263A Calculation Worksheet

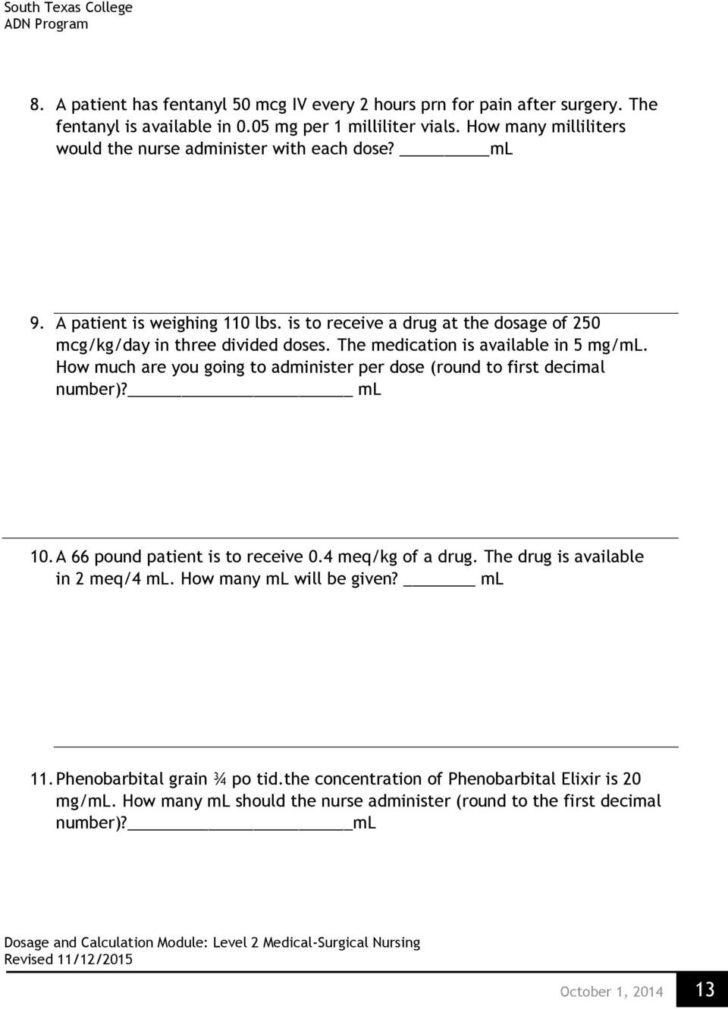

263A Calculation Worksheet - The first step of calculating section 263a is to separate all of the company's expenses which appear on its profit and loss statement. Web the taxpayer would then perform the traditional sec. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g., by using. 263a computation that may be scrutinized during an irs examination, which include: 263a that, among other things, provide a new simplified method of. Web irs code section 263a details the uniform capitalization rules ( unicap) that business owners need to use in their calculations for capitalizing their costs for tax purposes. Web the irs in 2018 published uniform capitalization (unicap) final regulations under sec. Thus, section 263a costs are the sum of a taxpayer's section 471 costs, its. In many instances, the bdo team is able. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: Determine all indirect purchase costs, which could. Thus, section 263a costs are the sum of a taxpayer's section 471 costs, its. 263a calculation with respect to all other capitalizable costs (i.e. Web the taxpayer would. Web i know using the word simple on 263a is probably an oxymoron. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and sellers. Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g.,. Thus, section 263a costs are the sum of. 263a calculation with respect to all other capitalizable costs (i.e. Web section 263a for producers. Web section 263a costs are defined as the costs that a taxpayer must capitalize under section 263a. 263a that, among other things, provide a new simplified method of. Web the taxpayer would then perform the traditional sec. In many instances, the bdo team is able. Web the basics of calculating section 263a. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and sellers. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: The. 263a computation that may be scrutinized during an irs examination, which include: Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g., by using. 263a calculation with respect to all other capitalizable costs (i.e. Web section 263a costs are defined as the costs that a taxpayer must capitalize under section. Web the basics of calculating section 263a. Web i know using the word simple on 263a is probably an oxymoron. Web section 263a costs are defined as the costs that a taxpayer must capitalize under section 263a. Thus, section 263a costs are the sum of a taxpayer's section 471 costs, its. Web the taxpayer would then perform the traditional sec. I've seen some sample calculations in specialized publications, like the. Determine all indirect purchase costs, which could. Thus, section 263a costs are the sum of a taxpayer's section 471 costs, its. Web the taxpayer would then perform the traditional sec. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: I've seen some sample calculations in specialized publications, like the. Web also known as the uniform capitalization (unicap) rules, section 263a outlines which. Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g., by using. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and sellers. 263a that, among other things, provide a new simplified method of. Web bdo can review existing section 263a calculations. 263a calculation with respect to all other capitalizable costs (i.e. Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g.,. Web also known as the uniform capitalization (unicap) rules, section 263a outlines which costs must be capitalized, as well as which costs and businesses are exempt from the rules. Use. Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g.,. 263a computation that may be scrutinized during an irs examination, which include: Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g., by using. 263a that, among other things, provide a new simplified method of. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and sellers. Web the basics of calculating section 263a. 263a calculation with respect to all other capitalizable costs (i.e. Thus, section 263a costs are the sum of a taxpayer's section 471 costs, its. Web also known as the uniform capitalization (unicap) rules, section 263a outlines which costs must be capitalized, as well as which costs and businesses are exempt from the rules. Web section 263a costs are defined as the costs that a taxpayer must capitalize under section 263a. Web irs code section 263a details the uniform capitalization rules ( unicap) that business owners need to use in their calculations for capitalizing their costs for tax purposes. The first step of calculating section 263a is to separate all of the company's expenses which appear on its profit and loss statement. Web the irs in 2018 published uniform capitalization (unicap) final regulations under sec. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. Determine all indirect purchase costs, which could. Web the taxpayer would then perform the traditional sec. Web i know using the word simple on 263a is probably an oxymoron. In many instances, the bdo team is able. I've seen some sample calculations in specialized publications, like the. Web section 263a for producers. Use multiplication and division within 100 to solve word problems in situations involving equal groups, arrays, and measurement quantities, e.g., by using. Web the taxpayer would then perform the traditional sec. 263a that, among other things, provide a new simplified method of. Of the many complexities contained within section 263a is the need for separate calculation methodologies for producers and sellers. Web the lb&i practice unit emphasizes key aspects of a reseller's sec. Web section 263a for producers. I've seen some sample calculations in specialized publications, like the. Web section 263a costs are defined as the costs that a taxpayer must capitalize under section 263a. Web i know using the word simple on 263a is probably an oxymoron. Web section 263a is one of the more difficult sections of the us tax code, but a basic overview of the calculation process runs thusly: Web the basics of calculating section 263a. Thus, section 263a costs are the sum of a taxpayer's section 471 costs, its. The first step of calculating section 263a is to separate all of the company's expenses which appear on its profit and loss statement. Web bdo can review existing section 263a calculations to identify what changes must be made to comply with the regulations. Web the irs in 2018 published uniform capitalization (unicap) final regulations under sec. 263a calculation with respect to all other capitalizable costs (i.e.Dosage Calculation Worksheets

263A

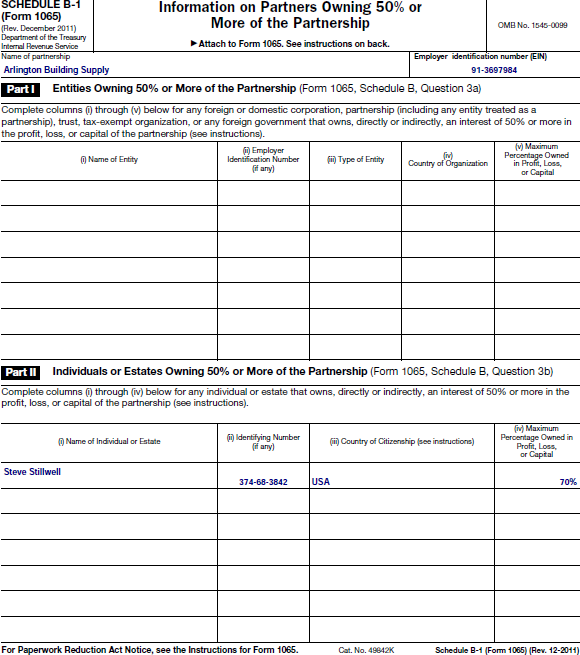

1. These book/tax differences are also separatelystated i...

Dimensional Analysis Practice Worksheet For Nursing Students worksheet

Form 24 Change To Section We've chosen to wrap it inside a tag in

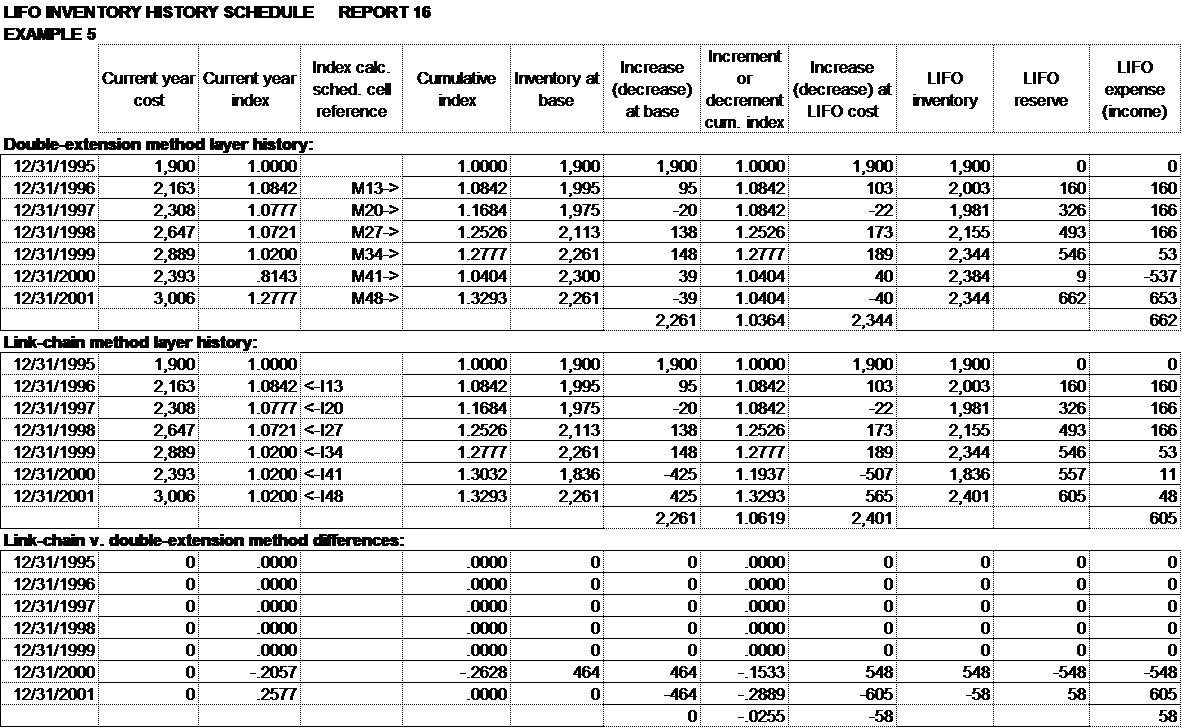

Why the Doubleextension LIFO Index Calculation Method is Unreliable

Nursing Dosage Calculations Printable Worksheets Coloring pages

Mole Worksheets 2 Answer Key

Assets Plant Prepaid insurance Interest receivable Inventories Research

Med Math for Nurses IV Dug Dosage Calculations Cheat Sheet

263A Computation That May Be Scrutinized During An Irs Examination, Which Include:

Web Irs Code Section 263A Details The Uniform Capitalization Rules ( Unicap) That Business Owners Need To Use In Their Calculations For Capitalizing Their Costs For Tax Purposes.

Use Multiplication And Division Within 100 To Solve Word Problems In Situations Involving Equal Groups, Arrays, And Measurement Quantities, E.g.,.

Determine All Indirect Purchase Costs, Which Could.

Related Post: