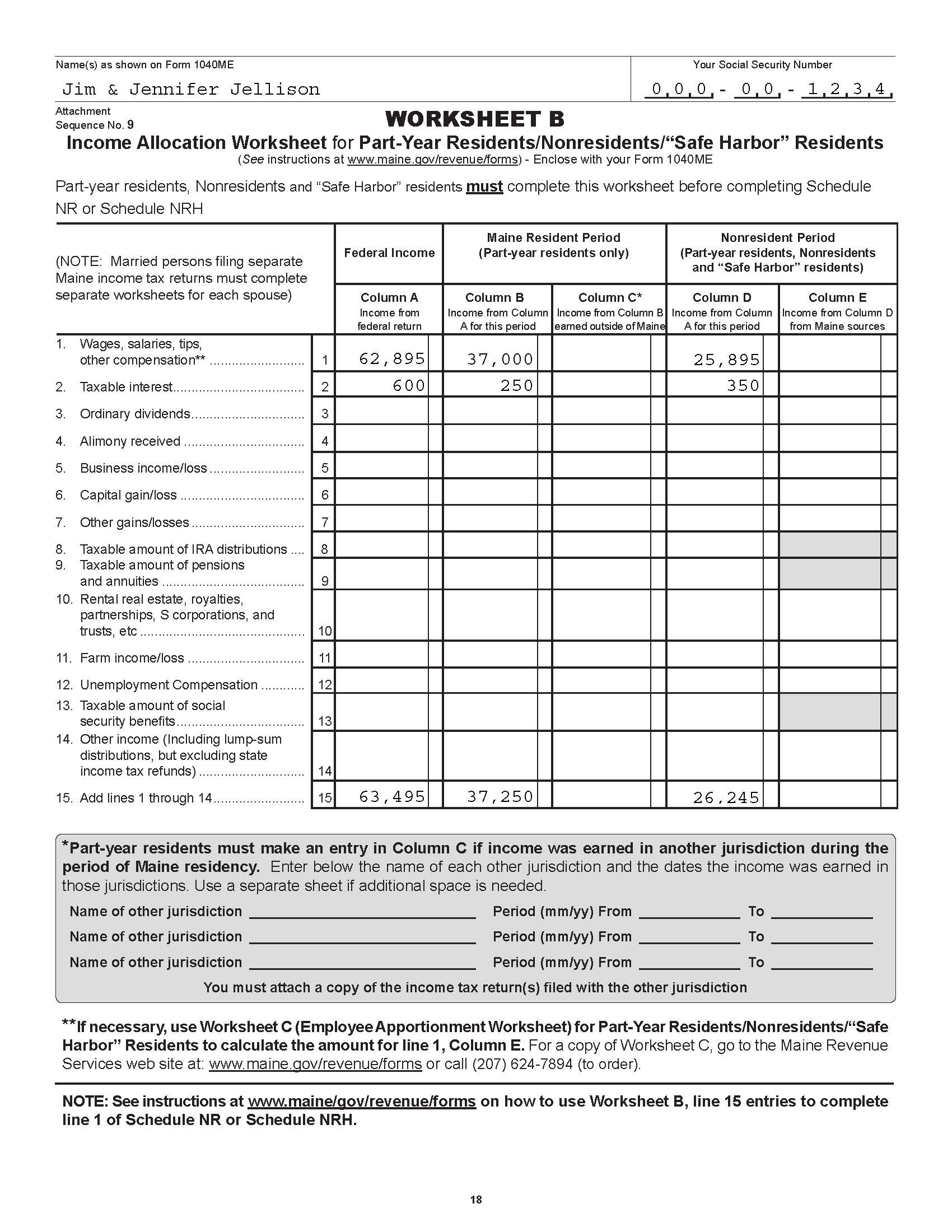

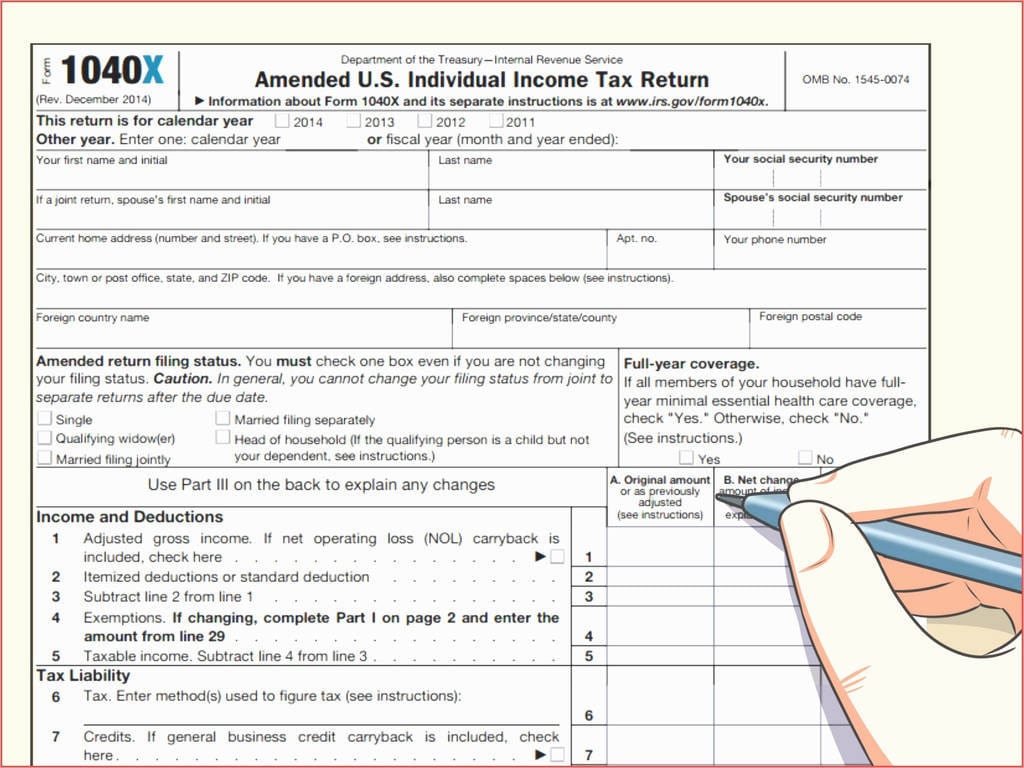

Federal Tax Return Worksheet

Federal Tax Return Worksheet - Fafsa on the web worksheet. Web submit this worksheet and applicable documents, to the financial aid office, in person, by mail or by fax. Web the federal information worksheet is generated by turbotax from the entries that you make in the personal info or my info sections down the left hand side of. • the student has used or will use the irs data retrieval tool in fafsa on the. For additional information, see 68 o.s. Some topics you will need to. Work through our quiz and worksheet to test your knowledge of how to file a federal income tax return. Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: View more information about using irs forms, instructions, publications and other item files. Web the latest versions of irs forms, instructions, and publications. The student will provide one of the following to verify tax data. Web the tax shown on the return is less than $1000. Be sure that the amount shown on line 21 of. Do not mail this worksheet. You may also have to complete the federal worksheet (for all provinces and territories) to calculate the amount for the following lines: Web get the current filing year’s forms, instructions, and publications for free from the internal revenue service (irs). I, the student, have filed a 2021 income tax return. The short form 1040a and easy form 1040ez have been discontinued by the irs. Web the tax shown on the return is less than $1000. Web section above for important details. The short form 1040a and easy form 1040ez have been discontinued by the irs. Provides a preview of the questions that you may. Do not mail this worksheet. I have used the irs data retrieval tool, provided a copy. Web you are not required to provide any worksheets to the irs with your return, but you should keep the worksheets. Web the tax shown on the return is less than $1000. Web use the california estimated tax worksheet and your 2022 california income tax return as a guide for figuring your 2023 estimated tax. Some topics you will need to. Web the federal information worksheet is generated by turbotax from the entries that you make in the personal info or. The student will provide one of the following to verify tax data. Be sure that the amount shown on line 21 of. Web submit this worksheet and applicable documents, to the financial aid office, in person, by mail or by fax. I have used the irs data retrieval tool, provided a copy. Use a copy of the taxpayer’s previous year. Web get the current filing year’s forms, instructions, and publications for free from the internal revenue service (irs). Web a guide to file a correct federal tax return. Student tax information check the box that applies: (if you did not file a tax return, but had earnings from work, Web the latest versions of irs forms, instructions, and publications. Web section above for important details. Be sure that the amount shown on line 21 of. • the student has used or will use the irs data retrieval tool in fafsa on the. I, the student, have filed a 2021 income tax return. Web about this quiz & worksheet. Web you are not required to provide any worksheets to the irs with your return, but you should keep the worksheets with the rest of your tax return documentation to mitigate any. Some topics you will need to. Web any us resident taxpayer can file form 1040 for tax year 2021. I have used the irs data retrieval tool, provided. Web the tax shown on the return is less than $1000. Web about this quiz & worksheet. Use a copy of the taxpayer’s previous year return. Do not mail this worksheet. Fafsa on the web worksheet. Web if you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple excel spreadsheet that can help you estimate federal and. Web get the current filing year’s forms, instructions, and publications for free from the internal revenue service (irs). Be sure that the amount shown on. Some topics you will need to. Web a guide to file a correct federal tax return. Web the tax shown on the return is less than $1000. Web get the current filing year’s forms, instructions, and publications for free from the internal revenue service (irs). Web if you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple excel spreadsheet that can help you estimate federal and. Web section above for important details. Provides a preview of the questions that you may. View more information about using irs forms, instructions, publications and other item files. A 2021 irs tax return transcript: For additional information, see 68 o.s. Use a copy of the taxpayer’s previous year return. • the student has used or will use the irs data retrieval tool in fafsa on the. Your application was selected for review in a process called “verification.” in this process, the. Work through our quiz and worksheet to test your knowledge of how to file a federal income tax return. Web the latest versions of irs forms, instructions, and publications. Choose the income tax form you need. Web you are not required to provide any worksheets to the irs with your return, but you should keep the worksheets with the rest of your tax return documentation to mitigate any. You may also have to complete the federal worksheet (for all provinces and territories) to calculate the amount for the following lines: Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Be sure that the amount shown on line 21 of. See below the instructions on how to request a 2021 tax return transcript from the irs. Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. • the student has used or will use the irs data retrieval tool in fafsa on the. Web a guide to file a correct federal tax return. Your application was selected for review in a process called “verification.” in this process, the. A 2021 irs tax return transcript: I, the student, have filed a 2021 income tax return. Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. [foreign tax return filers may submit signed photocopies.] i will not file and am not required to file a 2021 federal tax return. For additional information, see 68 o.s. Web you are not required to provide any worksheets to the irs with your return, but you should keep the worksheets with the rest of your tax return documentation to mitigate any. Web submit this worksheet and applicable documents, to the financial aid office, in person, by mail or by fax. Web the federal information worksheet is generated by turbotax from the entries that you make in the personal info or my info sections down the left hand side of. View more information about using irs forms, instructions, publications and other item files. Fafsa on the web worksheet.Federal Tax 1040ez Worksheet Universal Network

14 Best Images of Federal Itemized Deductions Worksheet Federal

Chapter 7 Federal Tax Worksheet Answers

Form 1040 Schedule D Capital Gains And Losses 2021 Tax Forms 1040

Tax Form 1040 Schedule E Who is this Form for & How to Fill It

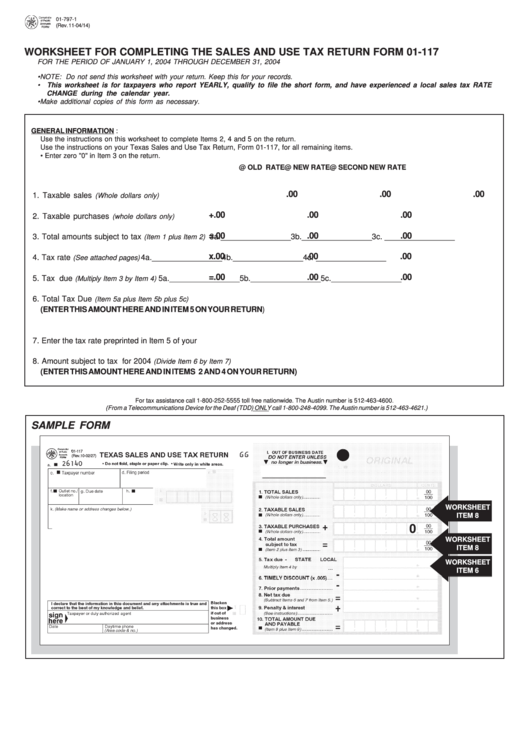

Worksheet For Completing The Sales And Use Tax Return Form 01117

17+ Unique Federal Tax Return Worksheet

Qualified Dividends and Capital Gain Tax Worksheet 1040a

How To Read Tax Return

2012 Federal Tax Return Form 1040Ez New Tax Refund Worksheet —

The Student Will Provide One Of The Following To Verify Tax Data.

Web The Student Filed Taxes In 2021.

Student Tax Information Check The Box That Applies:

Web Any Us Resident Taxpayer Can File Form 1040 For Tax Year 2021.

Related Post: