Capital Loss Carryforward Worksheet

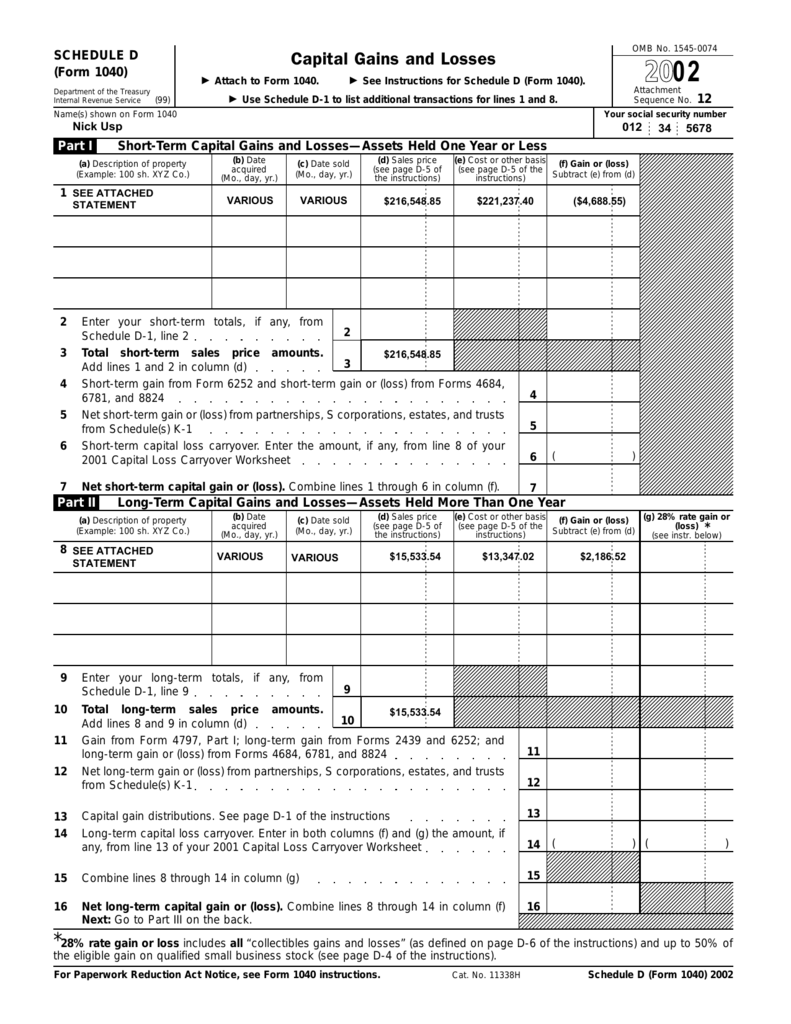

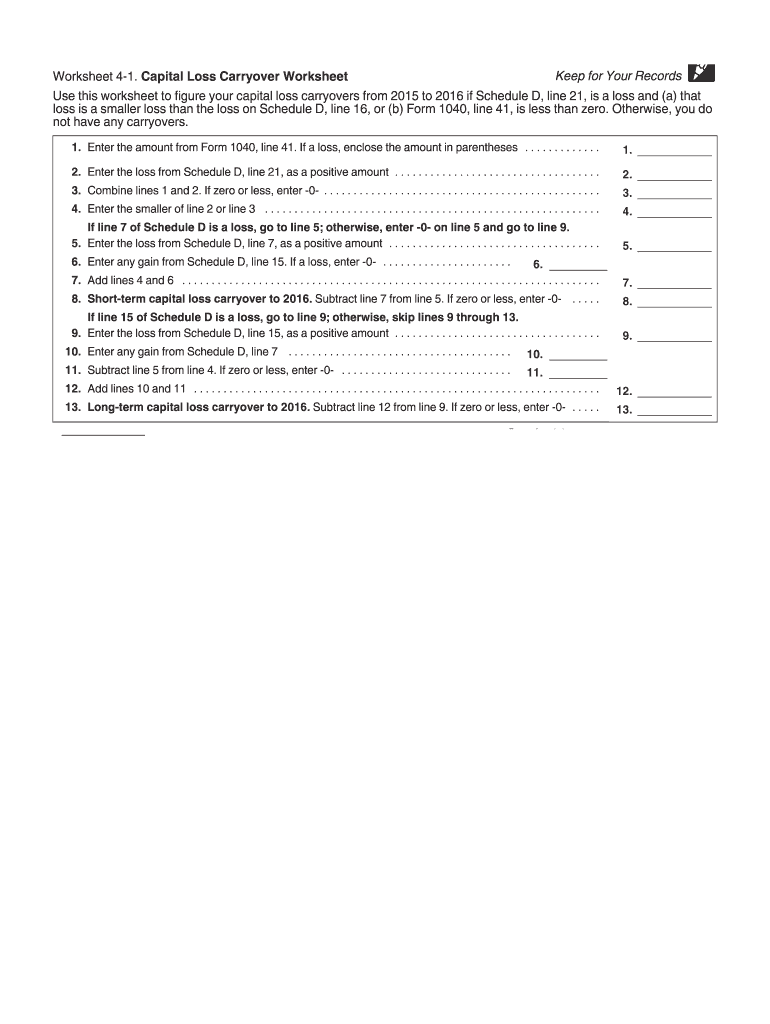

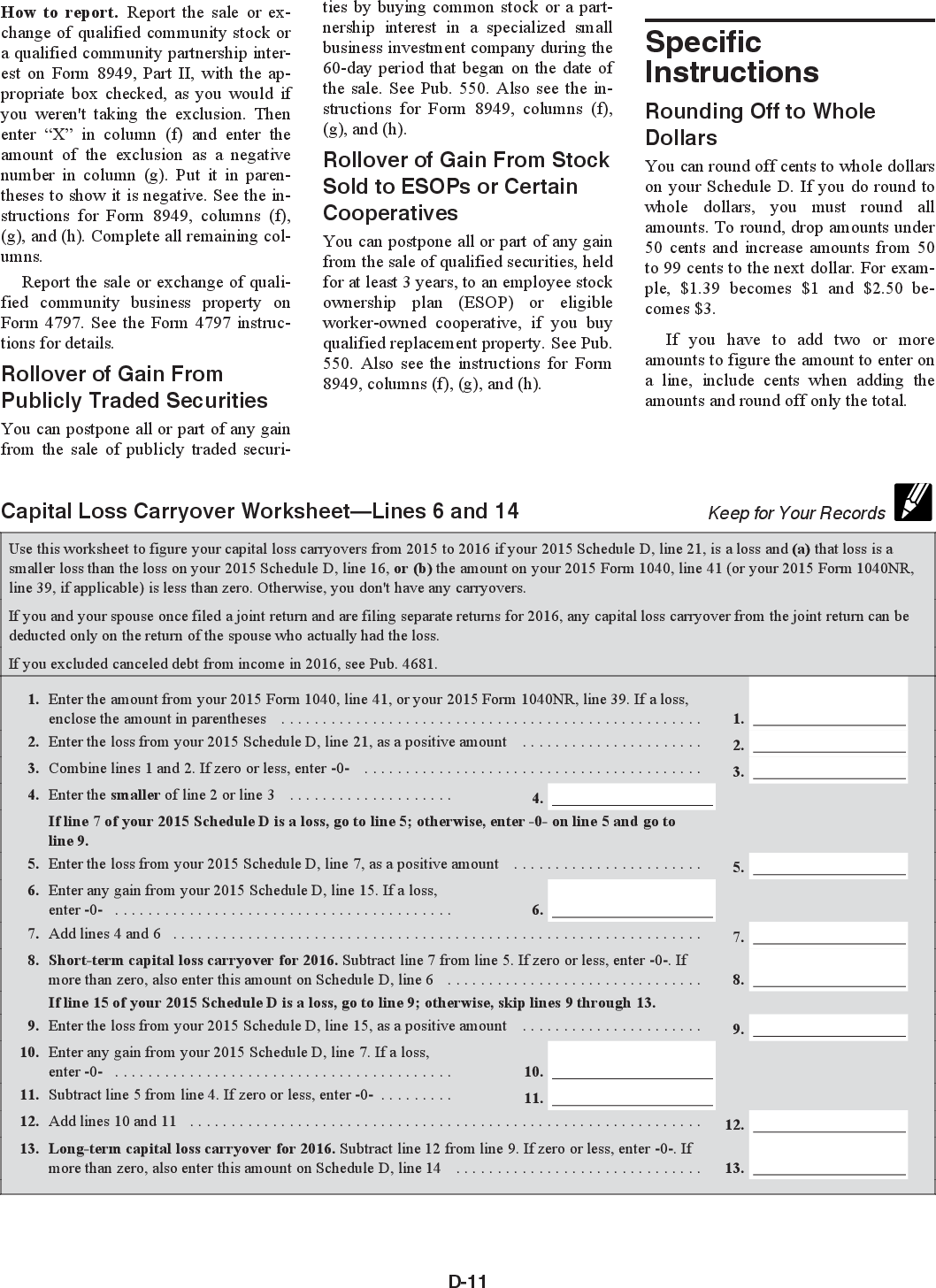

Capital Loss Carryforward Worksheet - One way to find your capital loss carryover amount is to look at your return schedule d page 2. Web yes, you're right. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of the following is true. Web june 5, 2019 11:34 pm. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Difference between line 10 and line 11: Surprisingly your capital loss carryover is reduced by the amount of capital loss that was actually used to reduce your taxable income, not by the. An example of capital loss carryover. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. • that loss is a smaller loss than the. An example of capital loss carryover. Web loss on line 10 and gain on line 11. Web june 5, 2019 11:34 pm. • that loss is a smaller loss. • that loss is a smaller loss. Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of the following is true. Difference between line 10 and line 11: ($2,000) california gain on line 11 is: Web june 5, 2019 11:34 pm. Web to enter capital loss carryovers, do the following: Line 16 will be your total loss and line 21. Federal loss on line 10 is: Surprisingly your capital loss carryover is reduced by the amount of capital loss that was actually used to reduce your taxable income, not by the. Web it also includes links to worksheets you can use. Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Web to enter capital loss carryovers, do the following: Use the capital loss carryover. Web june 5, 2019 11:34 pm. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have. Web loss on line 10 and gain on line 11. An example of capital loss carryover. Federal loss on line 10 is: One way to find your capital loss carryover amount is to look at your return schedule d page 2. • that loss is a smaller loss than the. Use the capital loss carryover. Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. ($2,000) california gain on line 11 is: Web schedule d line 15. • that loss is a smaller loss. Surprisingly your capital loss carryover is reduced by the amount of capital loss that was actually used to reduce your taxable. Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of the following. Add lines 12 and 13. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Use the capital loss carryover. Surprisingly your capital loss carryover is reduced. • that loss is a smaller loss. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. ($2,000) california gain on line 11 is: Federal loss on line 10 is: Web capital loss carryover is the net amount of capital losses. Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Web loss on line 10 and gain on line 11. Net capital losses (the amount that total capital. Web schedule d line 15. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Add lines 6 and 8. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. An example of capital loss carryover. Difference between line 10 and line 11: Federal loss on line 10 is: Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Web yes, you're right. Difference between line 10 and line 11: ($2,000) california gain on line 11 is: Web june 5, 2019 11:34 pm. One way to find your capital loss carryover amount is to look at your return schedule d page 2. Add lines 12 and 13. Use the capital loss carryover. Surprisingly your capital loss carryover is reduced by the amount of capital loss that was actually used to reduce your taxable income, not by the. Web june 5, 2019 11:34 pm. Federal loss on line 10 is: Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of the following is true. Web loss on line 10 and gain on line 11. • that loss is a smaller loss. Web yes, you're right. Web loss on line 10 and gain on line 11. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. ($2,000) california gain on line 11 is: Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Difference between line 10 and line 11: Web schedule d line 15. Line 16 will be your total loss and line 21. Use the capital loss carryover. Net capital losses (the amount that total capital. Federal loss on line 10 is:39 best ideas for coloring Capital Loss Carryover Worksheet

Capital Loss Carryover Worksheet slidesharedocs

39 best ideas for coloring Capital Loss Carryover Worksheet

1040 capital loss carryover worksheet

Capital Loss Carryover Worksheet slidesharedocs

Carryover Worksheet Form Fill Out and Sign Printable PDF Template

worksheet. 2013 Capital Loss Carryover Worksheet. Grass Fedjp Worksheet

50 best ideas for coloring Capital Loss Deduction

capital loss carryover worksheet 1041

capital loss carryover worksheet 1041

Add Lines 12 And 13.

Web To Enter Capital Loss Carryovers, Do The Following:

Surprisingly Your Capital Loss Carryover Is Reduced By The Amount Of Capital Loss That Was Actually Used To Reduce Your Taxable Income, Not By The.

Web Use This Worksheet To Calculate Capital Loss Carryovers From 2019 To 2020 If 2019 Schedule D, Line 21, Is A Loss And One Of The Following Is True.

Related Post: