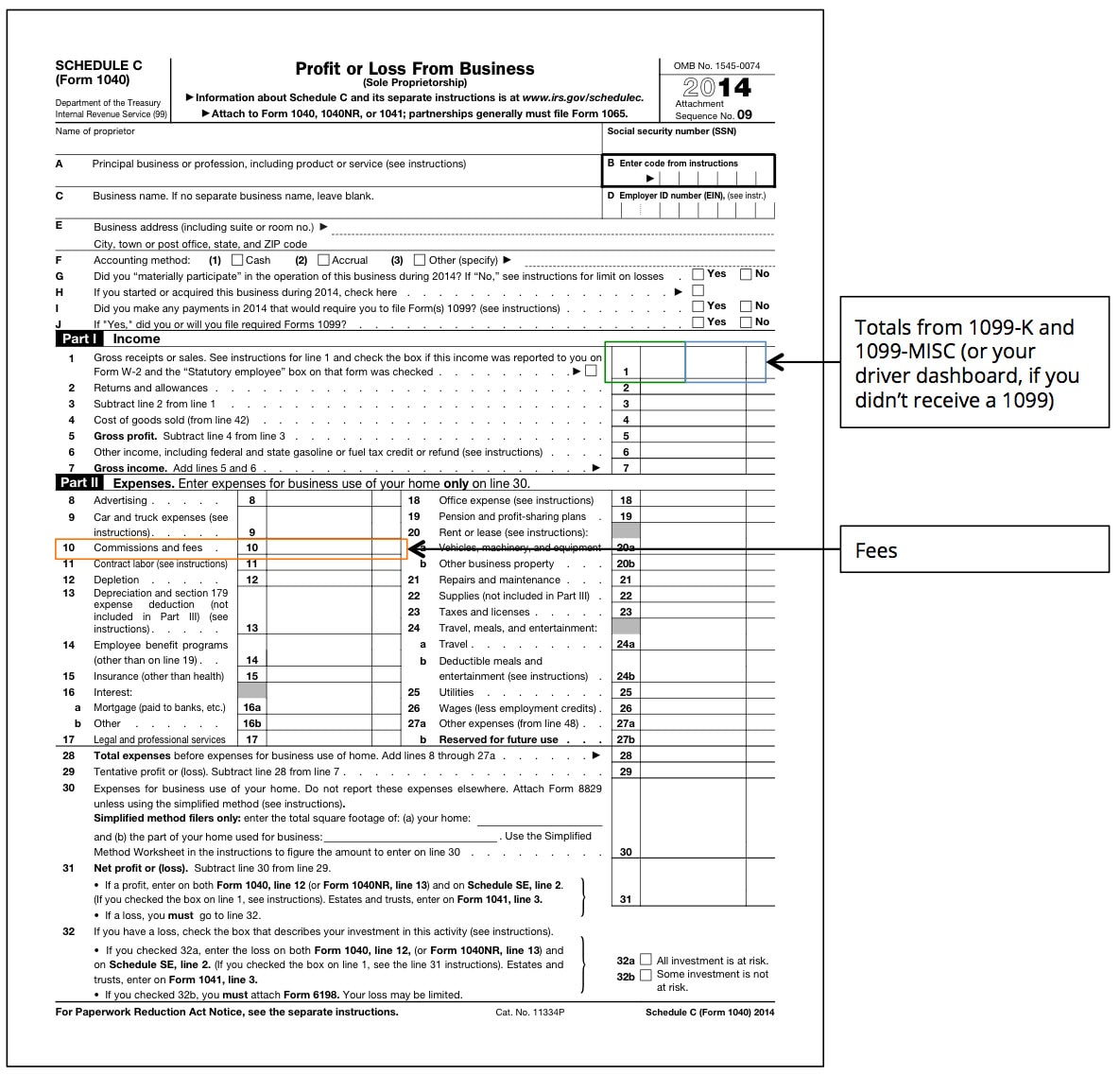

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

1099 nec worksheet

Form 1099NEC Nonemployee Compensation, Payer Copy C

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Form 1099NEC How Will it Impact Your Business? Ketel Thorstenson, LLP

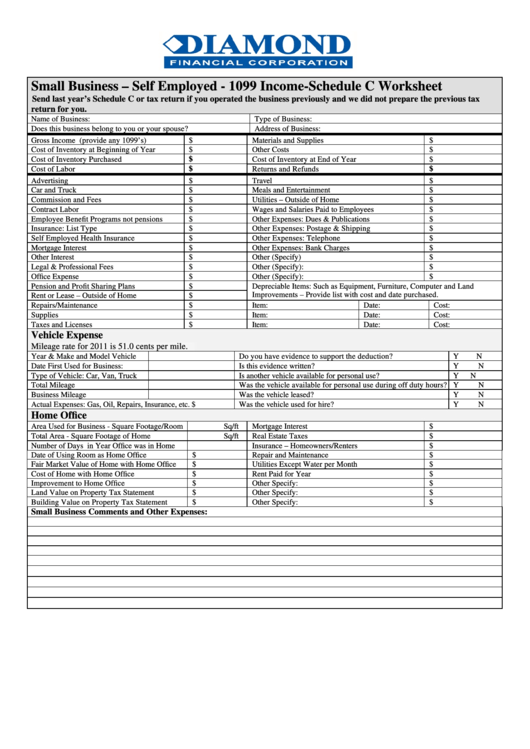

Fillable Small Business Self Employed 1099 C

Schedule c or 1099 Infinings

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Do Verify That The Recipient’s Taxpayer Id Is Correct.

Web If You Do Not Already Have A Schedule C In Your Return, Follow The Prompts And Enter The Information About Your Work/Business For Which You Received The Form.

It's From The Same Company And In The Amount As In Tax Year 2020.

Related Post:

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://digitalasset.intuit.com/IMAGE/A3dN5e1ZW/schedule-c-mileage_ty19.png)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)