Depreciation Recapture Worksheet

Depreciation Recapture Worksheet - Web keep in mind that the values are based on the physical structure’s value without including the cost of the land itself. To calculate your depreciation recapture for equipment or other assets, you’ll first need to determine your asset’s cost. Web depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain. Web a photocopier has a value of $2,000 and a life of 5 years. Web what is depreciation recapture? To collect taxes on the sale of property. Some of the worksheets for this concept are depreciation formulas 1annualdepreciationexpense,. Depreciation recapture is a procedure by the internal revenue service (irs) in the u.s. The tax rate for depreciation recapture is. Web decomposing fractions worksheets are flexible and easy to solve. To collect taxes on the sale of property. What is the percentage depreciation each year using the double declining balance method? Web depreciation recapture is a tax provision that allows the irs to collect taxes on any profitable sale of an asset that the taxpayer had used to previously offset. Some of the worksheets for this concept are depreciation formulas. Web depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain. Some of the worksheets for this concept are depreciation formulas 1annualdepreciationexpense,. The tax rate for depreciation recapture is. Web keep in mind that the values are based on the physical structure’s value without including the cost. To calculate your depreciation recapture for equipment or other assets, you’ll first need to determine your asset’s cost. Students can download the pdf format of these worksheets to practice questions for free. Web keep in mind that the values are based on the physical structure’s value without including the cost of the land itself. The tax rate for depreciation recapture. Web depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain. Depreciation recapture is a procedure by the internal revenue service (irs) in the u.s. Web but the amount of depreciation claimed on sec 1250 property that is not recaptured as ordinary income under the sec1250 recapture. The tax rate for depreciation recapture is. Web what is depreciation recapture? Web depreciation recapture is the usa internal revenue service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that. Some of the worksheets for this concept are depreciation formulas 1annualdepreciationexpense,. Web depreciation recapture is a tax provision that. Web but the amount of depreciation claimed on sec 1250 property that is not recaptured as ordinary income under the sec1250 recapture rules is unrecaptured. What is the percentage depreciation each year using the double declining balance method? Web decomposing fractions worksheets are flexible and easy to solve. Web a photocopier has a value of $2,000 and a life of. Depreciation recapture is a procedure by the internal revenue service (irs) in the u.s. Students can download the pdf format of these worksheets to practice questions for free. The tax rate for depreciation recapture is. Web a photocopier has a value of $2,000 and a life of 5 years. Web keep in mind that the values are based on the. This would be if i elected to take no. Web a photocopier has a value of $2,000 and a life of 5 years. Depreciation recapture is a procedure by the internal revenue service (irs) in the u.s. What is the percentage depreciation each year using the double declining balance method? The tax rate for depreciation recapture is. Web what is depreciation recapture? Web decomposing fractions worksheets are flexible and easy to solve. Web depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain. Students can download the pdf format of these worksheets to practice questions for free. Web keep in mind that the values. Web depreciation recapture is the usa internal revenue service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that. Web how to calculate depreciation recapture. Web a photocopier has a value of $2,000 and a life of 5 years. What is the percentage depreciation each year using the double declining. Web depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain. Depreciation recapture is a procedure by the internal revenue service (irs) in the u.s. Web a photocopier has a value of $2,000 and a life of 5 years. Web depreciation recapture is a tax provision that allows the irs to collect taxes on any profitable sale of an asset that the taxpayer had used to previously offset. To calculate your depreciation recapture for equipment or other assets, you’ll first need to determine your asset’s cost. The tax rate for depreciation recapture is. Web depreciation recapture is the usa internal revenue service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that. Web how to calculate depreciation recapture. Web keep in mind that the values are based on the physical structure’s value without including the cost of the land itself. Students can download the pdf format of these worksheets to practice questions for free. To collect taxes on the sale of property. What is the percentage depreciation each year using the double declining balance method? Web what is depreciation recapture? This would be if i elected to take no. Web decomposing fractions worksheets are flexible and easy to solve. Some of the worksheets for this concept are depreciation formulas 1annualdepreciationexpense,. Web but the amount of depreciation claimed on sec 1250 property that is not recaptured as ordinary income under the sec1250 recapture rules is unrecaptured. Web but the amount of depreciation claimed on sec 1250 property that is not recaptured as ordinary income under the sec1250 recapture rules is unrecaptured. To collect taxes on the sale of property. Web keep in mind that the values are based on the physical structure’s value without including the cost of the land itself. Depreciation recapture is a procedure by the internal revenue service (irs) in the u.s. Web how to calculate depreciation recapture. To calculate your depreciation recapture for equipment or other assets, you’ll first need to determine your asset’s cost. Web what is depreciation recapture? Some of the worksheets for this concept are depreciation formulas 1annualdepreciationexpense,. This would be if i elected to take no. Web depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain. Web a photocopier has a value of $2,000 and a life of 5 years. The tax rate for depreciation recapture is. What is the percentage depreciation each year using the double declining balance method?depreciation schedule worksheet template Templates at

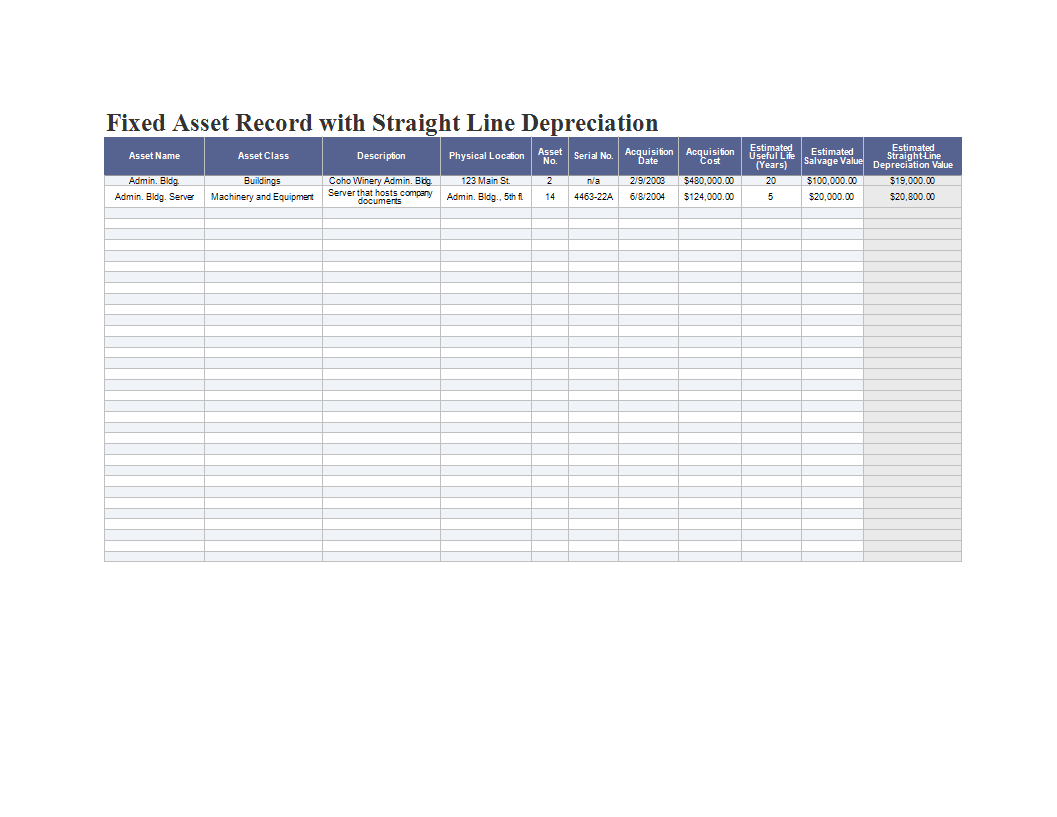

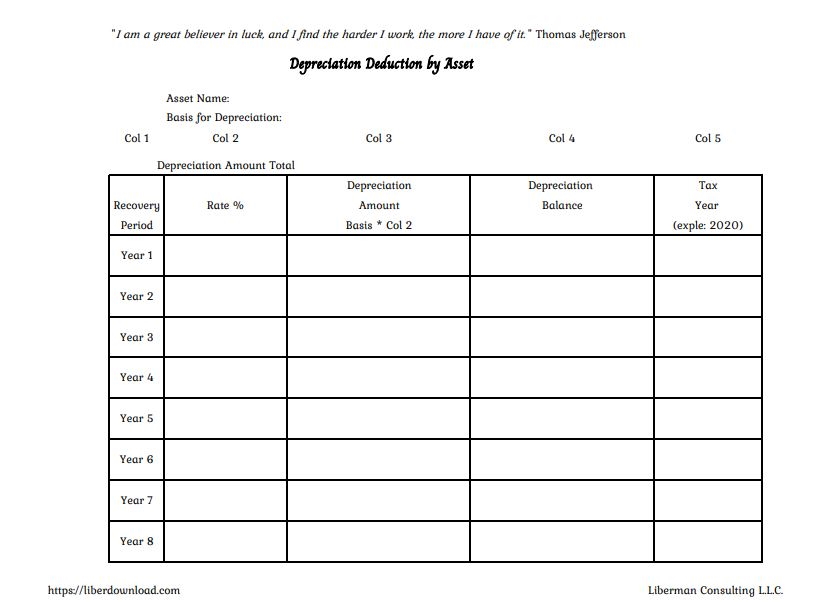

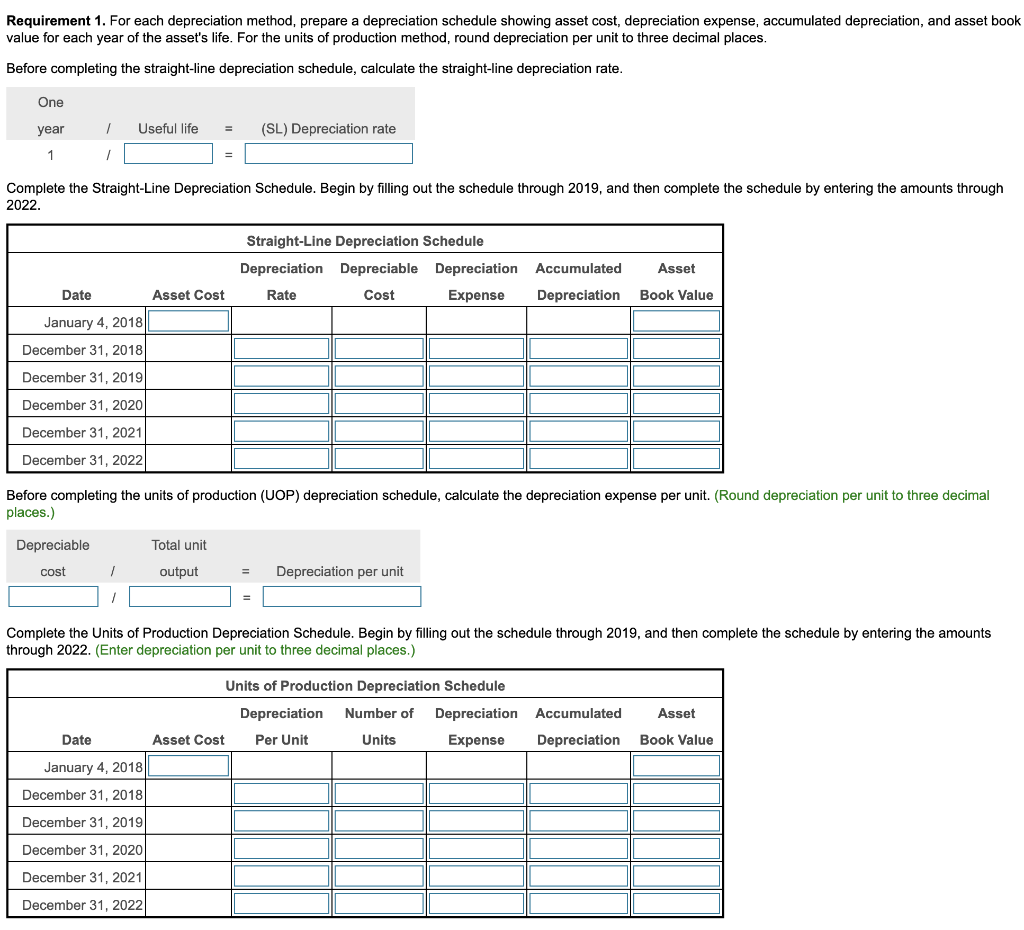

9 Free Depreciation Schedule Templates in MS Word and MS Excel

depreciation recapture worksheet

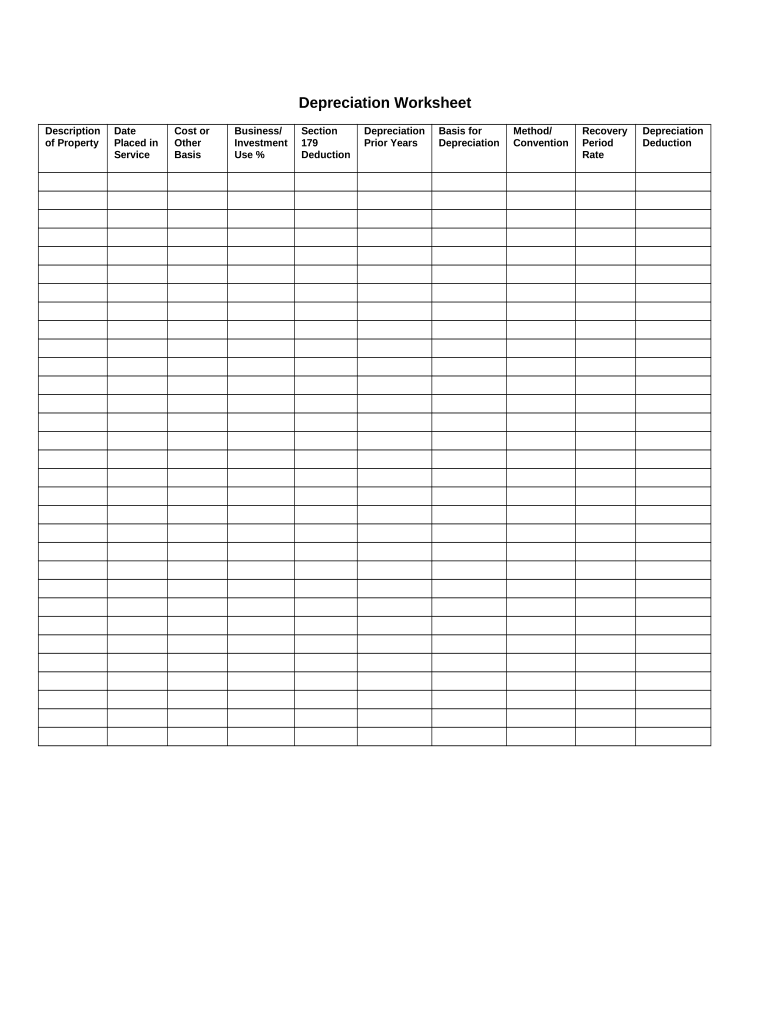

Depreciation Worksheet Fill and Sign Printable Template Online US

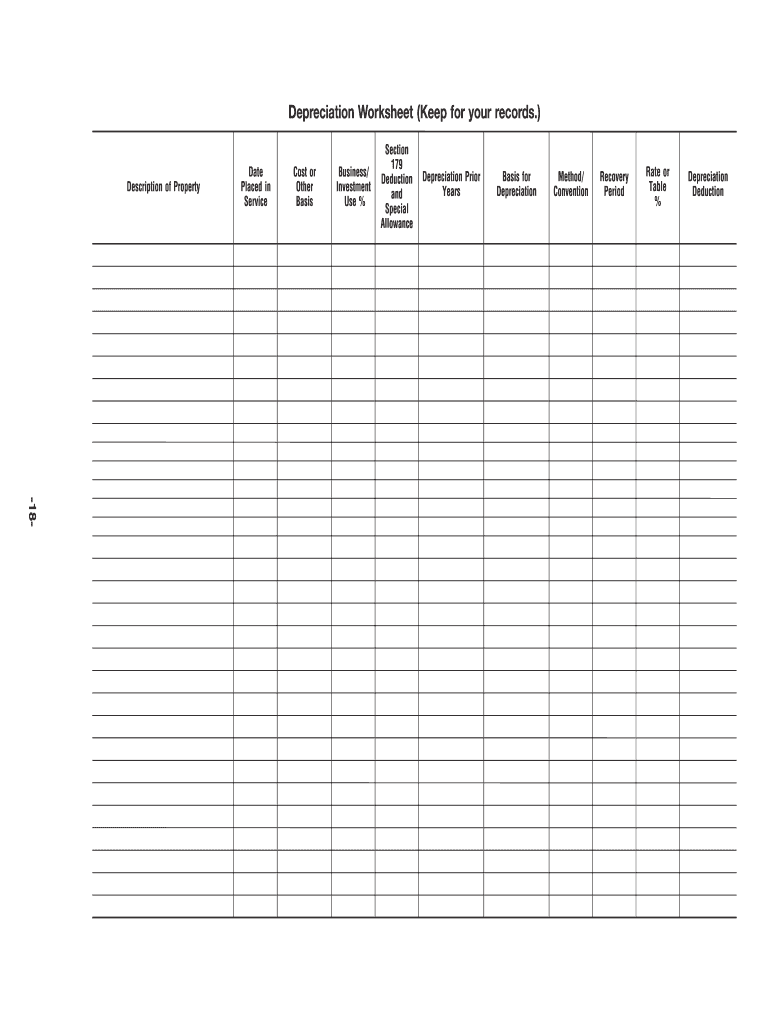

depreciation worksheet pdf Fill out & sign online DocHub

depreciation recapture worksheet

depreciation recapture worksheet

depreciation recapture worksheet

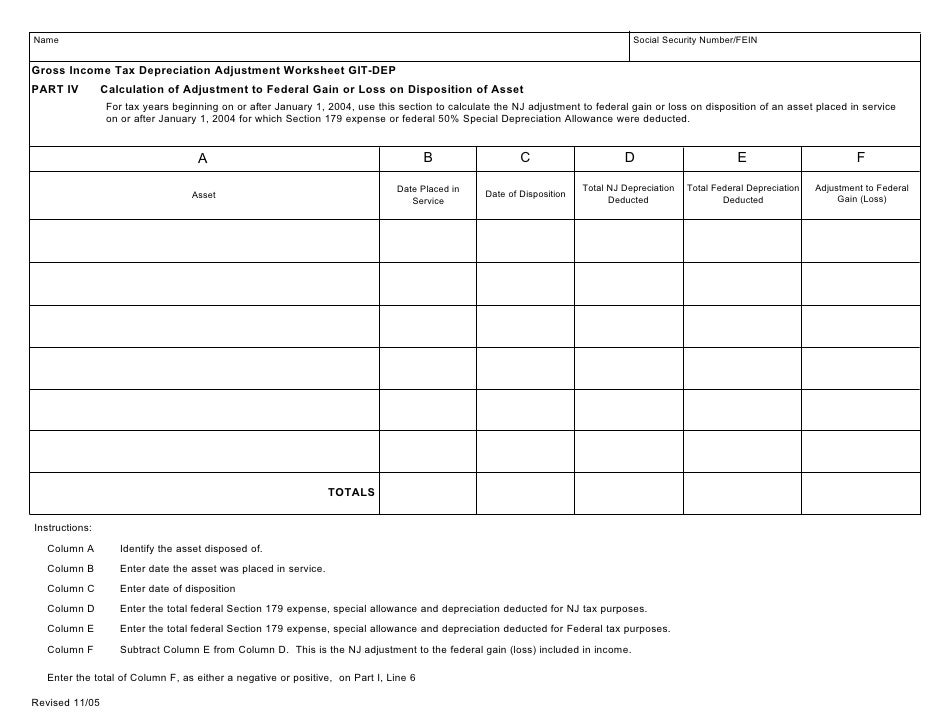

Gross Tax Depreciation Adjustment Worksheet (Updated 11/29/05)

Depreciation Recapture Worksheet Toolkit For Purchasing Hawaii

Students Can Download The Pdf Format Of These Worksheets To Practice Questions For Free.

Web Depreciation Recapture Is A Tax Provision That Allows The Irs To Collect Taxes On Any Profitable Sale Of An Asset That The Taxpayer Had Used To Previously Offset.

Web Depreciation Recapture Is The Usa Internal Revenue Service Procedure For Collecting Income Tax On A Gain Realized By A Taxpayer When The Taxpayer Disposes Of An Asset That.

Web Decomposing Fractions Worksheets Are Flexible And Easy To Solve.

Related Post: