Fannie Mae Liquidity Test Worksheet

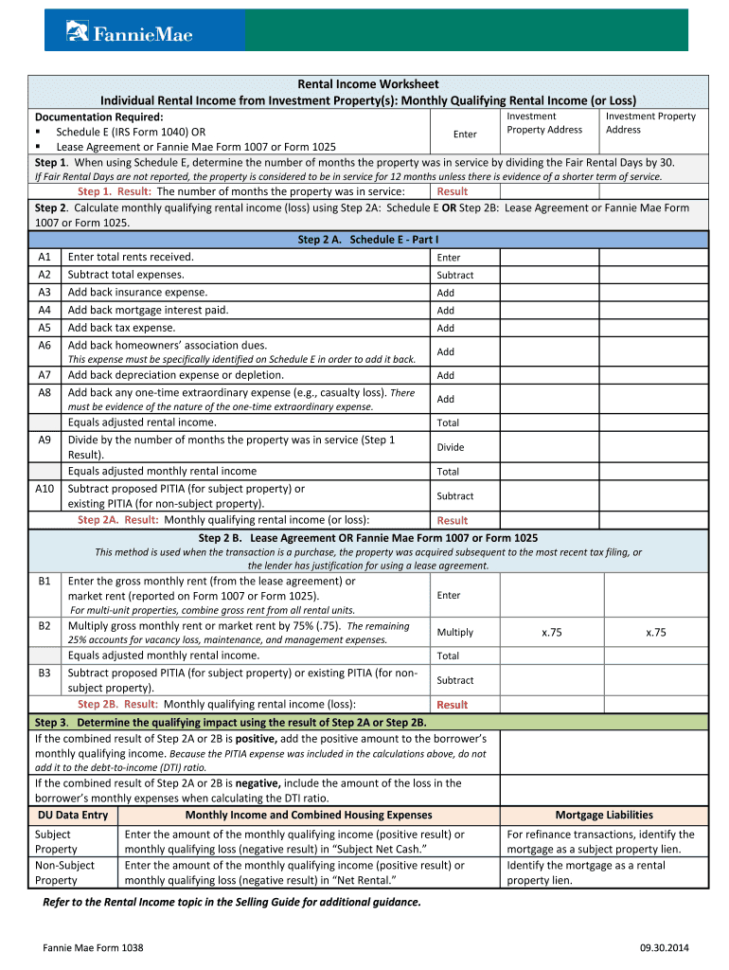

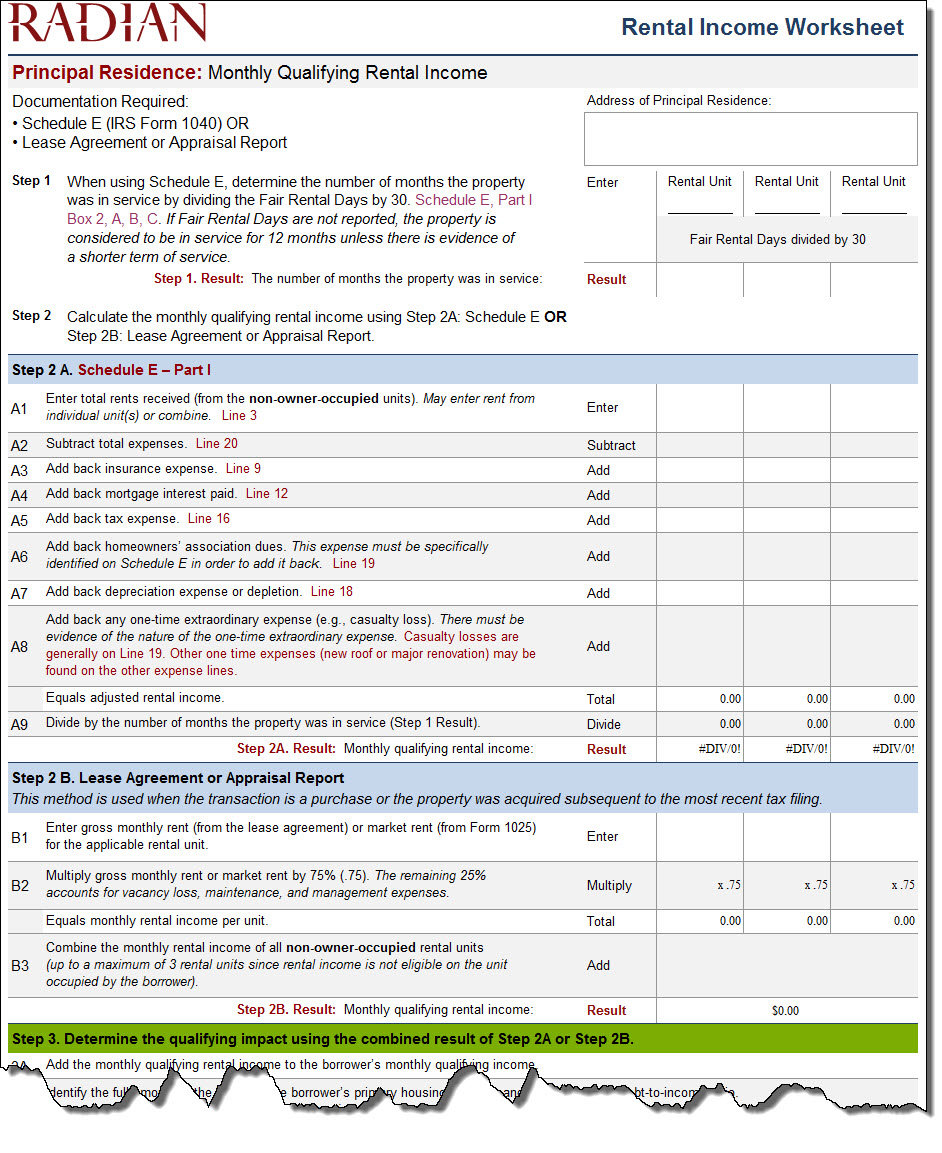

Fannie Mae Liquidity Test Worksheet - Monthly qualifying rental income (or loss) documentation required: Schedule a liquidity quiz answer me! For either ratio, a result of one or greater is generally sufficient to confirm adequate business liquidity to support the. Web must support that the business has sufficient liquidity and is financially capable of producing stable monthly income for the borrower. Web fannie mae income worksheet pdf details. Or lenders must verify the business has adequate liquidity to support the withdrawal of earnings. § schedule e (irs form. One or more cells in this workbook contain data validation rules which refer to values on. Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. In addition to the business review and analysis. Launch ask poli for sellers. Web fannie mae income worksheet pdf details. See liquidity calculators to aid in confirmation of. Are you considering buying or refinancing a home in the near future? Web rental income worksheet individual rental income from investment property(s): Web current ratio = current assets ÷ current liabilities. Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. Web find the information to do a liquidity test? See liquidity calculators to aid in confirmation of. Web the liquidity calculator, provided by enact. In addition to the business review and analysis. Web cash flow analysis (fannie mae form 1084) instructions. For either ratio, a result of one or greater is generally sufficient to confirm adequate business liquidity to support the. Launch ask poli for sellers. § schedule e (irs form. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). For either ratio, a result of one or greater is generally sufficient to confirm adequate business liquidity to support the. See liquidity calculators to aid in confirmation of. Monthly qualifying rental income (or loss) documentation required:. Web find the information to do a liquidity test? Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. Web current ratio = current assets ÷ current liabilities. Or lenders must verify the business has adequate liquidity to support the withdrawal of earnings.. See liquidity calculators to aid in confirmation of. § schedule e (irs form. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Web must support that the business has sufficient liquidity and is financially capable of producing stable monthly income for the borrower. Web current. Monthly qualifying rental income (or loss) documentation required: Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. One or more cells in this workbook contain data validation rules which refer to values on. Web current ratio = current assets ÷ current liabilities.. If so, you will likely need to complete a fannie mae income. Launch ask poli for sellers. Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. Or lenders must verify the business has adequate liquidity to support the withdrawal of earnings. Web. Web current ratio = current assets ÷ current liabilities. Web income used to qualify; § schedule e (irs form. Monthly qualifying rental income (or loss) documentation required: Web how to complete a liquidity test? For either ratio, a result of one or greater is generally sufficient to confirm adequate business liquidity to support the. Monthly qualifying rental income (or loss) documentation required: Web current ratio = current assets ÷ current liabilities. Web the liquidity calculator, provided by enact mortgage insurance, assists in analyzing whether the borrower’s business may have the ability to meet immediate. Are you considering buying or refinancing a home in the near future? Web find the information to do a liquidity test? Web must support that the business has sufficient liquidity and is financially capable of producing stable monthly income for the borrower. Make sure that the borrower’s business has stable sales and expenses that are generated for the. Web current ratio = current assets ÷ current liabilities. For either ratio, a result of one or greater is generally sufficient to confirm adequate business liquidity to support the. Web income used to qualify; One or more cells in this workbook contain data validation rules which refer to values on. § schedule e (irs form. Or lenders must verify the business has adequate liquidity to support the withdrawal of earnings. Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. Web how to complete a liquidity test? Web rental income worksheet individual rental income from investment property(s): If so, you will likely need to complete a fannie mae income. In addition to the business review and analysis. See liquidity calculators to aid in confirmation of. Schedule a liquidity quiz answer me! Web fannie mae income worksheet pdf details. Inventories line 3, column d + 4. Launch ask poli for sellers. Schedule a liquidity quiz answer me! For either ratio, a result of one or greater is generally sufficient to confirm adequate business liquidity to support the. See liquidity calculators to aid in confirmation of. Web how to complete a liquidity test? Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property(s) (up to 4 properties). Web this document is designed to help you manage your quality risk and comply with fannie mae’s selling guide minimum quality control (qc) requirements and includes highly. One or more cells in this workbook contain data validation rules which refer to values on. Inventories line 3, column d + 4. Are you considering buying or refinancing a home in the near future? Web the liquidity calculator, provided by enact mortgage insurance, assists in analyzing whether the borrower’s business may have the ability to meet immediate debt obligations. Web income used to qualify; In addition to the business review and analysis. Launch ask poli for sellers. Web fannie mae income worksheet pdf details. § schedule e (irs form. Or lenders must verify the business has adequate liquidity to support the withdrawal of earnings.Fannie Mae Rental Worksheet Ishtarairlines Com Fannie Mae — db

Fannie Mae Cash Flow Analysis Worksheet

Fill Free fillable Genworth PDF forms

Fannie Mae Selfemployed Worksheet

10++ Genworth Rental Worksheet

Fannie Mae Worksheet Fill Online Printable —

Fannie Mae Rental Worksheet Fill Online, Printable, Fillable

Fill Free fillable Fannie Mae Cash Flow Analysis (Genworth) PDF form

36 Fannie Mae Budget Worksheet support worksheet

Rental Calculation Worksheet Fannie Mae Rental

Web Rental Income Worksheet Individual Rental Income From Investment Property(S):

Web Must Support That The Business Has Sufficient Liquidity And Is Financially Capable Of Producing Stable Monthly Income For The Borrower.

Monthly Qualifying Rental Income (Or Loss) Documentation Required:

Make Sure That The Borrower’s Business Has Stable Sales And Expenses That Are Generated For The.

Related Post: