941X Worksheet 1 Excel

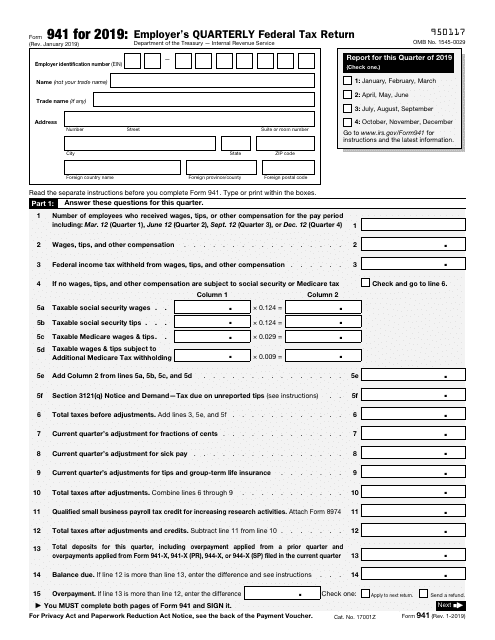

941X Worksheet 1 Excel - Web i do a few small payrolls tax forms. Any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Web the credit for sick & family leave wages and employee retention credit (worksheet1) is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. I'm looking for an excel sheet or other software that i can use to calculate worksheet 1. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. The irs doesn’t require employers to attach worksheet 1 to their form 941. Open it up with online editor and begin editing. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Use get form or simply click on the template preview to open it in the editor. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Thus, any employer who files the quarterly. Web the credit for sick & family leave wages and employee retention credit (worksheet1) is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond.. Find the form 941 worksheet 1 fillable you want. Web up to $40 cash back fill 941x worksheet 1 excel, edit online. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Currently i need to figure out the sick leave credit. Web the irs introduced worksheet 1. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. The irs doesn’t require employers to attach worksheet 1 to their form 941. Thus, any employer who files the quarterly. Web reference worksheet 4 if you claimed the employee. Web i do a few small payrolls tax forms. Currently i need to figure out the sick leave credit. Thus, any employer who files the quarterly. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Find the form 941 worksheet 1 fillable you want.. Currently i need to figure out the sick leave credit. I'm looking for an excel sheet or other software that i can use to calculate worksheet 1. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Find the form 941 worksheet 1 fillable you want. Web the. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web i do a few small payrolls tax forms. Currently i need to figure out the sick leave credit. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. The irs doesn’t require employers to. Currently i need to figure out the sick leave credit. Thus, any employer who files the quarterly. Use get form or simply click on the template preview to open it in the editor. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web the irs introduced worksheet 1 to help employers calculate the tax credits for. Thus, any employer who files the quarterly. Web up to $40 cash back fill 941x worksheet 1 excel, edit online. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Open it up with online editor and begin editing. Use get form or simply click on the template. Any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Thus, any employer who files the quarterly. Currently i need to figure out the sick leave credit. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Open it up with online editor and begin editing. I'm looking for an excel sheet or other software that i can use to calculate worksheet 1. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Find the form 941 worksheet 1 fillable you want. Web the credit for sick & family leave wages and employee retention credit (worksheet1) is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Use get form or simply click on the template preview to open it in the editor. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Currently i need to figure out the sick leave credit. The irs doesn’t require employers to attach worksheet 1 to their form 941. Web up to $40 cash back fill 941x worksheet 1 excel, edit online. Thus, any employer who files the quarterly. Web i do a few small payrolls tax forms. Currently i need to figure out the sick leave credit. Web i do a few small payrolls tax forms. Any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Open it up with online editor and begin editing. I'm looking for an excel sheet or other software that i can use to calculate worksheet 1. Web the credit for sick & family leave wages and employee retention credit (worksheet1) is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web up to $40 cash back fill 941x worksheet 1 excel, edit online. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Use get form or simply click on the template preview to open it in the editor. The irs doesn’t require employers to attach worksheet 1 to their form 941. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Find the form 941 worksheet 1 fillable you want.Don’t Worksheet 1 When You File Your Form 941 this Quarter

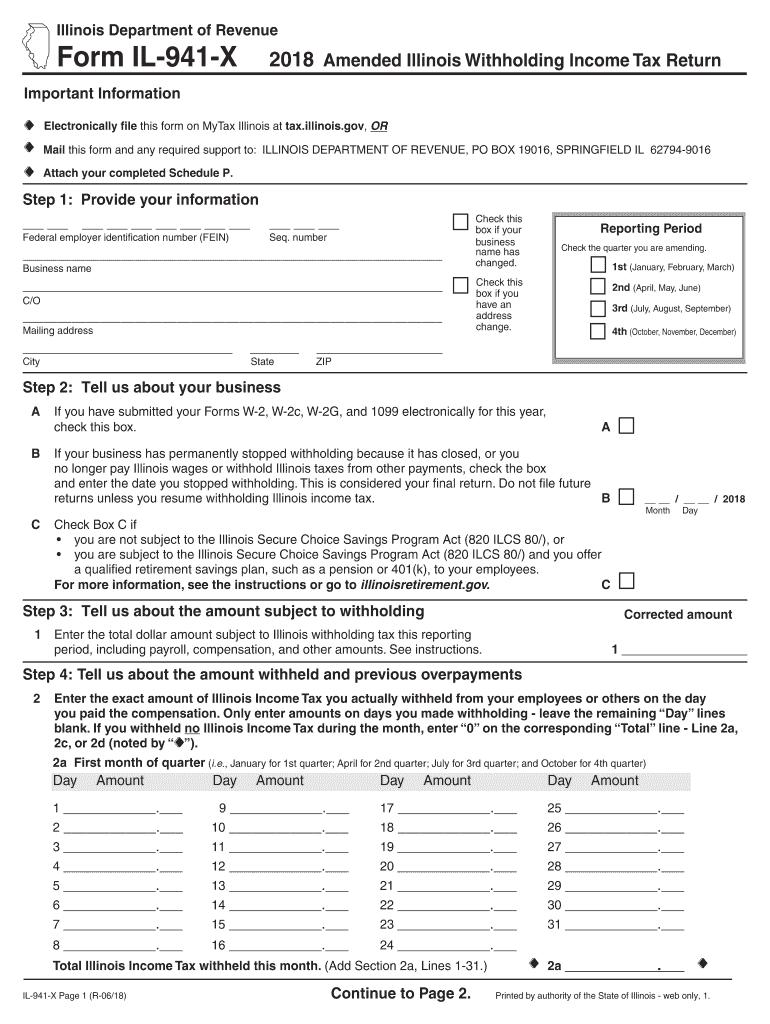

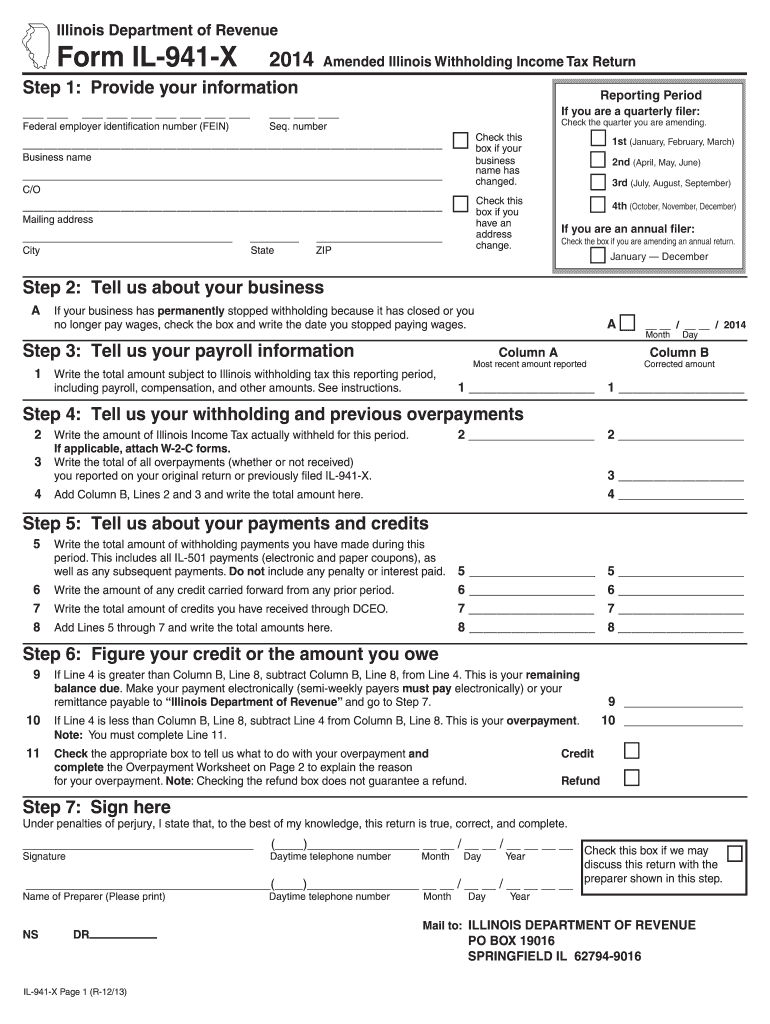

Create And Download Form 941 X Fillable And Printable

941 Worksheet 1 2020 Fillable Pdf

2014 il 941 x form Fill out & sign online DocHub

Taxme

form 941 worksheet 1 employee retention credit

form 941 Fill out & sign online DocHub

Trying to file 941 but getting 'No Employees paid

How To Fill Out 941x For Employee Retention Credit TAX

Create And Download Form 941 X Fillable And Printable

Thus, Any Employer Who Files The Quarterly.

Web Form 941 Worksheet 1 Is Designed To Accompany The Newly Revised Form 941 For The Second Quarter Of 2020 And Beyond.

Web The Irs Introduced Worksheet 1 To Help Employers Calculate The Tax Credits For Which They Are Eligible.

Related Post: