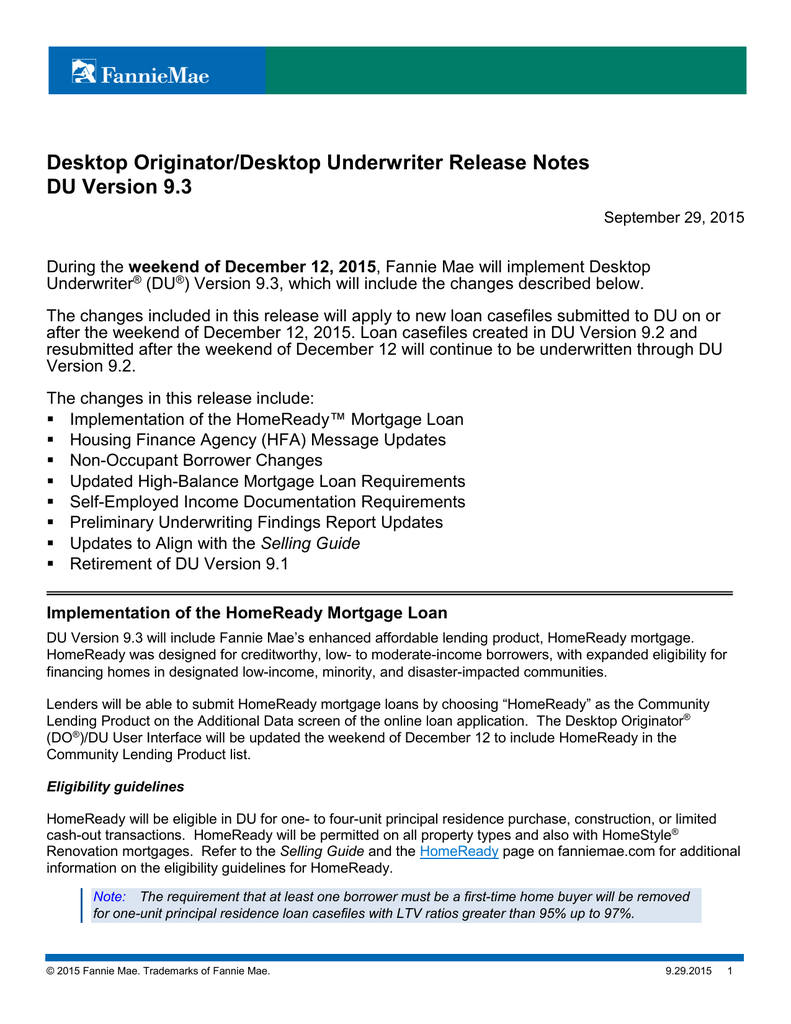

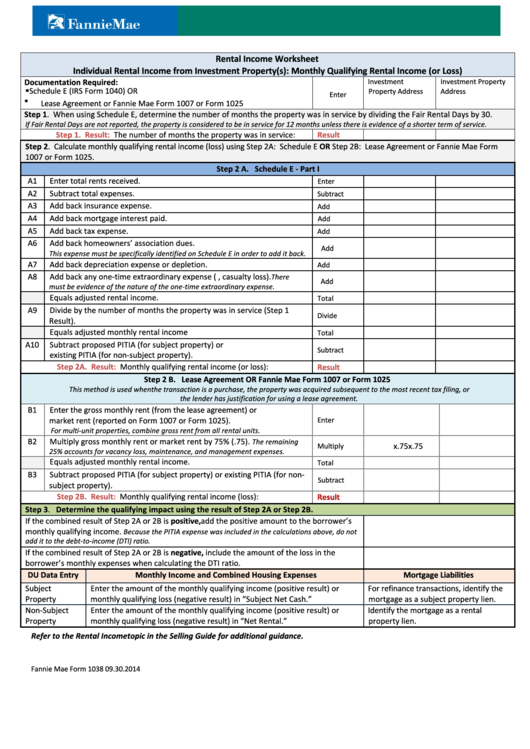

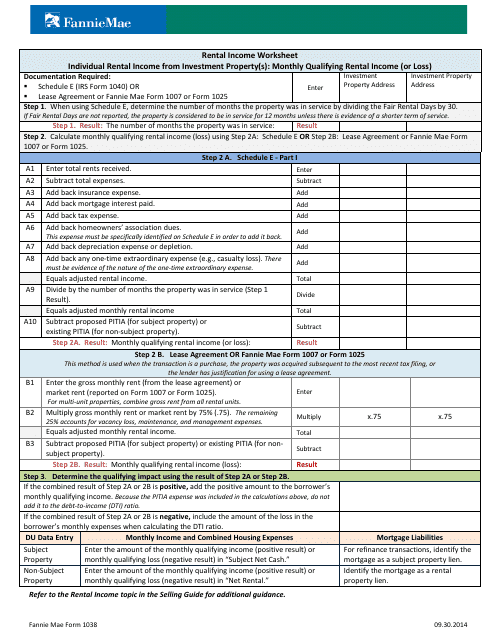

Fannie Mae Form 1038 Rental Income Worksheet

Fannie Mae Form 1038 Rental Income Worksheet - When current lease agreements or shop rents reported on. Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss). Web fannie mae form 1038. Monthly qualifying rental income (or loss). Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Web check treatment of the income (or loss) below for further manuals. Monthly qualifying rental income (or loss) documentation required: Use of these worksheets is optional. Individual rental income from investment property (s) (up to 4 properties) download xlxs. Web check treatment of the income (or loss) below for further manuals. Web fannie mae form 1038. When current lease agreements or shop rents reported on. Reporting of gross monthly rent eligible rents on the subject property. Web fannie mae publishes worksheets that lenders may use to calculate rental income. Lease agreements or form 1007 or form 1025: Web how does fannie mae calculate rental income? Web rental income worksheet individual rental income from investment property(s): Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Reporting of gross monthly rent eligible rents on the subject. Web fannie mae form 1038 09.30.2014 rental income worksheet individual rental income from investment property(s): Web check treatment of the income (or loss) below for further manuals. Monthly qualifying rental income (or loss). When current lease agreements or market rents reported on form 1007 or form. Web rental income worksheet individual rental income from investment property(s): Use of these worksheets is optional. When current lease agreements or market rents reported on form 1007 or form. Reporting of gross monthly rent eligible rents on the subject property. Web how does fannie mae calculate rental income? Monthly qualifying rental income (or loss) documentation required: League agreements or forms 1007 or form 1025: Web rental income worksheet individual rental income from investment property(s): Web fannie mae publishes worksheets that lenders may use to calculate rental income. The rental income worksheets are:. Reporting of gross monthly rent eligible rents on the subject property. Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Lease agreements or form 1007 or form 1025: Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). When current lease agreements or market rents. Web rental income worksheet individual rental income from investment property(s): Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss). Lease agreements or form 1007 or form 1025: Monthly qualifying rental income (or loss) documentation required: When current lease agreements or market rents reported on form 1007 or form. Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Web check treatment of the income (or loss) below for further manuals. Lease agreements or form 1007 or form 1025: The rental income worksheets are:. Web fannie mae form 1038. Monthly qualifying rental income (or loss). Use of these worksheets is optional. When current lease agreements or market rents reported on form 1007 or form. When current lease agreements or shop rents reported on. Web fannie mae publishes worksheets that lenders may use to calculate rental income. Web how does fannie mae calculate rental income? Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Web fannie mae form 1038. Web rental. Web rental income worksheet individual rental income from investment property(s): Individual rental income from investment property (s) (up to 4 properties) download xlxs. Web fannie mae form 1038 09.30.2014 rental income worksheet individual rental income from investment property(s): Lease agreements or form 1007 or form 1025: Reporting of gross monthly rent eligible rents on the subject property. Web check treatment of the income (or loss) below for further manuals. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). When current lease agreements or market rents reported on form 1007 or form. Web how does fannie mae calculate rental income? Use of these worksheets is optional. Web fannie mae form 1038. Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Monthly qualifying rental income (or loss). Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss). Monthly qualifying rental income (or loss) documentation required: Web fannie mae publishes worksheets that lenders may use to calculate rental income. When current lease agreements or shop rents reported on. The rental income worksheets are:. League agreements or forms 1007 or form 1025: Web how does fannie mae calculate rental income? Web fannie mae publishes worksheets that lenders may use to calculate rental income. Web fannie mae form 1038 09.30.2014 rental income worksheet individual rental income from investment property(s): Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Individual rental income from investment property (s) (up to 4 properties) download xlxs. When current lease agreements or market rents reported on form 1007 or form. Web fannie mae form 1038. Monthly qualifying rental income (or loss) documentation required: Reporting of gross monthly rent eligible rents on the subject property. League agreements or forms 1007 or form 1025: Web rental income worksheet individual rental income from investment property(s): Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss). Web check treatment of the income (or loss) below for further manuals. Use of these worksheets is optional. Monthly qualifying rental income (or loss).mgic worksheet

43 Fannie Mae Rental Worksheet Worksheet Master

Form 1073 Fill Online, Printable, Fillable, Blank pdfFiller

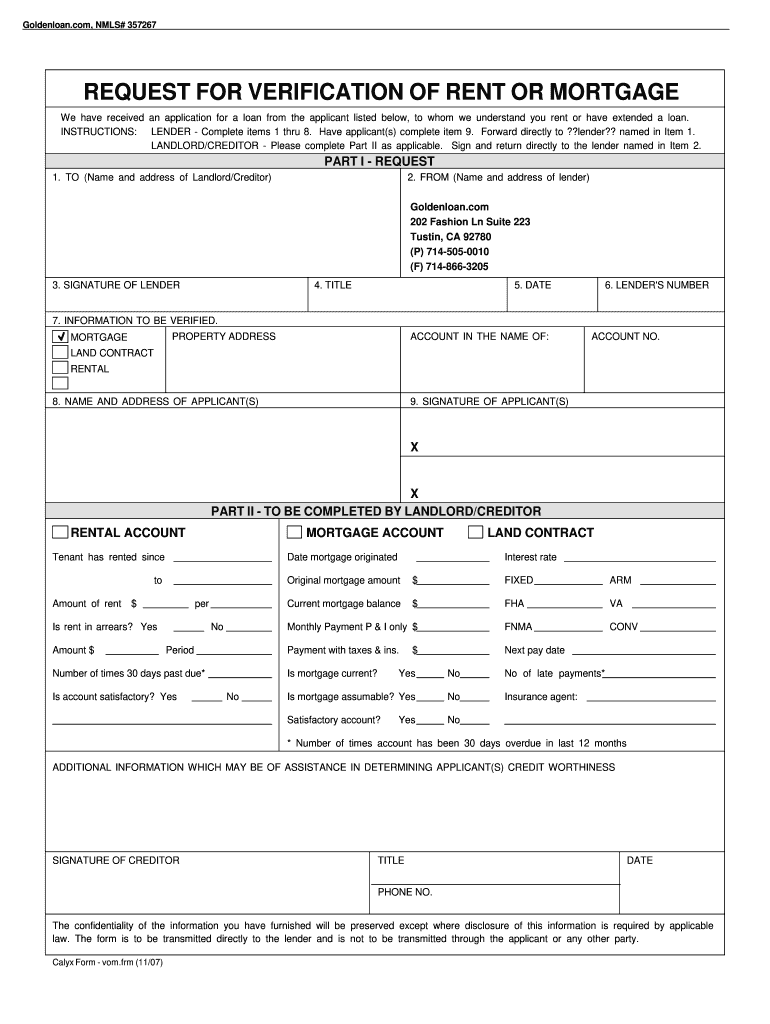

Verification of rent form fannie mae Fill out & sign online DocHub

18 Fannie Mae Forms And Templates free to download in PDF

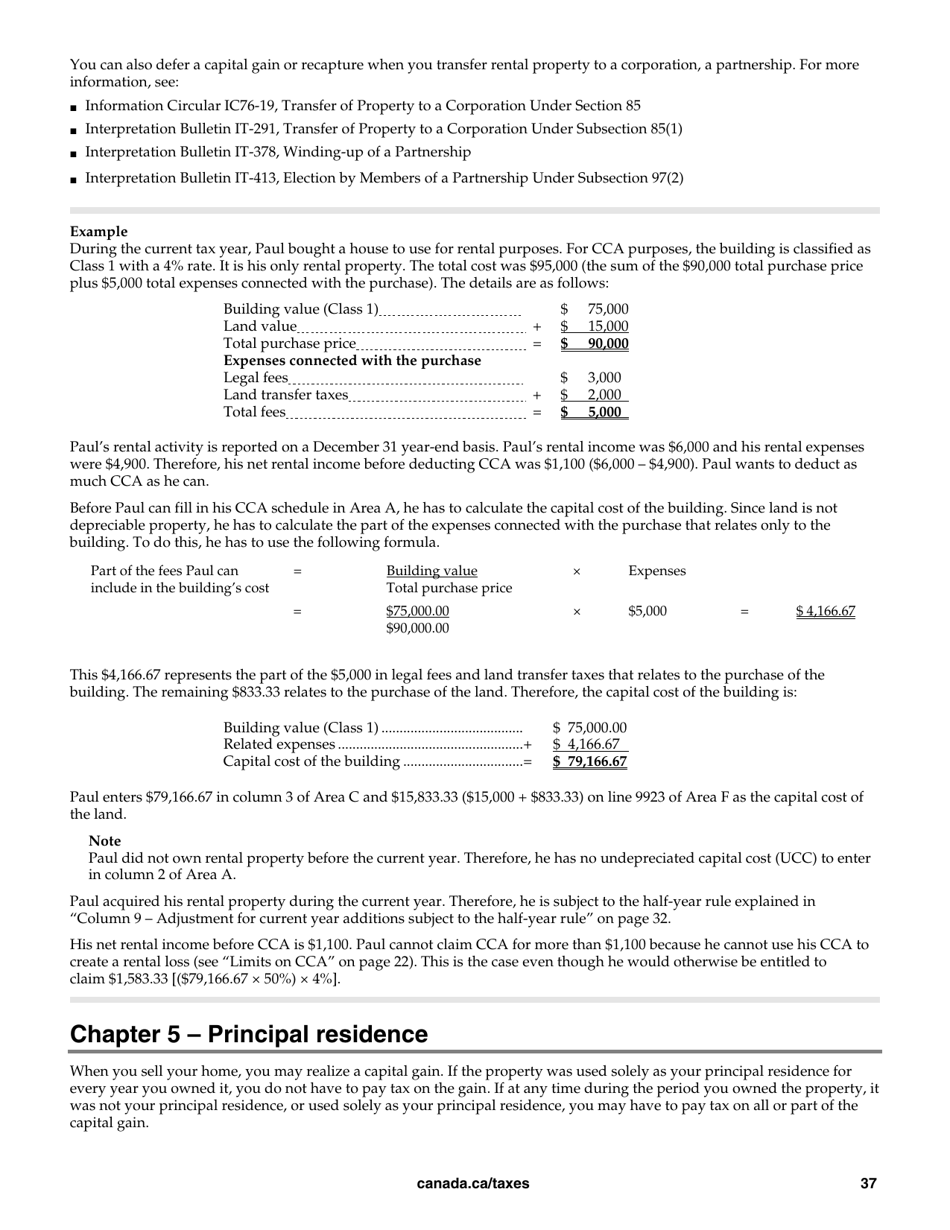

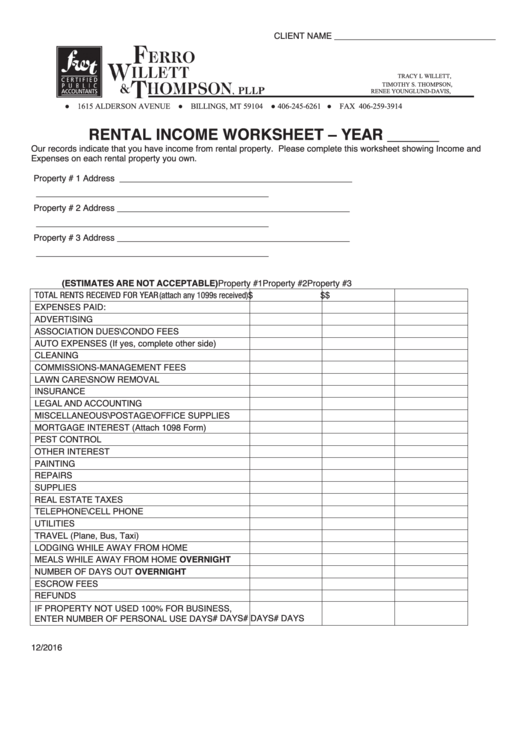

Form T4036 Download Printable PDF or Fill Online Rental 2019

10++ Genworth Rental Worksheet

Fannie Mae Form 1038 Download Printable PDF or Fill Online Rental

fha calculation worksheet

36 Rental And Expense Worksheet support worksheet

Use Fannie Mae Rental Income Worksheets (Form 1037 Or Form 1038) To Evaluate Individual Rental Income (Loss) Reported On Schedule E.

The Rental Income Worksheets Are:.

When Current Lease Agreements Or Shop Rents Reported On.

Lease Agreements Or Form 1007 Or Form 1025:

Related Post: