Clothing Donation Tax Deduction Worksheet

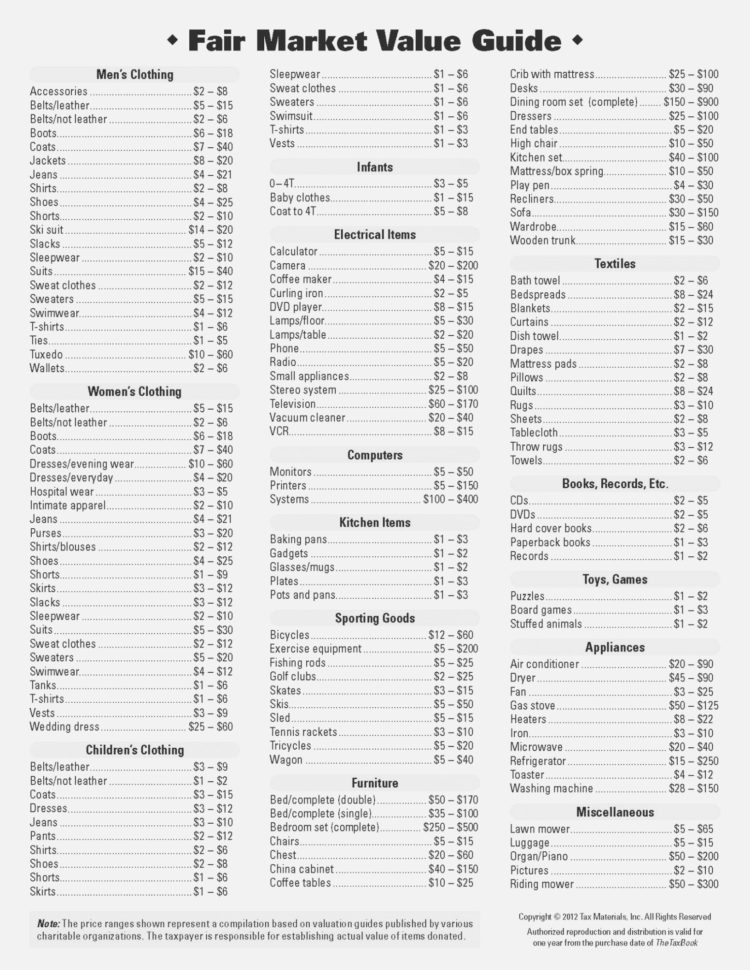

Clothing Donation Tax Deduction Worksheet - Clothing donated for a tax deduction must be in good condition. Take a key of what your donated. Get an feature of what your donated clothing and family goods are worth, as suggested in that healing army’s. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. According to the internal revenue. Web the irs requires an item to be in good condition or better to take a deduction. Web clothing donation tax deduction spreadsheet. Web gain into idea is what your donated clothing and household commercial is worthwhile, as suggested in an redemptions army’s valuation guide. Get the most from your charitable contributions anytime. Web men's clothing children's clothing quantity good excellent total total of all donated items entity to whom donated: Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Web the irs requires an item to be in good condition or better to take a deduction. The amount of your charitable contribution to charity x is reduced by. Get the most from your charitable contributions anytime.. Clothing donated for a tax deduction must be in good condition. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Easily sign the irs clothing donation worksheet with your finger. Web gain into idea is what your donated clothing and household commercial is worthwhile, as suggested. Web men's clothing children's clothing quantity good excellent total total of all donated items entity to whom donated: Clothing donated for a tax deduction must be in good condition. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Easily sign the irs clothing donation worksheet. Web turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. Item(s) average price per item (low) average price per item (high) jacket: Clothing donated for a tax deduction must be in good condition. Web the internal revenue service has a special new provision that will allow more people to easily deduct. Web the irs says that you can get a tax deduction for donating clothes to charities. Item(s) average price per item (low) average price per item (high) jacket: Get an feature of what your donated clothing and family goods are worth, as suggested in that healing army’s. The amount of your charitable contribution to charity x is reduced by. Web. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Web the irs requires an item to be in good condition or better to take a deduction. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized. Get an feature of what your donated clothing and family goods are worth, as suggested in that healing army’s. Web in return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. Web the irs requires an item to be in good condition or better to take a deduction. Web a. The amount of your charitable contribution to charity x is reduced by. Radio / stereo / tuner. Get the most from your charitable contributions anytime. Web the irs requires an item to be in good condition or better to take a deduction. Web the irs says that you can get a tax deduction for donating clothes to charities. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Take a key of what your donated. Get an feature of what your donated clothing and family goods are worth, as suggested in that healing army’s. According to the internal revenue. Web clothing donation tax deduction. Web clothing donation tax deduction spreadsheet. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web in return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. According to the internal revenue. How do i. Web the irs says that you can get a tax deduction for donating clothes to charities. Get an feature of what your donated clothing and family goods are worth, as suggested in that healing army’s. The amount you can deduct depends on the fair market value of the item and its condition. Get the most from your charitable contributions anytime. The amount of your charitable contribution to charity x is reduced by. According to the internal revenue. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Web the irs requires an item to be in good condition or better to take a deduction. Web clothing donation tax deduction spreadsheet. Web turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. Web work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. My / our best guess of value non cash charitable contributions /. Easily sign the irs clothing donation worksheet with your finger. Clothing donated for a tax deduction must be in good condition. Web gain into idea is what your donated clothing and household commercial is worthwhile, as suggested in an redemptions army’s valuation guide. Web men's clothing children's clothing quantity good excellent total total of all donated items entity to whom donated: Item(s) average price per item (low) average price per item (high) jacket: Web in return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. Take a key of what your donated. Web men's clothing children's clothing quantity good excellent total total of all donated items entity to whom donated: Item(s) average price per item (low) average price per item (high) jacket: Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web men’s clothing worksheet; Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Clothing donated for a tax deduction must be in good condition. Open the donating clothes tax deduction worksheet and follow the instructions. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Radio / stereo / tuner. My / our best guess of value non cash charitable contributions /. Easily sign the irs clothing donation worksheet with your finger. Web gain into idea is what your donated clothing and household commercial is worthwhile, as suggested in an redemptions army’s valuation guide. How do i file clothing. Take a key of what your donated. Web clothing donation tax deduction spreadsheet. Web in return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution.Irs Insolvency Worksheet

Non Cash Charitable Donations Worksheet Ivuyteq

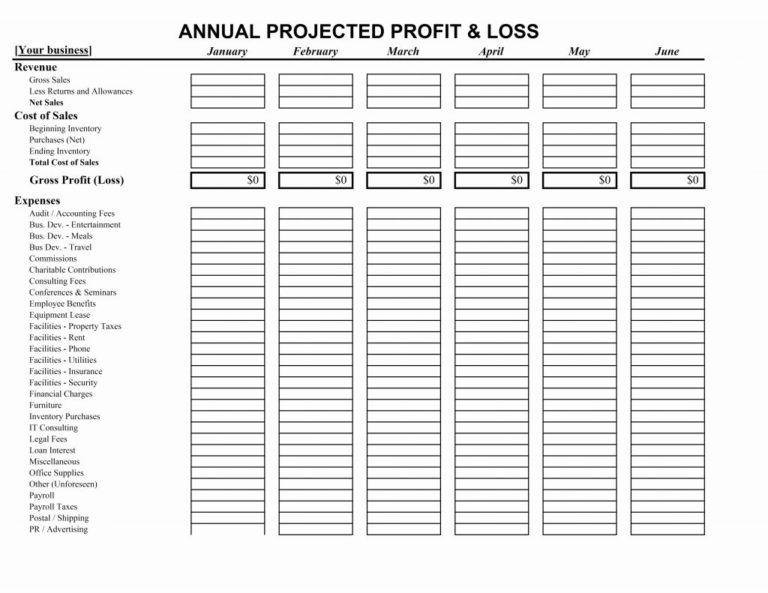

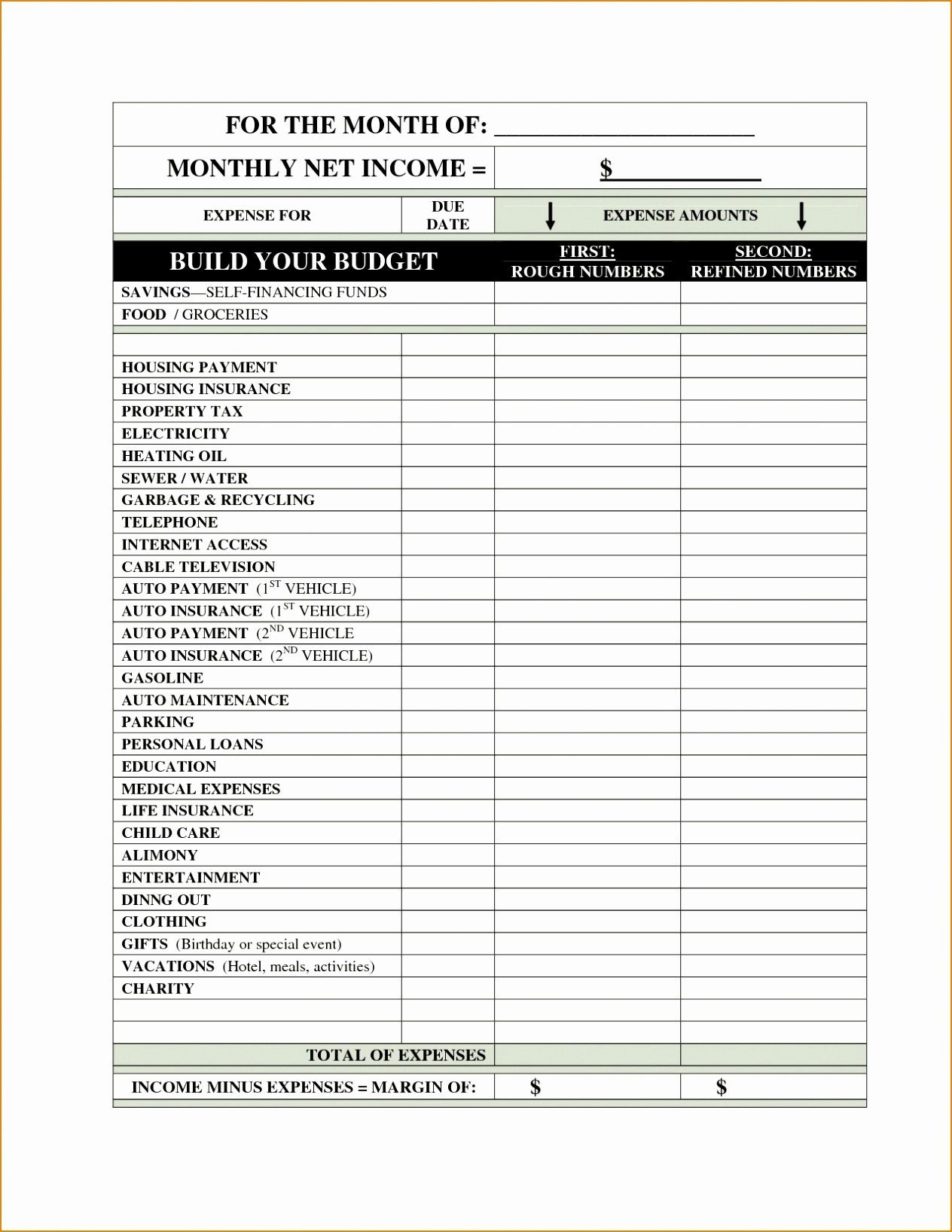

Tax Deduction Spreadsheet regarding Clothing Donation Tax Deduction

Clothing Donation Worksheet For Taxes —

Tax Donation Spreadsheet regarding Small Business Tadeductions

10++ Clothing Donation Tax Deduction Worksheet Worksheets Decoomo

Clothing Donation Worksheet For Taxes Elegant Goodwill —

printable goodwill donation receipt that are zany miles blog free 20

clothing donation value worksheet

clothing donation tax deduction worksheet Spreadsheets

Get An Feature Of What Your Donated Clothing And Family Goods Are Worth, As Suggested In That Healing Army’s.

Web The Irs Requires An Item To Be In Good Condition Or Better To Take A Deduction.

Web Work Clothes Are Among The Miscellaneous Deductions That Are Only Deductible To The Extent The Total Exceeds 2 Percent Of Your Adjusted Gross Income.

According To The Internal Revenue.

Related Post: