941X Worksheet 1

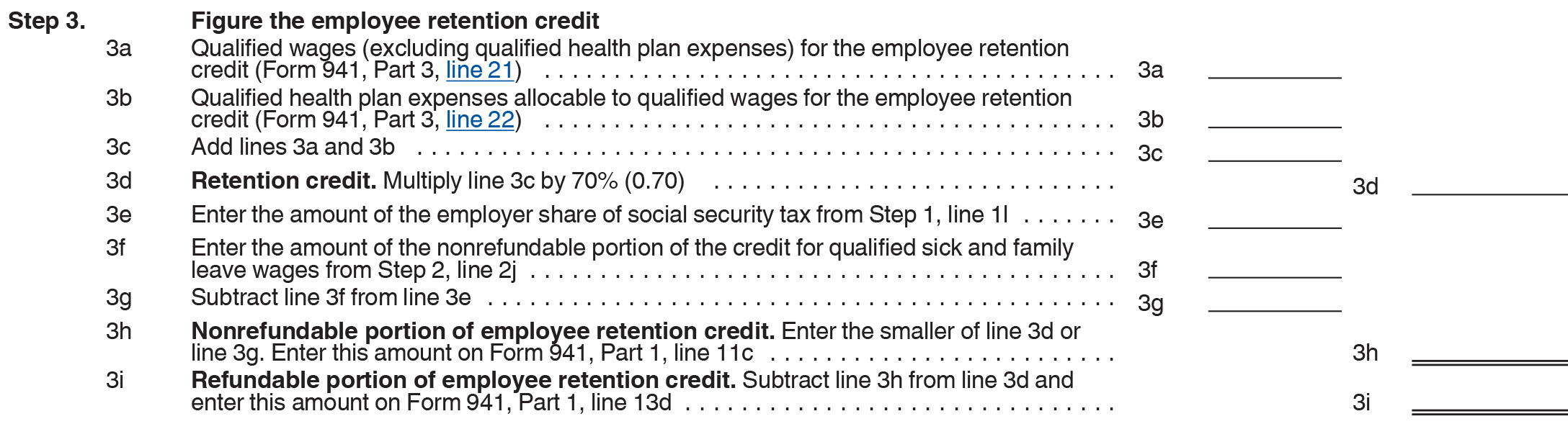

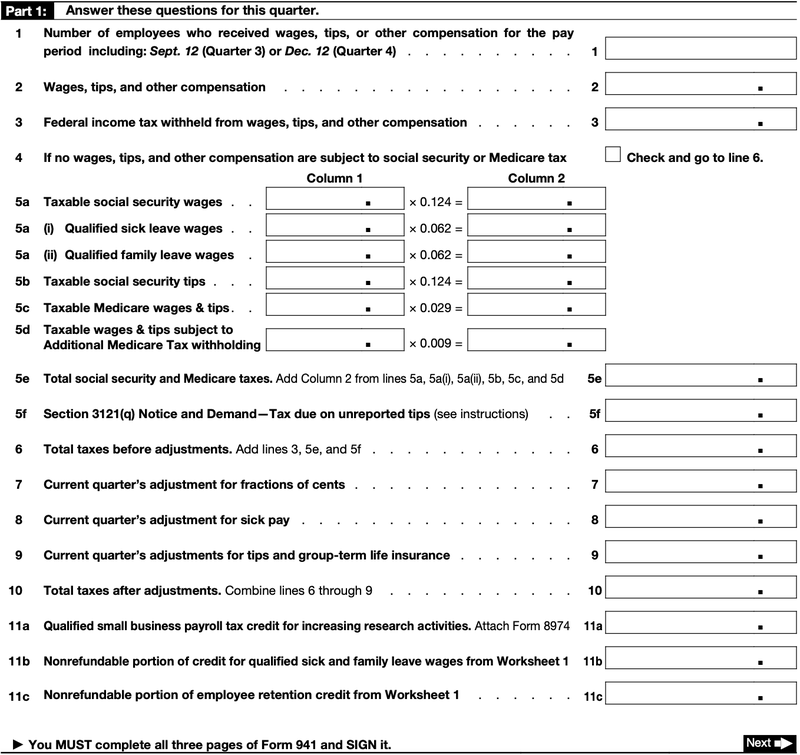

941X Worksheet 1 - Web finally, enter the corrected amount from column 1, worksheet 2, step 2, line 2b on form 941x, line 31a. This worksheet is broken up into two steps:. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web form 941 worksheet 1 is used to credit for qualified sick and family leave wages for leave taken before april 1, 2021. The irs doesn’t require employers to attach worksheet 1 to their form 941. You can send a pdf by email, text. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Worksheet 4 (06/30/2021 to 01/01/2022) reference. Don't use an earlier revision of form 941 to report taxes for 2021. Web worksheet 1 for the form 941 for that quarter. This worksheet is broken up into two steps:. Worksheet 4 (06/30/2021 to 01/01/2022) reference. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Don't use an earlier revision of. Web up to $40 cash back once your 941 x form is ready, you can securely share it with recipients and collect esignatures in a few clicks with pdffiller. Web form 941 worksheet 1 is used to credit for qualified sick and family leave wages for leave taken before april 1, 2021. This worksheet is broken up into two steps:.. For more information about this credit, go to irs.gov/form5884d. This worksheet is broken up into two steps:. The irs doesn’t require employers to attach worksheet 1 to their form 941. Web finally, enter the corrected amount from column 1, worksheet 2, step 2, line 2b on form 941x, line 31a. Web up to $40 cash back once your 941 x. This worksheet is broken up into two steps:. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web worksheet 1 for the form 941 for that quarter. Thus, any. Don't use an earlier revision of form 941 to report taxes for 2021. For more information about this credit, go to irs.gov/form5884d. The irs doesn’t require employers to attach worksheet 1 to their form 941. Worksheet 4 (06/30/2021 to 01/01/2022) reference. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of. The irs doesn’t require employers to attach worksheet 1 to their form 941. For more information about this credit, go to irs.gov/form5884d. Thus, any employer who files the quarterly. Web worksheet 1 for the form 941 for that quarter. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Web up to $40 cash back once your 941 x form is ready, you can securely share it with recipients and collect esignatures in a few clicks with pdffiller. For more information about this credit, go to irs.gov/form5884d. You can send a pdf by email, text. This worksheet is broken up into two steps:. Thus, any employer who files the. Web worksheet 1 for the form 941 for that quarter. For more information about this credit, go to irs.gov/form5884d. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Thus, any employer who files the quarterly. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the. Web worksheet 1 for the form 941 for that quarter. Worksheet 4 (06/30/2021 to 01/01/2022) reference. Don't use an earlier revision of form 941 to report taxes for 2021. This worksheet is broken up into two steps:. You can send a pdf by email, text. Don't use an earlier revision of form 941 to report taxes for 2021. You can send a pdf by email, text. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. This worksheet is broken up into two steps:. Worksheet 4 (06/30/2021 to 01/01/2022) reference. This worksheet is broken up into two steps:. Worksheet 4 (06/30/2021 to 01/01/2022) reference. You can send a pdf by email, text. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. Web finally, enter the corrected amount from column 1, worksheet 2, step 2, line 2b on form 941x, line 31a. Web up to $40 cash back once your 941 x form is ready, you can securely share it with recipients and collect esignatures in a few clicks with pdffiller. Thus, any employer who files the quarterly. Web worksheet 1 for the form 941 for that quarter. For more information about this credit, go to irs.gov/form5884d. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. The irs doesn’t require employers to attach worksheet 1 to their form 941. Web form 941 worksheet 1 is used to credit for qualified sick and family leave wages for leave taken before april 1, 2021. Don't use an earlier revision of form 941 to report taxes for 2021. Web the irs introduced worksheet 1 to help employers calculate the tax credits for which they are eligible. This worksheet is broken up into two steps:. Web worksheet 1 for the form 941 for that quarter. Web finally, enter the corrected amount from column 1, worksheet 2, step 2, line 2b on form 941x, line 31a. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web form 941 worksheet 1 is used to credit for qualified sick and family leave wages for leave taken before april 1, 2021. Web up to $40 cash back once your 941 x form is ready, you can securely share it with recipients and collect esignatures in a few clicks with pdffiller. The irs doesn’t require employers to attach worksheet 1 to their form 941. For more information about this credit, go to irs.gov/form5884d. Thus, any employer who files the quarterly.Create And Download Form 941 X Fillable And Printable

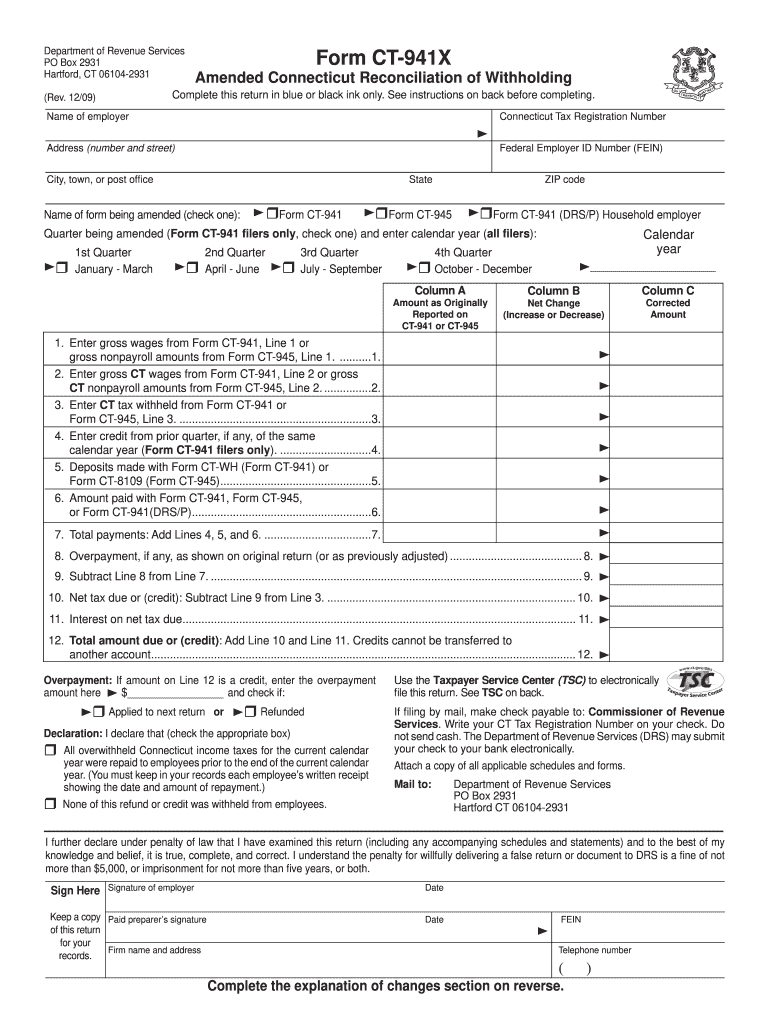

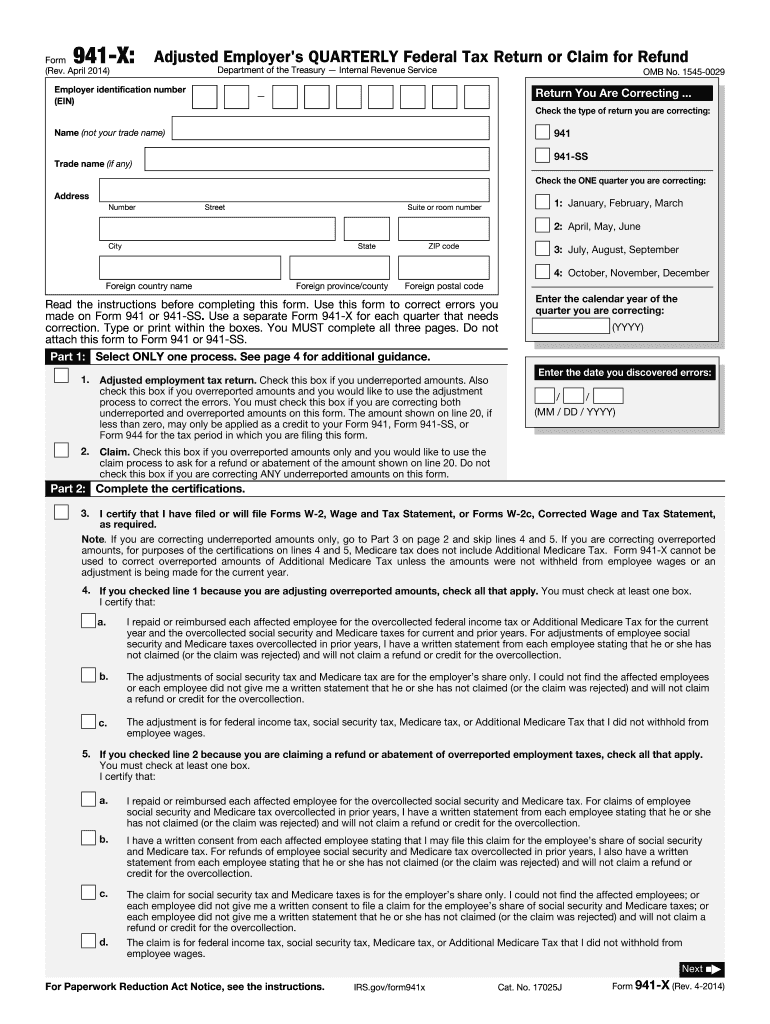

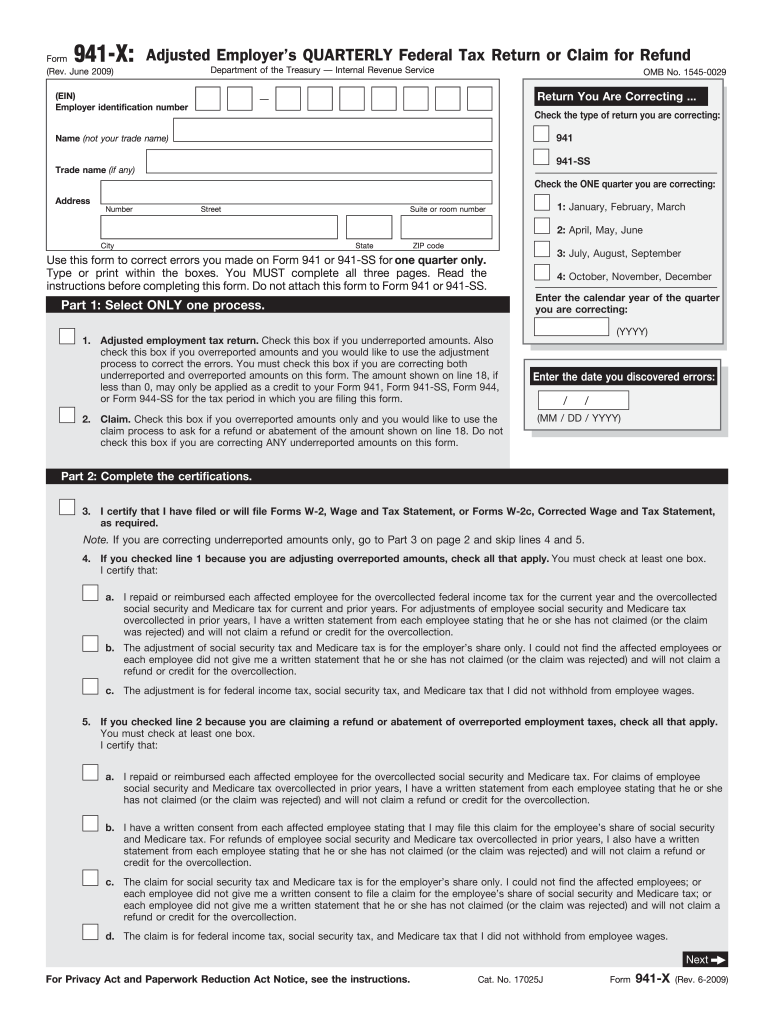

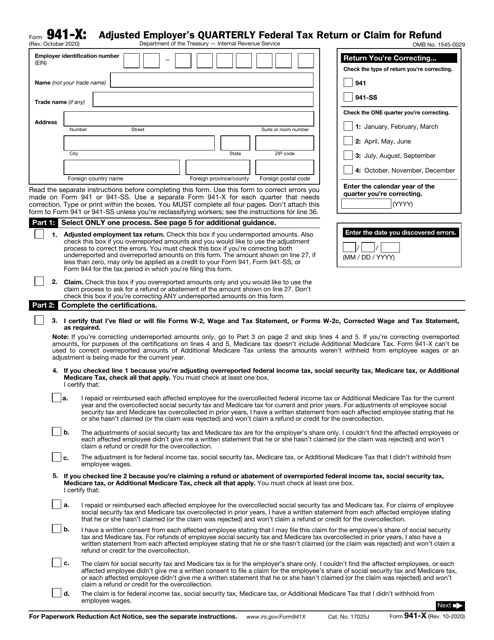

2022 Form IRS 941X Fill Online, Printable, Fillable, Blank pdfFiller

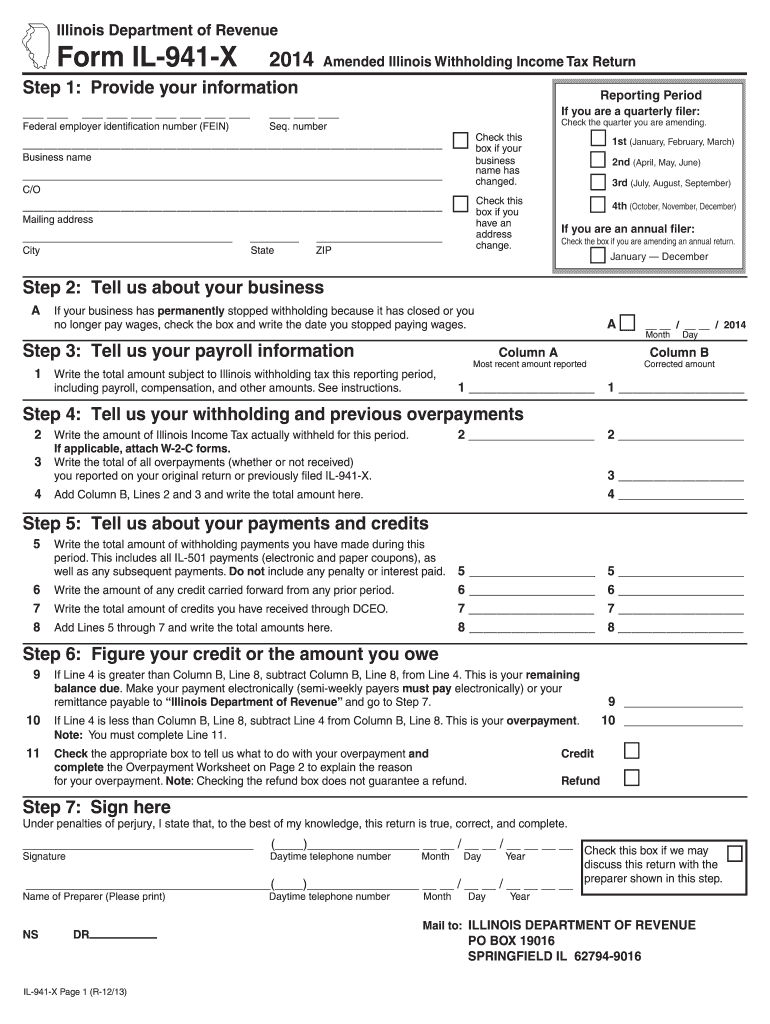

2014 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

IRS Form 941 Worksheet 1 for 2021 & 2020 (COVID19 Tax Credits)

Irs Form 941 Worksheet 1 Pdf Updated 2021

2014 941x form Fill out & sign online DocHub

Form 941 X Fill Out and Sign Printable PDF Template signNow

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

Don’t Worksheet 1 When You File Your Form 941 this Quarter

Create And Download Form 941 X Fillable And Printable

You Can Send A Pdf By Email, Text.

Don't Use An Earlier Revision Of Form 941 To Report Taxes For 2021.

Worksheet 4 (06/30/2021 To 01/01/2022) Reference.

Related Post: