Erc Worksheet 1

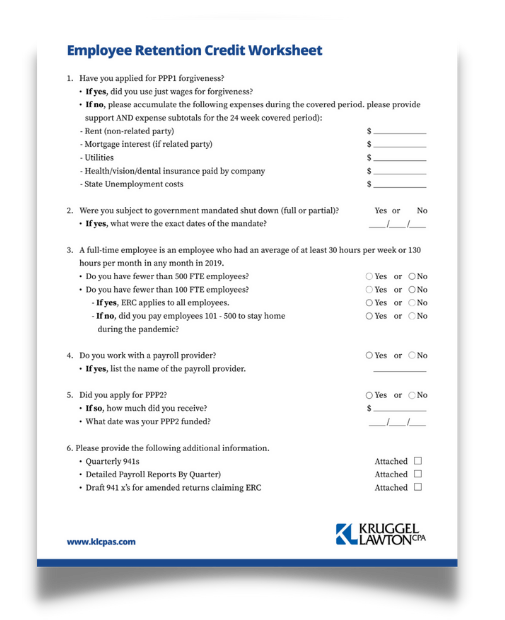

Erc Worksheet 1 - Have you applied for ppp1 forgiveness? Fill & sign online, print, email, fax, or. The credit is available to all employers regardless of size including tax exempt organizations. How to complete worksheet 1 (form 941)? The worksheet now takes into account. Web ercs should be calculated to the nearest hundredth. (1) state and local governments. Web worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation. Determine if you had a. Worksheet 1 should be used for qualifying earnings. • if yes, did you use just wages for forgiveness? Worksheet 1 should be used for qualifying earnings. An erc may not be less than 1.00. Unlike in 2020, when erc is calculated in aggregate for the year, in 2021, you calculate. Web employee retention credit worksheet 1. Worksheet 1 should be used for qualifying earnings. • if yes, did you use just wages for forgiveness? Web calculating your 2021 erc. The credit is available to all employers regardless of size including tax exempt organizations. Web ercs should be calculated to the nearest hundredth. Web worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation. The district reserves the right to modify in its sole discretion, the gpd used to calculate. Web erc is a trusted resource for hundreds of organizations. Basically, form 941 worksheet 1 consists of 3 steps. Web calculating your 2021 erc. Worksheet 1 should be used for qualifying earnings. Unlike in 2020, when erc is calculated in aggregate for the year, in 2021, you calculate. The district reserves the right to modify in its sole discretion, the gpd used to calculate. Determine if you had a. Web calculating your 2021 erc. Web ercs should be calculated to the nearest hundredth. The worksheet now takes into account. In 2021, the opportunities for erc increase. Web worksheet 1 should be familiar to every employer who submits the quarterly employment tax form with the irs. How to complete worksheet 1 (form 941)? In 2021, the opportunities for erc increase. Unlike in 2020, when erc is calculated in aggregate for the year, in 2021, you calculate. Web ercs should be calculated to the nearest hundredth. Web worksheet 1 should be familiar to every employer who submits the quarterly employment tax form with the irs. Before you begin to complete worksheet 1,. Fill & sign online, print, email, fax, or. Web water (per erc), ×13.28 per month, 010,000, $1.12. Unlike in 2020, when erc is calculated in aggregate for the year, in 2021, you calculate. Web worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation. The credit is available to all employers regardless. Web erc is a trusted resource for hundreds of organizations. Determine if you had a. • if yes, did you use just wages for forgiveness? • draft 941 x’s for amended returns claiming. Before you begin to complete worksheet 1,. Have you applied for ppp1 forgiveness? The district reserves the right to modify in its sole discretion, the gpd used to calculate. The worksheet now takes into account. Web worksheet 1 should be familiar to every employer who submits the quarterly employment tax form with the irs. Unlike in 2020, when erc is calculated in aggregate for the year, in. Determine if you had a. An erc may not be less than 1.00. There are only two exceptions: • draft 941 x’s for amended returns claiming. Fill & sign online, print, email, fax, or. Web calculating your 2021 erc. Basically, form 941 worksheet 1 consists of 3 steps. Before you begin to complete worksheet 1,. Web employee retention credit worksheet calculation. (1) state and local governments. Web worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation. The worksheet now takes into account. • if yes, did you use just wages for forgiveness? In 2021, the opportunities for erc increase. Web water (per erc), ×13.28 per month, 010,000, $1.12. The credit is available to all employers regardless of size including tax exempt organizations. How to complete worksheet 1 (form 941)? Fill & sign online, print, email, fax, or. • draft 941 x’s for amended returns claiming. Web learn more about worksheet 1 2022. Determine if you had a. An erc may not be less than 1.00. Have you applied for ppp1 forgiveness? Web ercs should be calculated to the nearest hundredth. The district reserves the right to modify in its sole discretion, the gpd used to calculate. • draft 941 x’s for amended returns claiming. (1) state and local governments. Web ercs should be calculated to the nearest hundredth. Web water (per erc), ×13.28 per month, 010,000, $1.12. Determine if you had a. Web learn more about worksheet 1 2022. Web worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation. An erc may not be less than 1.00. Web erc is a trusted resource for hundreds of organizations. Web worksheet 1 should be familiar to every employer who submits the quarterly employment tax form with the irs. In 2021, the opportunities for erc increase. The worksheet now takes into account. Before you begin to complete worksheet 1,. Web employee retention credit worksheet 1. Web employee retention credit worksheet calculation. Unlike in 2020, when erc is calculated in aggregate for the year, in 2021, you calculate.Get 941 Worksheet 1 Employee Retention Credit Pictures Worksheet for

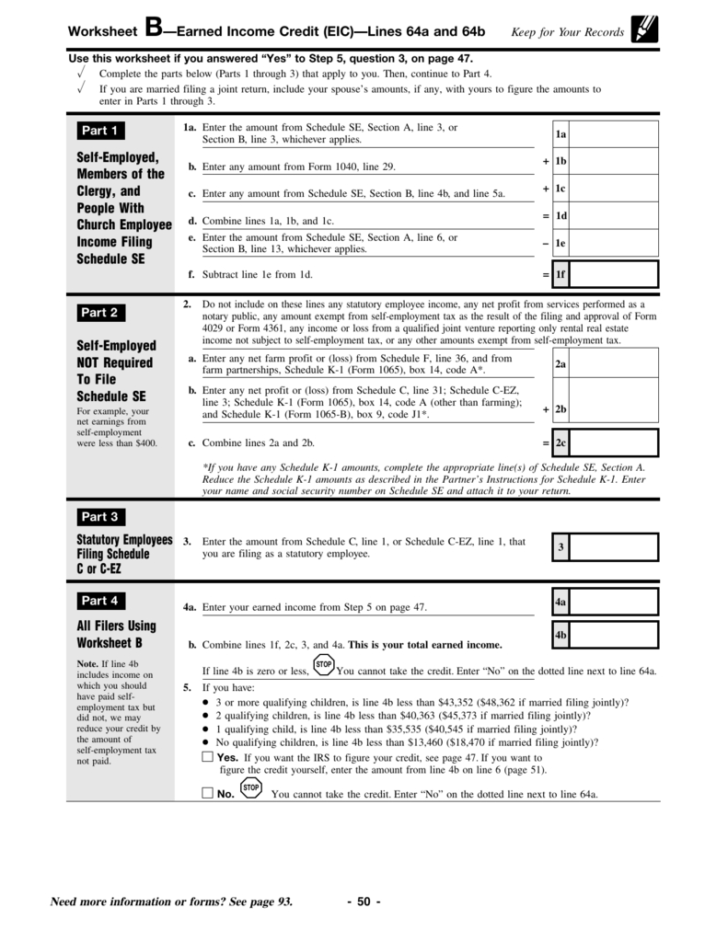

5 Best Images of Printable EIC Worksheet 2015 IRS Earned

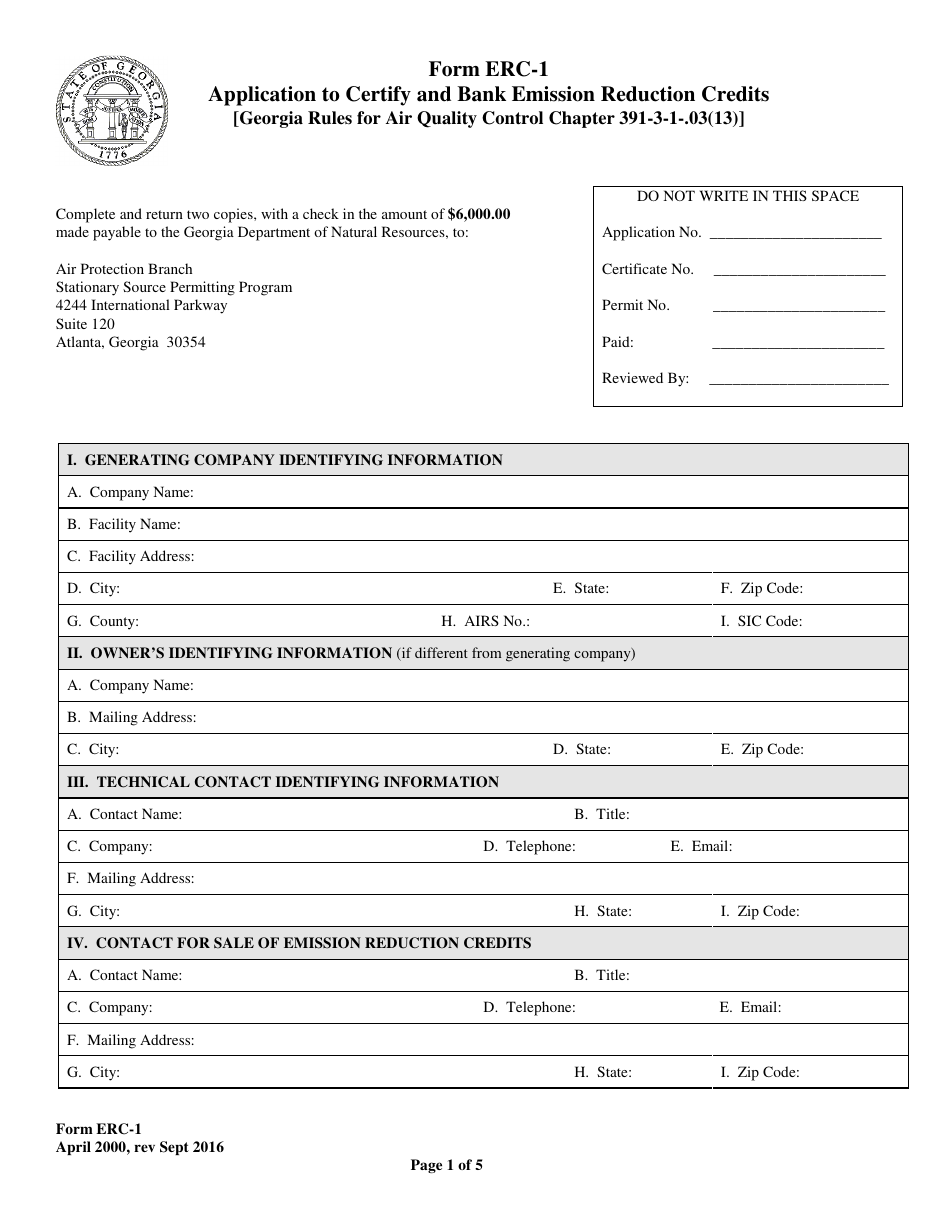

Form ERC1 Download Printable PDF or Fill Online Application to Certify

employee retention worksheet

ERCSelfAssessmentForm1JAZUL.docx Informed Consent Clinical Trial

erc form download romanholidayvannuys

Employee Retention Credit Worksheet 1

How to Unlock the Employer Retention Credit (ERC) for Your Business or

Taxme

Earned Credit Worksheet —

Worksheet 1 Should Be Used For Qualifying Earnings.

The Credit Is Available To All Employers Regardless Of Size Including Tax Exempt Organizations.

Fill & Sign Online, Print, Email, Fax, Or.

Basically, Form 941 Worksheet 1 Consists Of 3 Steps.

Related Post: