California Capital Loss Carryover Worksheet

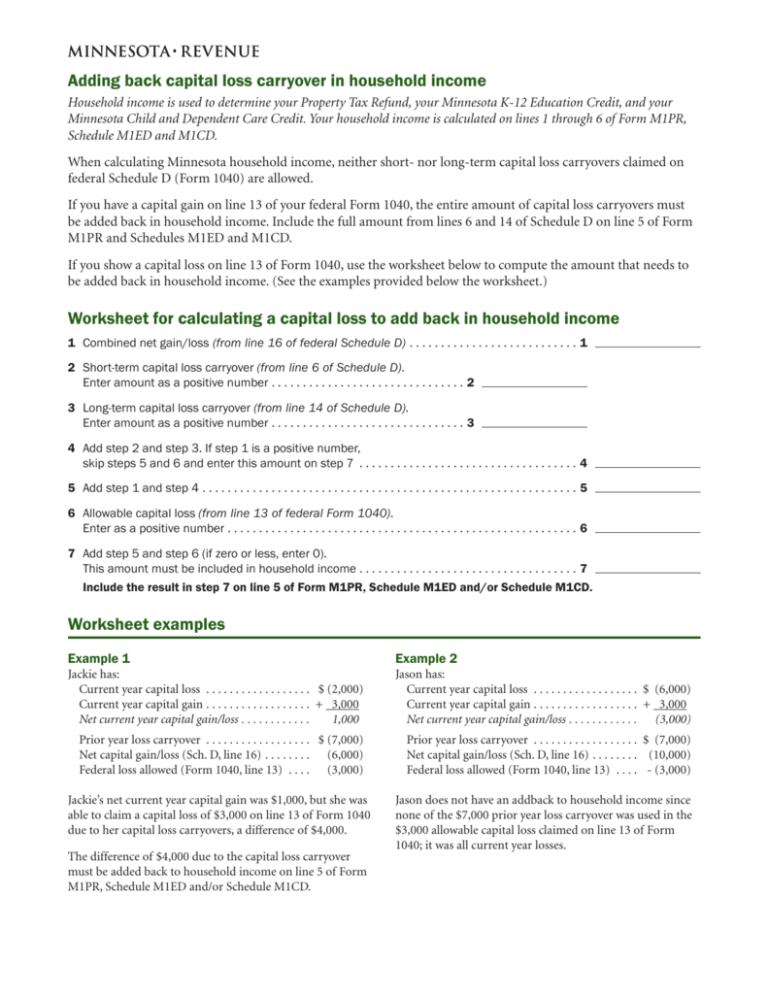

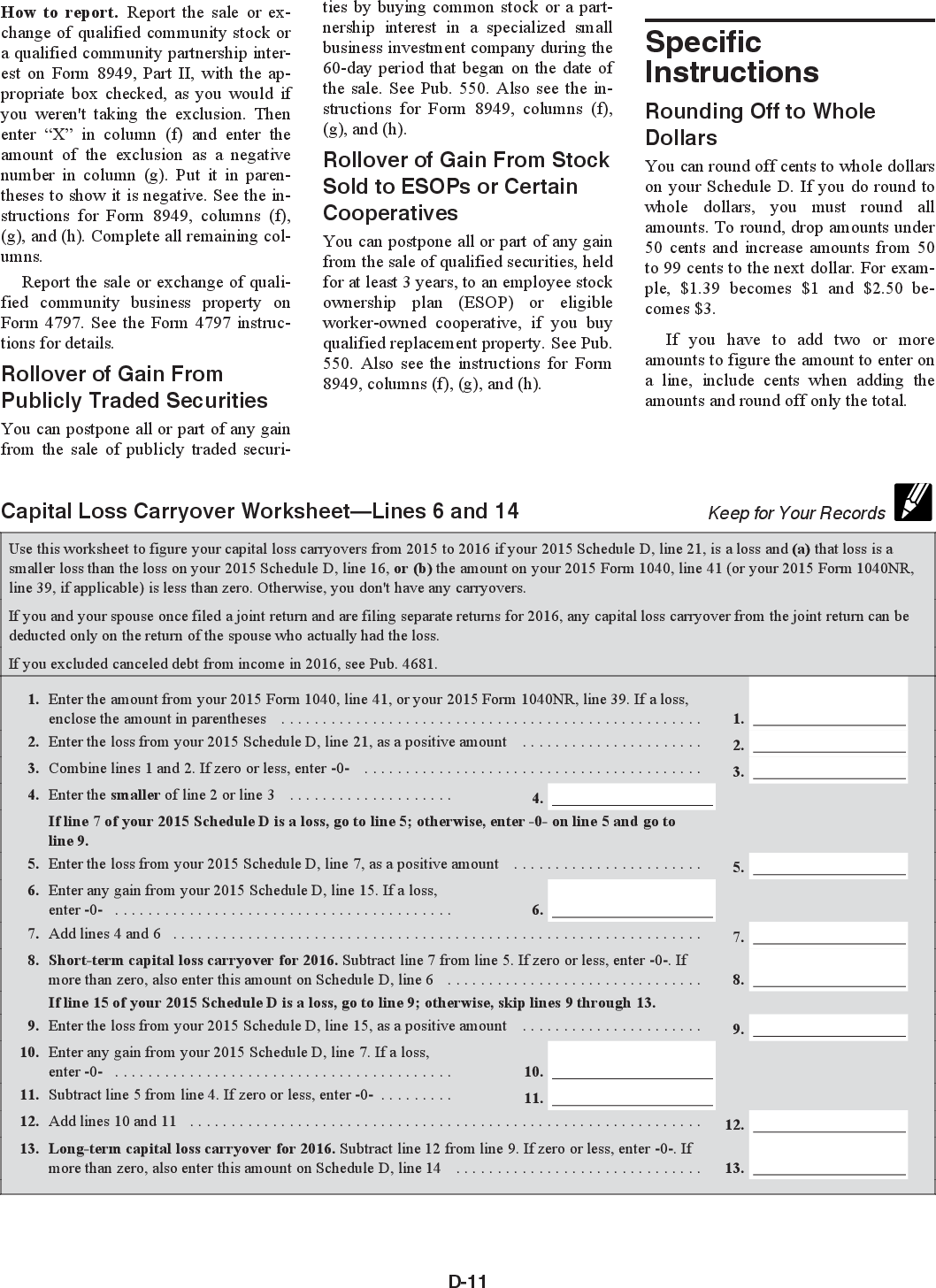

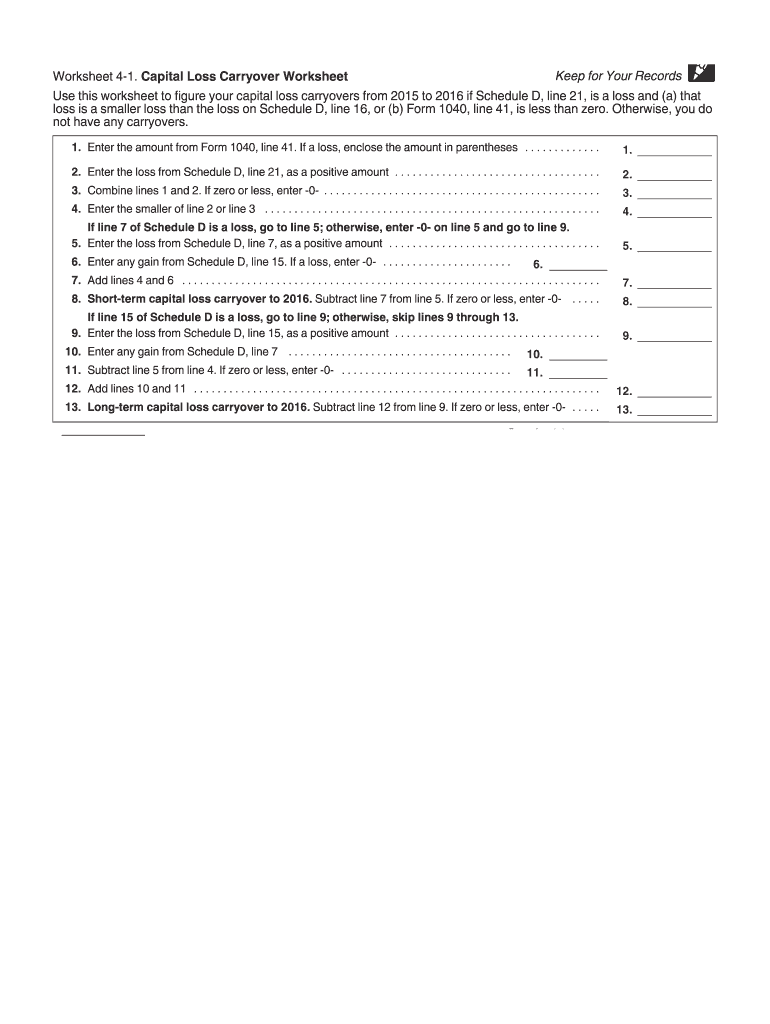

California Capital Loss Carryover Worksheet - Web but any capital losses over $3,000 can be carried forward to future tax. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Urban catalyst is a leader in opportunity zone investing. Invest now in fund ii. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017. The ca sch d line 6 has the carryover from the prior year. Web the capital loss carryover is a great resource you can use. Urban catalyst is a leader in opportunity zone investing. Web schedule d line 15. Urban catalyst is a leader in opportunity zone investing. Carryover from a prior year carryback from subsequent year 2. Web use the worksheet below to figure your capital loss carryover to 2022. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your. Web schedule d line 15. Urban catalyst is a leader in opportunity zone investing. Invest now in fund ii. Web capital loss carryover worksheet—schedule d (form 1040) (2020) tools for a rosea. Web march 3, 2022 8:52 pm. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this. Urban catalyst is a leader in opportunity zone investing. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Web schedule d line 15. Add lines 6 and 8. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your. Web but any capital losses over $3,000 can be carried forward to future tax. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Web use the worksheet below to figure your capital loss carryover to 2022. Invest. Invest now in fund ii. Carryover from a prior year carryback from subsequent year 2. Web use the worksheet below to figure your capital loss carryover to 2022. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this. Web capital loss carryover worksheet—schedule d (form 1040) (2020) tools for a rosea. Urban catalyst is a leader in opportunity zone investing. Add lines 6 and 8. Web but any capital losses over $3,000 can be carried forward to future tax. Web my ca cap loss carryover from calif sources has been zero. Web schedule d line 15. Add lines 6 and 8. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Web march 3, 2022 8:52 pm. Web but any capital losses over $3,000 can be carried forward to future tax. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your. Web march 3, 2022 8:52 pm. Invest now in fund ii. Web capital loss carryover worksheet—schedule d (form 1040) (2020) tools for a rosea. The ca sch d line 6 has the carryover from the prior year. Add lines 6 and 8. Add lines 6 and 8. Urban catalyst is a leader in opportunity zone investing. Web schedule d line 15. Invest now in fund ii. Web march 3, 2022 8:52 pm. Web the capital loss carryover is a great resource you can use. The ca sch d line 6 has the carryover from the prior year. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017. Invest now in fund ii. Urban catalyst is a leader in opportunity zone investing. Carryover from a prior year carryback from subsequent year 2. Urban catalyst is a leader in opportunity zone investing. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017. Web capital loss carryover worksheet—schedule d (form 1040) (2020) tools for a rosea. Line 9 if line 8 is a. Invest now in fund ii. Web a comprehensive federal, state & international tax resource that you can trust to provide. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this. Web schedule d line 15. Urban catalyst is a leader in opportunity zone investing. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Web but any capital losses over $3,000 can be carried forward to future tax. The ca sch d line 6 has the carryover from the prior year. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your. Web my ca cap loss carryover from calif sources has been zero. Invest now in fund ii. Web use the worksheet below to figure your capital loss carryover to 2022. Web march 3, 2022 8:52 pm. Add lines 6 and 8. Web the capital loss carryover is a great resource you can use. Invest now in fund ii. Carryover from a prior year carryback from subsequent year 2. Line 9 if line 8 is a. The ca sch d line 6 has the carryover from the prior year. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Urban catalyst is a leader in opportunity zone investing. Web use the worksheet below to figure your capital loss carryover to 2022. Web my ca cap loss carryover from calif sources has been zero. Invest now in fund ii. Add lines 6 and 8. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017. Urban catalyst is a leader in opportunity zone investing. Web a comprehensive federal, state & international tax resource that you can trust to provide. Web march 3, 2022 8:52 pm. Web schedule d line 15. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your.Capital Loss Carryover Worksheet slidesharedocs

39 best ideas for coloring Capital Loss Carryover Worksheet

Federal Carryover Worksheet Balancing Equations Worksheet

Capital Loss Carryover Worksheet

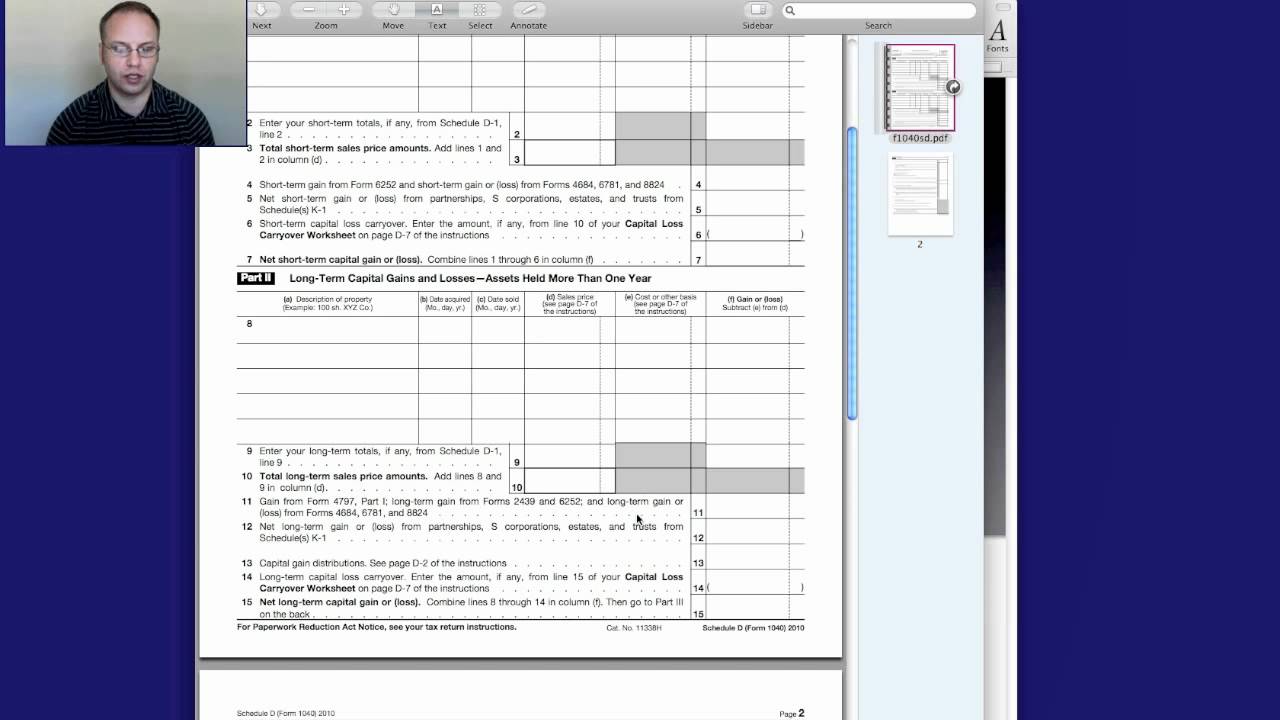

1040 capital loss carryover worksheet

1040 capital loss carryover worksheet

39 best ideas for coloring Capital Loss Carryover Worksheet

Carryover Worksheet Form Fill Out and Sign Printable PDF Template

capital loss carryover worksheet 1041

39 best ideas for coloring Capital Loss Carryover Worksheet

Web Capital Loss Carryover Worksheet—Schedule D (Form 1040) (2021) Use This.

Web Capital Loss Carryover Worksheet—Schedule D (Form 1040) (2020) Tools For A Rosea.

Web The Capital Loss Carryover Is A Great Resource You Can Use.

Web But Any Capital Losses Over $3,000 Can Be Carried Forward To Future Tax.

Related Post: