Delaware Franchise Tax Calculation Worksheet

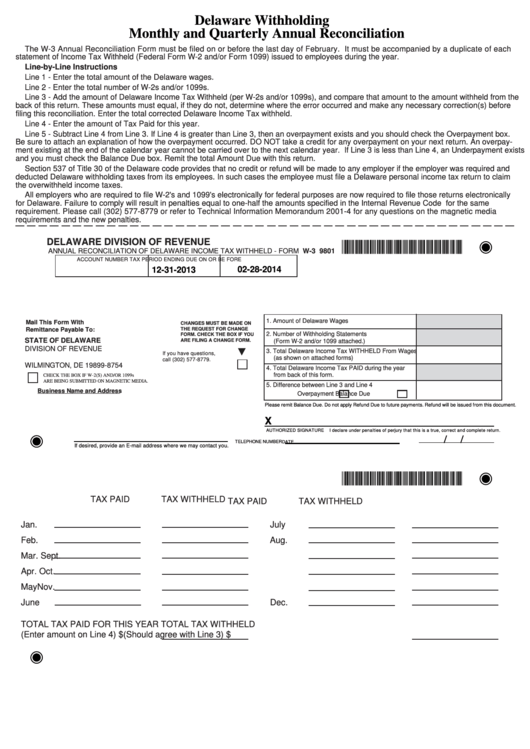

Delaware Franchise Tax Calculation Worksheet - Web our delaware franchise tax calculator was developed to help you understand and plan for how much you'll likely need to pay your delaware franchise taxes for your delaware business. Pay your delaware franchise tax here! How to calculate your delaware franchise tax fee Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. Web rounded capital_____ divided by 1,000,000 x 250= tax owed (year) _____ (min. Web how to calculate delaware franchise taxes. You can calculate delaware franchise taxes in the following ways: For a business owner incorporated in the state of delaware, it. Web how do i calculate my delaware franchise tax? Using method #1 calculator, enter number of par value shares and calculate franchise tax due. Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. 2017 franchise tax calculator 2018 franchise fax calculator **(ms excel format is required for usage of this. Web understanding delaware’s corporate franchise tax. How to calculate your delaware franchise tax fee Web our delaware franchise tax calculator was developed to help you. Ad late with your franchise tax payment? Web 1104 estimated franchise tax report 5 del.c. Calculating the delaware franchise tax: You can calculate delaware franchise taxes in the following ways: Web the minimum delaware franchise tax fee is $175 with a $50 filing fee. Ad late with your franchise tax payment? Read on to find out how much you’ll pay, or visit our delaware franchise tax calculator app for a quick answer. You can calculate delaware franchise taxes in the following ways: Using method #1 calculator, enter number of par value shares and calculate franchise tax due. Web rounded capital_____ divided by 1,000,000 x. The franchise tax for a. Ad late with your franchise tax payment? Web how to calculate delaware franchise taxes. $165,000) if assumed par value capital (line 3) is less than1,000,000,divide by 1,000,000 then multiply by 250. How to calculate your delaware franchise tax fee Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. Web the minimum delaware franchise tax fee is $175 with a $50 filing fee. Assumed par value capital_____ divided by 1,000,000 x 250 =. Ad late with your franchise tax payment? The franchise tax for a. Web our delaware franchise tax calculator was developed to help you understand and plan for how much you'll likely need to pay your delaware franchise taxes for your delaware business. Ad late with your franchise tax payment? Web how do i calculate my delaware franchise tax? Then, using method #2 calculator, enter the total gross assets of your company and. For a business owner incorporated in the state of delaware, it. Web 1104 estimated franchise tax report 5 del.c. You can calculate delaware franchise taxes in the following ways: If tax on assumed par method is greater then $200,000.00, then only $200,000 is due. Then, using method #2 calculator, enter the total gross assets of your company and enter total. Ad late with your franchise tax payment? Using method #1 calculator, enter number of par value shares and calculate franchise tax due. How to calculate your delaware franchise tax fee Web how to calculate delaware franchise taxes. You can calculate delaware franchise taxes in the following ways: Web understanding delaware’s corporate franchise tax. Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. Web the minimum delaware franchise tax fee is $175 with a $50 filing fee. The following table is used to compute a corporation’s delaware franchise tax using the authorized shares method: You can calculate delaware franchise. Calculating the delaware franchise tax: Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. How to calculate your delaware franchise tax fee Read on to find out how much you’ll pay, or visit our delaware franchise tax calculator app for a quick answer. Pay your delaware franchise tax here! Assumed par value capital_____ divided by 1,000,000 x 250 =. Web 1104 estimated franchise tax report 5 del.c. The following table is used to compute a corporation’s delaware franchise tax using the authorized shares method: Web how to calculate delaware franchise taxes. Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. Read on to find out how much you’ll pay, or visit our delaware franchise tax calculator app for a quick answer. Then, using method #2 calculator, enter the total gross assets of your company and enter total issued shares to determine par value. The methods of calculating delaware franchise tax are detailed below. Web how do i calculate my delaware franchise tax? $165,000) if assumed par value capital (line 3) is less than1,000,000,divide by 1,000,000 then multiply by 250. The franchise tax for a. The minimum delaware franchise tax and annual report payment is $225 for domestic corporations. 2017 franchise tax calculator 2018 franchise fax calculator **(ms excel format is required for usage of this. Web understanding delaware’s corporate franchise tax. Calculating the delaware franchise tax: Ad late with your franchise tax payment? How to calculate your delaware franchise tax fee Pay your delaware franchise tax here! For a business owner incorporated in the state of delaware, it. Web the minimum delaware franchise tax fee is $175 with a $50 filing fee. $165,000) if assumed par value capital (line 3) is less than1,000,000,divide by 1,000,000 then multiply by 250. Using method #1 calculator, enter number of par value shares and calculate franchise tax due. The franchise tax for a. If tax on assumed par method is greater then $200,000.00, then only $200,000 is due. Web how to calculate delaware franchise taxes. How to calculate your delaware franchise tax fee Then, using method #2 calculator, enter the total gross assets of your company and enter total issued shares to determine par value. Ad late with your franchise tax payment? Authorized share approach the “authorized shares” approach of tax computation will provide cheaper taxes than the “assumed par. For a business owner incorporated in the state of delaware, it. The methods of calculating delaware franchise tax are detailed below. Web rounded capital_____ divided by 1,000,000 x 250= tax owed (year) _____ (min. Web 1104 estimated franchise tax report 5 del.c. Web understanding delaware’s corporate franchise tax. The minimum delaware franchise tax and annual report payment is $225 for domestic corporations. You can calculate delaware franchise taxes in the following ways:Fillable Form W3 Delaware Withholding Monthly And Quarterly Annual

Topic

How to Pay Franchise Tax in Delaware 10 Steps (with Pictures)

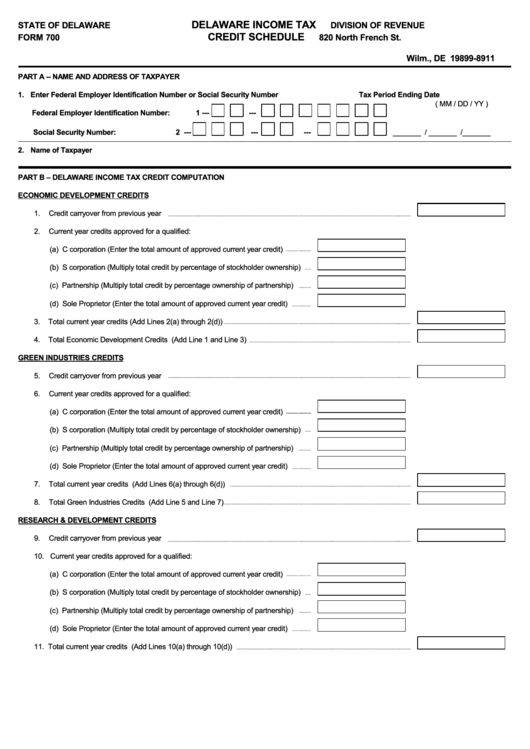

Form 700 Delaware Tax Credit Schedule printable pdf download

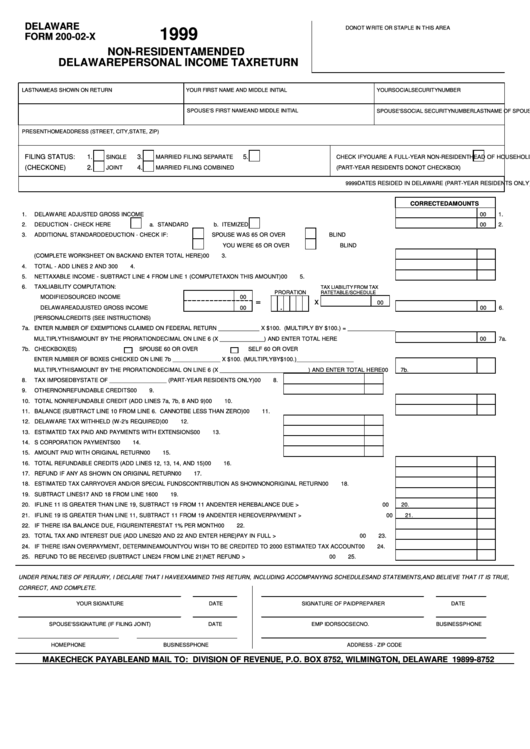

Form 20002X NonResident Amended Delaware Personal Tax

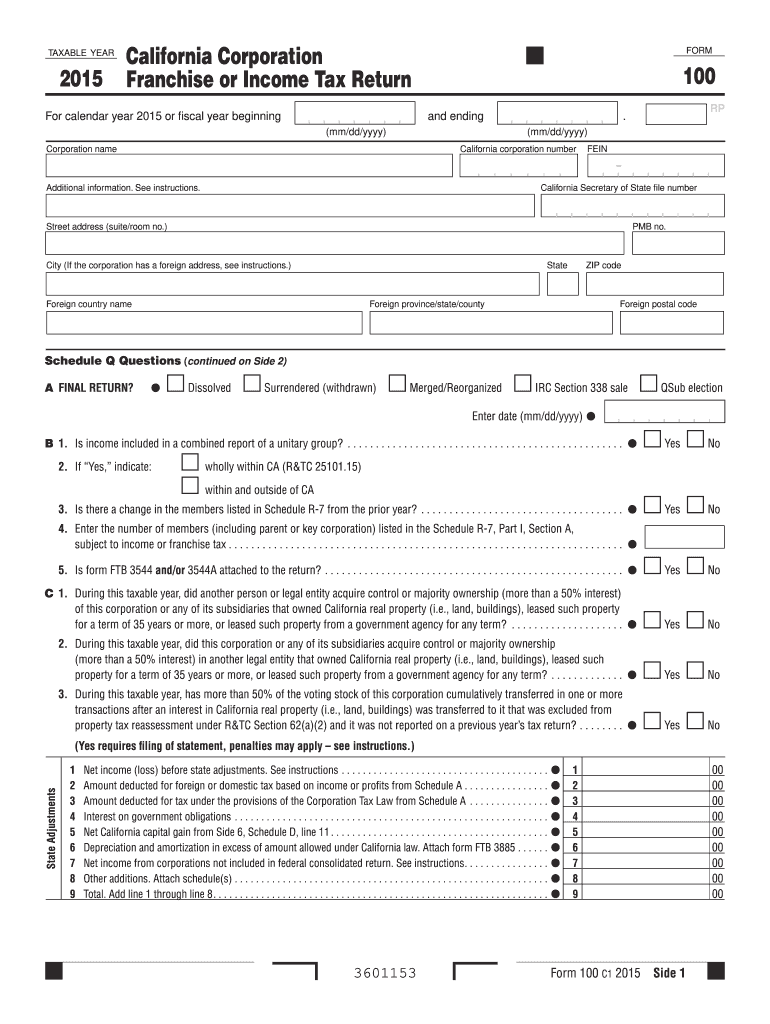

Form Franchise Tax Fill Out and Sign Printable PDF Template signNow

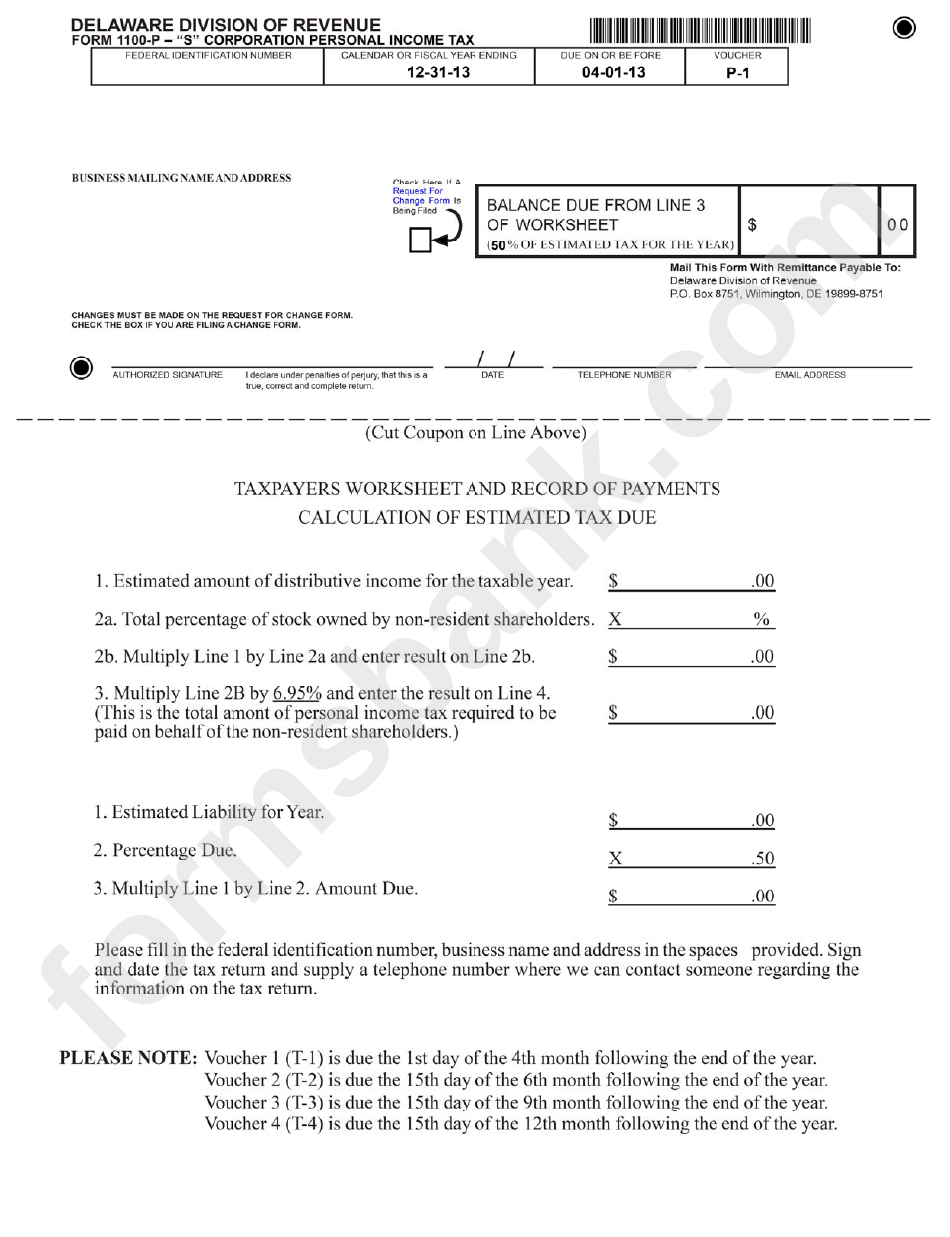

Taxpayers Worksheet And Record Of Payments Calculation Of Estimated

Form 540 Fill and Sign Printable Template Online US Legal Forms

Calculator for Delaware Franchise Tax Harvard Business Services

Delaware Franchise Tax Dates Of Inactivity

Web How Do I Calculate My Delaware Franchise Tax?

Calculating The Delaware Franchise Tax:

Web The Minimum Delaware Franchise Tax Fee Is $175 With A $50 Filing Fee.

Pay Your Delaware Franchise Tax Here!

Related Post: