Alabama Federal Income Tax Deduction Worksheet

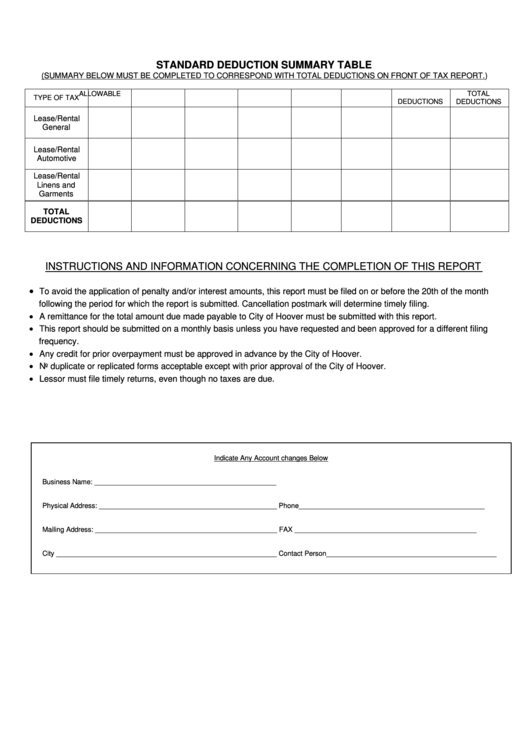

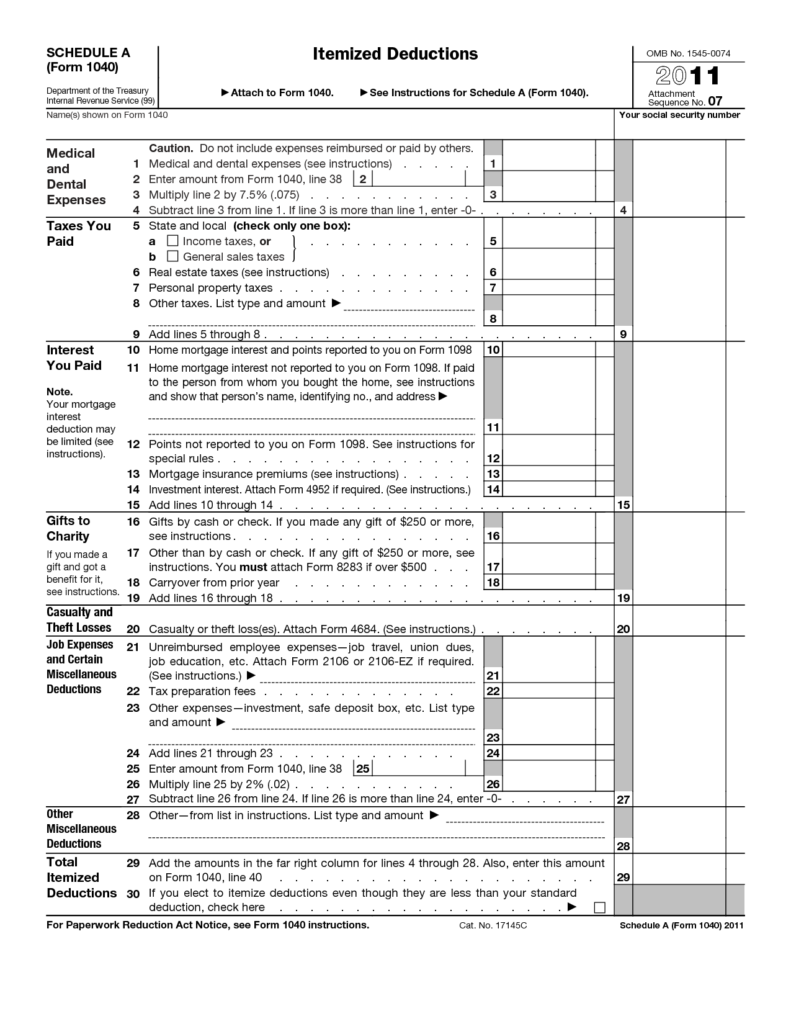

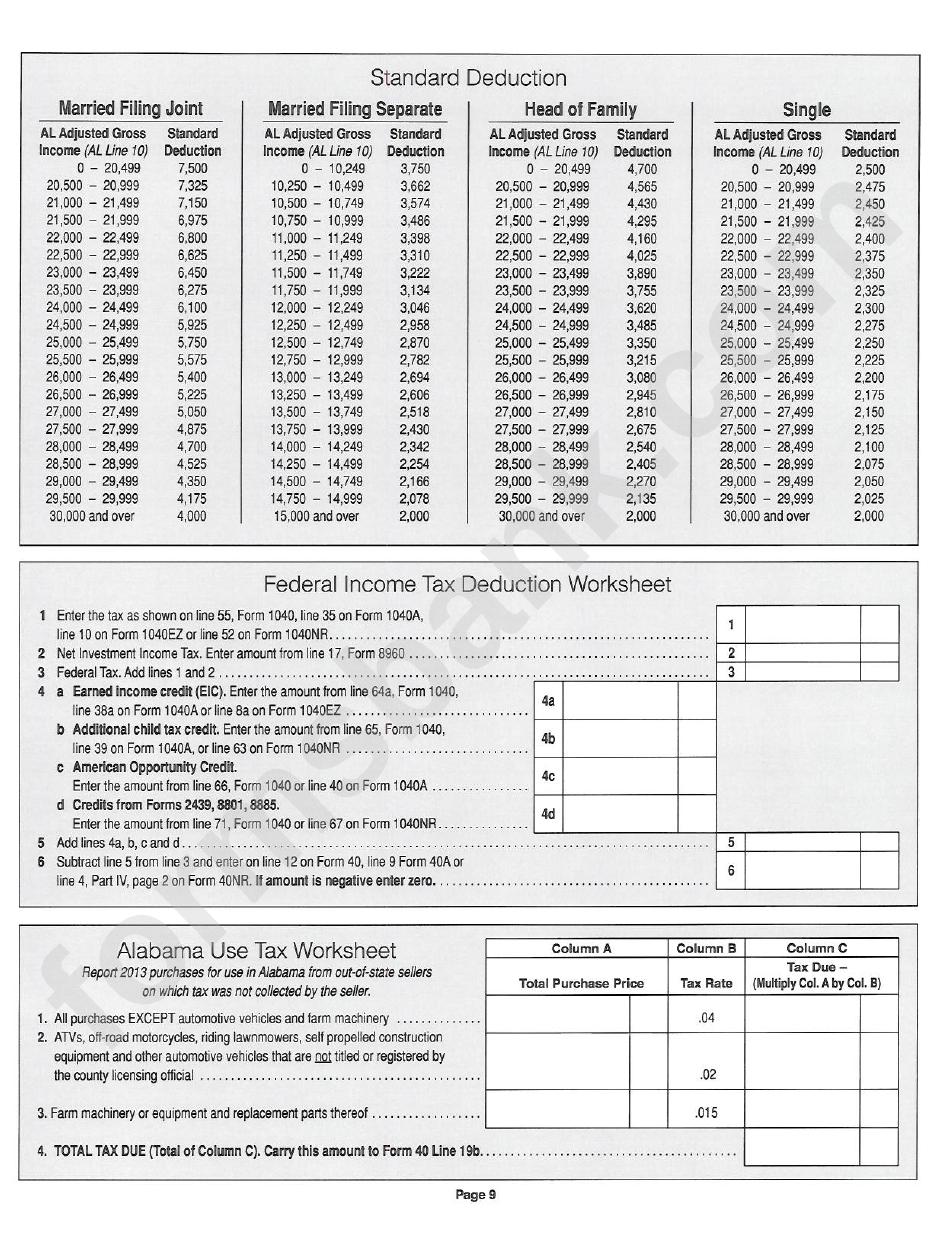

Alabama Federal Income Tax Deduction Worksheet - Web the federal income tax allowed as a deduction to a nonresident of alabama is the amount calculated using the federal income tax deduction worksheet on this page. Web use schedule a (form 1040) to figure your itemized deductions. Alabama federal income tax deduction worksheet is a deduction worksheet that can be. Web web alabama federal income tax deduction worksheet is a deduction worksheet that. $4,000 to $7,500 if filing. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or. For tax years beginning before 2022, the standard deduction ranges are as follows: 2 net investment income tax. Web what are the standard deductions for alabama income tax? Web improving lives through smart tax policy. Alabama federal income tax deduction worksheet is a deduction worksheet that can be. Web improving lives through smart tax policy. Signnow allows users to edit, sign, fill. $4,000 to $7,500 if filing. Web the federal income tax allowed as a deduction to a nonresident of alabama is the amount calculated using the federal income tax deduction worksheet on this page. Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. For tax years beginning before 2022, the standard deduction ranges are as follows: 2 net investment income tax. Signnow allows users to edit, sign, fill. Web use schedule a (form 1040) to figure your. Web web alabama federal income tax deduction worksheet is a deduction worksheet that. Web the federal income tax allowed as a deduction to a nonresident of alabama is the amount calculated using the federal income tax deduction worksheet on this page. Web what are the standard deductions for alabama income tax? Web deductions worksheet, line 5, if you expect to. For tax years beginning before 2022, the standard deduction ranges are as follows: Web use schedule a (form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or. Web web alabama federal income tax deduction worksheet is a deduction worksheet that. Web this updated. Web use schedule a (form 1040) to figure your itemized deductions. For tax years beginning before 2022, the standard deduction ranges are as follows: Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. Web standard deduction married filing joint al adjusted gross standard. Web what are the standard deductions for alabama income tax? Web get an extension until october 15 in just 5 minutes. Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. Alabama federal income tax deduction worksheet is a deduction worksheet that can be.. 2 net investment income tax. Signnow allows users to edit, sign, fill. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web get an extension until october 15 in just 5 minutes. Web 5 rows we last updated alabama federal. Signnow allows users to edit, sign, fill. Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. Web 5 rows we last updated alabama federal income tax deduction worksheet in february 2023 from the alabama. Web standard deduction married filing joint al adjusted gross. Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. Alabama federal income tax deduction worksheet is a deduction worksheet that can be. Signnow allows users to edit, sign, fill. In most cases, your federal income tax will be less if you take the. Web 5 rows we last updated alabama federal income tax deduction worksheet in february 2023 from the alabama. For tax years beginning before 2022, the standard deduction ranges are as follows: Alabama federal income tax deduction worksheet is a deduction worksheet that can be. Web standard deduction married filing joint al adjusted gross standard income (al line 10) deduction 0. For tax years beginning before 2022, the standard deduction ranges are as follows: Web standard deduction married filing joint al adjusted gross standard income (al line 10) deduction 0 20,499 7,500 20,500 20,999 7,325 21,000 21,499 7,150 21,500 21,999. Web web alabama federal income tax deduction worksheet is a deduction worksheet that. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. 2 net investment income tax. Web the federal income tax allowed as a deduction to a nonresident of alabama is the amount calculated using the federal income tax deduction worksheet on this page. $4,000 to $7,500 if filing. Signnow allows users to edit, sign, fill. Web what are the standard deductions for alabama income tax? Web improving lives through smart tax policy. Alabama federal income tax deduction worksheet is a deduction worksheet that can be. Web use schedule a (form 1040) to figure your itemized deductions. Web 5 rows we last updated alabama federal income tax deduction worksheet in february 2023 from the alabama. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or. Web get an extension until october 15 in just 5 minutes. $4,000 to $7,500 if filing. Web the federal income tax allowed as a deduction to a nonresident of alabama is the amount calculated using the federal income tax deduction worksheet on this page. Web web alabama federal income tax deduction worksheet is a deduction worksheet that. For tax years beginning before 2022, the standard deduction ranges are as follows: Web use schedule a (form 1040) to figure your itemized deductions. Web this updated worksheet changes the calculation of the federal income tax deduction for taxpayers who file an individual alabama tax return and have one or. 2 net investment income tax. Web get an extension until october 15 in just 5 minutes. Web standard deduction married filing joint al adjusted gross standard income (al line 10) deduction 0 20,499 7,500 20,500 20,999 7,325 21,000 21,499 7,150 21,500 21,999. Alabama federal income tax deduction worksheet is a deduction worksheet that can be. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or. Signnow allows users to edit, sign, fill.Standard Deduction Summary Table State Of Alabama printable pdf download

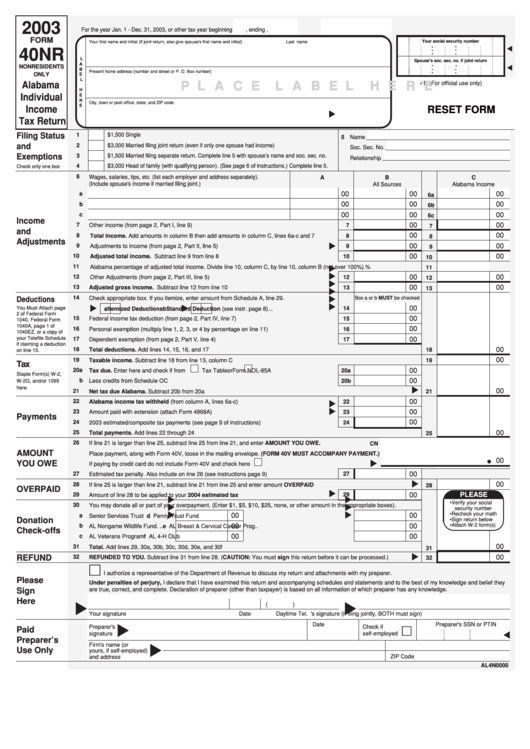

Fillable Form 40nr Alabama Individual Tax Return 2003

Alabama Federal Tax Deduction Worksheet

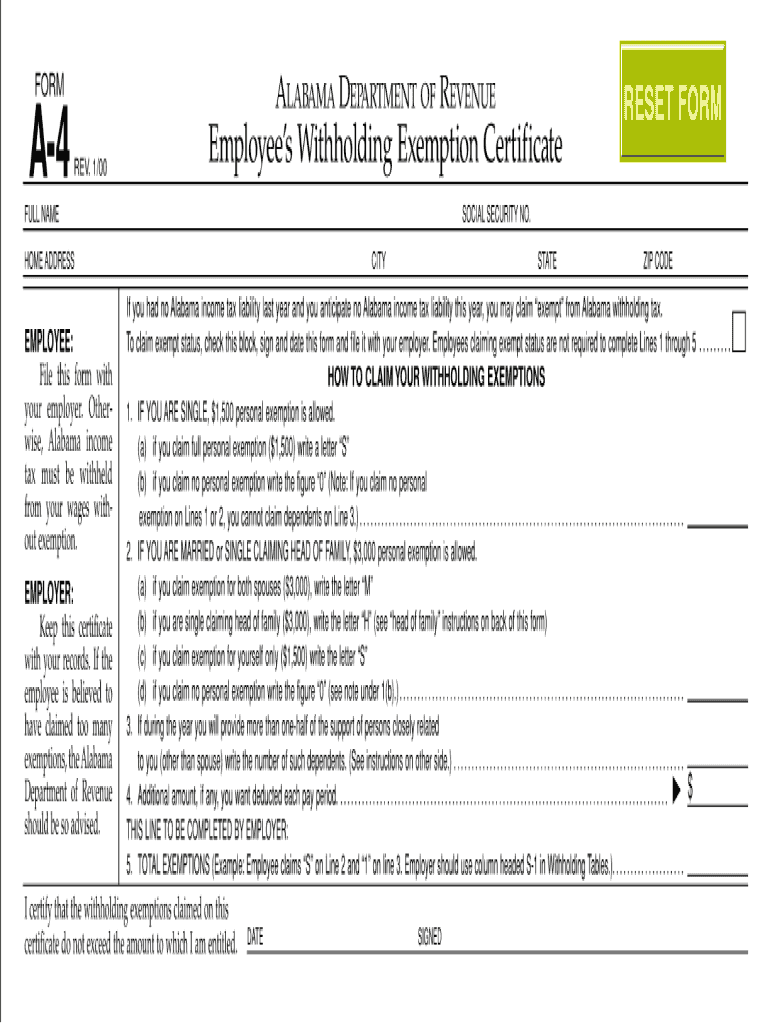

2000 Form AL DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

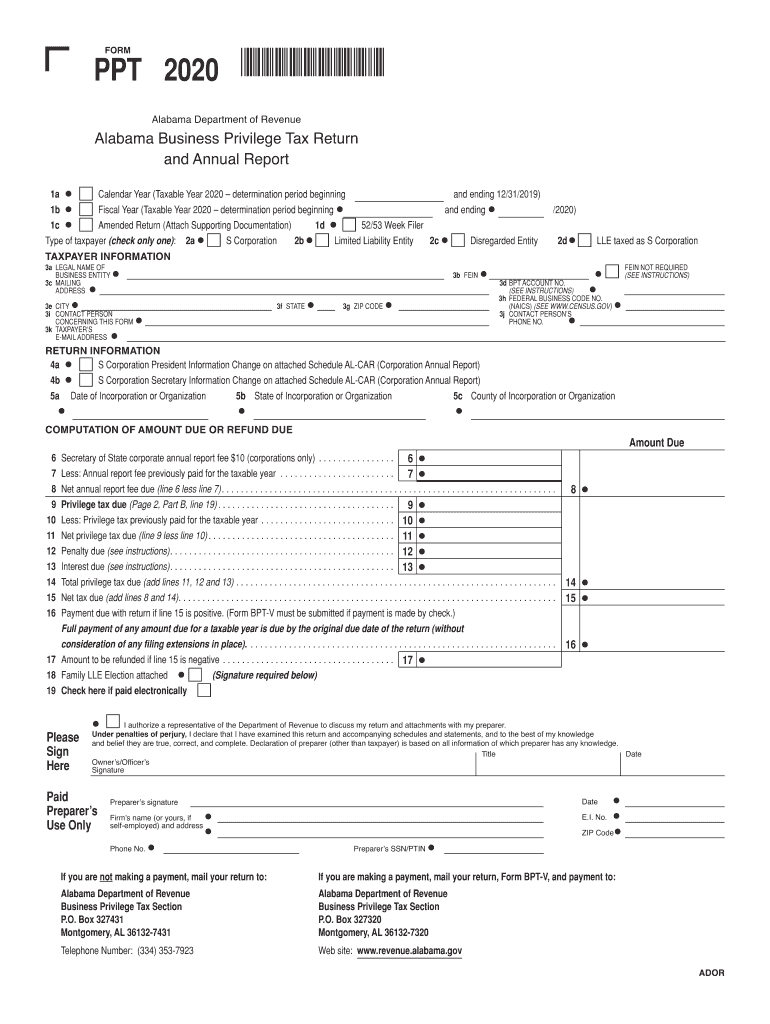

Al Ppt Instructions Fill Out and Sign Printable PDF Template signNow

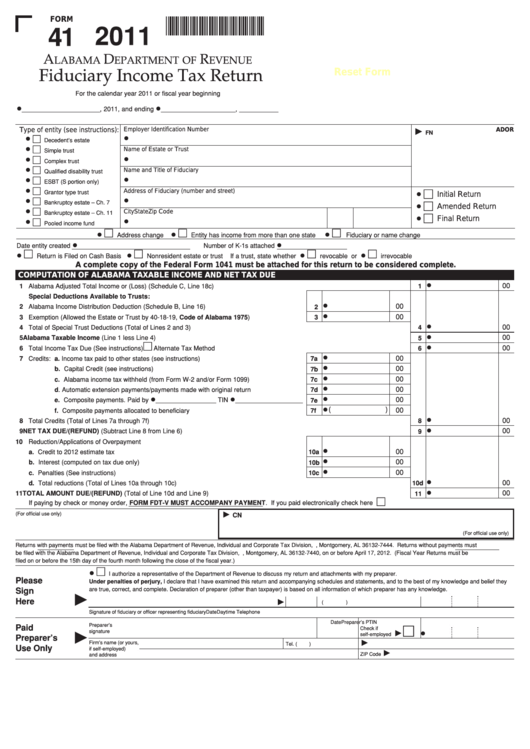

Fillable Form 41 Alabama Fiduciary Tax Return 2011 printable

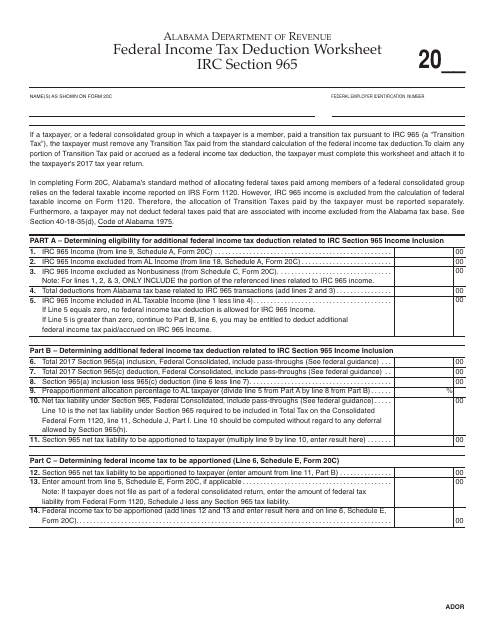

Federal Tax Deduction Worksheet Irc Section 965 Alabama

business tax deductions worksheet

️Irs Ovdp Penalty Calculation Worksheet Free Download Goodimg.co

Federal Tax Deduction Worksheet And Alabama Use Tax Worksheet

Web Deductions Worksheet, Line 5, If You Expect To Claim Deductions Other Than The Basic Standard Deduction On Your 2023 Tax Return And Want To Reduce Your Withholding To.

Web Improving Lives Through Smart Tax Policy.

Web What Are The Standard Deductions For Alabama Income Tax?

Web 5 Rows We Last Updated Alabama Federal Income Tax Deduction Worksheet In February 2023 From The Alabama.

Related Post: