941-X Worksheet 1 Fillable Form

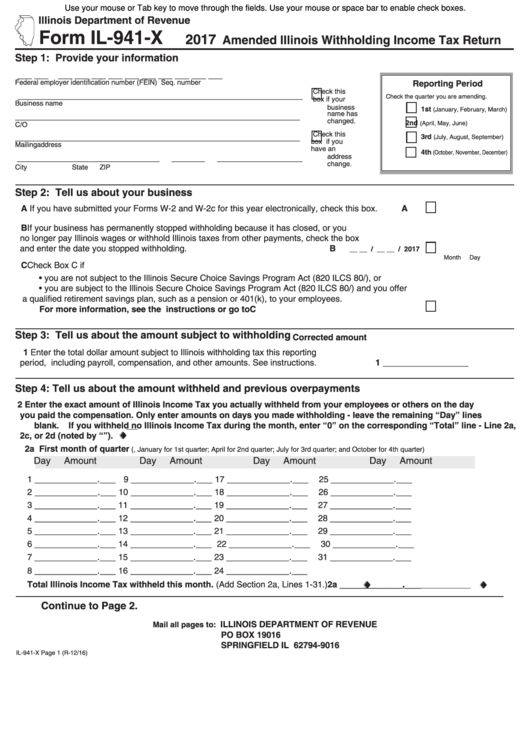

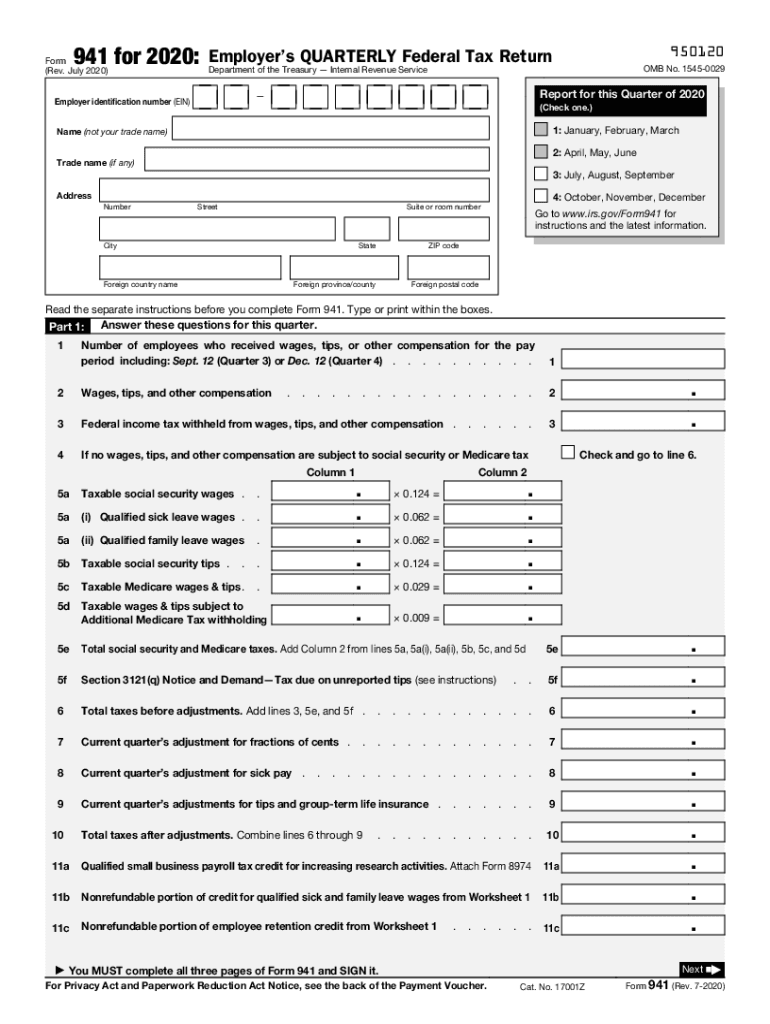

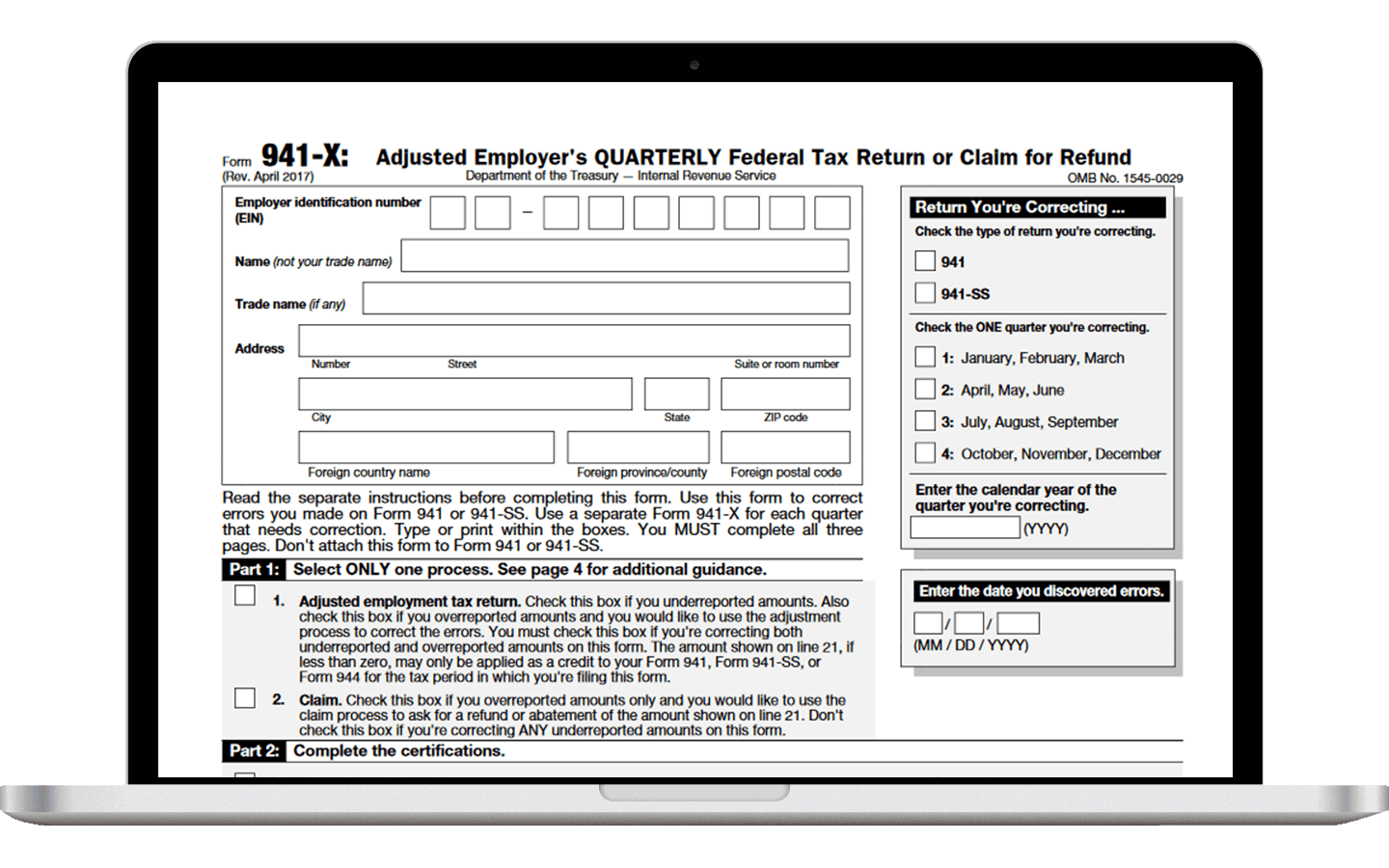

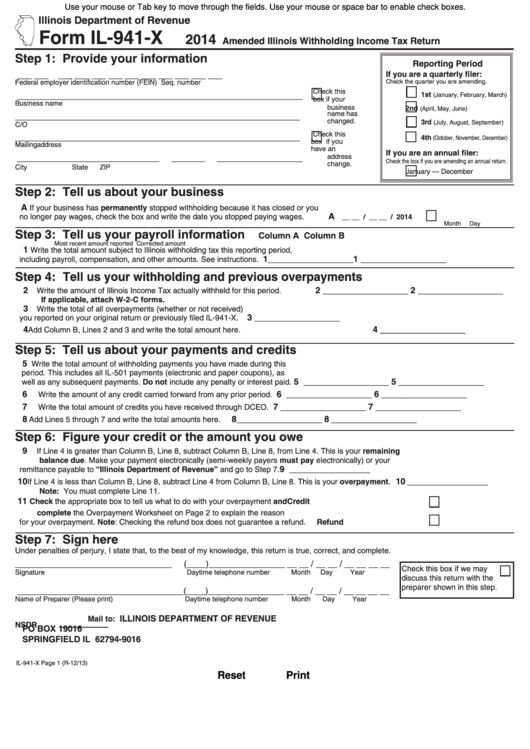

941-X Worksheet 1 Fillable Form - Use get form or simply click on the template preview to open it in the editor. Web worksheet 1 (included in the instructions to form 941) is used to calculate. Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Web web worksheet 1 (different from worksheet 1 for quarter 1 2021), 3, 4, and 5 are used for. Ad we resolve & reduce tax liabilities by speaking the tax language so you don't have to. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. A second version of the. Reach out to us today! Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. Use get form or simply click on the template preview to open it in the editor. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web worksheet 1 (included in the instructions to form 941) is used to calculate. Ad we resolve & reduce tax liabilities by speaking the tax. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web worksheet 1 (included in the instructions to form 941) is used to calculate. Web web worksheet 1 (different from worksheet 1 for quarter 1 2021), 3, 4, and 5 are used for. Our teams are licensed enrolled. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. Reach out to us today! What are the new changes in form 941 worksheets for 2023? A second version of the. Use get form or simply click on the template preview to. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. What are the new changes in form 941 worksheets for 2023? Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web web worksheet 1 (different from worksheet. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Ad we resolve & reduce tax liabilities by speaking the tax language so. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Reach out to us today! Our teams are licensed enrolled agents trained in tax resolution. What are the new. The irs has updated the first step of worksheet 1 and reintroduced worksheet 2. We need it to figure and collect the right amount of tax. Web worksheet 1 (included in the instructions to form 941) is used to calculate. Reach out to us today! Thus, any employer who files the. Web september 15, 2021. A second version of the. We need it to figure and collect the right amount of tax. Web web worksheet 1 (different from worksheet 1 for quarter 1 2021), 3, 4, and 5 are used for. Thus, any employer who files the. Use get form or simply click on the template preview to open it in the editor. We need it to figure and collect the right amount of tax. Thus, any employer who files the. Our teams are licensed enrolled agents trained in tax resolution. What are the new changes in form 941 worksheets for 2023? Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Our teams are licensed enrolled agents trained in tax resolution. A second version of the. Ad we resolve & reduce tax liabilities by speaking the tax language so you don't have to. Web worksheet 1 (included in the. Our teams are licensed enrolled agents trained in tax resolution. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. Web september 15, 2021. Web worksheet 1 (included in the instructions to form 941) is used to calculate. We need it to figure and collect the right amount of tax. The irs has updated the first step of worksheet 1 and reintroduced worksheet 2. Web web worksheet 1 (different from worksheet 1 for quarter 1 2021), 3, 4, and 5 are used for. What are the new changes in form 941 worksheets for 2023? Reach out to us today! Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Thus, any employer who files the. A second version of the. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Ad we resolve & reduce tax liabilities by speaking the tax language so you don't have to. Use get form or simply click on the template preview to open it in the editor. Employer identification number (ein) name; Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Employer identification number (ein) name; Use get form or simply click on the template preview to open it in the editor. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. A second version of the. We need it to figure and collect the right amount of tax. Web web worksheet 1 (different from worksheet 1 for quarter 1 2021), 3, 4, and 5 are used for. Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Web september 15, 2021. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Our teams are licensed enrolled agents trained in tax resolution. What are the new changes in form 941 worksheets for 2023? Reach out to us today! The irs has updated the first step of worksheet 1 and reintroduced worksheet 2.2016 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

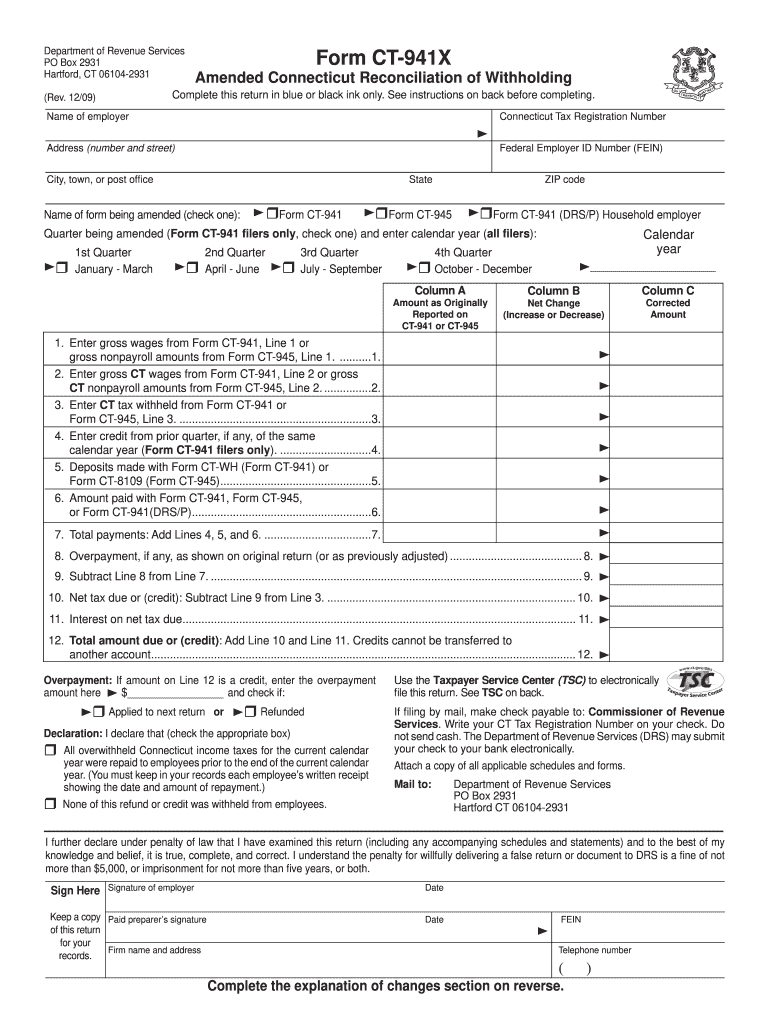

941 X Printable Blank PDF Online

Fillable Form Il941X Amended Illinois Withholding Tax Return

Check Form 941 Worksheet 1 Pdf

IRS Fillable Forms 2290, 941, 941X, W2 & 1099 Download & Print

Fillable Form Il941X Amended Illinois Withholding Tax Return

Don’t Worksheet 1 When You File Your Form 941 this Quarter

Create And Download Form 941 X Fillable And Printable

IRS Form 941X Download Fillable PDF, Adjusted Employer's Quarterly

941 X Form Fill Out and Sign Printable PDF Template signNow

Thus, Any Employer Who Files The.

Ad We Resolve & Reduce Tax Liabilities By Speaking The Tax Language So You Don't Have To.

Web Worksheet 1 (Included In The Instructions To Form 941) Is Used To Calculate.

Web Form 941 Worksheet 1 Is Designed To Accompany The Newly Revised Form 941 For The Second Quarter Of 2020 And Beyond.

Related Post: