Carryover Worksheet Turbotax

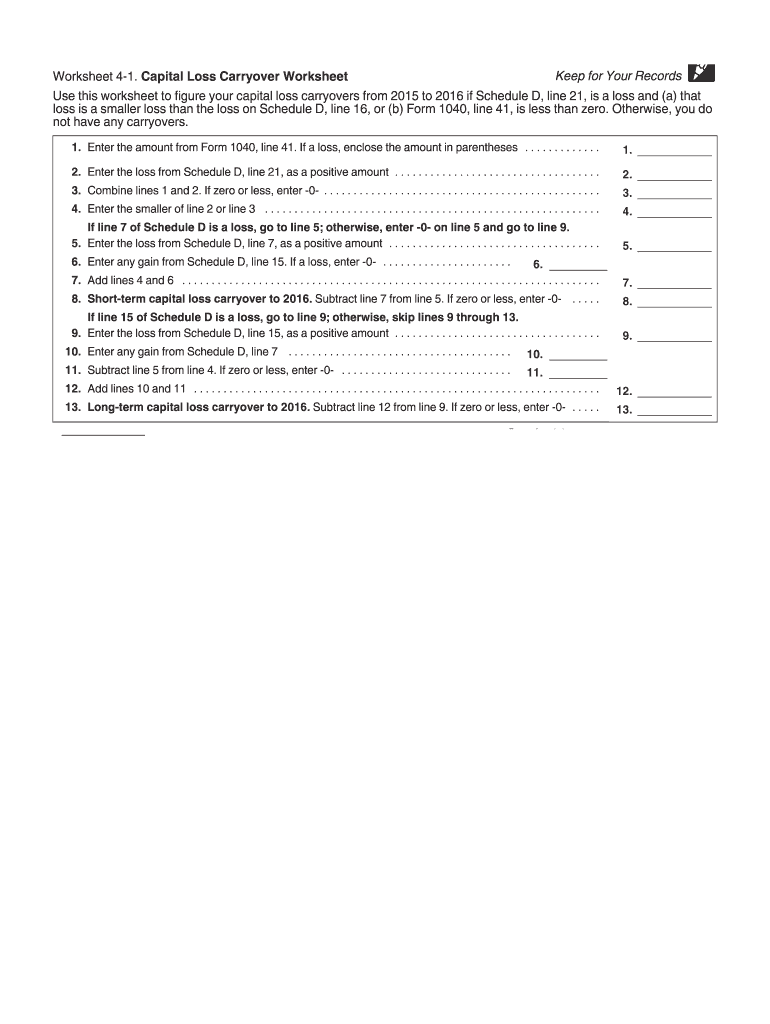

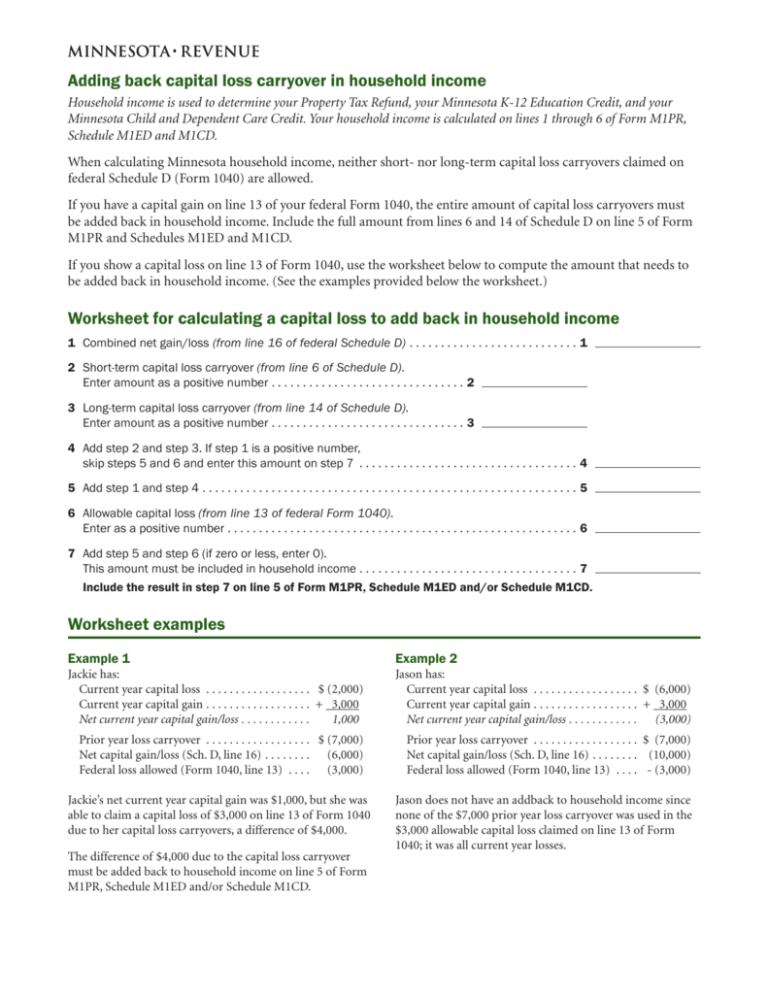

Carryover Worksheet Turbotax - Entering section 179 carryover from a schedule f:. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Web how to file your taxes with turbotax?in this video, i cover the basics of capital loss carryovers and where to enter those on schedule d. Web this set of math worksheets is the vertical addition method. Web how do i enter my capital loss carryover? Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. This product is great for teachers that are looking for a vertical addition method with carrying for grade 1. Web to better understand the irs issue with the claim for the contribution tell us on what line the carry forward amount was reported on the 2020 schedule a. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Easily sort by irs forms to find the product that best fits your tax situation. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Enter the section 179 as a positive number on line a. Entering section 179 carryover from a schedule f:. Web this set of math worksheets is the vertical addition method. Web does turbotax not automatically carryover prior year negative agi amount into the next consecutive year's 1040 as nol in the carryover worksheet? Solved•by turbotax•2069•updated january 13, 2023. Easily sort by irs forms to find the product that best fits your tax situation. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax. If you want to figure your carryover. Web how to file your taxes with turbotax?in this video, i cover the basics of capital loss carryovers and where to enter those on schedule d. If you transferred last year's turbotax. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Enter the section 179 as a positive number on line a. Web does turbotax not automatically carryover prior year negative agi amount into. Easily sort by irs forms to find the product that best fits your tax situation. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Web how to file your taxes with turbotax?in this video, i cover the basics of capital loss carryovers and where to. Web to better understand the irs issue with the claim for the contribution tell us on what line the carry forward amount was reported on the 2020 schedule a. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. You will be asked for. Web how do i enter my capital loss. If you transferred last year's turbotax. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. You will be asked for. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web scroll down to the carryovers to 2022 smart worksheet. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. This product is great for teachers that are looking for a vertical addition method with carrying for grade 1. Entering section 179 carryover. Web to better understand the irs issue with the claim for the contribution tell us on what line the carry forward amount was reported on the 2020 schedule a. Entering section 179 carryover from a schedule f:. You will be asked for. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web how to file your taxes with turbotax?in this video, i cover the basics of capital loss carryovers and where to enter those on schedule d. If you want to figure your carryover. Web to figure any capital loss carryover to 2023, you will. If you want to figure your carryover. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. This product is great for teachers that are looking for a vertical addition method with carrying for grade 1. Web this set of math worksheets is the vertical addition method. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. Web how to file your taxes with turbotax?in this video, i cover the basics of capital loss carryovers and where to enter those on schedule d. Web scroll down to the carryovers to 2022 smart worksheet. If you transferred last year's turbotax. Web how do i enter my capital loss carryover? Easily sort by irs forms to find the product that best fits your tax situation. Entering section 179 carryover from a schedule f:. Web ok i just searched an old thread on tt and this solution worked for me as it allows you to go through that questionnaire section once more to create a new form on it's own. Web to better understand the irs issue with the claim for the contribution tell us on what line the carry forward amount was reported on the 2020 schedule a. Solved•by turbotax•2069•updated january 13, 2023. Web does turbotax not automatically carryover prior year negative agi amount into the next consecutive year's 1040 as nol in the carryover worksheet? Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. You will be asked for. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Enter the section 179 as a positive number on line a. Web how do i enter my capital loss carryover? Entering section 179 carryover from a schedule f:. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Web scroll down to the carryovers to 2022 smart worksheet. You will be asked for. Web in turbotax desktop, form 3800, part ii, line 34 shows carryovers. Web ok i just searched an old thread on tt and this solution worked for me as it allows you to go through that questionnaire section once more to create a new form on it's own. If you want to figure your carryover. Web this set of math worksheets is the vertical addition method. Use the ' form 380 0' in search, and 'jump to form 3800' to get there. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. This product is great for teachers that are looking for a vertical addition method with carrying for grade 1. Web does turbotax not automatically carryover prior year negative agi amount into the next consecutive year's 1040 as nol in the carryover worksheet? Easily sort by irs forms to find the product that best fits your tax situation. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. If you transferred last year's turbotax.Solved Contribution Carryover Worksheet Intuit Accountants Community

Tax help Turbotax carrying over 2010 Foreign Tax Credit?

capital loss carryover worksheet 1041

Carryover Worksheet Form Fill Out and Sign Printable PDF Template

Capital Loss Carryover Worksheet slidesharedocs

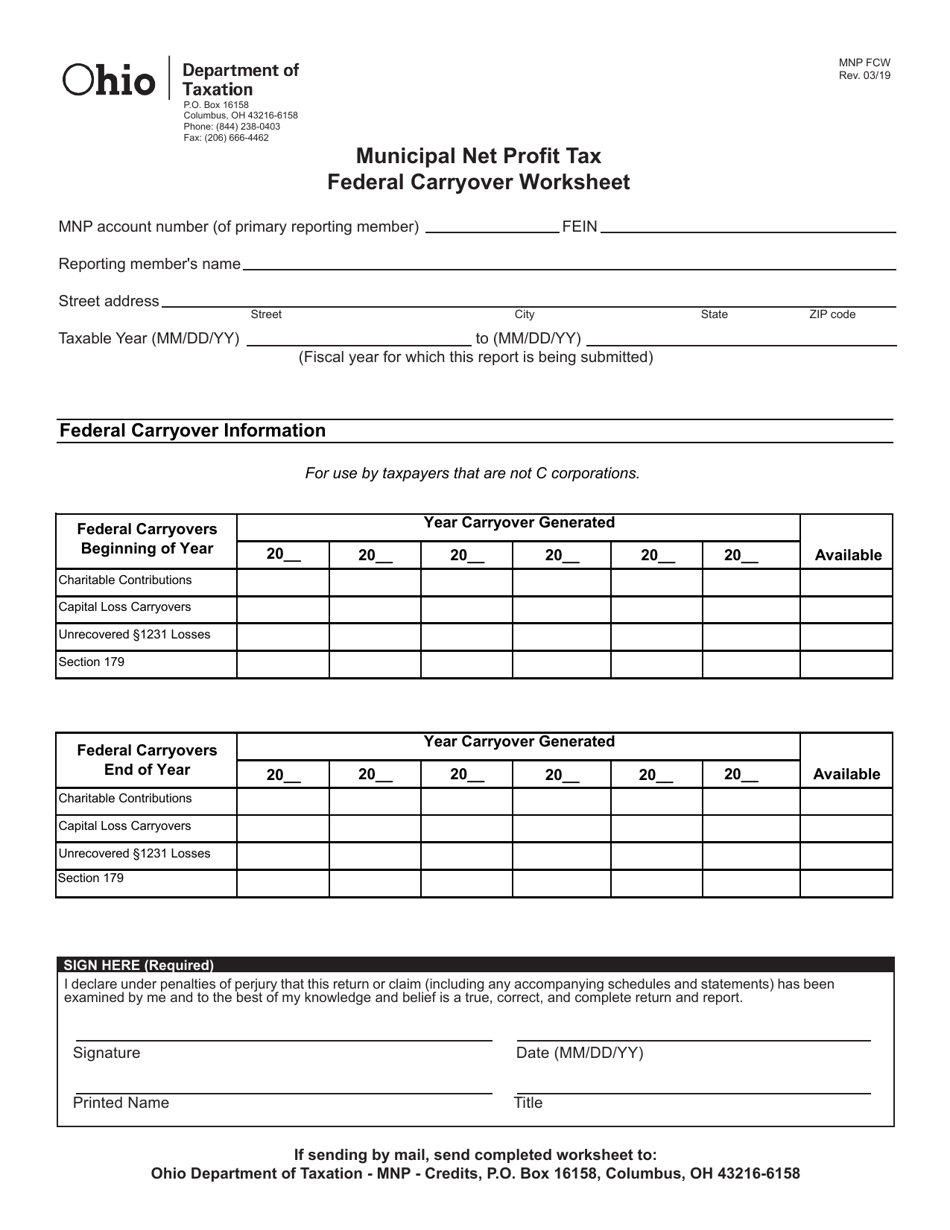

Federal Carryover Worksheet Balancing Equations Worksheet

Capital Loss Carryover Worksheet slidesharedocs

Federal Carryover Worksheet Balancing Equations Worksheet

Federal Carryover Worksheet Balancing Equations Worksheet

Turbo Tax Charitable Donations Worksheet And Charitable Qualads

Enter The Section 179 As A Positive Number On Line A.

Web To Better Understand The Irs Issue With The Claim For The Contribution Tell Us On What Line The Carry Forward Amount Was Reported On The 2020 Schedule A.

Solved•By Turbotax•2069•Updated January 13, 2023.

Web See What Tax Forms Are Included In Turbotax Basic, Deluxe, Premier And Home & Business Tax Software.

Related Post: