Federal Carryover Worksheet Turbotax

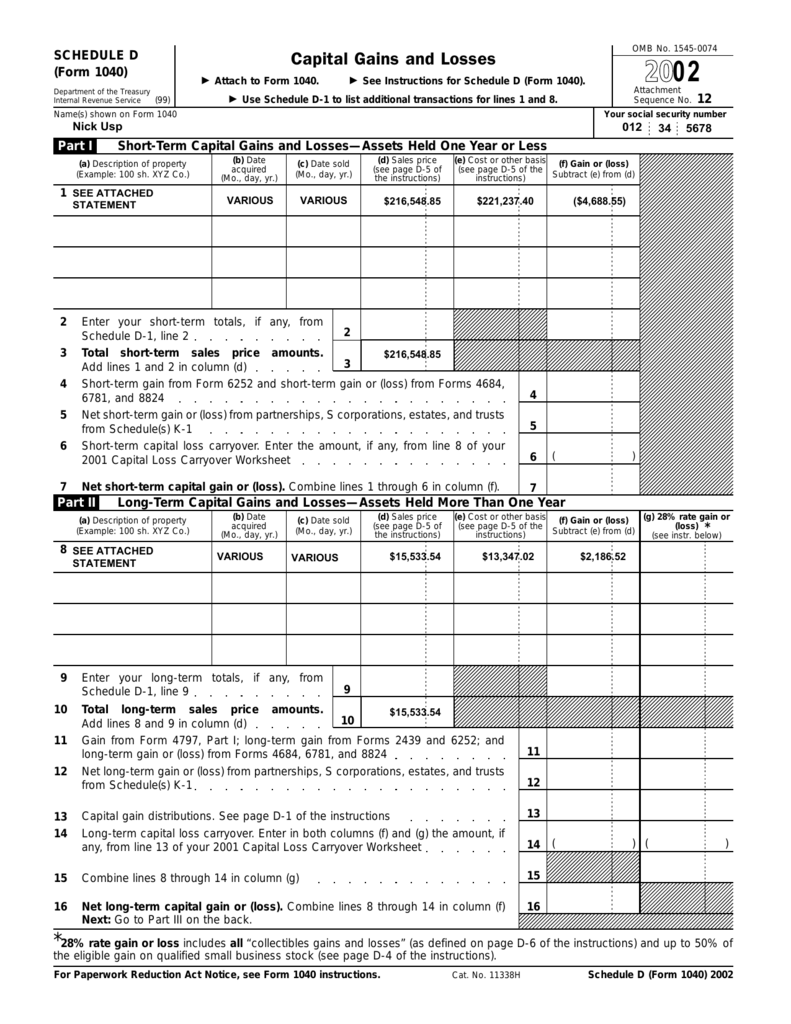

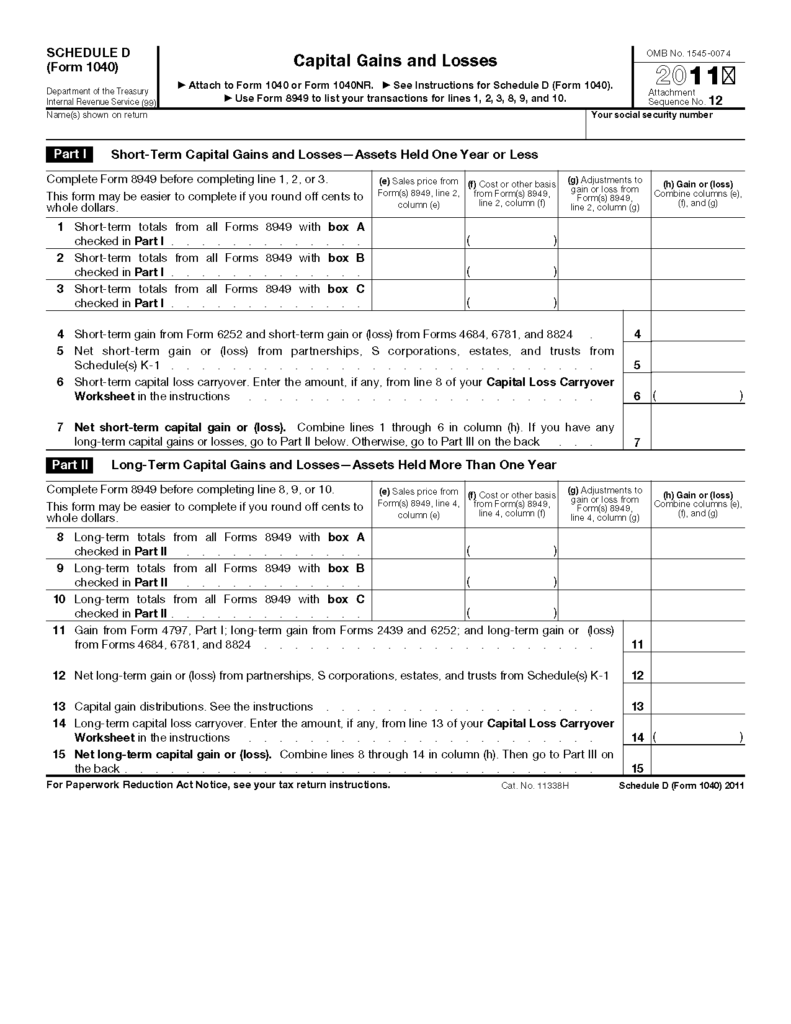

Federal Carryover Worksheet Turbotax - Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. June 6, 2019 7:16 am. Web capital loss carryover worksheet. From the forms menu, choose select form. If you want to figure your carryover. Make changes to your 2022 tax. It means you have a loss carryover, which means you couldn't use it. Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. Web follow these steps to open the federal carryover worksheet: If you're using proseries basic, from the forms. June 6, 2019 7:16 am. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. June 4, 2019 6:35 pm. From the forms menu, choose select form. If you want to figure your carryover. Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. Entering section 179 carryover from a schedule f:. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. June 4,. Enter the section 179 as a positive number on line a. June 4, 2019 6:35 pm. Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. From the forms menu, choose select form. Entering section 179 carryover from a schedule f:. Web capital loss carryover worksheet. If you're using proseries basic, from the forms. From the forms menu, choose select form. Entering section 179 carryover from a schedule f:. June 4, 2019 6:35 pm. Enter the section 179 as a positive number on line a. If you want to figure your carryover. Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. June 4, 2019 6:35 pm. It means you have a loss carryover, which means you couldn't use it. If you want to figure your carryover. If you're using proseries basic, from the forms. Web capital loss carryover worksheet. Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. June 4, 2019 6:35 pm. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. It means you have a loss carryover, which means you couldn't use it. From the forms menu, choose select form. Web capital loss. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Enter the section 179 as a positive number on line a. If you want to figure your carryover. Web follow these steps to open the federal carryover worksheet: Web capital loss carryover worksheet. Web follow these steps to open the federal carryover worksheet: From the forms menu, choose select form. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Web scroll down to the carryovers to 2022 smart worksheet. If you want to figure your carryover. Entering section 179 carryover from a schedule f:. If you want to figure your carryover. Web capital loss carryover worksheet. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. June 6, 2019 7:16 am. June 4, 2019 6:35 pm. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Web scroll down to the carryovers to 2022 smart worksheet. If you want to figure your carryover. It means you have a loss carryover, which means you couldn't use it. If you're using proseries basic, from the forms. Enter the section 179 as a positive number on line a. Web capital loss carryover worksheet. Make changes to your 2022 tax. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. From the forms menu, choose select form. Web follow these steps to open the federal carryover worksheet: Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. Entering section 179 carryover from a schedule f:. June 6, 2019 7:16 am. Web follow these steps to open the federal carryover worksheet: Web scroll down to the carryovers to 2022 smart worksheet. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. From the forms menu, choose select form. Web capital loss carryover worksheet. It means you have a loss carryover, which means you couldn't use it. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. June 4, 2019 6:35 pm. Please type net operating loss (nol) carryovers in the search box at the top right of the screen and jump to that. June 6, 2019 7:16 am. Enter the section 179 as a positive number on line a. Make changes to your 2022 tax.capital loss carryover worksheet 1041

Federal Carryover Worksheet Balancing Equations Worksheet

Tax help Turbotax carrying over 2010 Foreign Tax Credit?

Capital Loss Carryover Worksheet slidesharedocs

Solved NOL Carryforward worksheet or statement

1040 capital loss carryover worksheet

1040 capital loss carryover worksheet

Solved Contribution Carryover Worksheet Intuit Accountants Community

capital loss carryover worksheet 1041

39 best ideas for coloring Capital Loss Carryover Worksheet

If You Want To Figure Your Carryover.

Entering Section 179 Carryover From A Schedule F:.

If You're Using Proseries Basic, From The Forms.

Web To Figure Any Capital Loss Carryover To 2023, You Will Use The Capital Loss Carryover Worksheet In The 2023 Instructions For Schedule D.

Related Post: