8829 Line 11 Worksheet

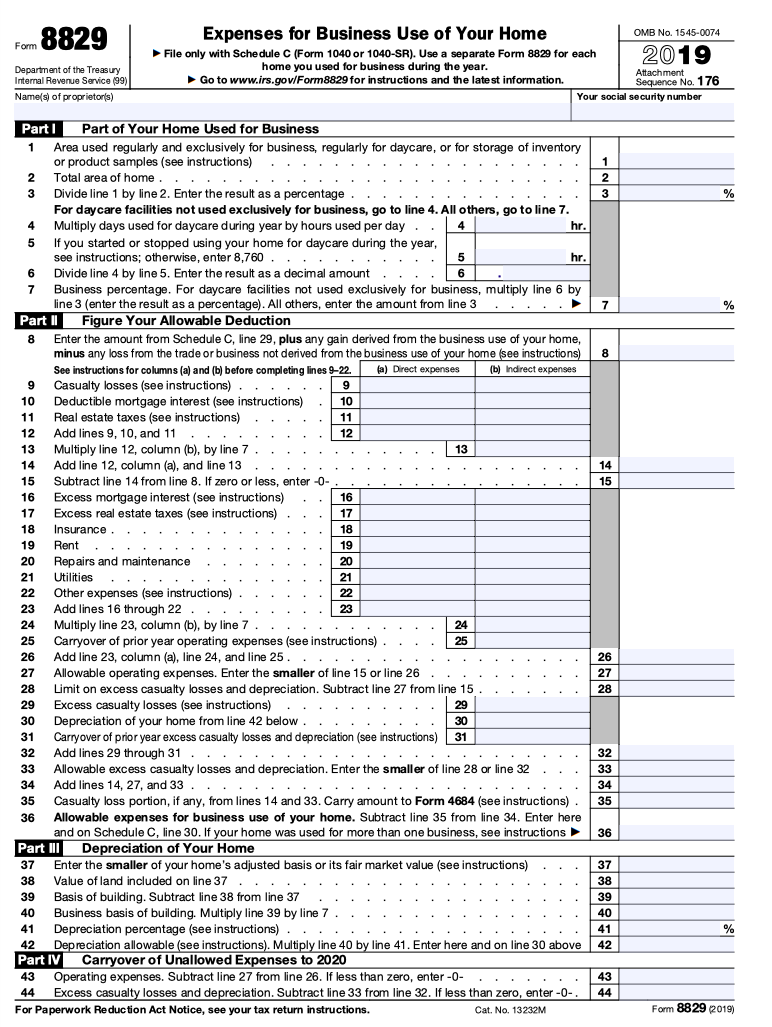

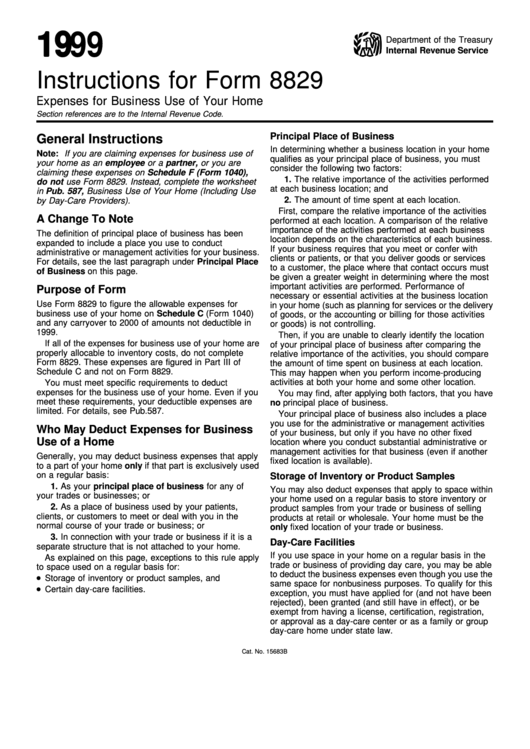

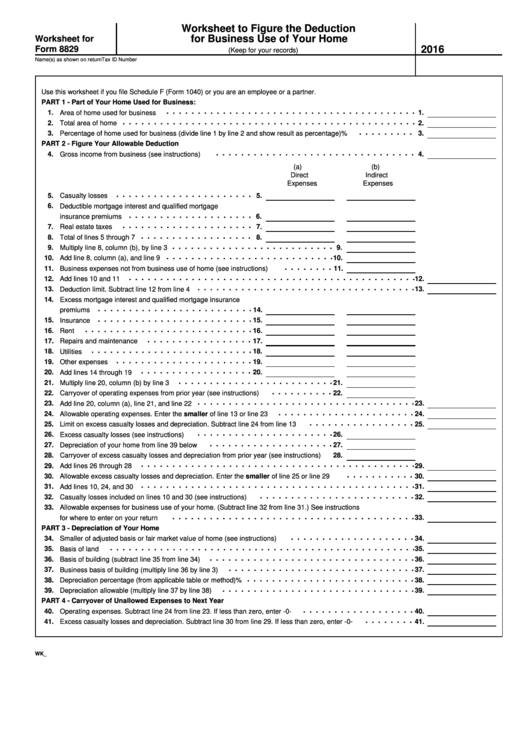

8829 Line 11 Worksheet - Web there are two ways to claim the deduction: Web irs form 8829 is the form used to deduct expenses for your home business space. If greater, see the line 11 worksheet in the form instructions. Web you find the worksheet in the instructions to form 8829. Enjoy the preschool number worksheets that help the kids. It is considered an indirect expense unless you have real estate taxes specifically for a. It's a pain in the neck. Enter the resulting amount in column. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2015 of amounts not deductible. On screen 29 i removed the real estate tax from indirect column and entered the. Web i completed the 8829 line 11 worksheet. Web there are two ways to claim the deduction: Enjoy the preschool number worksheets that help the kids. On screen 29 i removed the real estate tax from indirect column and entered the. Total home mortgage interest and total real estate taxes should be entered on irs form 8829 in the indirect. Web you find the worksheet in the instructions to form 8829. The calculated amount will flow to the applicable schedule instead. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. Free printable worksheet on number 29 for preschool kids are perfect for learning numbers. Line 11a is. Web you find the worksheet in the instructions to form 8829. This is where you would enter any real estate tax you have paid. If greater, see the line 11 worksheet in the form instructions. Web there are two ways to claim the deduction: It is considered an indirect expense unless you have real estate taxes specifically for a. Web if less, enter the amount attributable to business use in line 11b; Web you find the worksheet in the instructions to form 8829. Then you take the results and enter into lacerte where the diagnostic tells you to. Web the deduction for mortgage insurance premiums. Free printable worksheet on number 29 for preschool kids are perfect for learning numbers. It's a pain in the neck. If you are eligible for this. Line 11a is zero and line 17a is $1,200. Web irs form 8829 is the form used to deduct expenses for your home business space. Total home mortgage interest and total real estate taxes should be entered on irs form 8829 in the indirect expenses. Web the deduction for mortgage insurance premiums. Then you take the results and enter into lacerte where the diagnostic tells you to. Line 11a is zero and line 17a is $1,200. It's a pain in the neck. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Then you take the results and enter into lacerte where the diagnostic tells you to. Web irs form 8829 is the form used to deduct expenses for your home business space. Web the deduction for mortgage insurance premiums. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total.. This is where you would enter any real estate tax you have paid. See lines 9, 10, and 11 and line 16, later, and the instructions for schedule a for more information. On screen 29 i removed the real estate tax from indirect column and entered the. It's a pain in the neck. If greater, see the line 11 worksheet. Then you take the results and enter into lacerte where the diagnostic tells you to. Free printable worksheet on number 29 for preschool kids are perfect for learning numbers. Web if less, enter the amount attributable to business use in line 11b; It's a pain in the neck. Web form 8829 line 11 worksheet instructions for irs form 8829. This is where you would enter any real estate tax you have paid. See lines 9, 10, and 11 and line 16, later, and the instructions for schedule a for more information. On screen 29 i removed the real estate tax from indirect column and entered the. Then you take the results and enter into lacerte where the diagnostic tells. Line 11a is zero and line 17a is $1,200. Enter the resulting amount in column. Web the deduction for mortgage insurance premiums. Web worksheet on number 29. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2015 of amounts not deductible. Enjoy the preschool number worksheets that help the kids. Web there are two ways to claim the deduction: If greater, see the line 11 worksheet in the form instructions. Web if less, enter the amount attributable to business use in line 11b; The calculated amount will flow to the applicable schedule instead. Web form 8829 line 11 worksheet instructions for irs form 8829. Total home mortgage interest and total real estate taxes should be entered on irs form 8829 in the indirect expenses. Web i completed the 8829 line 11 worksheet. The irs determines the eligibility of an allowable home business space using two. Web you find the worksheet in the instructions to form 8829. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. It is considered an indirect expense unless you have real estate taxes specifically for a. Free printable worksheet on number 29 for preschool kids are perfect for learning numbers. This is where you would enter any real estate tax you have paid. Web irs form 8829 is the form used to deduct expenses for your home business space. Web i completed the 8829 line 11 worksheet. Web there are two ways to claim the deduction: Web form 8829 line 11 worksheet instructions for irs form 8829. The irs determines the eligibility of an allowable home business space using two. Web the deduction for mortgage insurance premiums. If greater, see the line 11 worksheet in the form instructions. Line 11a is zero and line 17a is $1,200. This is where you would enter any real estate tax you have paid. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; On screen 29 i removed the real estate tax from indirect column and entered the. The calculated amount will flow to the applicable schedule instead. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2015 of amounts not deductible. Web if less, enter the amount attributable to business use in line 11b; If you are eligible for this. Then you take the results and enter into lacerte where the diagnostic tells you to.Instructions For Form 8829 Expenses For Business Use Of Your Home

Eic Worksheet

Publication 972 Child Tax Credit; Publication 972 Main Contents

How to Fill out Form 8829 Bench Accounting

Form 8829 Worksheet Fill Out and Sign Printable PDF Template signNow

Instructions For Form 8829 Expenses For Business Use Of Your Home

number 11 tracing worksheet for preschool englishbix number 11

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Fillable IRS Form 8829 2018 2019 Online PDF Template

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Total Home Mortgage Interest And Total Real Estate Taxes Should Be Entered On Irs Form 8829 In The Indirect Expenses.

It's A Pain In The Neck.

Enjoy The Preschool Number Worksheets That Help The Kids.

Web Worksheet On Number 29.

Related Post: