199A Worksheet

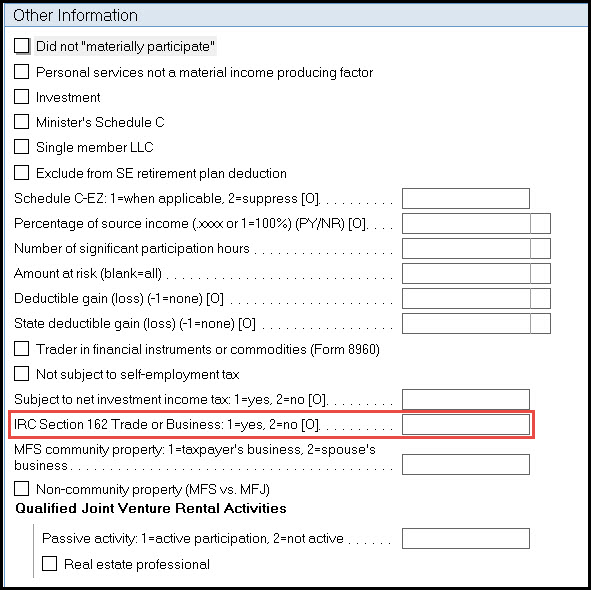

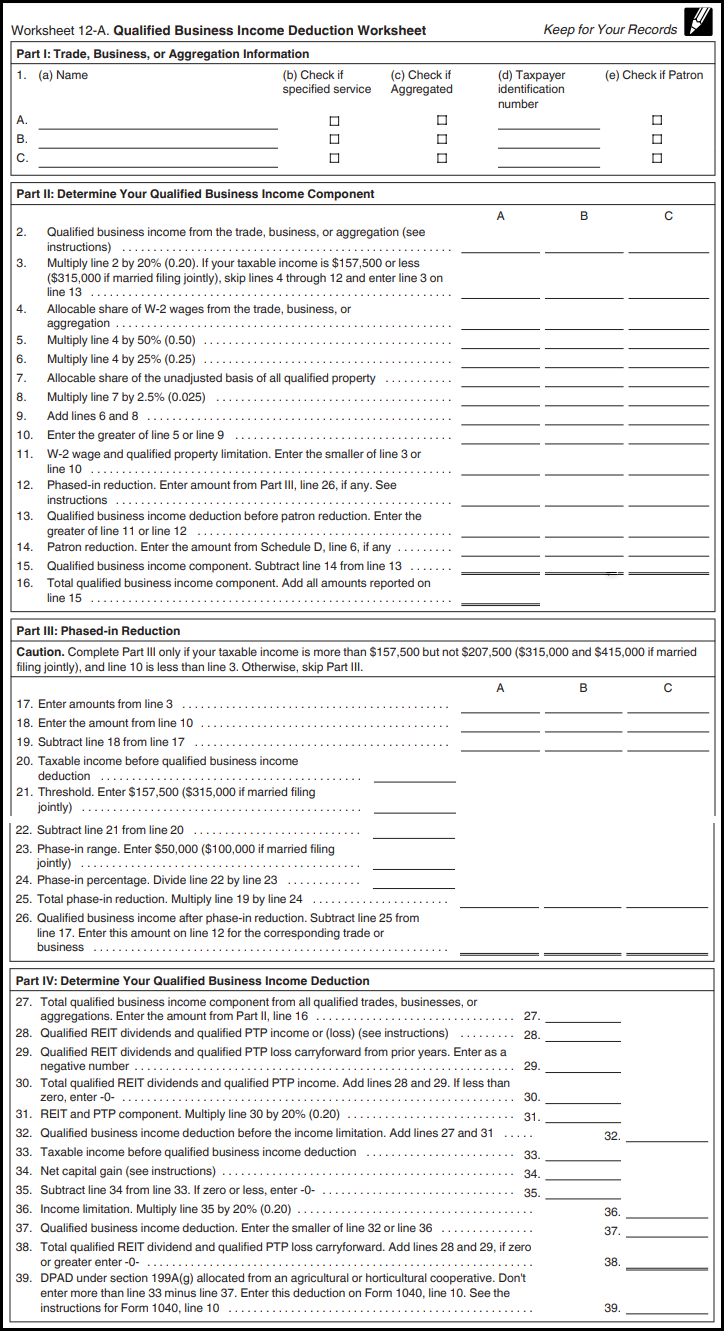

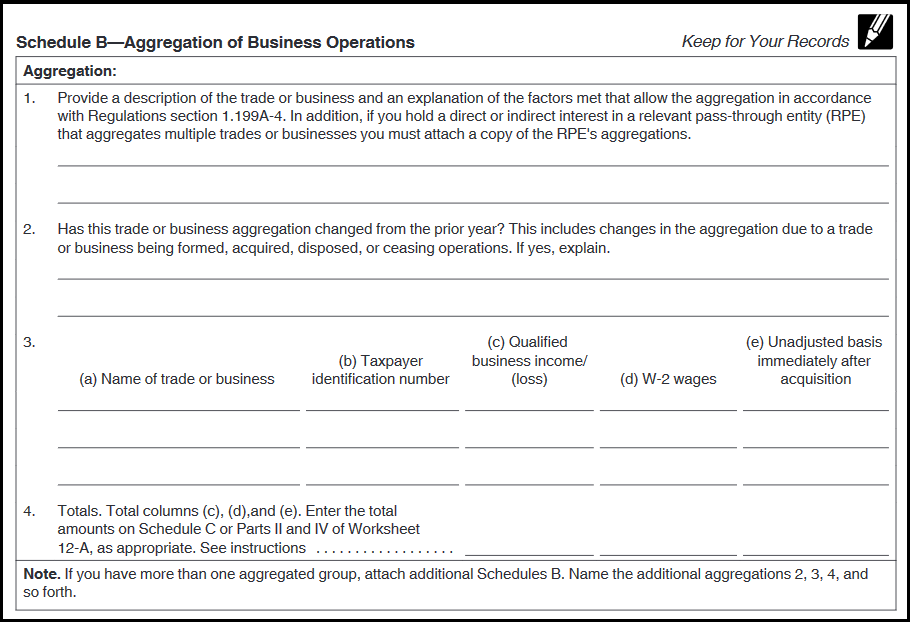

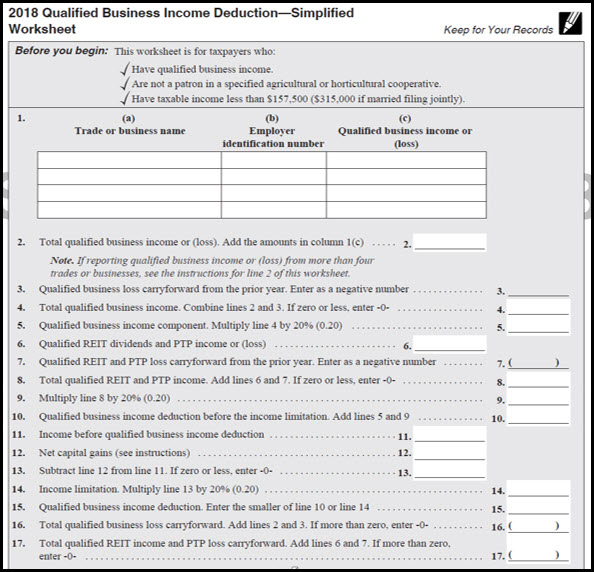

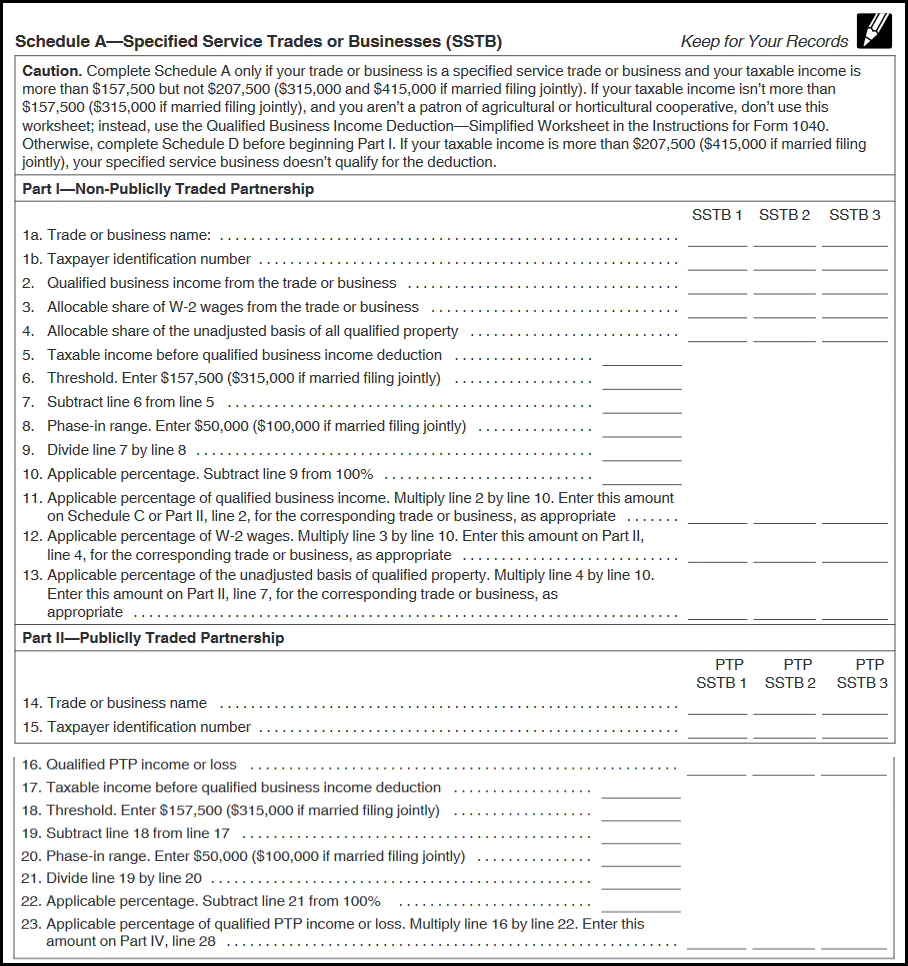

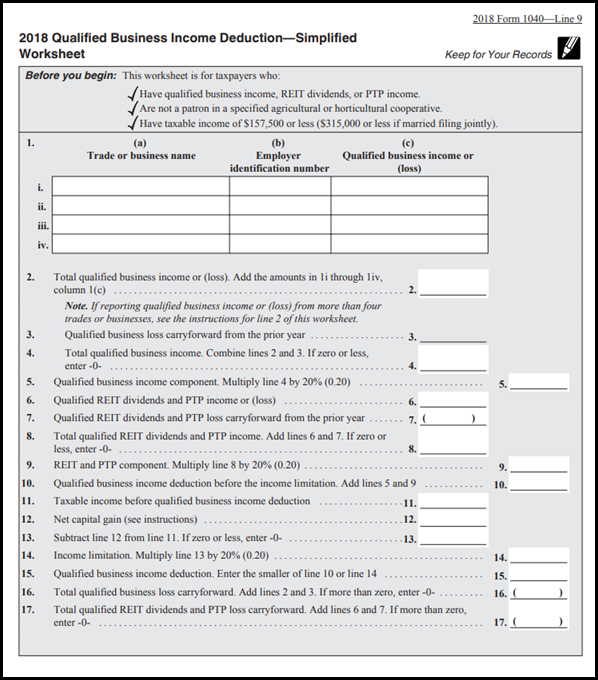

199A Worksheet - Web for aggregration of businesses see caution: Web 199a deduction is temporary: Web the 2017 tax cuts and jobs act created section 199a of the internal revenue code, which allows pass through businesses to deduct up to 20 percent of. For multiple rental business see how to handle multiple rental. Solved•by intuit•62•updated july 14, 2022. Web terms have the meanings given. (a) alternative minimum taxable income means the sum of the following for the taxable. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. Web calculating the section 199a deductions. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. Solved•by intuit•62•updated july 14, 2022. Web for aggregration of businesses see caution: Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business. Web how to enter adjustments in 199a worksheet? (1) the taxpayer's federal alternative. Web 199a deduction is temporary: Web for aggregration of businesses see caution: For multiple rental business see how to handle multiple rental. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. Solved•by intuit•62•updated july 14, 2022. Web the 2017 tax cuts and jobs act created section 199a of the internal revenue code, which allows pass through businesses to deduct up to 20 percent of. For multiple rental business. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Web this worksheet lists a portion of the dividends identified as section. Web qualified business income deduction. (1) the taxpayer's federal alternative. Solved•by intuit•62•updated july 14, 2022. (a) alternative minimum taxable income means the sum of the following for the taxable. Web terms have the meanings given. Web for aggregration of businesses see caution: For multiple rental business see how to handle multiple rental. By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Web when i print my form 1065 return for filing by mail, included is the 199a summary and. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. Solved•by intuit•62•updated july 14, 2022. Web when i print my form 1065 return for filing by mail, included is. (1) the taxpayer's federal alternative. Web qualified business income deduction. Web terms have the meanings given. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web the 2017 tax cuts and jobs act created section 199a of the internal revenue code, which allows pass through businesses to deduct up to 20. Web 199a deduction is temporary: Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. Web for aggregration of businesses see caution: Web the 2017 tax cuts and jobs act created section 199a of the internal revenue code, which allows pass through businesses to deduct up to. Web how to enter adjustments in 199a worksheet? Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked keep for your. For multiple rental business see how to. It is available from 2018 to 2025. Web calculating the section 199a deductions. Solved•by intuit•62•updated july 14, 2022. (a) alternative minimum taxable income means the sum of the following for the taxable. Web for aggregration of businesses see caution: Web the 2017 tax cuts and jobs act created section 199a of the internal revenue code, which allows pass through businesses to deduct up to 20 percent of. Web for aggregration of businesses see caution: Web how to enter adjustments in 199a worksheet? For multiple rental business see how to. Web calculating the section 199a deductions. By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. It is available from 2018 to 2025. Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked keep for your. Web terms have the meanings given. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business. A line is generated on the worksheet for each activity (located on screen. (1) the taxpayer's federal alternative. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web qualified business income deduction. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. For multiple rental business see how to handle multiple rental. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Web calculating the section 199a deductions. For multiple rental business see how to. A line is generated on the worksheet for each activity (located on screen. (1) the taxpayer's federal alternative. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal. Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked keep for your. Web terms have the meanings given. Web how to enter adjustments in 199a worksheet? Web 199a deduction is temporary: Web for aggregration of businesses see caution: Solved•by intuit•62•updated july 14, 2022. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section 1202. It is available from 2018 to 2025.Lacerte Simplified Worksheet Section 199A Qualified Business I

Lacerte Complex Worksheet Section 199A Qualified Business

Lacerte Complex Worksheet Section 199A Qualified Business Inco

How to enter and calculate the qualified business deduction

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

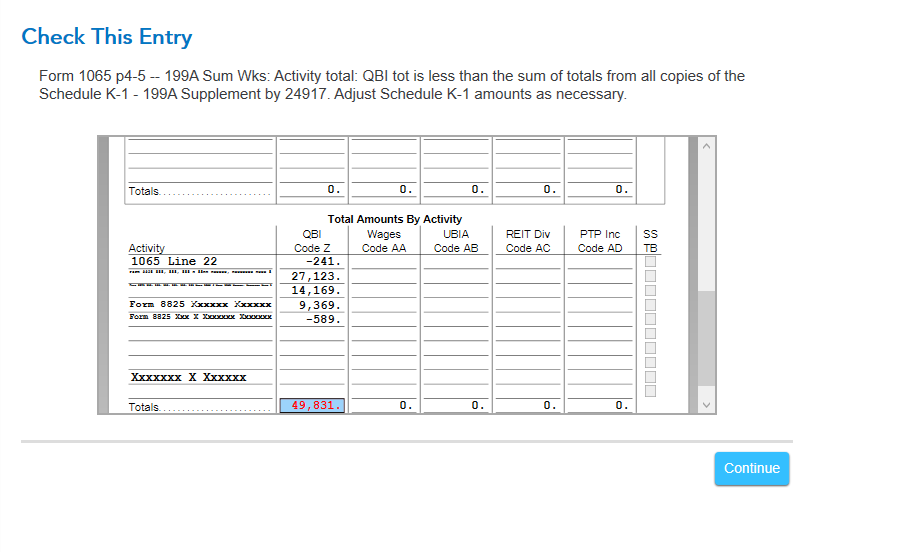

Does the 199A Summary Worksheet correctly compare the Totals on

Lacerte Complex Worksheet Section 199A Qualified Business Inco

Section 754 Calculation Worksheet Master of Documents

Lacerte Simplified Worksheet Section 199A Qualified Business I

Section 199a Deduction Worksheet Master of Documents

For Multiple Rental Business See How To Handle Multiple Rental.

Web For Aggregration Of Businesses See Caution:

Web Qualified Business Income Deduction.

Web The 2017 Tax Cuts And Jobs Act Created Section 199A Of The Internal Revenue Code, Which Allows Pass Through Businesses To Deduct Up To 20 Percent Of.

Related Post: