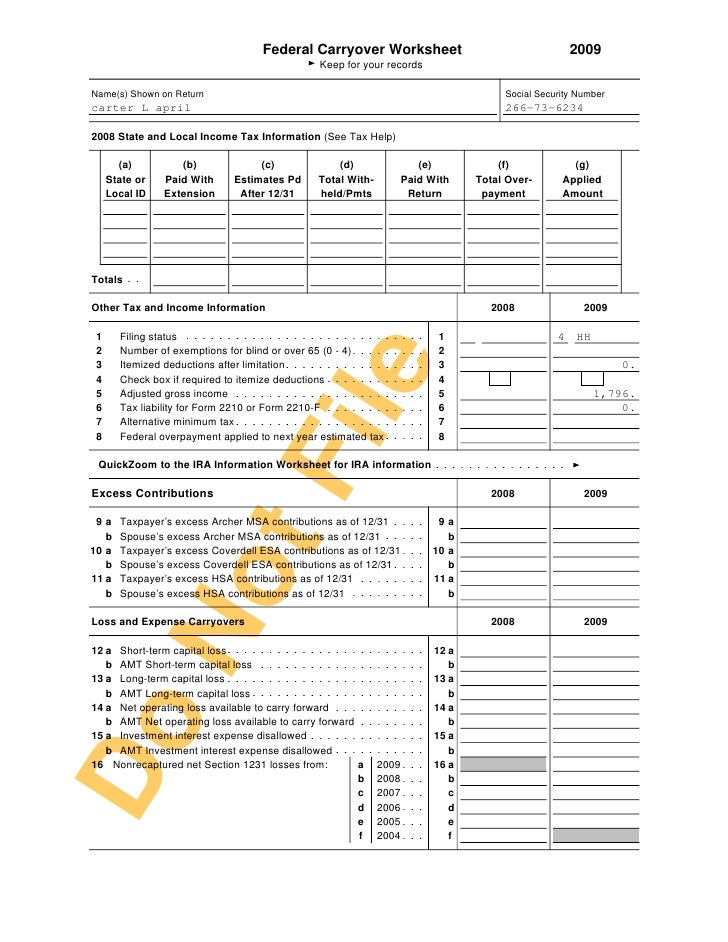

Federal Carryover Worksheet

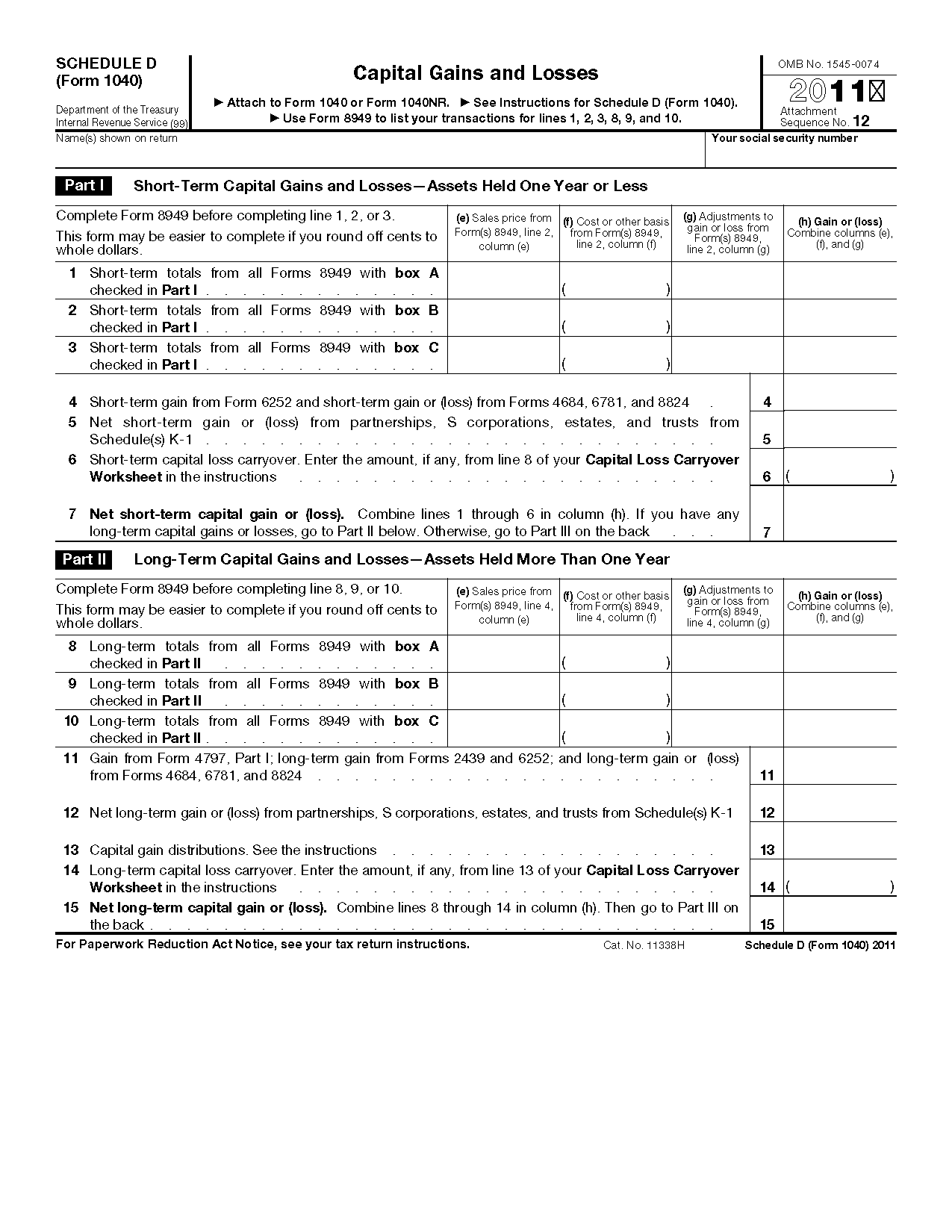

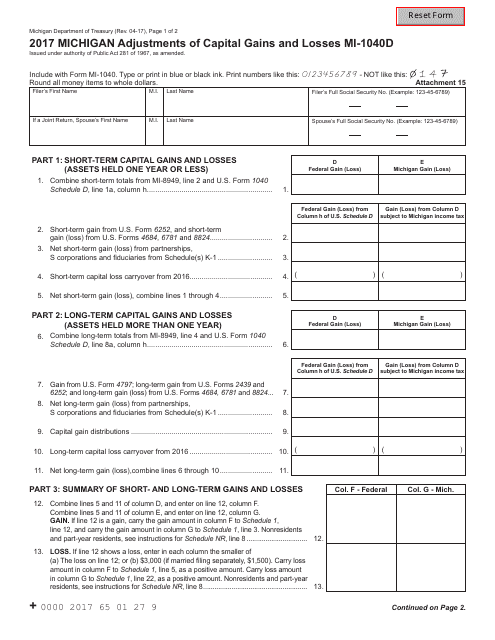

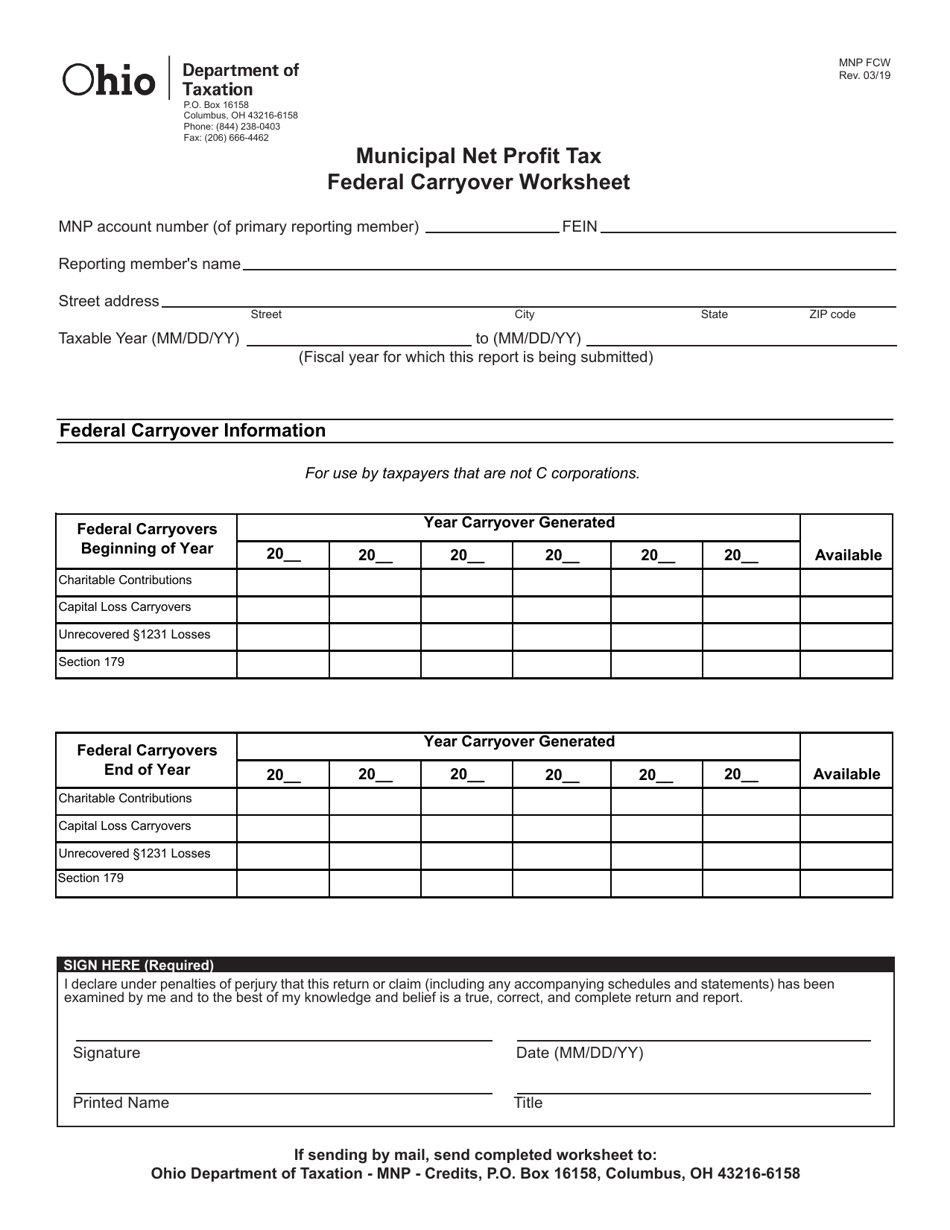

Federal Carryover Worksheet - If there was 179 carryover generated from multiple activities, add these amounts together to get the total 179 carryover. Enter any regular nol on line 14a in the 2021column. Web look for the federal carryover worksheet. on that worksheet you will find the ca total withheld/payments amount requested. Web turbotax does have a federal carryover worksheet which has an nol carryover and amt nol carryover field (line 14). Web capital loss carryover worksheet. Web what is a federal carryover worksheet. Web carry over net losses of more than $3,000 to next year's return. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Figure your allowable capital loss on schedule d and enter it on form. If ca was the only state you paid. If there was 179 carryover generated from multiple activities, add these amounts together to get the total 179 carryover. For instance, if you are not able to claim your entire loss. Figure your allowable capital loss on schedule d and enter it on form. Web look for the federal carryover worksheet. on that worksheet you will find the ca total. For instance, if you are not able to claim your entire loss. Web capital loss carryover worksheet. In a matter of seconds, receive an electronic document with a. Click + next to the forms and schedules manila folder (if that section is not. Web first, enter the total carryover amount: Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the. Web carry over net losses of more than $3,000 to next year's return. For instance, if you are not able to claim your entire loss. Please note the following correction to the capital. Web june 3, 2019 11:46 am. Web type co and select ok to open the federal carryover worksheet. If ca was the only state you paid. Web carry over net losses of more than $3,000 to next year's return. Web turbotax does have a federal carryover worksheet which has an nol carryover and amt nol carryover field (line 14). Web first, enter the total carryover amount: Web from within your taxact return ( online ), click the tools dropdown, then click forms assistant. Enter any regular nol on line 14a in the 2021column. For instance, if you are not able to claim your entire loss. Turbotax will fill out the carryover worksheet for you from this year to use. For instance, if you are not able to claim your entire loss. Web capital loss carryover worksheet. If ca was the only state you paid. Web type co and select ok to open the federal carryover worksheet. Web first, enter the total carryover amount: Turbotax will fill out the carryover worksheet for you from this year to use next year. Enter any regular nol on line 14a in the 2021column. You can carry over capital losses indefinitely. Web look for the federal carryover worksheet. on that worksheet you will find the ca total withheld/payments amount requested. Web june 3, 2019 11:46 am. In a matter of seconds, receive an electronic document with a. Web what is a federal carryover worksheet. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. If there was 179 carryover. Web june 3, 2019 11:46 am. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the. Please note the following correction to the capital loss carryover worksheet in the 2020 and the 2021 instructions. Web from within your taxact return ( online ),. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the. Web type co and select ok to open the federal carryover worksheet. Web look for the federal carryover worksheet. on that worksheet you will find the ca total withheld/payments amount requested. Web what. Scroll down to line 14. Web from within your taxact return ( online ), click the tools dropdown, then click forms assistant. If ca was the only state you paid. Turbotax will fill out the carryover worksheet for you from this year to use next year. You can carry over capital losses indefinitely. Web june 3, 2019 11:46 am. Web type co and select ok to open the federal carryover worksheet. In a matter of seconds, receive an electronic document with a. Web carry over net losses of more than $3,000 to next year's return. If there was 179 carryover generated from multiple activities, add these amounts together to get the total 179 carryover. Please note the following correction to the capital loss carryover worksheet in the 2020 and the 2021 instructions. Web what is a federal carryover worksheet. Enter any regular nol on line 14a in the 2021column. Web capital loss carryover worksheet. Figure your allowable capital loss on schedule d and enter it on form. Web first, enter the total carryover amount: Web look for the federal carryover worksheet. on that worksheet you will find the ca total withheld/payments amount requested. For instance, if you are not able to claim your entire loss. However, mine is blank and when i. Web turbotax does have a federal carryover worksheet which has an nol carryover and amt nol carryover field (line 14). Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the. Web capital loss carryover worksheet. You can carry over capital losses indefinitely. Web what is a federal carryover worksheet. Turbotax will fill out the carryover worksheet for you from this year to use next year. However, mine is blank and when i. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Figure your allowable capital loss on schedule d and enter it on form. Enter any regular nol on line 14a in the 2021column. If there was 179 carryover generated from multiple activities, add these amounts together to get the total 179 carryover. Web first, enter the total carryover amount: Click + next to the forms and schedules manila folder (if that section is not. Web turbotax does have a federal carryover worksheet which has an nol carryover and amt nol carryover field (line 14). Web june 3, 2019 11:46 am. If ca was the only state you paid. Web from within your taxact return ( online ), click the tools dropdown, then click forms assistant.Tax return

Nol Carryover Worksheet Master of Documents

What Is A Federal Carryover Worksheet kamberlawgroup

Federal Carryover Worksheet 2019 Worksheet Maker

39 best ideas for coloring Capital Loss Carryover Worksheet

Form 1040 Schedule D Capital LoSS Carryover Worksheet 1040 Form Printable

39 best ideas for coloring Capital Loss Carryover Worksheet

capital loss carryover worksheet 1041

Form MNP FCW Download Printable PDF or Fill Online Municipal Net Profit

1040 capital loss carryover worksheet

Web Type Co And Select Ok To Open The Federal Carryover Worksheet.

Web Carry Over Net Losses Of More Than $3,000 To Next Year's Return.

Web Look For The Federal Carryover Worksheet. On That Worksheet You Will Find The Ca Total Withheld/Payments Amount Requested.

Please Note The Following Correction To The Capital Loss Carryover Worksheet In The 2020 And The 2021 Instructions.

Related Post: