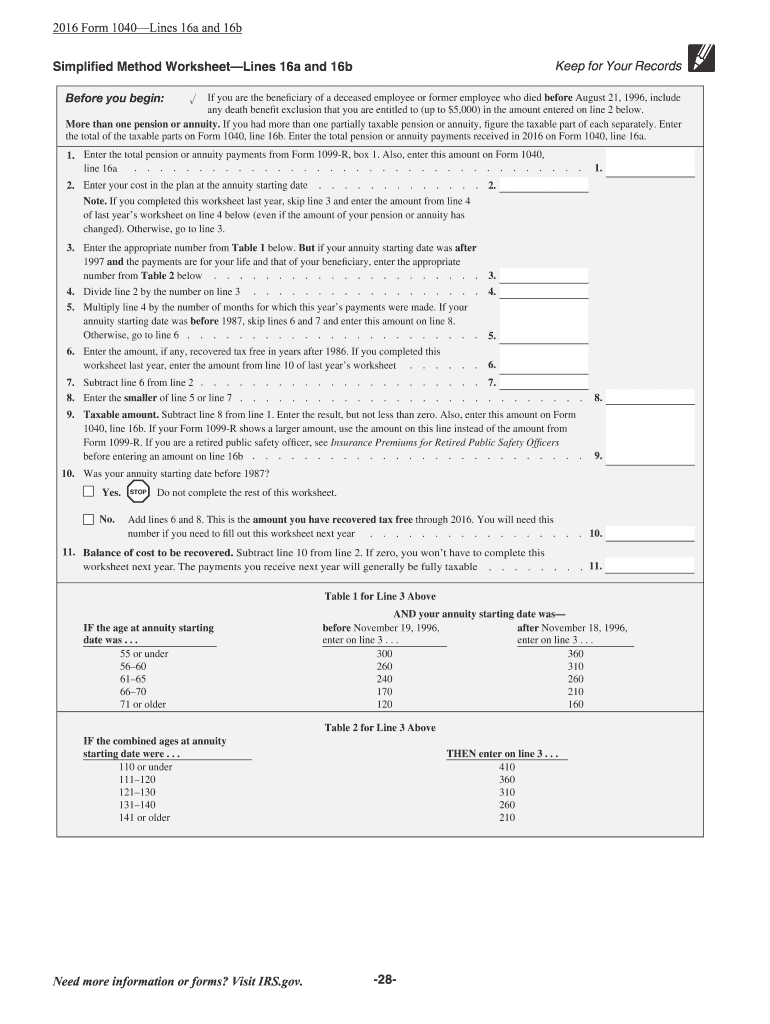

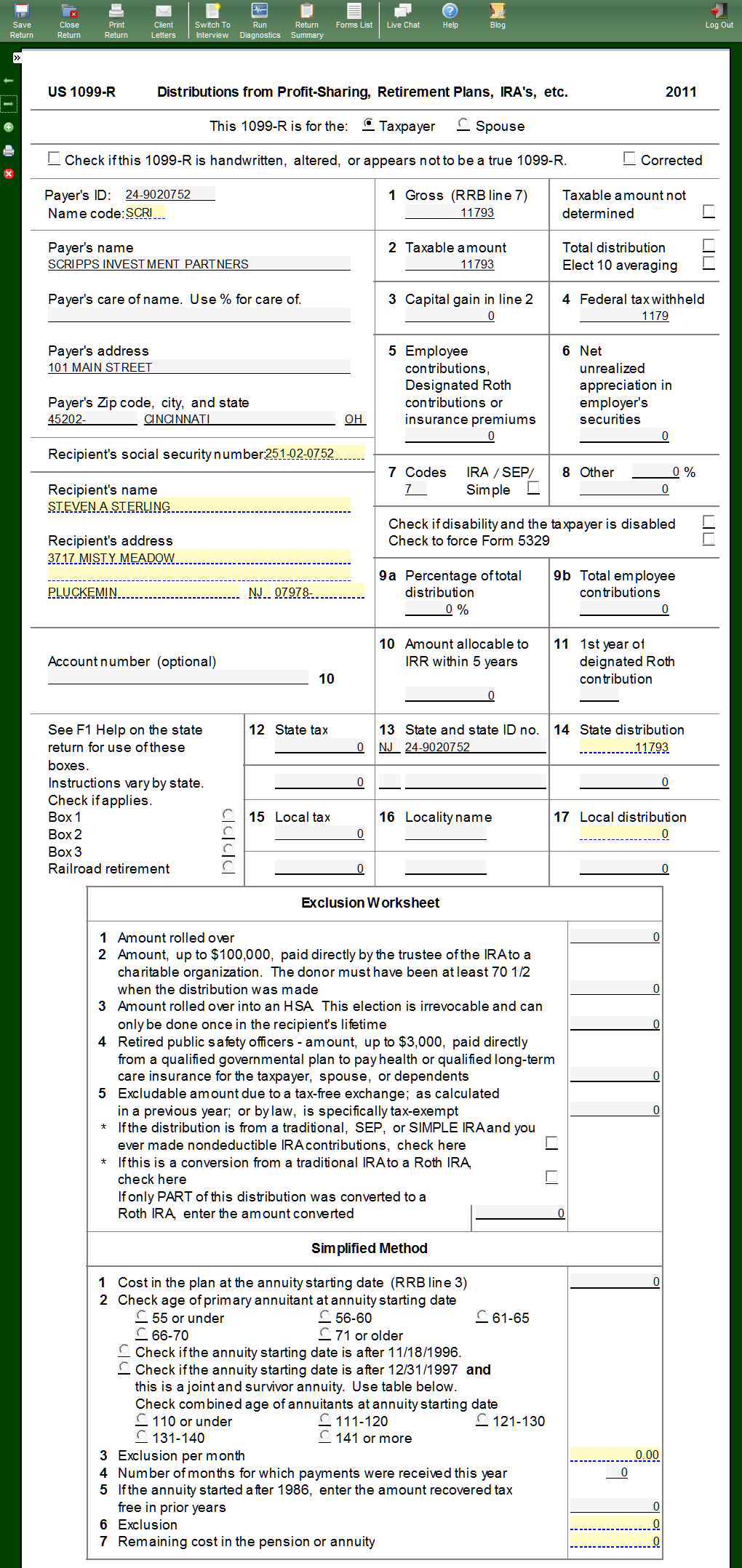

1099 R Simplified Method Worksheet

1099 R Simplified Method Worksheet - Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Be sure to keep the completed worksheet; Web april 16, 2022 6:44 pm. Qualified plans and section 403(b) plans. The notes mention after tax contributions, but mine were pre. See irs pub 939 for more information. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of the military retiree. If your annuity starting date is after 1997, you must use the. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. What is it, where do i find? If your annuity starting date is after 1997, you must use the. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of the military. Web here is a link to the simplified method worksheet for pensions and annuities from the irs. Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Web how to use the simplified method. Web april 16, 2022 6:44 pm. Qualified plans and section 403(b) plans. Web how to use the simplified method. If your annuity starting date is after 1997, you must use the. Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. Qualified plans and. If your annuity starting date is after 1997, you must use the. Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Web april 16, 2022 6:44 pm. If you are using turbotax cd/download this. Here is a link to the simplified method worksheet for pensions and annuities from the irs. Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: Web april 16, 2022 6:44 pm. Web the simplified general rule worksheet. Be sure to keep the completed worksheet; If your annuity starting date is after 1997, you must use the. Qualified plans and section 403(b) plans. See irs pub 939 for more information. What is it, where do i find? Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of the military retiree. Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of the military retiree. See irs pub 939 for more information. If your annuity starting date is after 1997, you must use the. Web. Web the simplified general rule worksheet. Here is a link to the simplified method worksheet for pensions and annuities from the irs. If you are using turbotax cd/download this. If your annuity starting date is after 1997, you must use the. Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Be sure to keep the completed worksheet; If you are using turbotax cd/download this. Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. Web to access the simplified general rule worksheet, from the main. The notes mention after tax contributions, but mine were pre. Qualified plans and section 403(b) plans. Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. Web here is a link to the simplified method. Web how to use the simplified method. If your annuity starting date is after 1997, you must use the. The notes mention after tax contributions, but mine were pre. Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. Be sure to keep the completed worksheet; Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. See irs pub 939 for more information. Here is a link to the simplified method worksheet for pensions and annuities from the irs. Web the simplified general rule worksheet. If you are using turbotax cd/download this. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of the military retiree. What is it, where do i find? Qualified plans and section 403(b) plans. If your annuity starting date is after 1997, you must use the. Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: Web april 16, 2022 6:44 pm. Web here is a link to the simplified method worksheet for pensions and annuities from the irs. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. Web simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Web you use this amount to calculate the taxable part of the rrb payment with either the general rule or simplifed method. The notes mention after tax contributions, but mine were pre. Qualified plans and section 403(b) plans. What is it, where do i find? Web here is a link to the simplified method worksheet for pensions and annuities from the irs. If you are using turbotax cd/download this. If your annuity starting date is after 1997, you must use the. Be sure to keep the completed worksheet; See irs pub 939 for more information. Here is a link to the simplified method worksheet for pensions and annuities from the irs. Web to access the simplified general rule worksheet, from the main menu of the tax return (form 1040) select: Web how to use the simplified method. Web april 16, 2022 6:44 pm.2015 Form IRS 1040 Lines 16a and 16b Fill Online, Printable, Fillable

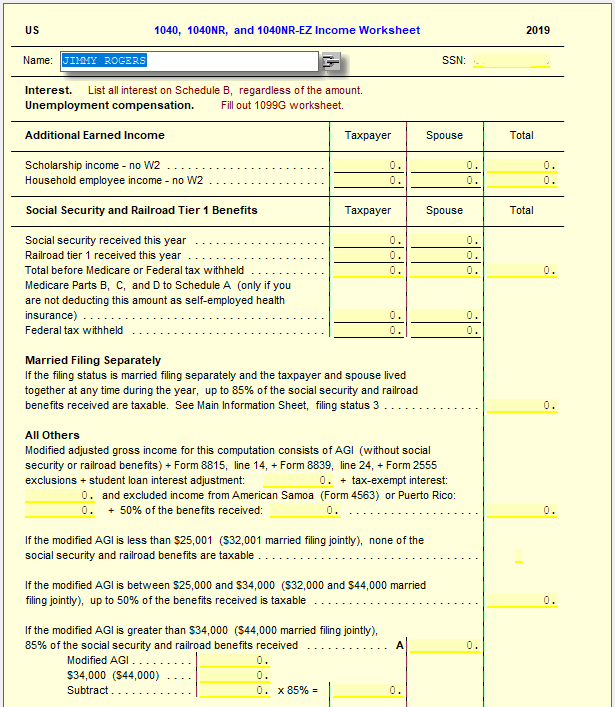

Where to Enter 1099RRB Information UltimateTax Solution Center

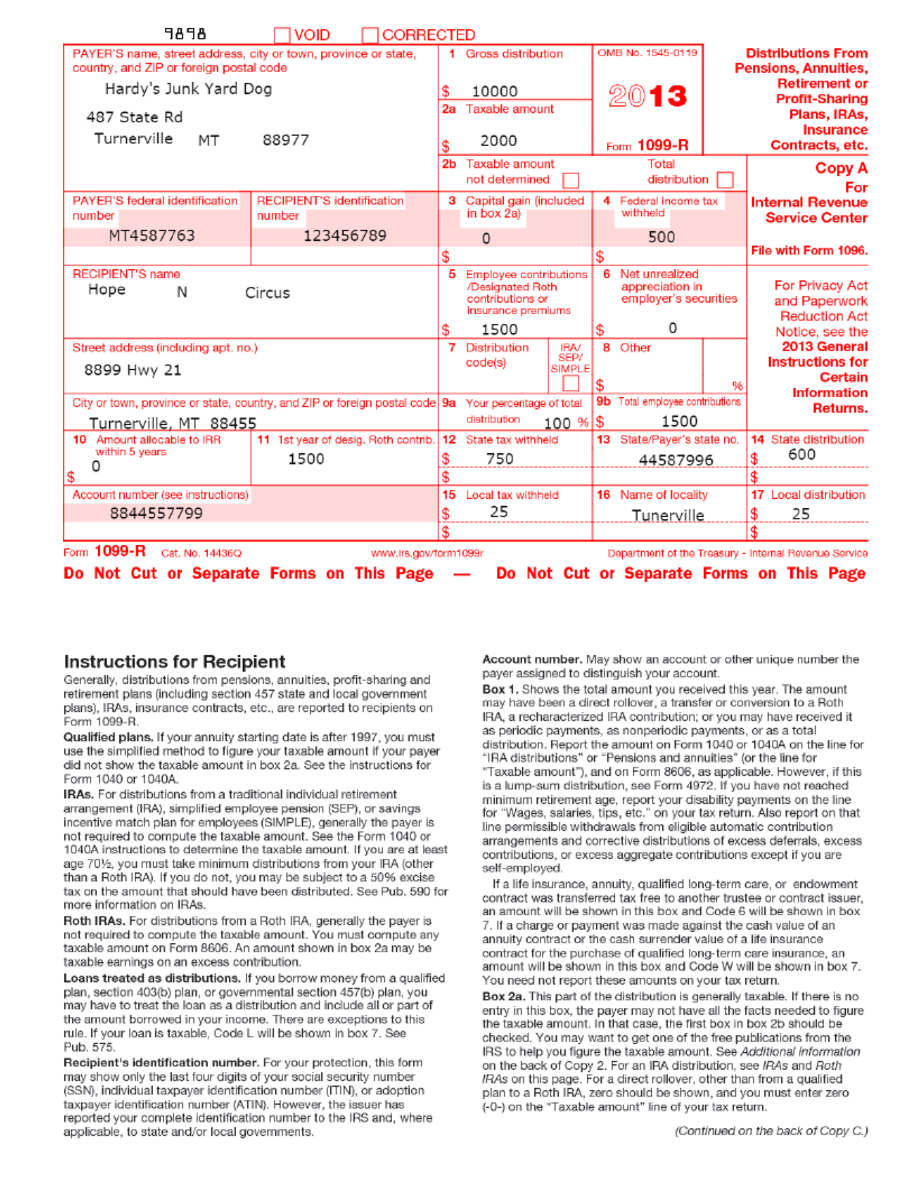

Do You Get A 1099 R For A Rollover Armando Friend's Template

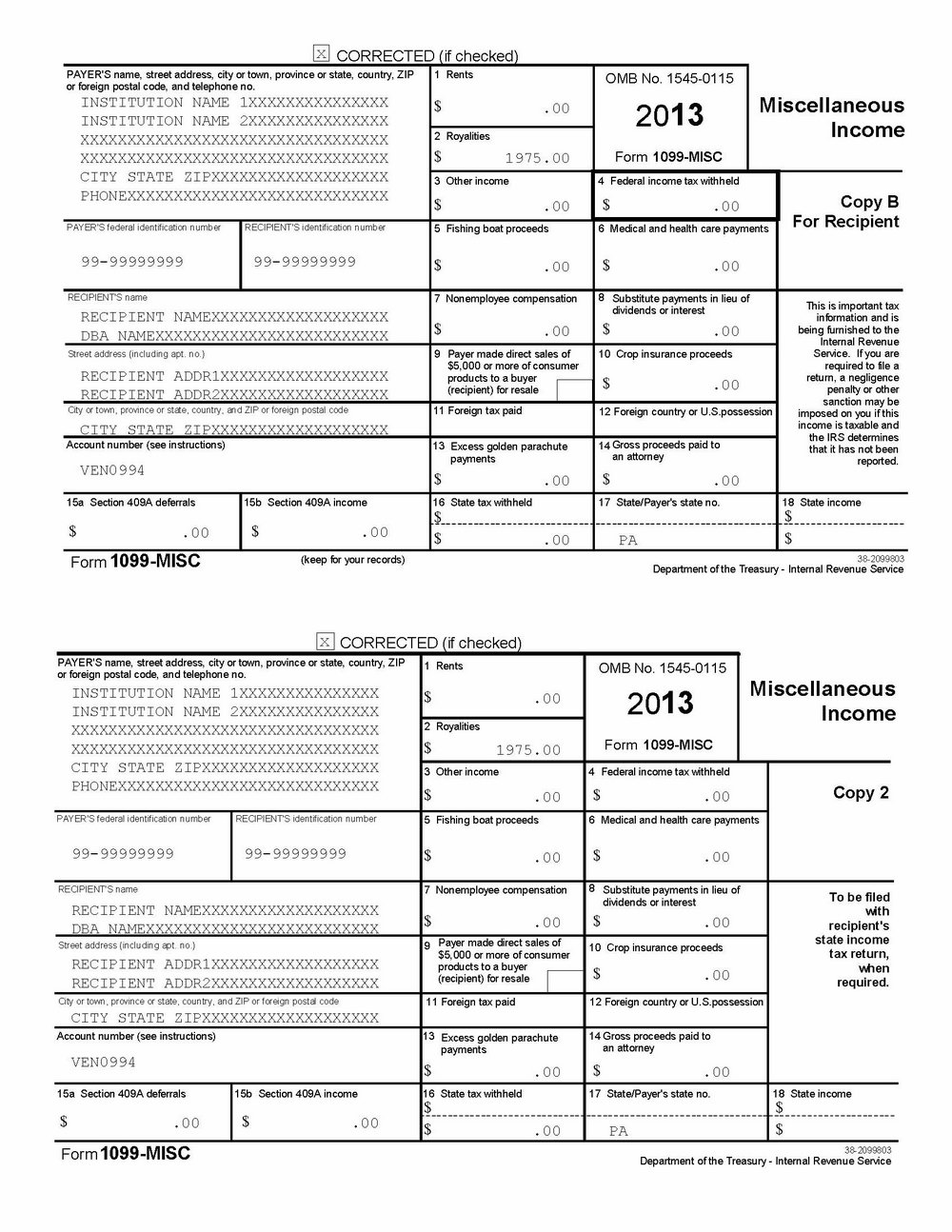

1099R Template. Create A Free 1099R Form.

How to Calculate Taxable Amount on a 1099R for Life Insurance

Irs Form 1099 R Instructions Universal Network

How to Calculate Taxable Amount on a 1099R for Life Insurance

2019 Form NY DTF IT1099R Fill Online, Printable, Fillable, Blank

How To Fill Out Form 1099 R Universal Network

4491W12 Sterling Refund Monitor

Complete Worksheet A Near The End Of This Publication To Figure Your Taxable Annuity For 2022.

Web The Simplified General Rule Worksheet.

Report Military Retirement Pay Awarded As A Property Settlement To A Former Spouse Under The Name And Tin Of The Recipient, Not That Of The Military Retiree.

If Your Annuity Starting Date Is After 1997, You Must Use The.

Related Post: