7-2 Modeling Tax Schedules Worksheet Answers

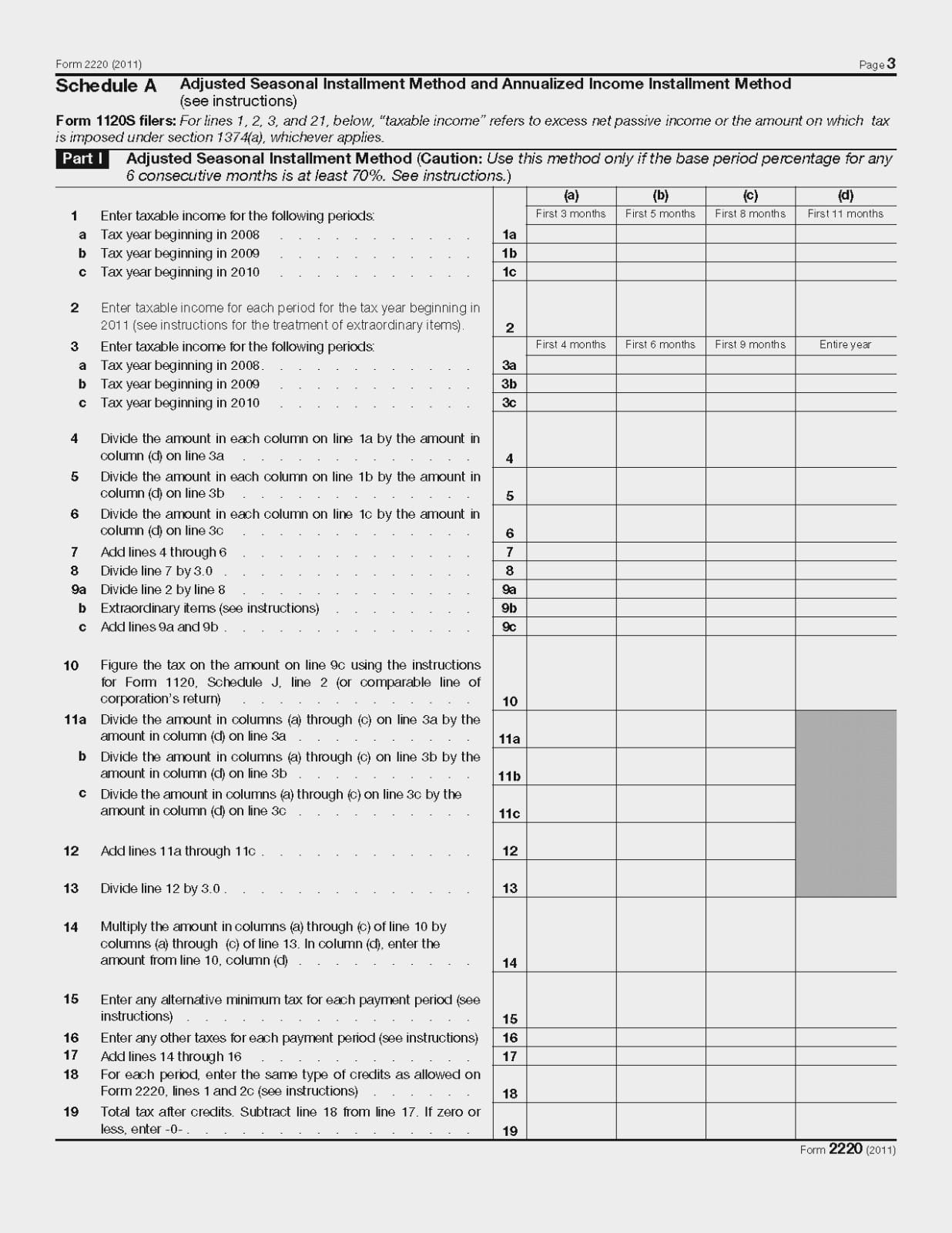

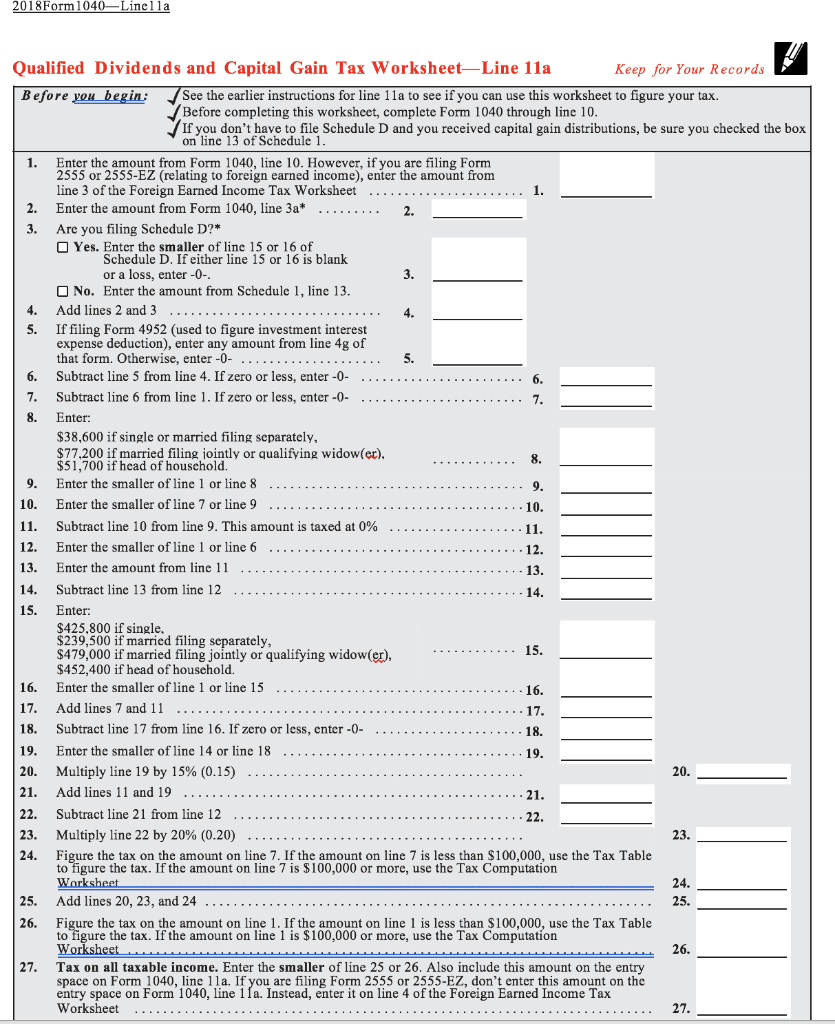

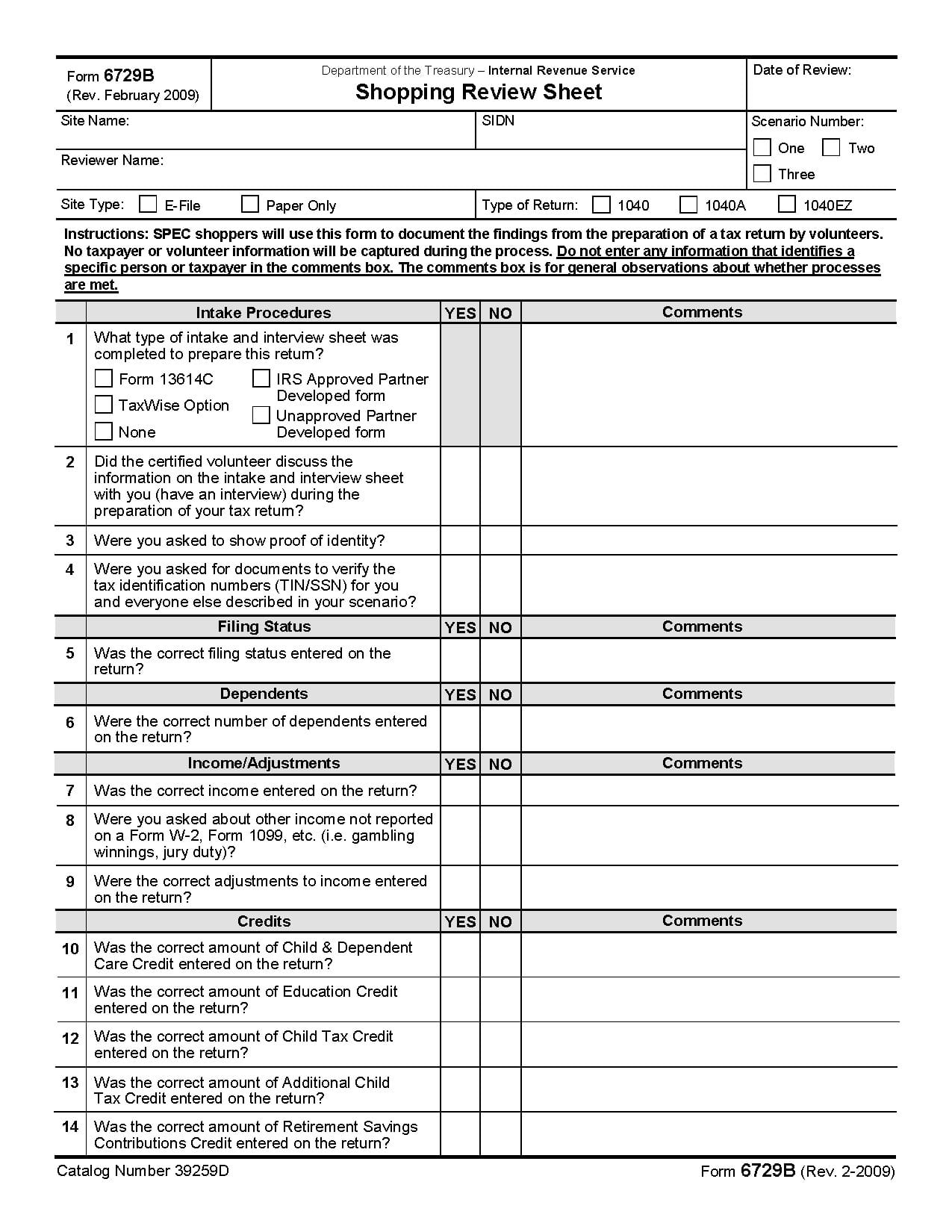

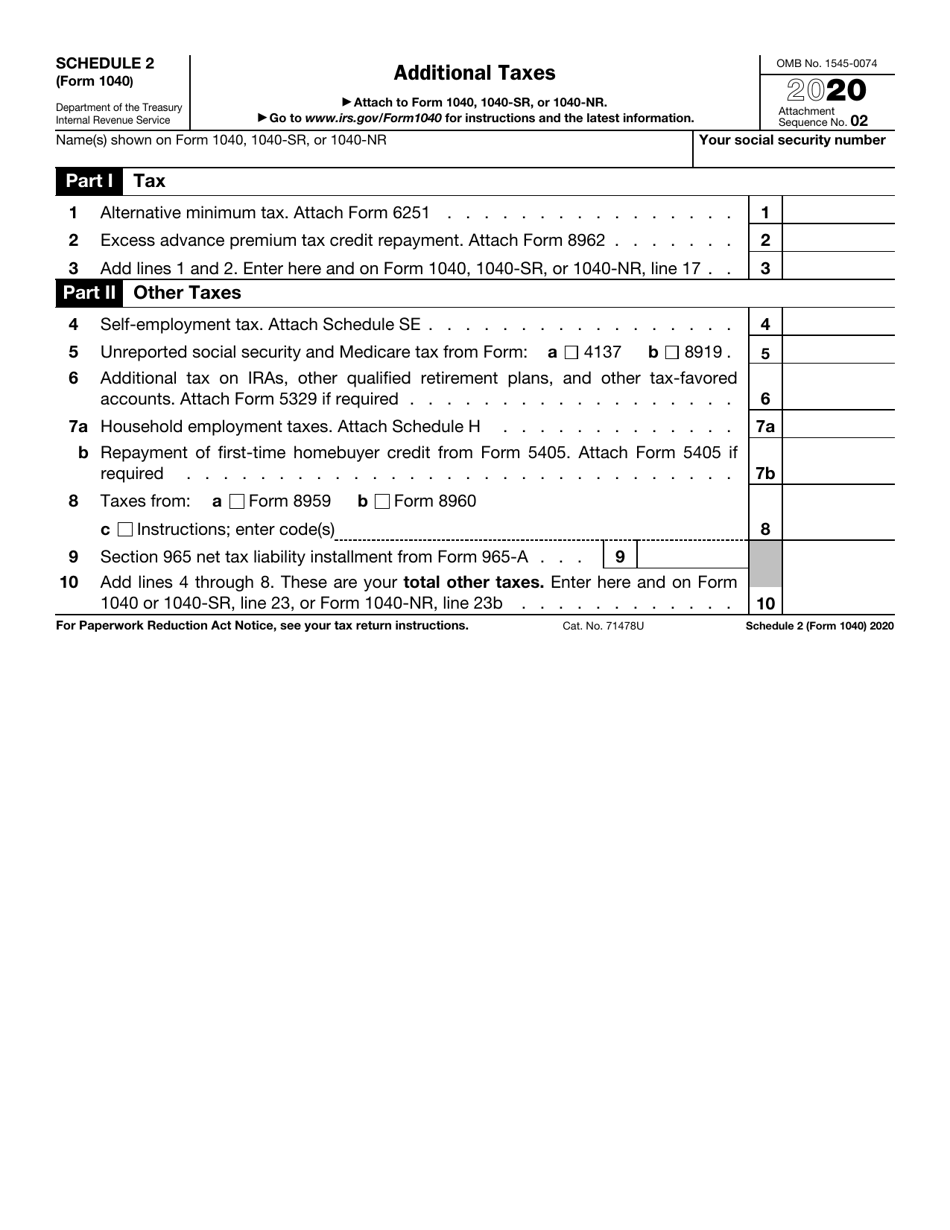

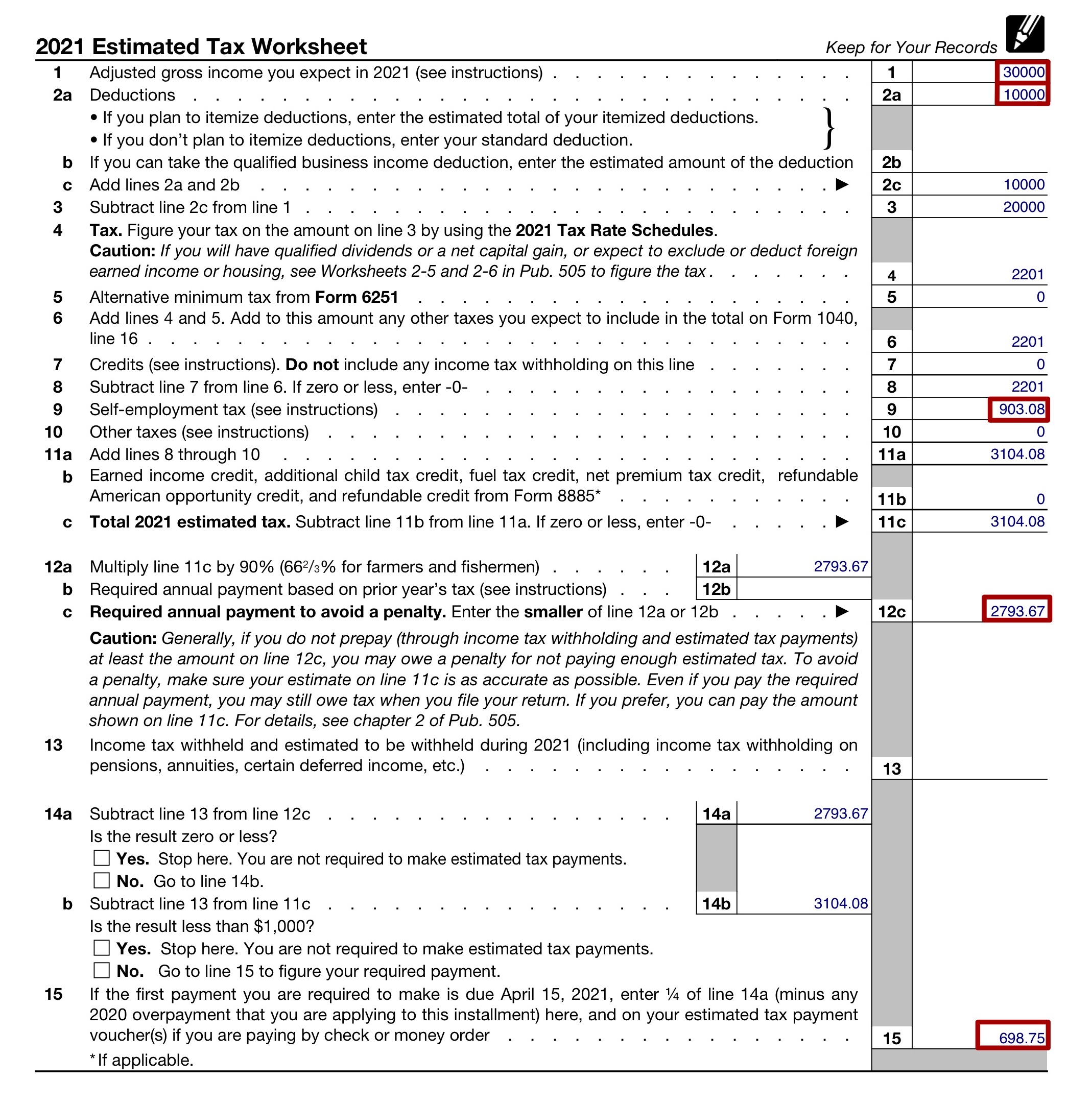

7-2 Modeling Tax Schedules Worksheet Answers - Web edit, sign, and share 7 2 modeling tax schedules worksheet answers online. • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. No need to install software, just go to dochub, and sign up instantly and for free. 7 income taxes 7.2 modeling tax schedules. Nevertheless, the public finds it easier to work with. Web our resource for financial algebra includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. A tax that increases as income increases; A tax that is the same percentage or rate such as sales tax. This amount may, or may not, apply to your state income tax, depending on your local laws. How much tax would a shopper pay if he or sheneeded to make a $100 purchase and the tax. A tax that is the same percentage or rate such as sales tax. • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. Web comments and help with 7 2 modeling tax schedules answers. No need to install software, just go to dochub, and sign up instantly and for free. Nevertheless, the public. No need to install software, just go to dochub, and sign up instantly and for free. Nevertheless, the public finds it easier to work with. It buries the delineations between tax brackets and the progressive rates. How much tax would a shopper pay if he or sheneeded to make a $100 purchase and the tax. This amount may, or may. 7 income taxes 7.2 modeling tax schedules. Web edit, sign, and share 7 2 modeling tax schedules worksheet answers online. No need to install software, just go to dochub, and sign up instantly and for free. • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. Web use the tax schedule to write. 7 income taxes 7.2 modeling tax schedules. Web comments and help with 7 2 modeling tax schedules answers. Use the distributive property and combine like. Web sales tax and tip worksheet (7th grade) this worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Web edit, sign, and share 7 2. Web edit, sign, and share 7 2 modeling tax schedules worksheet answers online. Flat tax proportional tax progressive tax system tax. Construct income tax graphs using compound equations. • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. Web sales tax and tip worksheet (7th grade) this worksheet provides 8 consumer math real. Calculate the tax for each taxable income of a head of household. No need to install software, just go to dochub, and sign up instantly and for free. Use the distributive property and combine like. Web sales tax and tip worksheet (7th grade) this worksheet provides 8 consumer math real world problems on sales tax and tip, as well as. A tax that is the same percentage or rate such as sales tax. Web edit, sign, and share 7 2 modeling tax schedules worksheet answers online. No need to install software, just go to dochub, and sign up instantly and for free. Web our resource for financial algebra includes answers to chapter exercises, as well as detailed information to walk. This amount may, or may not, apply to your state income tax, depending on your local laws. Web our resource for financial algebra includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. Construct income tax graphs using compound equations. Nevertheless, the public finds it easier to work with. Calculate the. The same as a flat tax; • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. A tax that is the same percentage or rate such as sales tax. A tax that increases as income increases; 7 income taxes 7.2 modeling tax schedules. Web comments and help with 7 2 modeling tax schedules answers. It buries the delineations between tax brackets and the progressive rates. Web our resource for financial algebra includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. A tax that increases as income increases; Web sales tax and tip worksheet. A tax that is the same percentage or rate such as sales tax. Construct income tax graphs using compound equations. How much tax would a shopper pay if he or sheneeded to make a $100 purchase and the tax. Calculate the tax for each taxable income of a head of household. The same as a flat tax; This amount may, or may not, apply to your state income tax, depending on your local laws. Web sales tax and tip worksheet (7th grade) this worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. A tax that increases as income increases; • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. Nevertheless, the public finds it easier to work with. Web edit, sign, and share 7 2 modeling tax schedules worksheet answers online. No need to install software, just go to dochub, and sign up instantly and for free. 7 income taxes 7.2 modeling tax schedules. Web use the tax schedule to write three equations in y = m x + b form for values of x that are greater than or equal to $ 100, 000. It buries the delineations between tax brackets and the progressive rates. Flat tax proportional tax progressive tax system tax. Use the distributive property and combine like. Web comments and help with 7 2 modeling tax schedules answers. Web our resource for financial algebra includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. • a tax schedule is a rate sheet used by individual tax payers to determine their estimated. Web edit, sign, and share 7 2 modeling tax schedules worksheet answers online. Web sales tax and tip worksheet (7th grade) this worksheet provides 8 consumer math real world problems on sales tax and tip, as well as 2 enrichment problems. Web our resource for financial algebra includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. Calculate the tax for each taxable income of a head of household. A tax that increases as income increases; Web comments and help with 7 2 modeling tax schedules answers. Construct income tax graphs using compound equations. The same as a flat tax; Nevertheless, the public finds it easier to work with. Flat tax proportional tax progressive tax system tax. How much tax would a shopper pay if he or sheneeded to make a $100 purchase and the tax. A tax that is the same percentage or rate such as sales tax. Web use the tax schedule to write three equations in y = m x + b form for values of x that are greater than or equal to $ 100, 000. It buries the delineations between tax brackets and the progressive rates.Estimated Tax Worksheet —

2015 Child Tax Credit Worksheet worksheet

1040 Qualified Dividends Worksheet Worksheet List

Worksheet 2020 Federal Tax Tables Askworksheet

Tax Return Worksheet

Pin on Worksheet

Irs Fillable Form 1040 IRS Form 1040NREZ Download Fillable PDF or

How do I file estimated quarterly taxes? Stride Health

7 2 Modeling Tax Schedules Worksheet Answers Fill Online, Printable

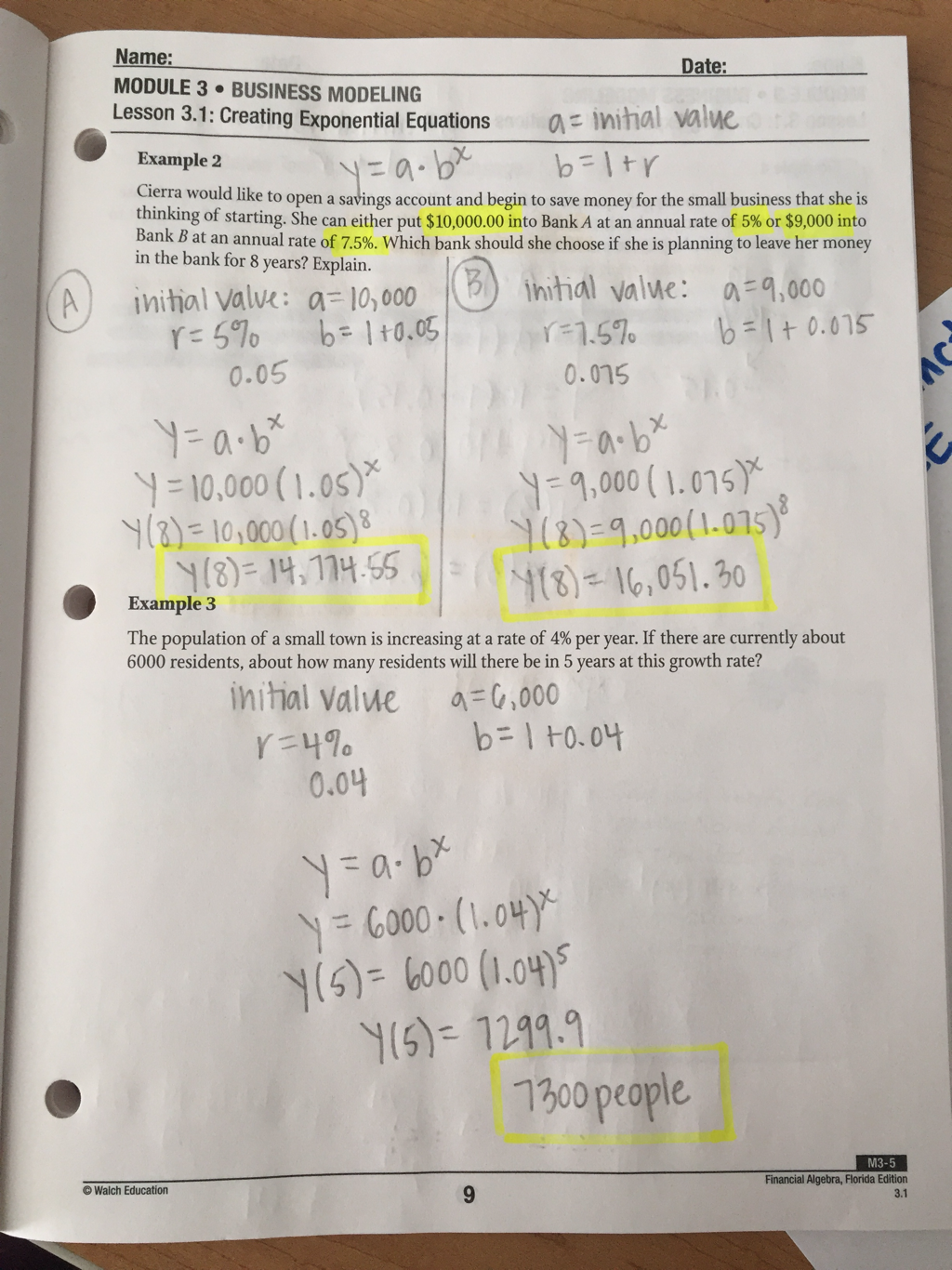

Financial Algebra Textbook Answer Key → Waltery Learning Solution for

Use The Distributive Property And Combine Like.

7 Income Taxes 7.2 Modeling Tax Schedules.

This Amount May, Or May Not, Apply To Your State Income Tax, Depending On Your Local Laws.

No Need To Install Software, Just Go To Dochub, And Sign Up Instantly And For Free.

Related Post: