California Itemized Deductions Worksheet

California Itemized Deductions Worksheet - In most cases, your federal income tax will be less if you take. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. Web if your deduction was limited on the federal return enter an adjustment on itemized deductions for the amount over the federal limit. Web on the ca info worksheet, you can check the box in part v, 'calculate ca itemized deductions even if itemized deductions are less than standard deduction'. Web what credits and deductions do i qualify for? Some of the worksheets displayed are deductions form 1040 itemized, 2019 schedule ca 540. Find out which credits and deductions you can take. Web complete the itemized deductions worksheet below. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. See how to fill it out, how to itemize tax deductions and helpful tips. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard. Web if your deduction was limited on the federal return enter an adjustment on itemized deductions for the amount over the federal limit. If you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage. Web what credits and deductions do i qualify for? Web california withholding schedules for 2023 california provides two methods. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. In most cases, your federal income tax will be less if you take. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web deductions. Web on the ca info worksheet, you can check the box in part v, 'calculate ca itemized deductions even if itemized deductions are less than standard deduction'. Federal rules have suspended the. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding. Web worksheet b estimated deductions. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Some. Find out which credits and deductions you can take. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. Web worksheet b estimated deductions. In. Find out which credits and deductions you can take. Web what credits and deductions do i qualify for? Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction. In most cases, your federal income tax will be less if you take. Web on the ca info worksheet, you can check the box in part v, 'calculate ca itemized deductions even if itemized deductions are less than standard deduction'. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add. Web worksheet b estimated deductions. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. Federal rules have suspended the. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): But under the new rules,. Web on the ca info worksheet, you can check the box in part v, 'calculate ca itemized deductions even if itemized deductions are less than standard deduction'. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. But under the new rules, for most people it simply isn’t worth. See. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web complete the itemized deductions worksheet below. Find out which credits and deductions you can take. Web 2022 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Federal rules have suspended the. Web if your deduction was limited on the federal return enter an adjustment on itemized deductions for the amount over the federal limit. Web what credits and deductions do i qualify for? Web worksheet b estimated deductions. Web on the ca info worksheet, you can check the box in part v, 'calculate ca itemized deductions even if itemized deductions are less than standard deduction'. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. If you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage. Some of the worksheets displayed are deductions form 1040 itemized, 2019 schedule ca 540. See how to fill it out, how to itemize tax deductions and helpful tips. Web schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). But under the new rules, for most people it simply isn’t worth. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web before the tcja was implemented, around 33% of all california tax deductions were itemized. In most cases, your federal income tax will be less if you take. If you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage. Web 2022 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web if your deduction was limited on the federal return enter an adjustment on itemized deductions for the amount over the federal limit. Web before the tcja was implemented, around 33% of all california tax deductions were itemized. Find out which credits and deductions you can take. Web complete the itemized deductions worksheet below. Federal rules have suspended the. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both itemize your. But under the new rules, for most people it simply isn’t worth. See how to fill it out, how to itemize tax deductions and helpful tips. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web on the ca info worksheet, you can check the box in part v, 'calculate ca itemized deductions even if itemized deductions are less than standard deduction'. Web worksheet b estimated deductions.California Itemized Deductions Worksheet

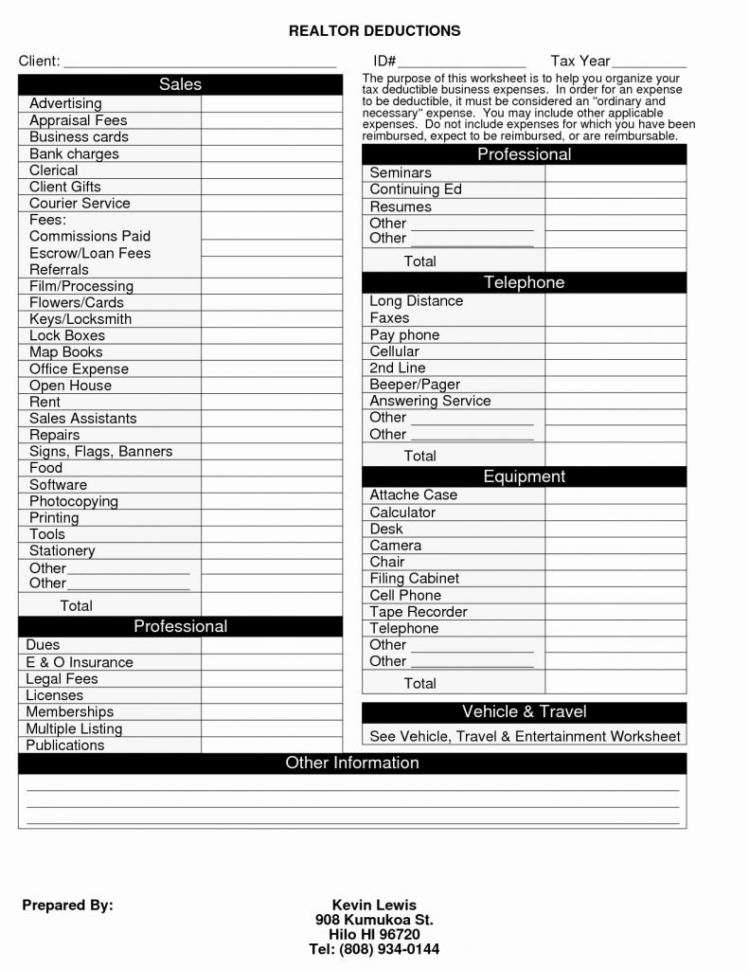

business tax deductions worksheet

California Itemized Deductions Worksheet

tax deduction worksheet template

10++ Itemized Deductions Worksheet Worksheets Decoomo

Itemized Deductions Worksheet 2018 Printable Worksheets and

10 2014 Itemized Deductions Worksheet /

20++ Irs Deductions Worksheet Worksheets Decoomo

California Itemized Deductions Worksheet

Home Office Deduction Worksheet HMDCRTN

Some Of The Worksheets Displayed Are Deductions Form 1040 Itemized, 2019 Schedule Ca 540.

Web Schedule A Is An Irs Form Used To Claim Itemized Deductions On A Tax Return (Form 1040).

In Most Cases, Your Federal Income Tax Will Be Less If You Take.

Web What Credits And Deductions Do I Qualify For?

Related Post: