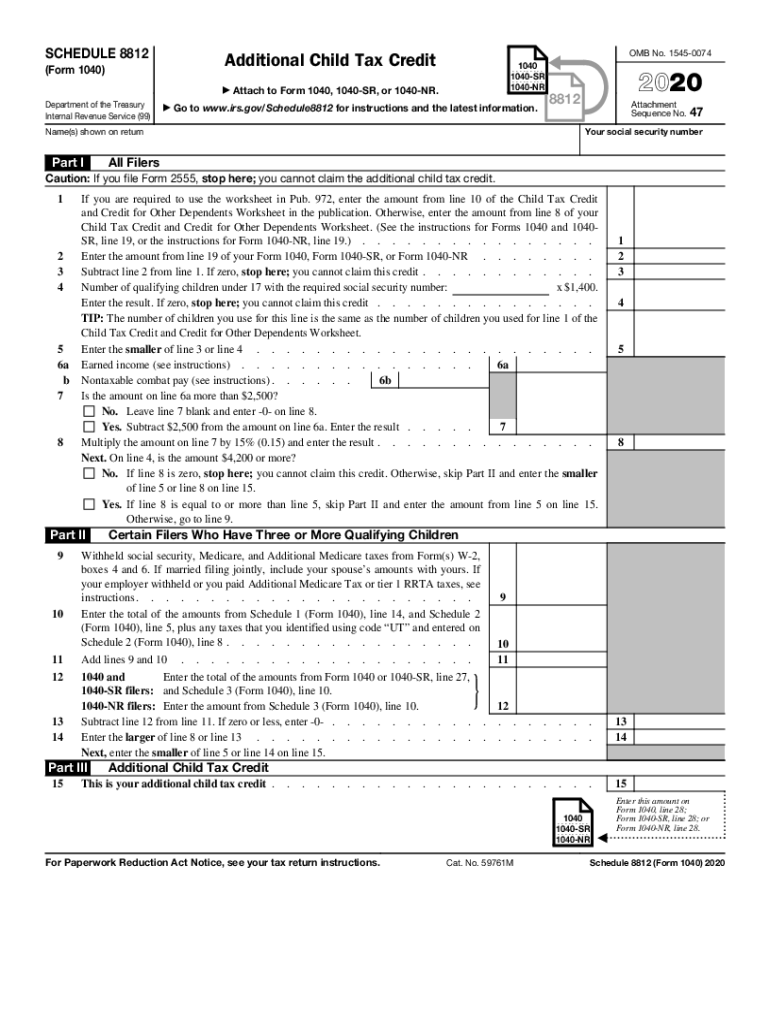

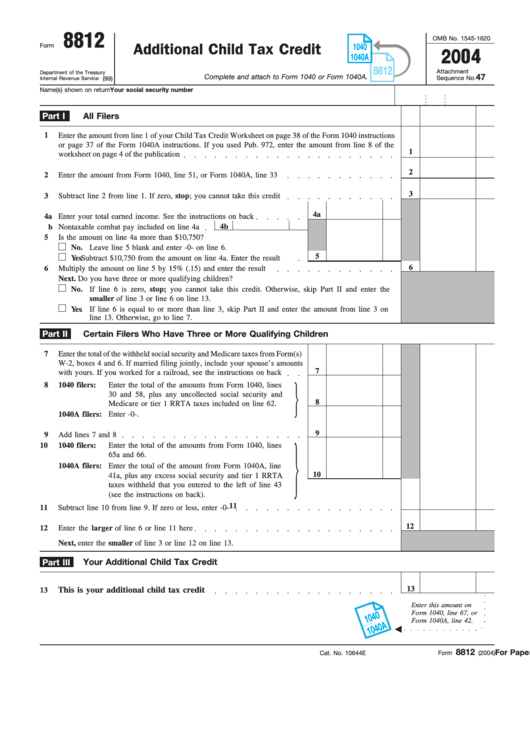

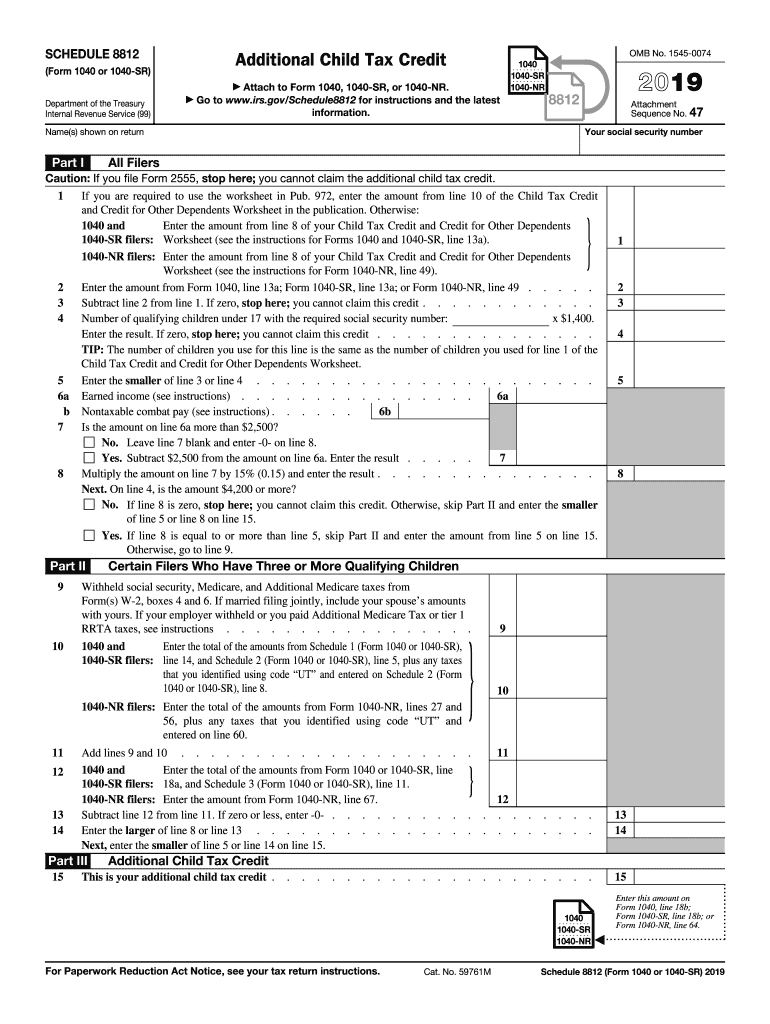

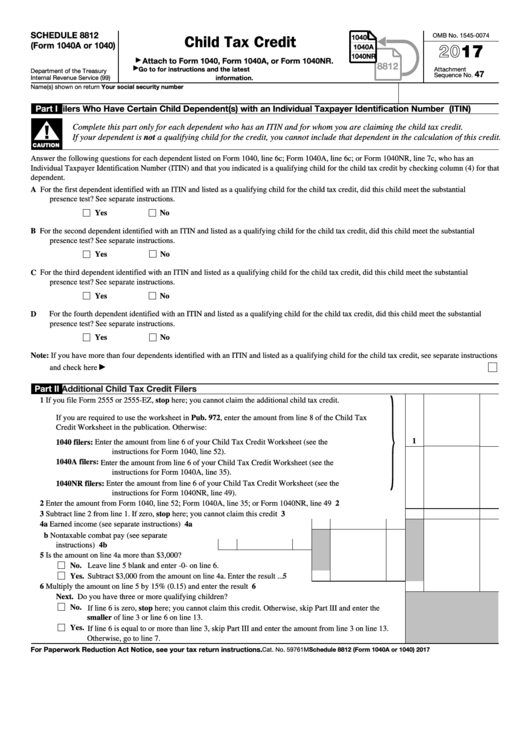

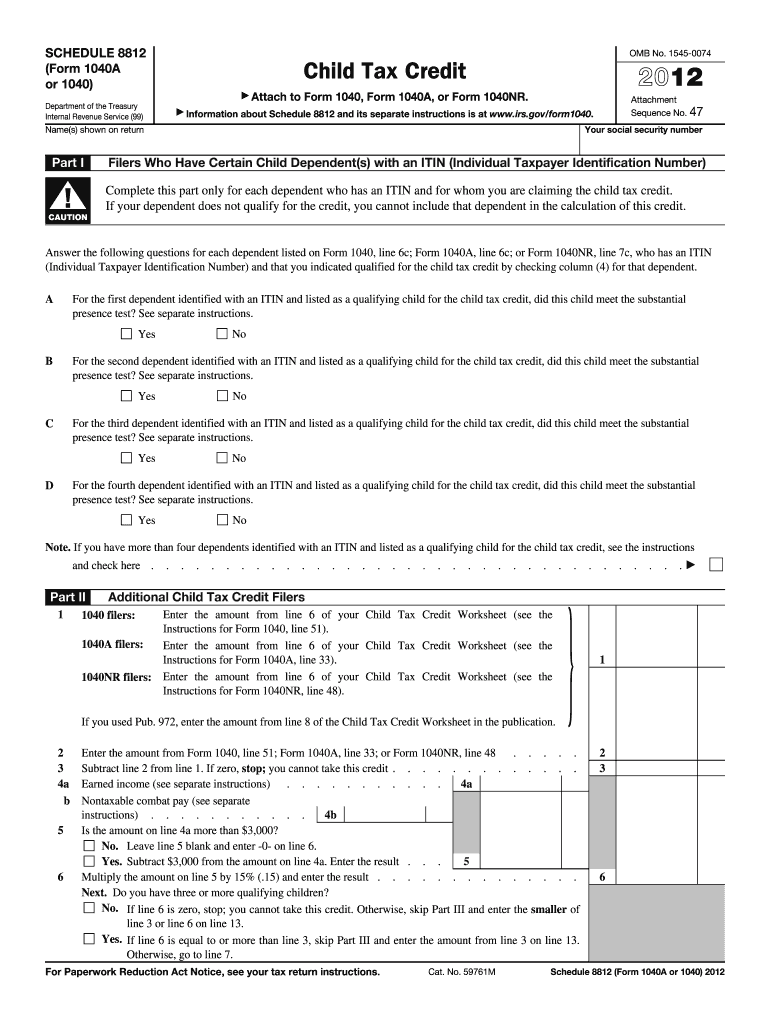

Credit Limit Worksheet A Schedule 8812

Credit Limit Worksheet A Schedule 8812 - Web schedule 8812 (form 1040). You can download or print current or. See the instructions for form caution!. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. If so, that would reduce the $10,200 child tax credit. Web who should use schedule 8812 first, complete the child tax credit and credit for other dependents worksheet that applies to you. They received $1500 each in advance credit so remainder should be $3000. If the child tax credit isn't. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other families (odc), and additional child pay credit (actc). The ctc and odc are. You can download or print current or. See the instructions for form caution!. If so, that would reduce the $10,200 child tax credit. Web who should use schedule 8812 first, complete the child tax credit and credit for other dependents worksheet that applies to you. Web schedule 8812 (form 1040). Why isn't the child tax credit calculating? Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web use schedule 8812 (form 1040) to figure your. If so, that would reduce the $10,200 child tax credit. Web child tax credit between 6 and 18 is $3,000 client has 2 kids that qualify. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other families (odc), and additional child pay credit (actc). Web look at your schedule 8812 on lines b1 and. Why isn't the child tax credit calculating? You can download or print current or. They received $1500 each in advance credit so remainder should be $3000. See the instructions for form caution!. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you. Web look at your schedule 8812 on lines b1 and b2 of principal place of abode and letter 6419 smart worksheet. If so, that would reduce the $10,200 child tax credit. See the instructions for form caution!. They received $1500 each in advance credit so remainder should be $3000. Web child tax credit between 6 and 18 is $3,000 client. They received $1500 each in advance credit so remainder should be $3000. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. See the instructions for form caution!. Web look at your schedule 8812 on lines b1 and b2 of principal place of. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other families (odc), and additional child pay credit (actc). That worksheet won't appear. For example, if the amount. See the instructions for form caution!. Web schedule 8812 (form 1040). While the maximum credit is $2,000 total per qualifying child, taxpayers who don’t have. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. See the instructions for form caution!. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web schedule 8812 (form 1040). That worksheet won't appear in turbotax, even though the program uses. Web you might need to calculate other credits first to properly apply the credit. Why isn't the child tax credit calculating? Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other families (odc), and additional child pay credit (actc). If so, that would reduce the $10,200 child tax credit. Web who should use schedule 8812 first, complete the child tax credit and credit for other dependents worksheet that. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web child tax credit between 6 and 18 is $3,000 client has 2 kids that qualify. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. The ctc and odc are. Web you might need to calculate other credits first to properly apply the credit. If the child tax credit isn't. If so, that would reduce the $10,200 child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other families (odc), and additional child pay credit (actc). Web who should use schedule 8812 first, complete the child tax credit and credit for other dependents worksheet that applies to you. They received $1500 each in advance credit so remainder should be $3000. Web in 2022, if the total credit amount for all of your qualifying children exceeds the amount of tax you owe for the year, the irs requires you to prepare schedule 8812. You can download or print current or. Web schedule 8812 (form 1040). Why isn't the child tax credit calculating? While the maximum credit is $2,000 total per qualifying child, taxpayers who don’t have. See the instructions for form caution!. For example, if the amount. That worksheet won't appear in turbotax, even though the program uses. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. If the child tax credit isn't. See the instructions for form caution!. Web who should use schedule 8812 first, complete the child tax credit and credit for other dependents worksheet that applies to you. Why isn't the child tax credit calculating? If so, that would reduce the $10,200 child tax credit. Web child tax credit between 6 and 18 is $3,000 client has 2 kids that qualify. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. That worksheet won't appear in turbotax, even though the program uses. You can download or print current or. While the maximum credit is $2,000 total per qualifying child, taxpayers who don’t have. The ctc and odc are. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web schedule 8812 (form 1040). Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. For example, if the amount.Credit Limit Worksheet credit limit worksheet Fill Online

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

2021 Instructions for Schedule 8812 (2021) Internal Revenue Service

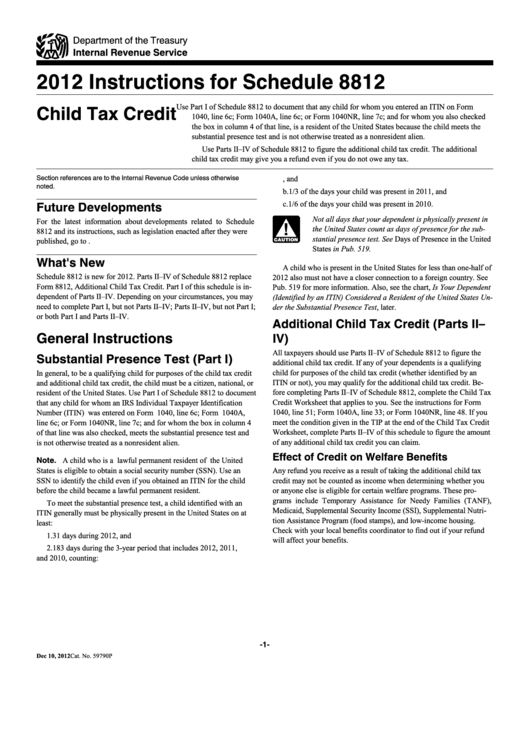

Instructions For Schedule 8812 Child Tax Credit 2012 printable pdf

Fillable Form 8812 Additional Child Tax Credit printable pdf download

Instructions for Schedule 8812 Child Tax Credit Download Printable

Chapter 7 Credit In America Worksheet Answers Jojo Worksheet

Child tax credit irs 2015 form Fill out & sign online DocHub

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

8812 Schedule Form Fill Out and Sign Printable PDF Template signNow

They Received $1500 Each In Advance Credit So Remainder Should Be $3000.

Web In 2022, If The Total Credit Amount For All Of Your Qualifying Children Exceeds The Amount Of Tax You Owe For The Year, The Irs Requires You To Prepare Schedule 8812.

Web You Might Need To Calculate Other Credits First To Properly Apply The Credit.

Web Look At Your Schedule 8812 On Lines B1 And B2 Of Principal Place Of Abode And Letter 6419 Smart Worksheet.

Related Post: