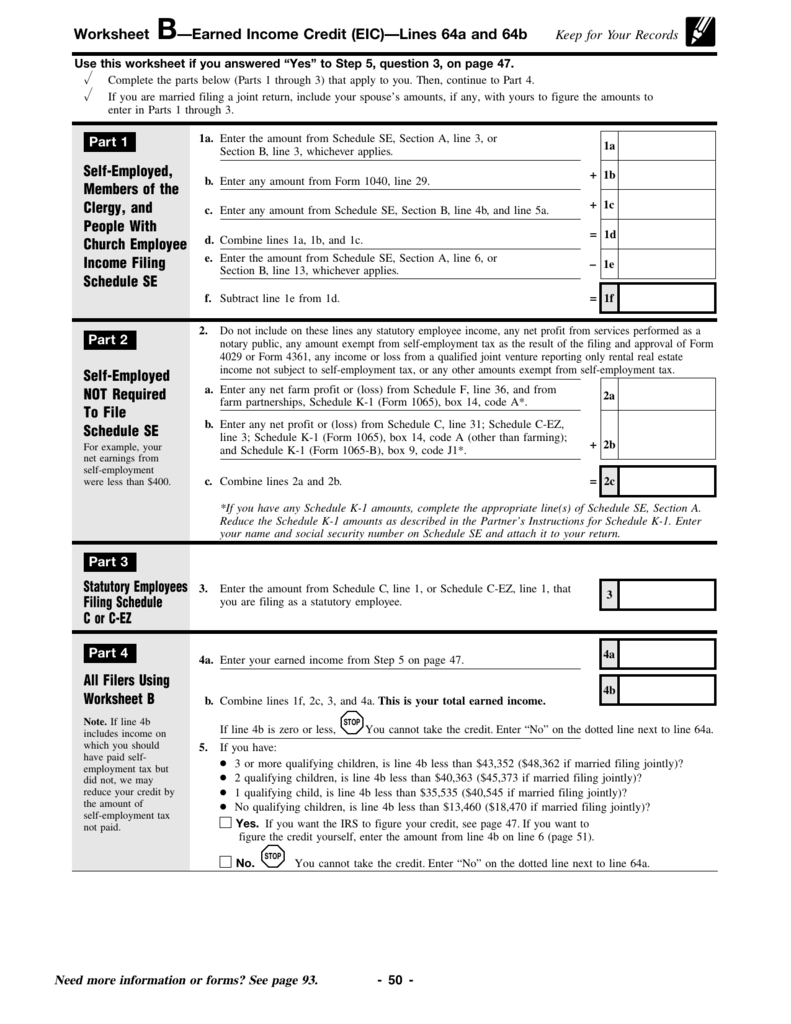

Eic Worksheet B In The Form 1040 Instructions

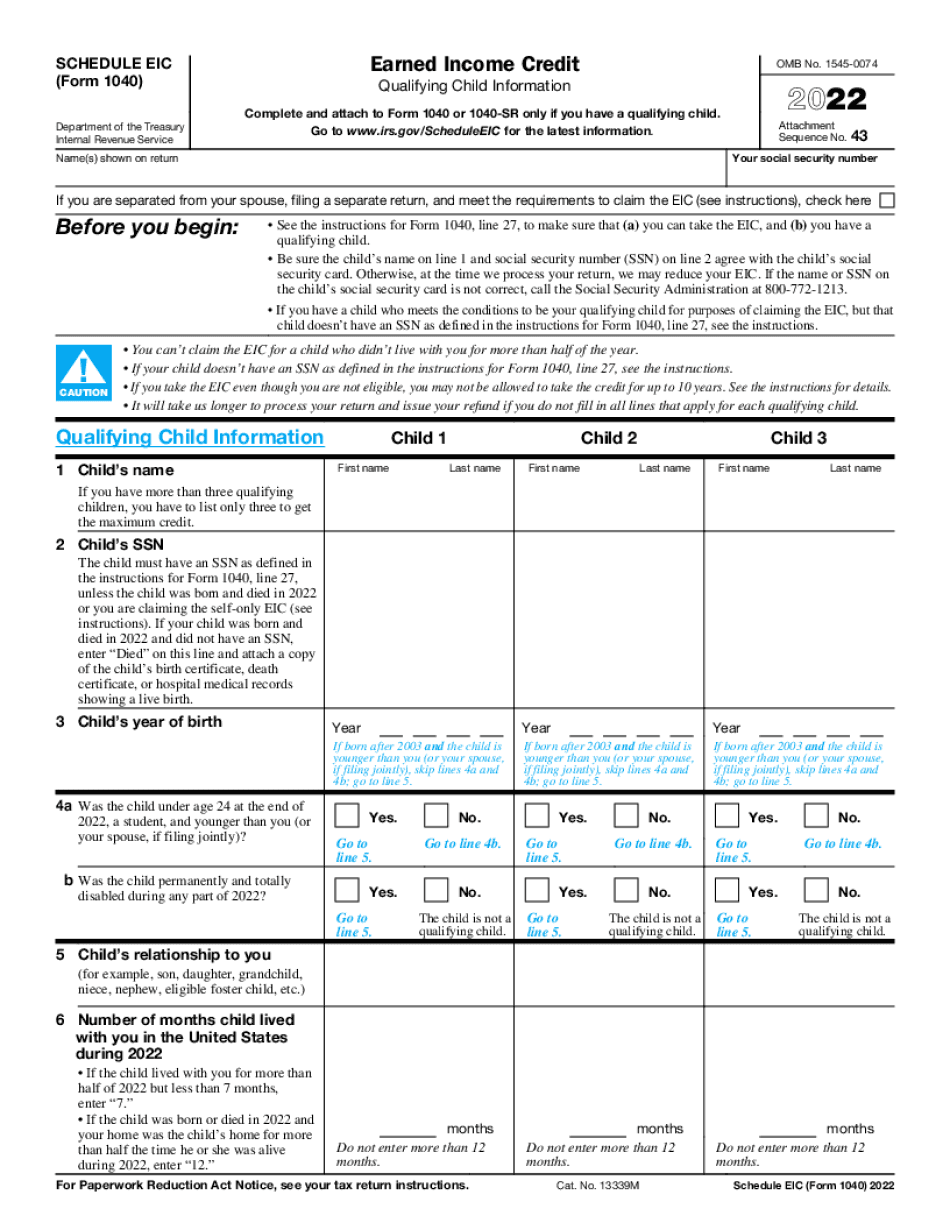

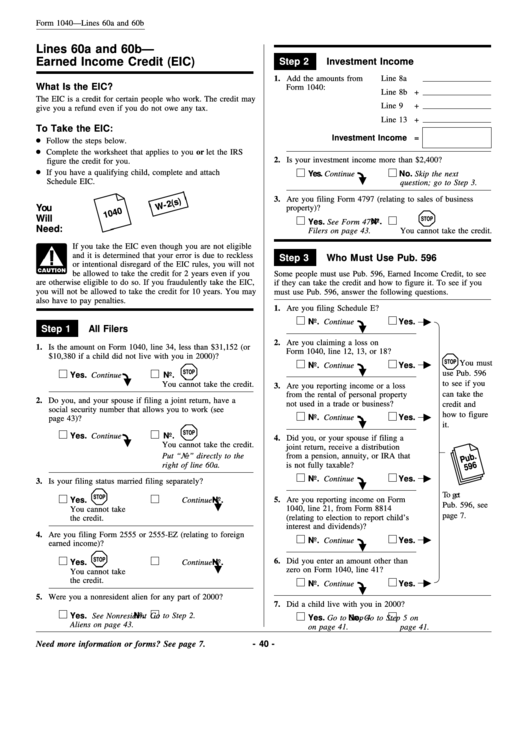

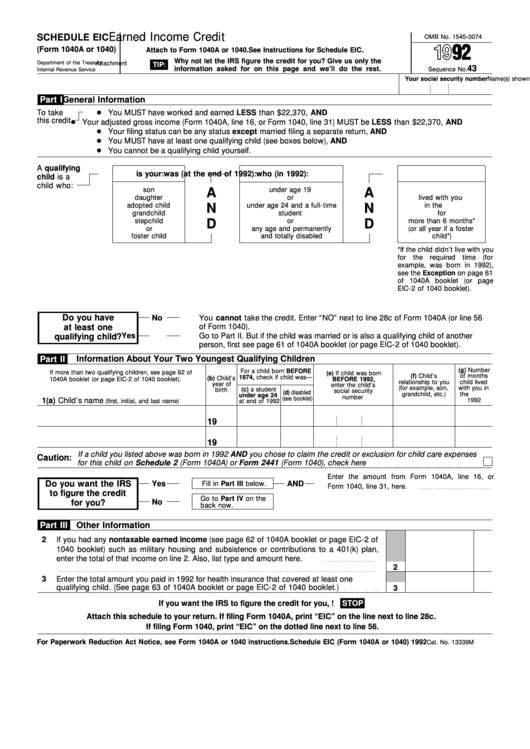

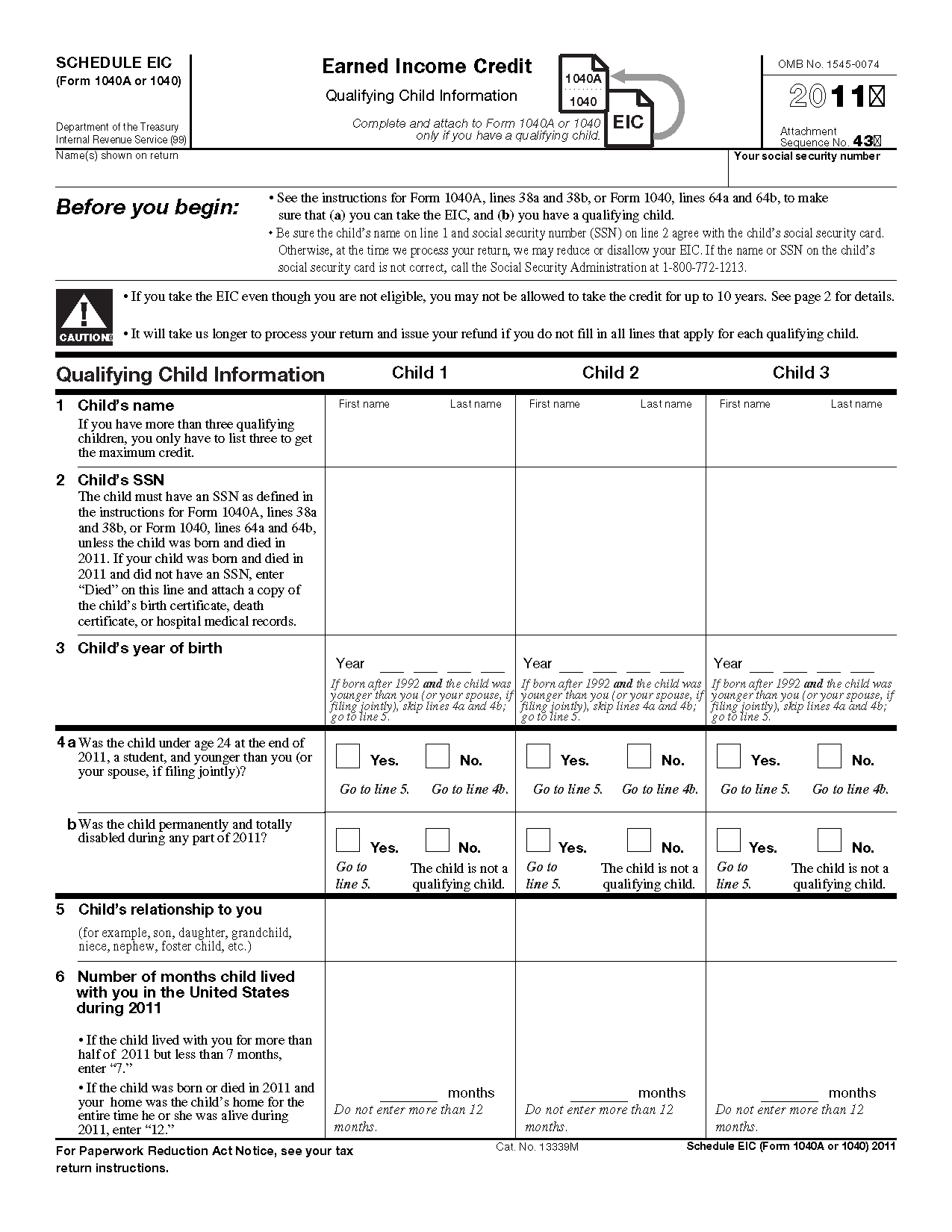

Eic Worksheet B In The Form 1040 Instructions - • see the instructions for form. Web look up the amount on line 1 above in the eic table (right after worksheet b) to nd the credit. Web enter the amount of business income or loss (the total of lines 1e, 2c, and 3) from your federal form 1040 instructions, earned income credit worksheet b. After you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child (ren). After you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child. Web income or loss from your federal form 1040 instructions, earned income credit worksheet b, the total of lines 1e, 2c and 3, increased by any amount(s) included on. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. Web federal form 1040 schedule eic instructions. Be sure you use the correct column for your ling status and the number of children. Web up to $40 cash back earned income credit. Web federal form 1040 schedule eic instructions. After you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child. • see the instructions for form. Web income or loss from your federal form 1040 instructions, earned income credit worksheet b, the total of lines 1e, 2c and 3, increased by any. Be sure you use the correct column for your ling status and the number of children. • see the instructions for form. Web look up the amount on line 1 above in the eic table (right after worksheet b) to nd the credit. After you have figured your earned income credit (eic), use schedule eic to give the irs information. • see the instructions for form. After you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child (ren). Web up to $40 cash back earned income credit. Web look up the amount on line 1 above in the eic table (right after worksheet b) to nd the credit. Web federal. • see the instructions for form. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. After you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child. Be sure you. Web enter the amount of business income or loss (the total of lines 1e, 2c, and 3) from your federal form 1040 instructions, earned income credit worksheet b. Web income or loss from your federal form 1040 instructions, earned income credit worksheet b, the total of lines 1e, 2c and 3, increased by any amount(s) included on. Web up to. Be sure you use the correct column for your ling status and the number of children. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. After you have figured your earned income credit (eic), use this schedule to give. • see the instructions for form. Web federal form 1040 schedule eic instructions. After you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child (ren). Web enter the amount of business income or loss (the total of lines 1e, 2c, and 3) from your federal form 1040 instructions, earned income. Web income or loss from your federal form 1040 instructions, earned income credit worksheet b, the total of lines 1e, 2c and 3, increased by any amount(s) included on. Web up to $40 cash back earned income credit. • see the instructions for form. After you have figured your earned income credit (eic), use schedule eic to give the irs. Web federal form 1040 schedule eic instructions. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. After you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child (ren). •. Web up to $40 cash back earned income credit. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. Web look up the amount on line 1 above in the eic table (right after worksheet b) to nd the credit.. Web up to $40 cash back earned income credit. After you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child (ren). Web enter the amount of business income or loss (the total of lines 1e, 2c, and 3) from your federal form 1040 instructions, earned income credit worksheet b. Web income or loss from your federal form 1040 instructions, earned income credit worksheet b, the total of lines 1e, 2c and 3, increased by any amount(s) included on. Be sure you use the correct column for your ling status and the number of children. • see the instructions for form. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. Web federal form 1040 schedule eic instructions. After you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child. Web look up the amount on line 1 above in the eic table (right after worksheet b) to nd the credit. Web federal form 1040 schedule eic instructions. Web income or loss from your federal form 1040 instructions, earned income credit worksheet b, the total of lines 1e, 2c and 3, increased by any amount(s) included on. Be sure you use the correct column for your ling status and the number of children. Web look up the amount on line 1 above in the eic table (right after worksheet b) to nd the credit. Web completed worksheet b, relating to the eic, in your instructions for form 1040, your earned income from worksheet b (in your instructions for form 1040), line 4b, plus all. • see the instructions for form. After you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child (ren). Web enter the amount of business income or loss (the total of lines 1e, 2c, and 3) from your federal form 1040 instructions, earned income credit worksheet b.2017 Eic Table 1040 Review Home Decor

Irs 1040 instructions 2017

Eic Worksheet 2023 Fill online, Printable, Fillable Blank

Instructions for Form 1040,

Form 1040 Lines 60a And 60b Earned Credit (Eic) Instruction

1040ez dependent worksheet

Schedule Eic (Form 1040a Or 1040) Earned Credit 1992

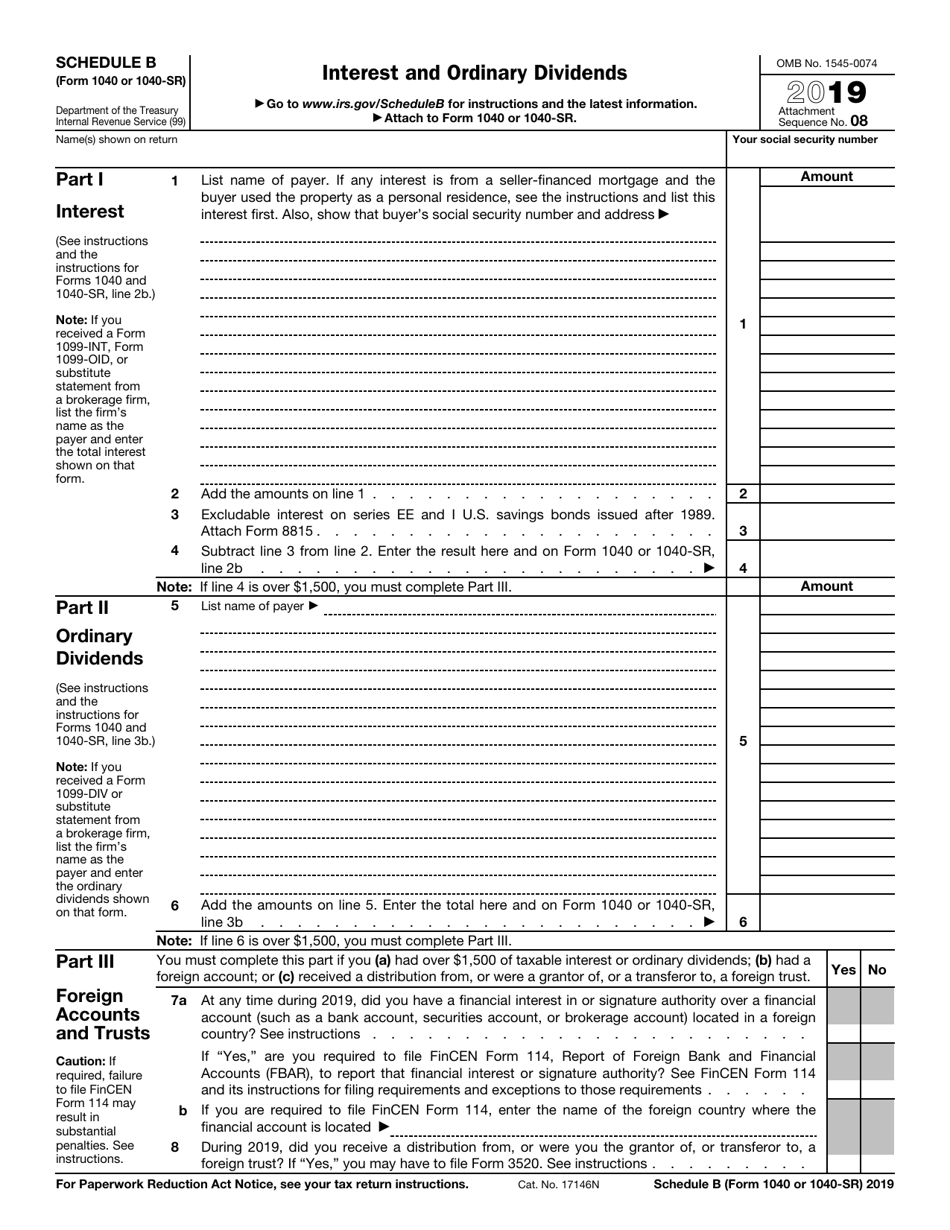

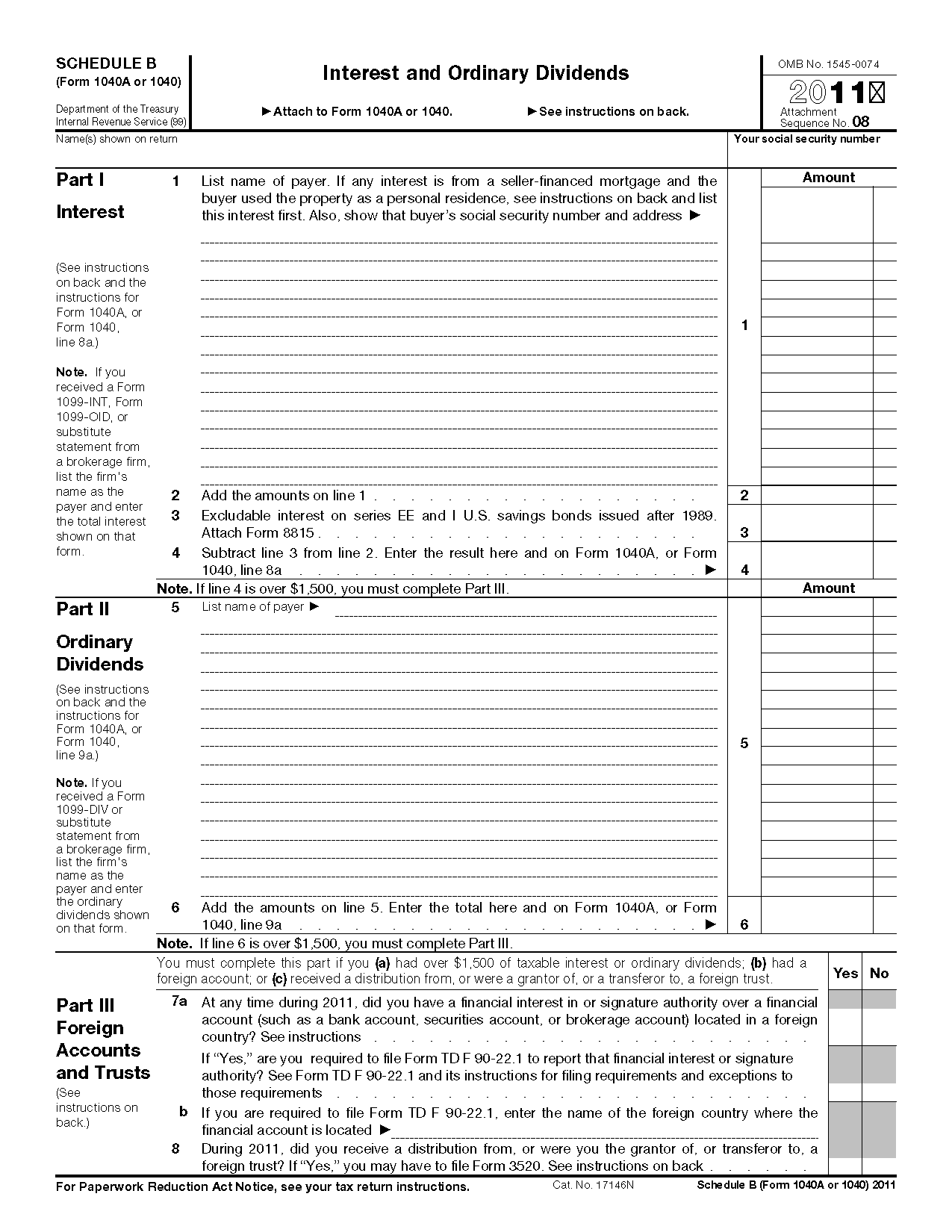

IRS Form 1040 (1040SR) Schedule B Download Fillable PDF or Fill Online

IRS Form 1040 Schedule Eic 2021 Tax Forms 1040 Printable

Form 1040 Schedule B Instructions Bond Premium 2021 Tax Forms 1040

Web Up To $40 Cash Back Earned Income Credit.

After You Have Figured Your Earned Income Credit (Eic), Use Schedule Eic To Give The Irs Information About Your Qualifying Child.

Related Post: