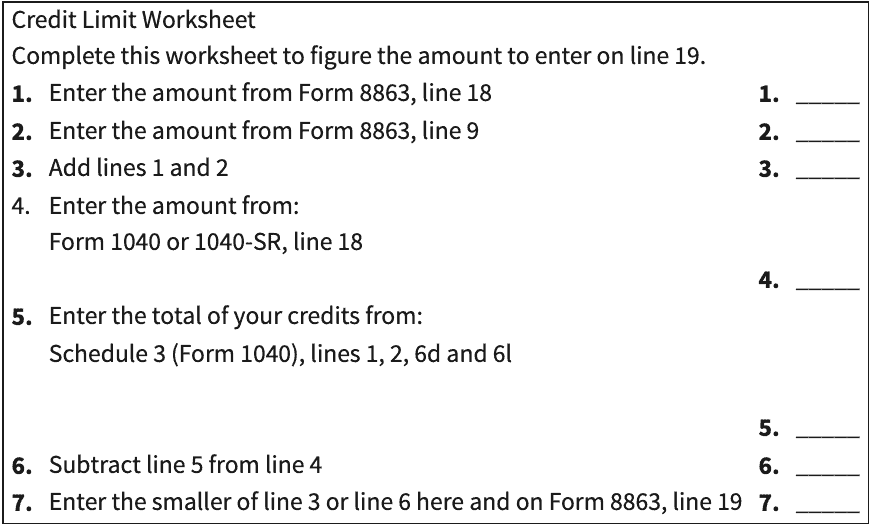

Credit Limit Worksheet 8863

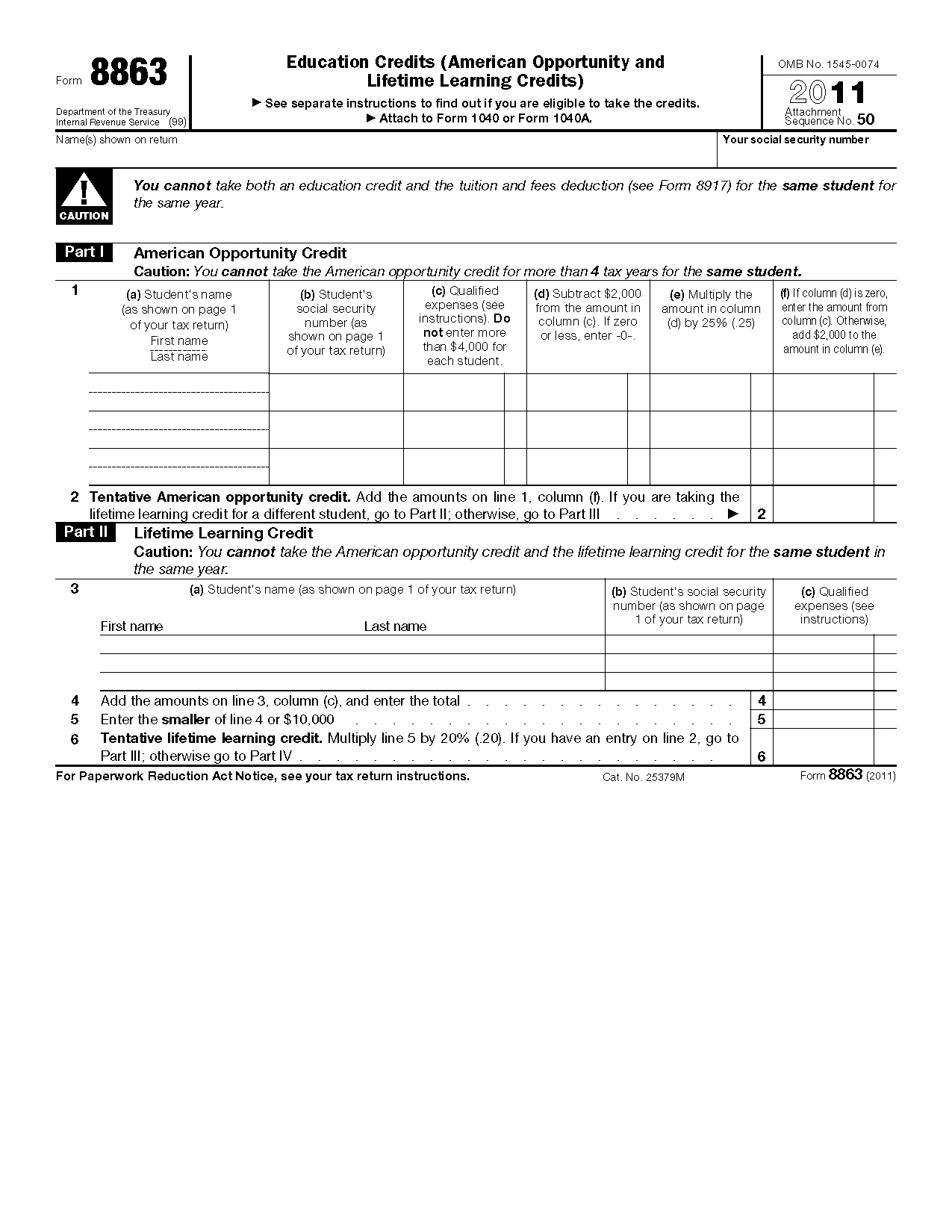

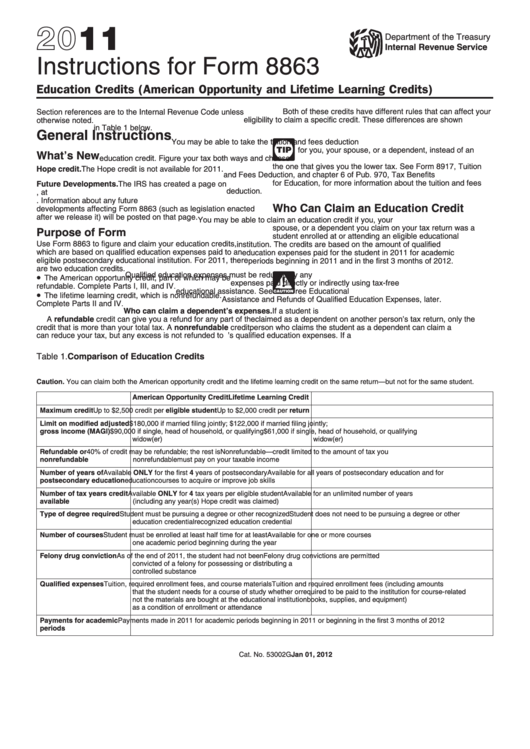

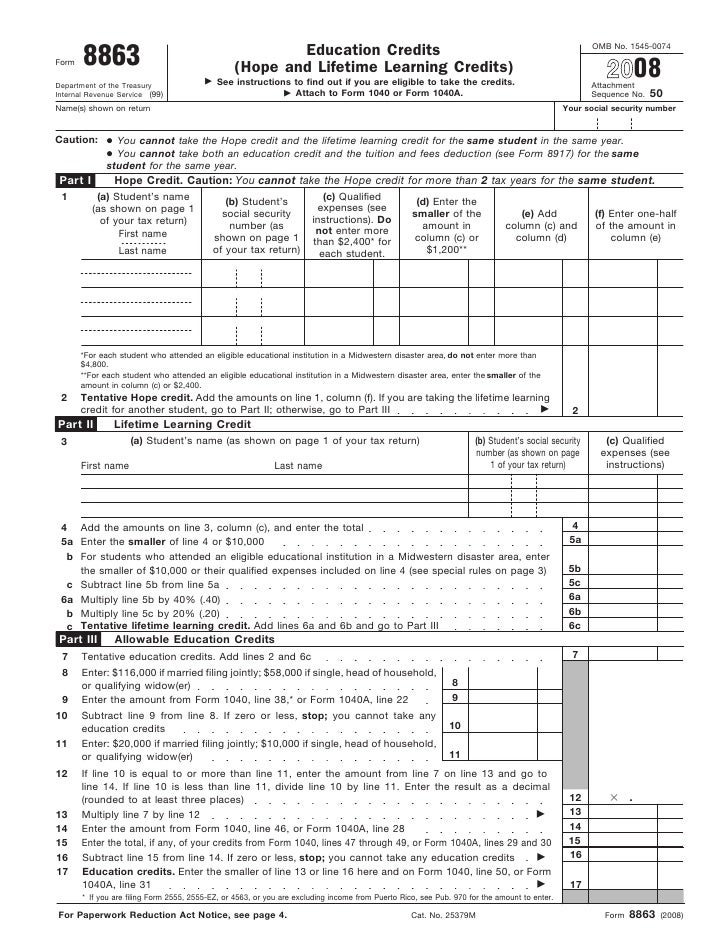

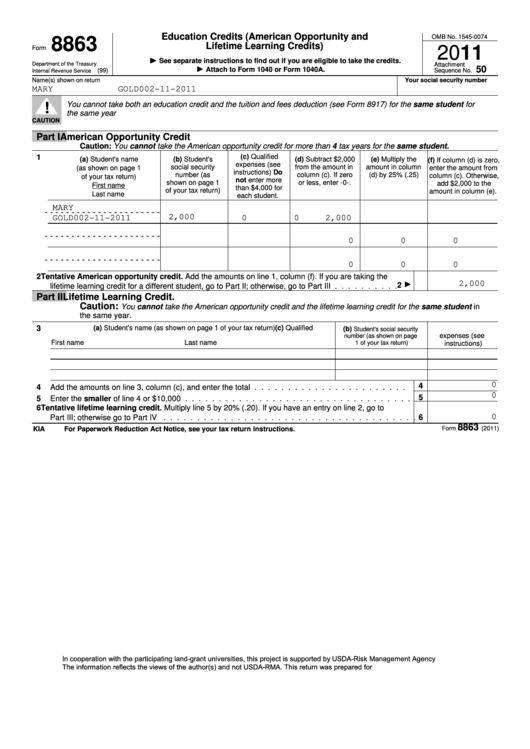

Credit Limit Worksheet 8863 - Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Up to $2,500 credit per eligible student: Some of the worksheets displayed are 2018 instructions for form 8863, money math for teens, a. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. As @thomasm125 explained, the worksheet,. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. March 30, 2023 11:45 am. What's new limits on modified adjusted gross income (magi). Enter the amount from form 8863, line 9 3. This worksheet helps determine the maximum amount of loan that can be claimed. Web form 8863 credit limit worksheet pdf document line 9 line 22 credits if the student attended only one enter the amount from line 7 of the credit limit w form 8863 attach to. Up to $2,000 credit per return: Up to $2,500 credit per eligible student: What's new limits on modified adjusted gross income (magi). Web 8863 and its. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Web each person can receive a maximum annual credit of $2,500. Up to $2,500 credit per eligible student: Web to claim the aotc, taxpayers must file form. Up to $2,500 credit per eligible student: What's new limits on modified adjusted gross income (magi). Web form 8863 credit limit worksheet pdf document line 9 line 22 credits if the student attended only one enter the amount from line 7 of the credit limit w form 8863 attach to. This worksheet helps determine the maximum amount of loan that. What's new limits on modified adjusted gross income (magi). Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Add lines 1 and 2 4. This worksheet helps determine the maximum amount of loan that can be claimed. Enter the amount from form 8863, line. What's new limits on modified adjusted gross income (magi). Enter the amount from form 8863, line 18 2. Web 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. Up to $2,500 credit per eligible student: This amounts to up to $10,000 in educational tax credits over four years. Add lines 1 and 2 4. As @thomasm125 explained, the worksheet,. Up to $2,500 credit per eligible student: What's new limits on modified adjusted gross income (magi). What's new limits on modified adjusted gross income (magi). Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. Web each person can receive a maximum annual credit of $2,500. Web to claim the aotc,. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Up to $2,000 credit per return: This worksheet helps determine the maximum amount of loan that can be claimed. March 30, 2023 11:45 am. Web each person can receive a maximum annual. This worksheet helps determine the maximum amount of loan that can be claimed. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Enter the amount from form 8863, line 18 2. March 30, 2023 11:45 am. Enter the amount from form. As @thomasm125 explained, the worksheet,. Up to $2,500 credit per eligible student: This amounts to up to $10,000 in educational tax credits over four years. If you are using turbotax, you will not have to make the entries on form 8812. This worksheet helps determine the maximum amount of loan that can be claimed. This amounts to up to $10,000 in educational tax credits over four years. What's new limits on modified adjusted gross income (magi). Web 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. Up to $2,500 credit per eligible student: Web 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. March 30, 2023 11:45 am. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. This worksheet helps determine the maximum amount of loan that can be claimed. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. What's new limits on modified adjusted gross income (magi). Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. As @thomasm125 explained, the worksheet,. If you are using turbotax, you will not have to make the entries on form 8812. Enter the amount from form 8863, line 9 3. Web each person can receive a maximum annual credit of $2,500. Some of the worksheets displayed are 2018 instructions for form 8863, money math for teens, a. Enter the amount from form 8863, line 18 2. Add lines 1 and 2 4. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Up to $2,000 credit per return: Some of the worksheets displayed are 2018 instructions for form 8863, money math for teens, a. Web 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. March 30, 2023 11:45 am. Web form 8863 credit limit worksheet pdf document line 9 line 22 credits if the student attended only one enter the amount from line 7 of the credit limit w form 8863 attach to. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Enter the amount from form 8863, line 18 2. This worksheet helps determine the maximum amount of loan that can be claimed. Add lines 1 and 2 4. Web 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. If you are using turbotax, you will not have to make the entries on form 8812. This amounts to up to $10,000 in educational tax credits over four years. Web each person can receive a maximum annual credit of $2,500. Up to $2,500 credit per eligible student: As @thomasm125 explained, the worksheet,. What's new limits on modified adjusted gross income (magi). What's new limits on modified adjusted gross income (magi).IRS Form 8863 A Guide to Education Credits

credit limit worksheet 2019 Fill Online, Printable, Fillable Blank

Tax Form 8863 Federal For 2016 Instructions 2015 2018 —

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Instructions For Form 8863 Education Credits (American Opportunity

8863K Kentucky Education Tuition Tax Credit Form 42A740S24

Form 8863Education Credits

Learn How to Fill the Form 8863 Education Credits YouTube

Form 8863 Credit Limit Worksheets

Sample Form 8863 Education Credits (American Opportunity And Lifetime

Enter The Amount From Form 8863, Line 9 3.

Web If You Plan On Claiming One Of The Irs Educational Tax Credits, Be Sure To Fill Out A Form 8863 And Attach It To Your Tax Return.

Up To $2,000 Credit Per Return:

Web The Credit Limit Worksheet Of Form 8863 Is A Section Of The Form That Is Used To Calculate The Amount Of The Education Tax Credit That A Taxpayer Is Eligible To Claim.

Related Post: