Estimated Tax Worksheet

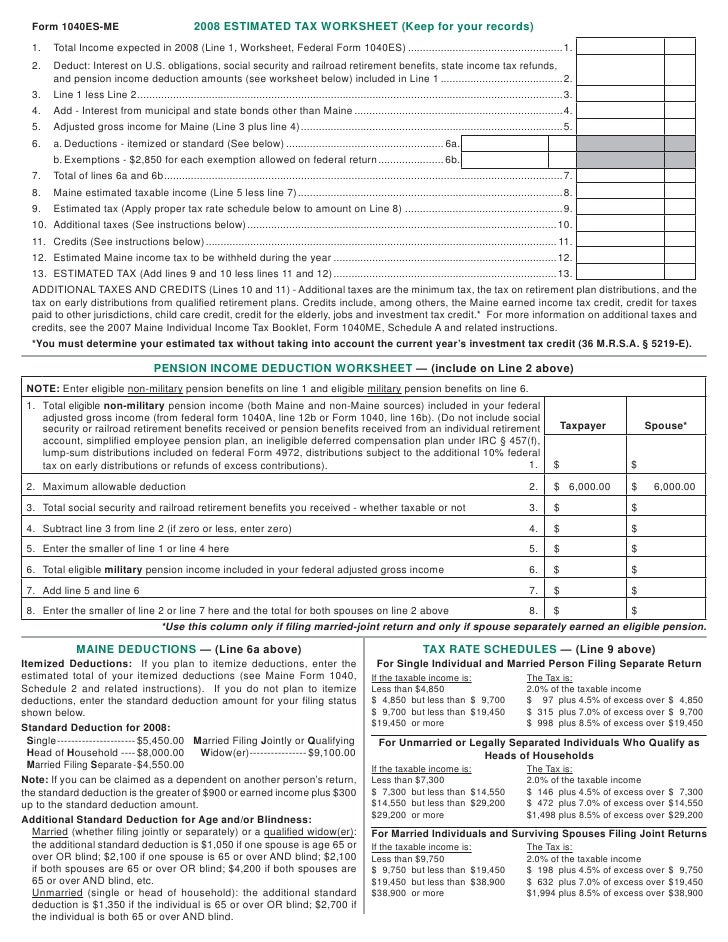

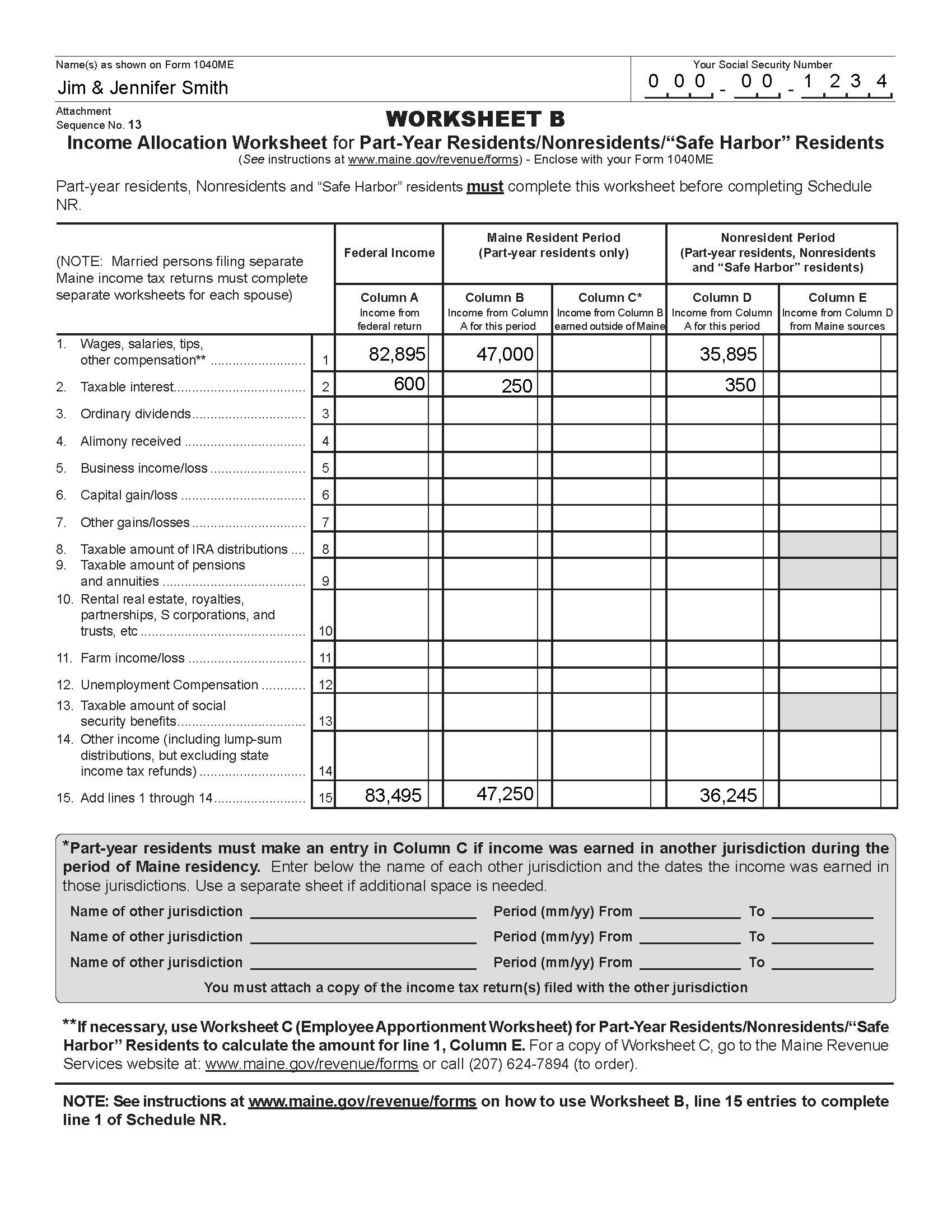

Estimated Tax Worksheet - 90% of estimated total tax (66 2/3% for farmers and fishermen) 0:. Tax computation worksheet for the 2022 taxes you’re paying in 2023 can be used to figure out taxes owed. Apply your 2022 refund to your 2023 estimated tax. Web look at the taxable income, tax paid, credits and deductions from the previous year and compare to the current year’s numbers. Web the estimated tax payments worksheet shows the entries made for estimated tax payments made for the current year's return (federal, state, and local). How much does something really cost? Be sure that the amount shown on line 21. Web you can make estimated tax payments using any of these methods: Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Web estimation worksheets are one of the most fundamental concepts from a mathematics point of view. Web individuals who are required to make estimated tax payments, and whose 2021 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Web estimated tax and extension payments. How much does something really cost? Based on your projected tax withholding for the year, we can. Apply your 2022 refund to your 2023 estimated tax. Be sure that the amount shown on line 21. To figure it out, you’ll have to practice calculating sales tax. Tax computation worksheet for the 2022 taxes you’re paying in 2023 can be used to figure out taxes owed. Web estimated tax and extension payments. Web estimation worksheets are one of the most fundamental concepts from a mathematics point of. Web estimated tax and extension payments. Web estimation worksheets are one of the most fundamental concepts from a mathematics point of view. Web key takeaways • if you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form 1040. Web use the california estimated tax worksheet. Be sure that the amount shown on line 21. How much does something really cost? We will handle everything from tax filings to wage rates, so you can focus on what matters Web look at the taxable income, tax paid, credits and deductions from the previous year and compare to the current year’s numbers. The tax computation worksheet is for. How much does something really cost? The amount of underpayment of estimated tax interest is computed at a rate of 20% per annum for the period of underpayment. Web individuals who are required to make estimated tax payments, and whose 2021 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. 90% of estimated total tax (66. Web estimated total tax (a negative amount indicates a refund) 0: Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. To figure it out, you’ll have to practice calculating sales tax. Web individuals who are required to make estimated tax payments, and whose 2021 california adjusted. Web estimated tax and extension payments. Based on your projected tax withholding for the year, we can. Be sure that the amount shown on line 21. To figure it out, you’ll have to practice calculating sales tax. Web you can make estimated tax payments using any of these methods: Web the irs has a worksheet to help you do the math. Web individuals who are required to make estimated tax payments, and whose 2021 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Web estimated total tax (a negative amount indicates a refund) 0: Be sure that the amount shown on line 21. Web look. Web estimation worksheets are one of the most fundamental concepts from a mathematics point of view. 90% of estimated total tax (66 2/3% for farmers and fishermen) 0:. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Web look at the taxable income, tax paid, credits and deductions from the previous year and compare. Web individuals who are required to make estimated tax payments, and whose 2021 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. 90% of estimated total tax (66 2/3% for farmers and fishermen) 0:. Web estimated tax and extension payments. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Be. Apply your 2022 refund to your 2023 estimated tax. Be sure that the amount shown on line 21. Web estimated tax and extension payments. 90% of estimated total tax (66 2/3% for farmers and fishermen) 0:. Web the irs has a worksheet to help you do the math. We will handle everything from tax filings to wage rates, so you can focus on what matters Web look at the taxable income, tax paid, credits and deductions from the previous year and compare to the current year’s numbers. How much does something really cost? Web individuals who are required to make estimated tax payments, and whose 2021 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Tax computation worksheet for the 2022 taxes you’re paying in 2023 can be used to figure out taxes owed. Web the estimated tax payments worksheet shows the entries made for estimated tax payments made for the current year's return (federal, state, and local). The amount of underpayment of estimated tax interest is computed at a rate of 20% per annum for the period of underpayment. Based on your projected tax withholding for the year, we can. Web you can make estimated tax payments using any of these methods: Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Ad say goodbye to the hassle of nanny taxes and payroll, with our expert service. The tax computation worksheet is for taxpayers with. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Web estimated total tax (a negative amount indicates a refund) 0: Web estimation worksheets are one of the most fundamental concepts from a mathematics point of view. The amount of underpayment of estimated tax interest is computed at a rate of 20% per annum for the period of underpayment. Based on your projected tax withholding for the year, we can. 90% of estimated total tax (66 2/3% for farmers and fishermen) 0:. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Tax computation worksheet for the 2022 taxes you’re paying in 2023 can be used to figure out taxes owed. The tax computation worksheet is for taxpayers with. We will handle everything from tax filings to wage rates, so you can focus on what matters Ad say goodbye to the hassle of nanny taxes and payroll, with our expert service. Web estimated tax and extension payments. Web look at the taxable income, tax paid, credits and deductions from the previous year and compare to the current year’s numbers. Web the irs has a worksheet to help you do the math. Web estimated total tax (a negative amount indicates a refund) 0: Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Web key takeaways • if you expect to owe more than $1,000 in federal taxes for the tax year, you may need to make estimated quarterly tax payments using form 1040. Apply your 2022 refund to your 2023 estimated tax. To figure it out, you’ll have to practice calculating sales tax.1040ESME vouchers for estimated tax payments

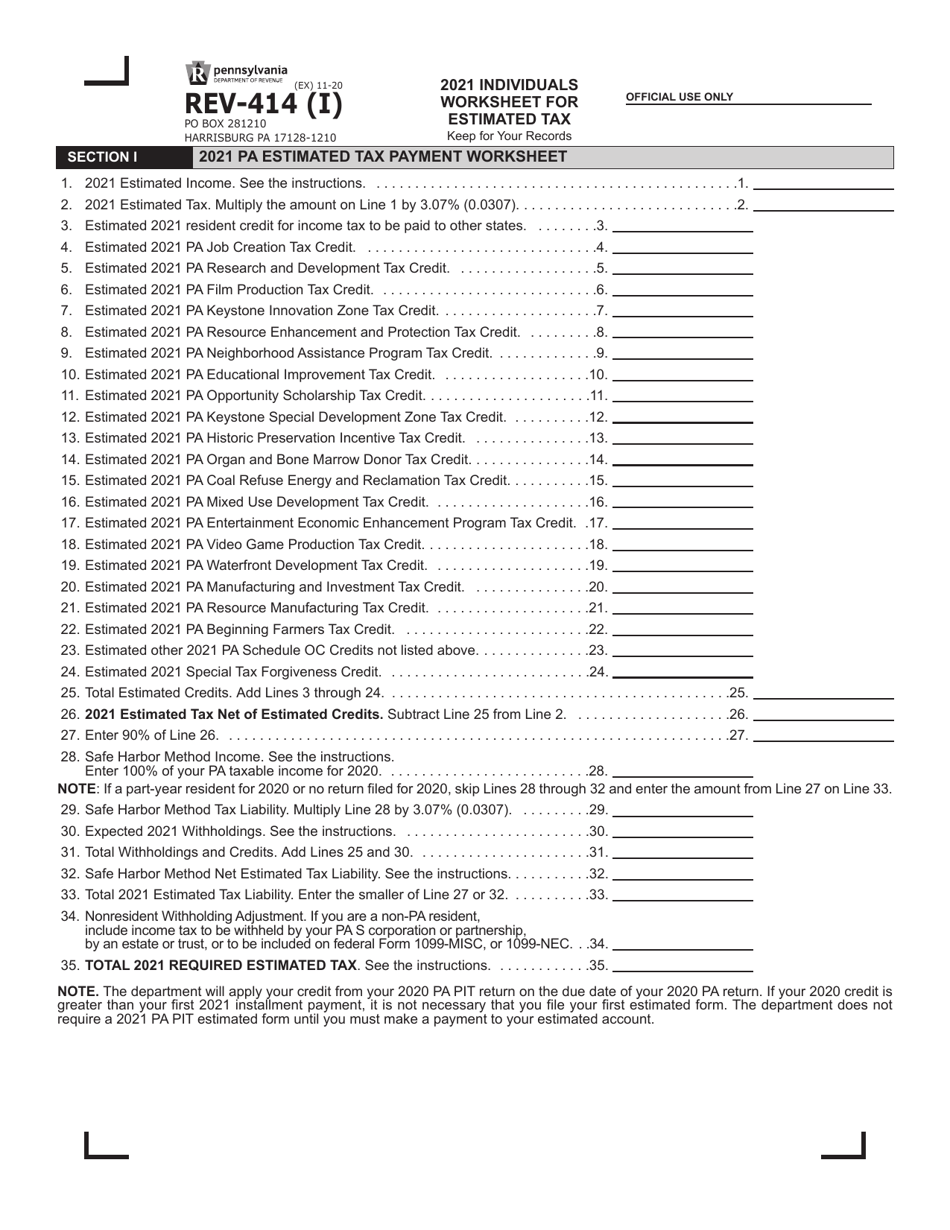

Form REV414 (I) Download Printable PDF or Fill Online Individuals

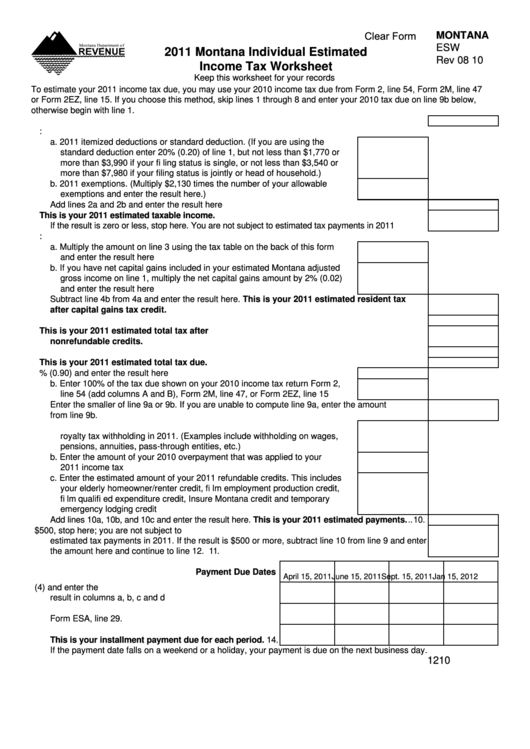

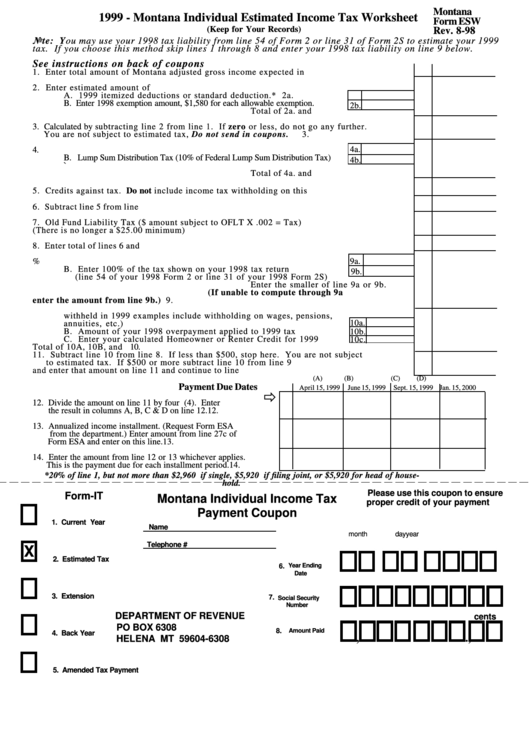

Fillable Form Esw Montana Individual Estimated Tax Worksheet

Federal Tax Worksheet —

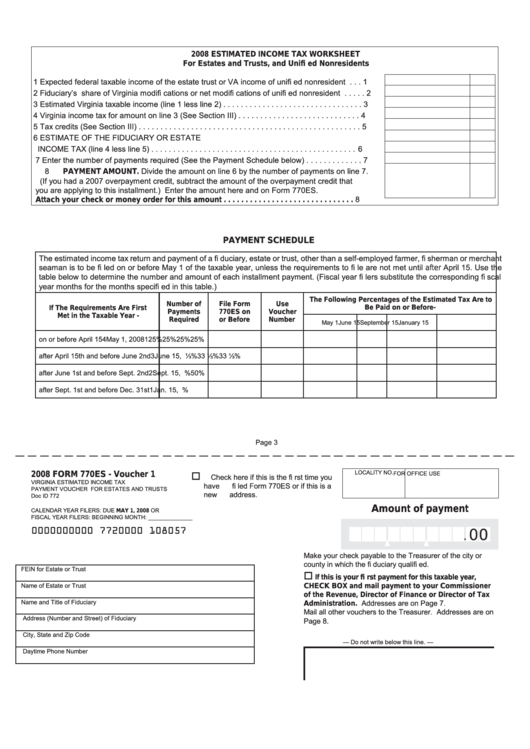

REV414 (F) 2010 PA Estimated Tax Worksheet for Estates and Trusts

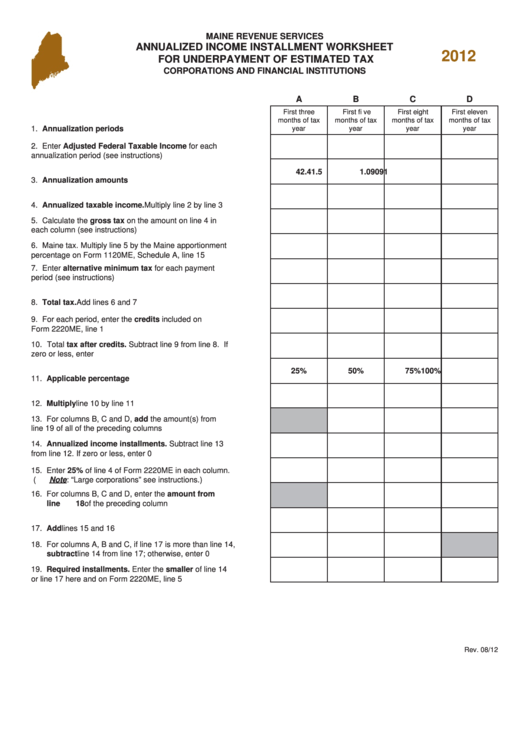

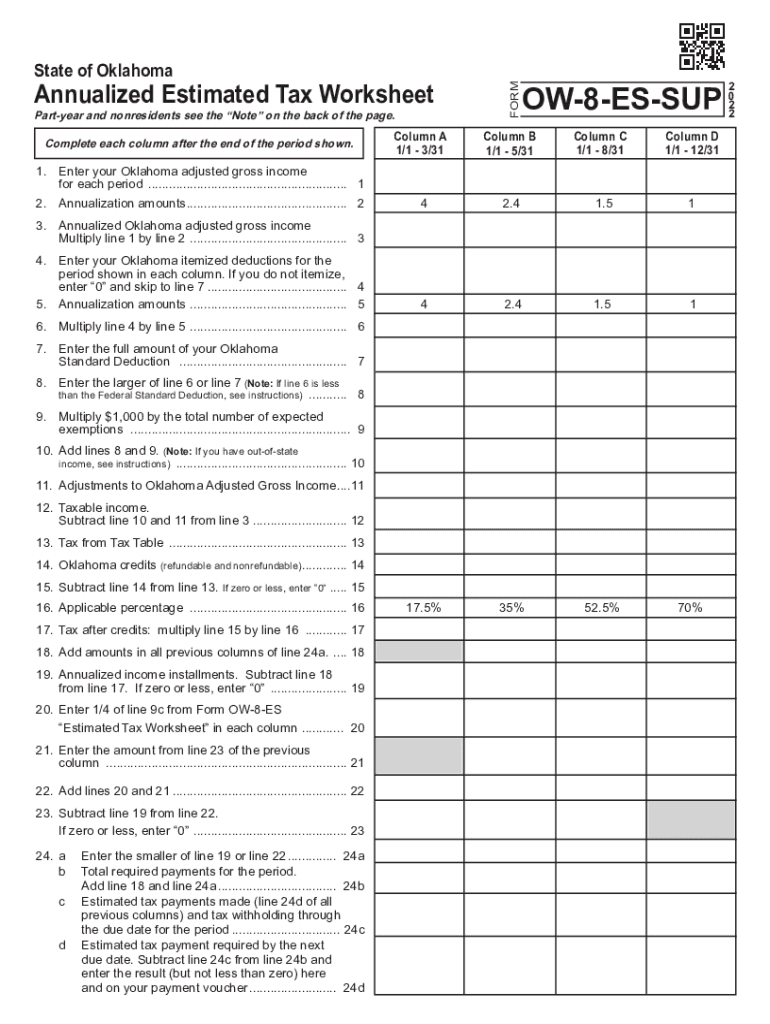

Annualized Estimated Tax Worksheet Worksheet Template Tips And Reviews

Fillable Form Esw Montana Individual Estimated Tax Worksheet

Form 770es Estimated Tax Worksheet For Estates And Trusts, And

Fillable Annualized Installment Worksheet For Underpayment Of

Form OW 8 ES SUP Annualized Estimated Tax Worksheet Fill Out and Sign

Web The Estimated Tax Payments Worksheet Shows The Entries Made For Estimated Tax Payments Made For The Current Year's Return (Federal, State, And Local).

How Much Does Something Really Cost?

Web Estimation Worksheets Are One Of The Most Fundamental Concepts From A Mathematics Point Of View.

Web Individuals Who Are Required To Make Estimated Tax Payments, And Whose 2021 California Adjusted Gross Income Is More Than $150,000 (Or $75,000 If Married/Rdp Filing.

Related Post: