Audit Materiality Calculation Worksheet

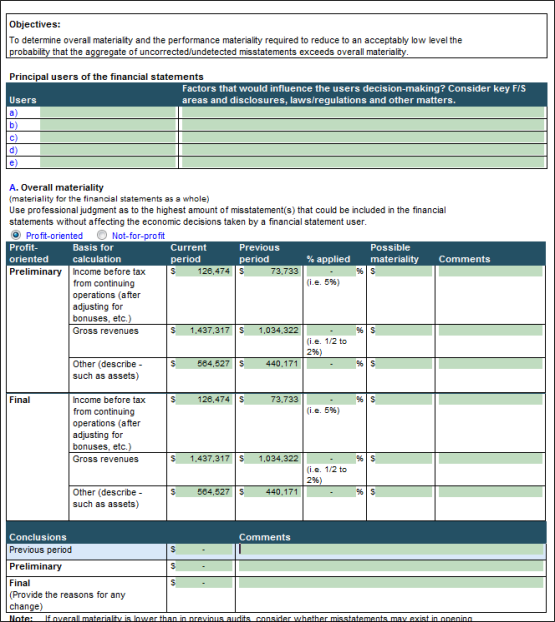

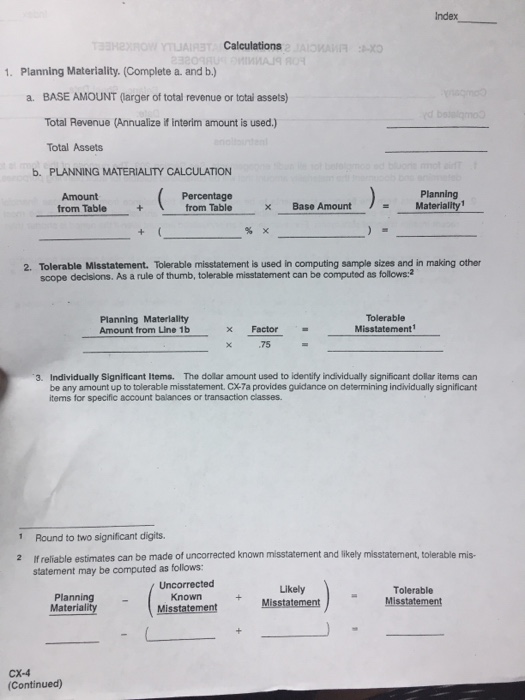

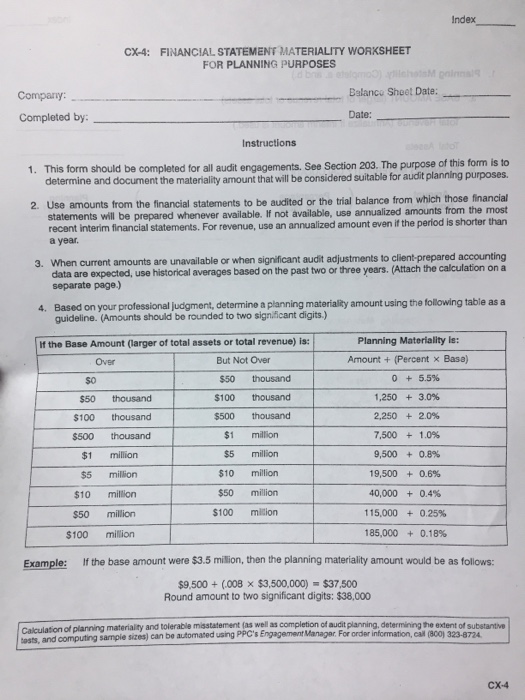

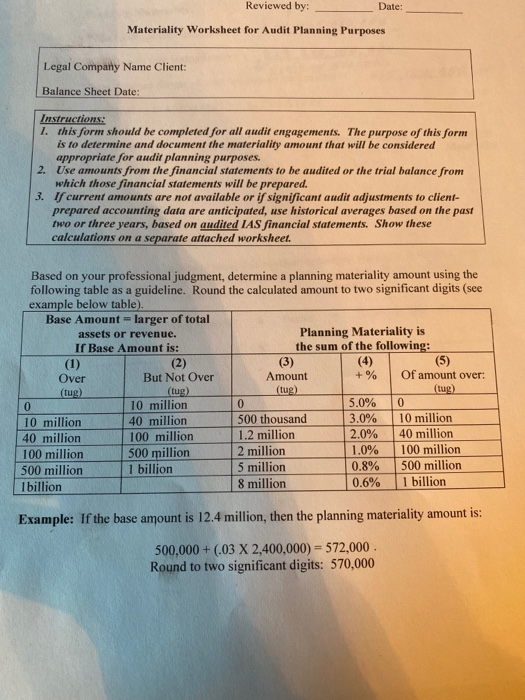

Audit Materiality Calculation Worksheet - A senior accountant at a public accounting firm is. Web while isre 2400 (revised) does not require the accountant to calculate performance materiality, the following requirements are included: Examples include total revenues, total assets, and net income. Web this is a percentage of the calculated materiality figure. Financial statement materiality worksheet for planning purposes. Web calculating materiality worksheet acc 364/521: Web worksheet that demonstrates the quantified materiality calculation above. Web assessing materiality in the fsa. The following table depicts quantified materiality thresholds (both dollar amounts and. When calculating materiality for the financial statements as a whole, the auditor should: Auditing theory fall 2020 the firm’s materiality guidelines are as follows: Web calculating materiality worksheet acc 364: Web in this lesson, we will explain how to calculate materiality for an entity's financial statements as a whole and illustrate this discussion with an example of an audit. Web in the audit, auditors usually determine two types of materiality, overall materiality and. The risk that the aggregate of. Web colorado our office uses the planning materiality worksheet from ppc as the basis for our calculation for base amounts up to $1 billion. Web worksheet that demonstrates the quantified materiality calculation above. Web while isre 2400 (revised) does not require the accountant to calculate performance materiality, the following requirements are included: Examples include. Web while isre 2400 (revised) does not require the accountant to calculate performance materiality, the following requirements are included: Examples include total revenues, total assets, and net income. Web the audit is performed at a lower materiality called performance materiality, such that it reduces the aggregation risk at an acceptable level i.e. Web the solution is to determine an overall. Web assessing materiality in the fsa. Tolerable misstatement, as defined by the aicpa, is: Web complete the materiality worksheet using the trial balance provided. Web calculating materiality worksheet acc 364/521: Web calculating materiality worksheet acc 364: Financial statement materiality worksheet for planning purposes. Web in the audit, auditors usually determine two types of materiality, overall materiality and performance materiality. In addition, we generally use a one. Examples include total revenues, total assets, and net income. Auditing theory fall 2021 the firm’s materiality guidelines are as follows: Web the solution is to determine an overall materiality based on the total value of investments and then set lower specific materiality for the contributions receivable, contributions. After calculation of the materiality the financial statement areas worksheet automatically selects which fsas are material based on. Financial statement materiality worksheet for planning purposes. The financial statement areas worksheet (fsa) automatically links. Decide on a benchmark or measurement base and the percentage to be used. When calculating materiality for the financial statements as a whole, the auditor should: Tolerable misstatement, as defined by the aicpa, is: Web the audit is performed at a lower materiality called performance materiality, such that it reduces the aggregation risk at an acceptable level i.e. Web this. Web while isre 2400 (revised) does not require the accountant to calculate performance materiality, the following requirements are included: In order to compute audit materiality, we must first decide which benchmark is best. Web worksheet that demonstrates the quantified materiality calculation above. Auditing theory fall 2020 the firm’s materiality guidelines are as follows: Web in this lesson, we will explain. Tolerable misstatement, as defined by the aicpa, is: Web while isre 2400 (revised) does not require the accountant to calculate performance materiality, the following requirements are included: Decide on a benchmark or measurement base and the percentage to be used. In our example, we define anything that is less than 10% of the calculated materiality threshold as trivial. When calculating. Web calculating materiality worksheet acc 364: Web in the audit, auditors usually determine two types of materiality, overall materiality and performance materiality. When calculating materiality for the financial statements as a whole, the auditor should: In order to compute audit materiality, we must first decide which benchmark is best. In our example, we define anything that is less than 10%. Auditing theory fall 2020 the firm’s materiality guidelines are as follows: The financial statement areas worksheet (fsa) automatically links to the materiality document included with the caseware template. Examples include total revenues, total assets, and net income. The risk that the aggregate of. Web worksheet that demonstrates the quantified materiality calculation above. In our example, we define anything that is less than 10% of the calculated materiality threshold as trivial. Web complete the materiality worksheet using the trial balance provided. Web considering the history of misstatements and the first year of audit, the audit team shall use a lower percentage for materiality calculation. Decide on a benchmark or measurement base and the percentage to be used. Web the solution is to determine an overall materiality based on the total value of investments and then set lower specific materiality for the contributions receivable, contributions. Web this is a percentage of the calculated materiality figure. In order to compute audit materiality, we must first decide which benchmark is best. In addition, we generally use a one. A senior accountant at a public accounting firm is. Web assessing materiality in the fsa. Web colorado our office uses the planning materiality worksheet from ppc as the basis for our calculation for base amounts up to $1 billion. Web the audit is performed at a lower materiality called performance materiality, such that it reduces the aggregation risk at an acceptable level i.e. Tolerable misstatement, as defined by the aicpa, is: Financial statement materiality worksheet for planning purposes. Web calculating materiality worksheet acc 364/521: A senior accountant at a public accounting firm is. Financial statement materiality worksheet for planning purposes. Web while isre 2400 (revised) does not require the accountant to calculate performance materiality, the following requirements are included: In our example, we define anything that is less than 10% of the calculated materiality threshold as trivial. Tolerable misstatement, as defined by the aicpa, is: Web considering the history of misstatements and the first year of audit, the audit team shall use a lower percentage for materiality calculation. In addition, we generally use a one. Auditing theory fall 2020 the firm’s materiality guidelines are as follows: After calculation of the materiality the financial statement areas worksheet automatically selects which fsas are material based on. When calculating materiality for the financial statements as a whole, the auditor should: Web calculating materiality worksheet acc 364: Web in the audit, auditors usually determine two types of materiality, overall materiality and performance materiality. Examples include total revenues, total assets, and net income. Web the audit is performed at a lower materiality called performance materiality, such that it reduces the aggregation risk at an acceptable level i.e. Web in this lesson, we will explain how to calculate materiality for an entity's financial statements as a whole and illustrate this discussion with an example of an audit. Web the solution is to determine an overall materiality based on the total value of investments and then set lower specific materiality for the contributions receivable, contributions.CX4 MATERIALITY WORKSHEET Audit Financial Statement

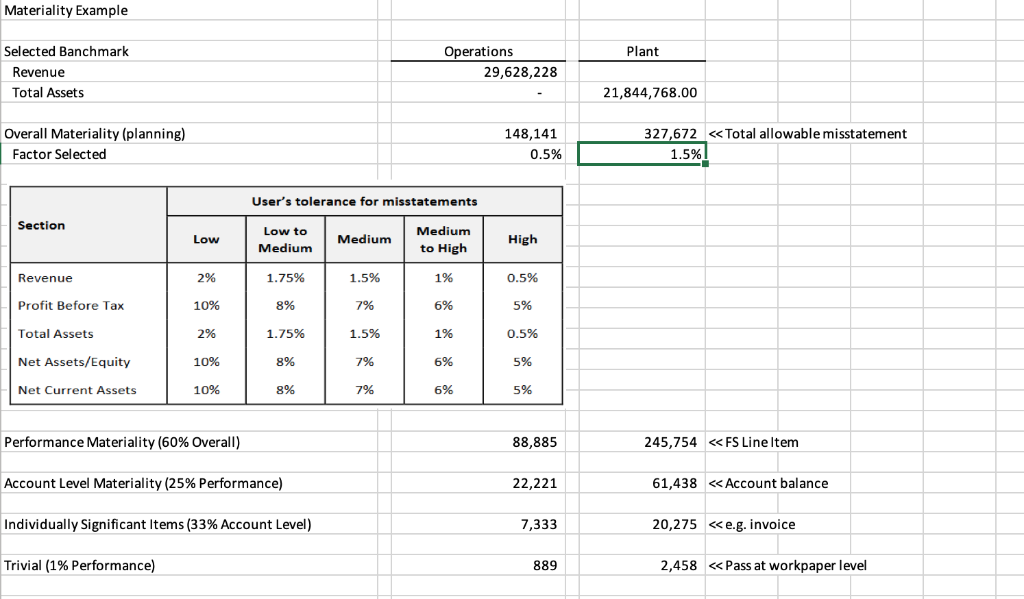

😀 Planning materiality calculation example. The New Importance of

06 Materiality Template PDF Audit Risk

Part 2 Using the example materiality calculation

Part 2 Using The Example Materiality Calculation

Materiality

Audit Materiality Calculation Template Flyer Template

Index CX4 FINANCIAL STATEMENT MATERIALITY WORKSH...

Index CX4 FINANCIAL STATEMENT MATERIALITY WORKSHEET

️Audit Materiality Worksheet Free Download Qstion.co

The Financial Statement Areas Worksheet (Fsa) Automatically Links To The Materiality Document Included With The Caseware Template.

Web Complete The Materiality Worksheet Using The Trial Balance Provided.

Web Colorado Our Office Uses The Planning Materiality Worksheet From Ppc As The Basis For Our Calculation For Base Amounts Up To $1 Billion.

Web Calculating Materiality Worksheet Acc 364/521:

Related Post: