Form 1099-B Worksheet

Form 1099-B Worksheet - You may also have a filing requirement. Web to figure the adjustment needed, see the worksheet for basis adjustments in column (g). Statement of specified financial assets. Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they closed or. Enter nursing home, assisted living facility, or adult family home expenses incurred. Profit or loss from business. For whom, they sold stocks,. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. (explained in the order it appears on the expenses worksheet in section 5 part ii on page 3) 1. A broker or barter exchange must file this form for each person: See the instructions for form. Statement of specified financial assets. You may also have a filing requirement. Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they closed or. For whom, they sold stocks,. A broker or barter exchange must file this form for each person: You may also have a filing requirement. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Enter nursing home, assisted living facility, or adult family home expenses incurred. Web to figure the adjustment needed, see the worksheet for basis. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Enter nursing home, assisted living facility, or adult family home expenses incurred. Profit or loss from business. For whom, they sold stocks,. A broker or barter exchange must file this form for each person: See the instructions for form. A broker or barter exchange must file this form for each person: You may also have a filing requirement. Web to figure the adjustment needed, see the worksheet for basis adjustments in column (g). The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. A broker or barter exchange must file this form for each person: Profit or loss from business. You may also have a filing requirement. Enter nursing home, assisted living facility, or adult family home expenses incurred. Profit or loss from business. You may also have a filing requirement. See the instructions for form. For whom, they sold stocks,. Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they closed or. You may also have a filing requirement. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. A broker or barter exchange must file this form for each person: Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. Statement of specified financial assets. A broker or barter exchange must file this form for each person: Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Enter nursing home, assisted living facility,. A broker or barter exchange must file this form for each person: (explained in the order it appears on the expenses worksheet in section 5 part ii on page 3) 1. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Web to figure the adjustment needed, see the worksheet for basis. Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they closed or. (explained in the order it appears on the expenses worksheet in section 5 part ii on page 3) 1. For whom, they sold stocks,. You may also have a filing requirement. The information is generally reported. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. You may also have a filing requirement. Statement of specified financial assets. (explained in the order it appears on the expenses worksheet in section 5 part ii on page 3) 1. Enter nursing home, assisted living facility, or adult family home expenses incurred. Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they closed or. Web to figure the adjustment needed, see the worksheet for basis adjustments in column (g). A broker or barter exchange must file this form for each person: Profit or loss from business. See the instructions for form. For whom, they sold stocks,. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. (explained in the order it appears on the expenses worksheet in section 5 part ii on page 3) 1. Web to figure the adjustment needed, see the worksheet for basis adjustments in column (g). Enter nursing home, assisted living facility, or adult family home expenses incurred. You may also have a filing requirement. Capital asset sales may not contain a date after 12/31/2021 yes, you can delete the offending rows for two reason, one they closed or. A broker or barter exchange must file this form for each person: For whom, they sold stocks,. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement.How To Read A 1099b Form Armando Friend's Template

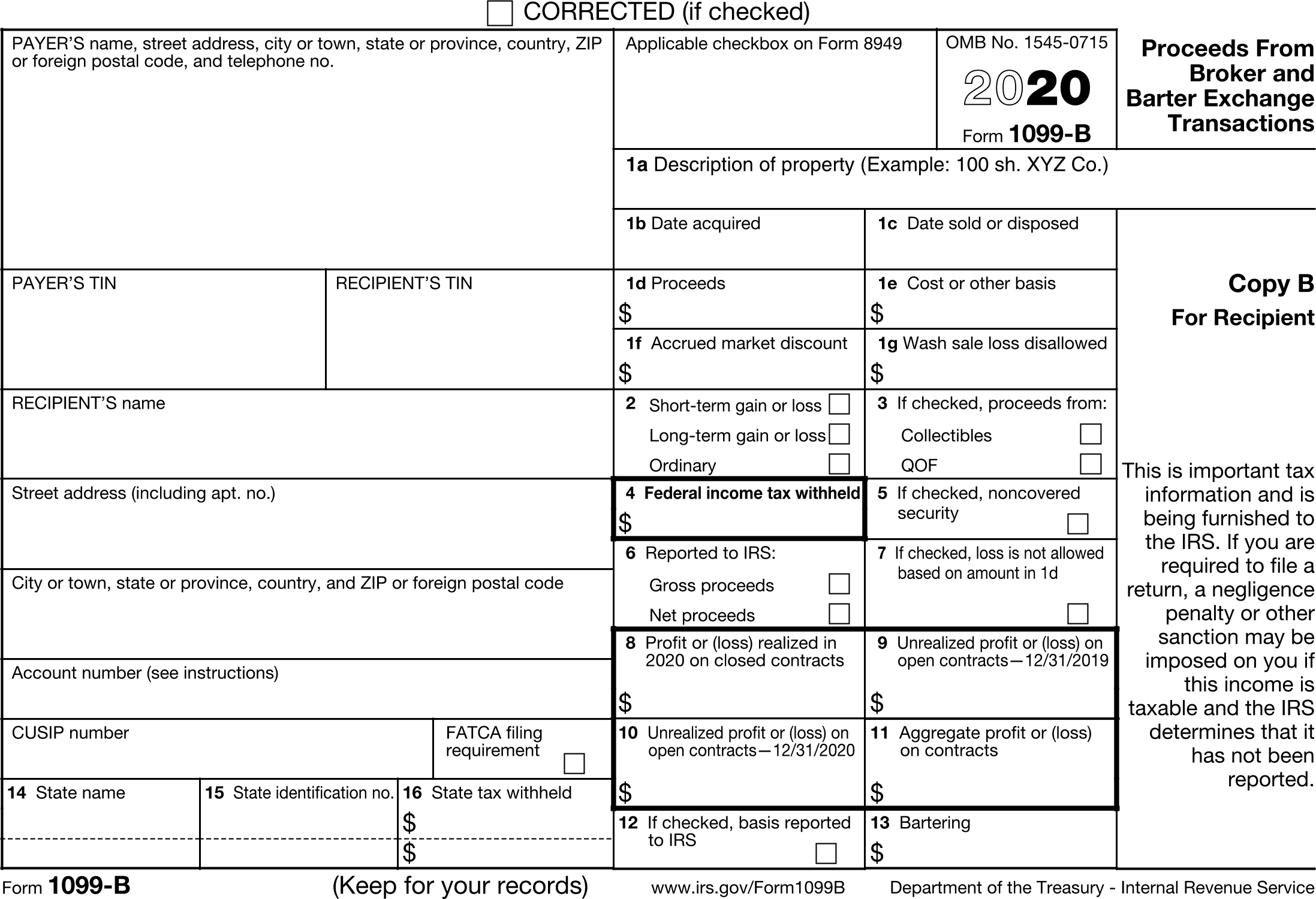

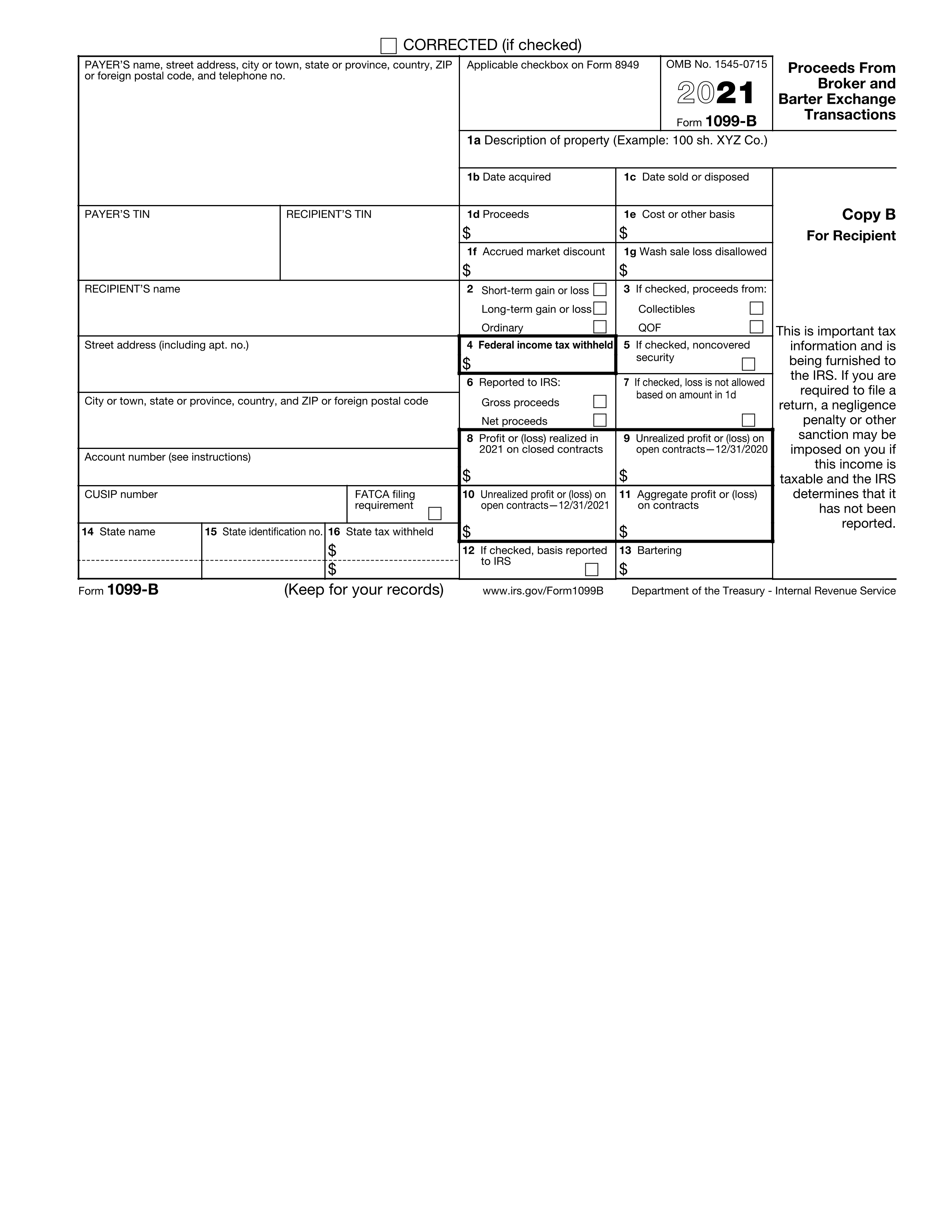

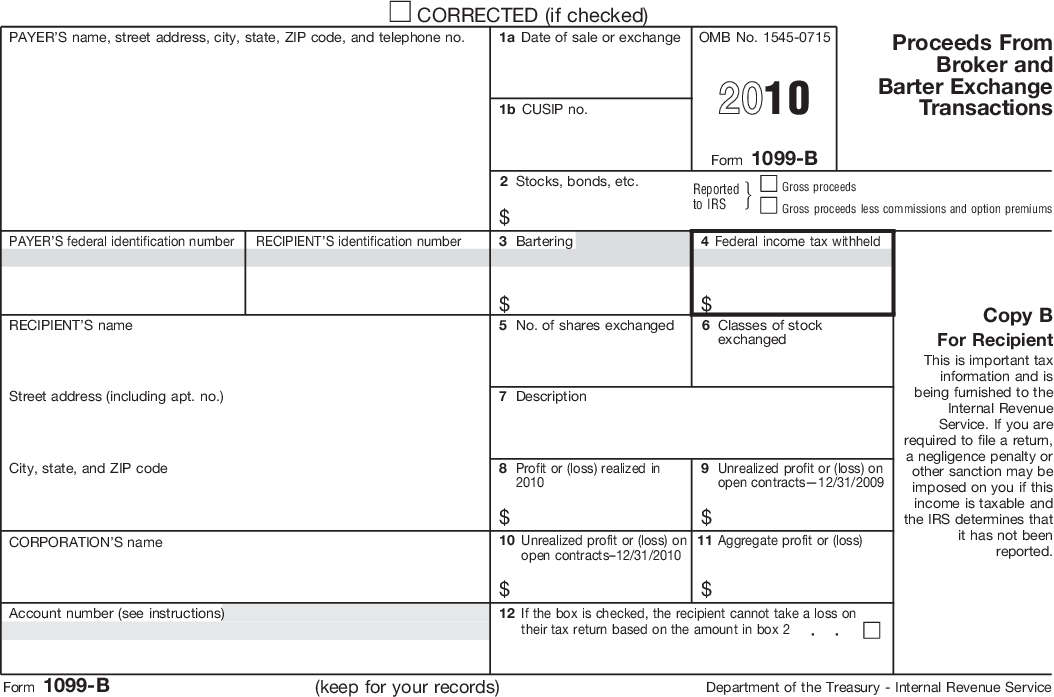

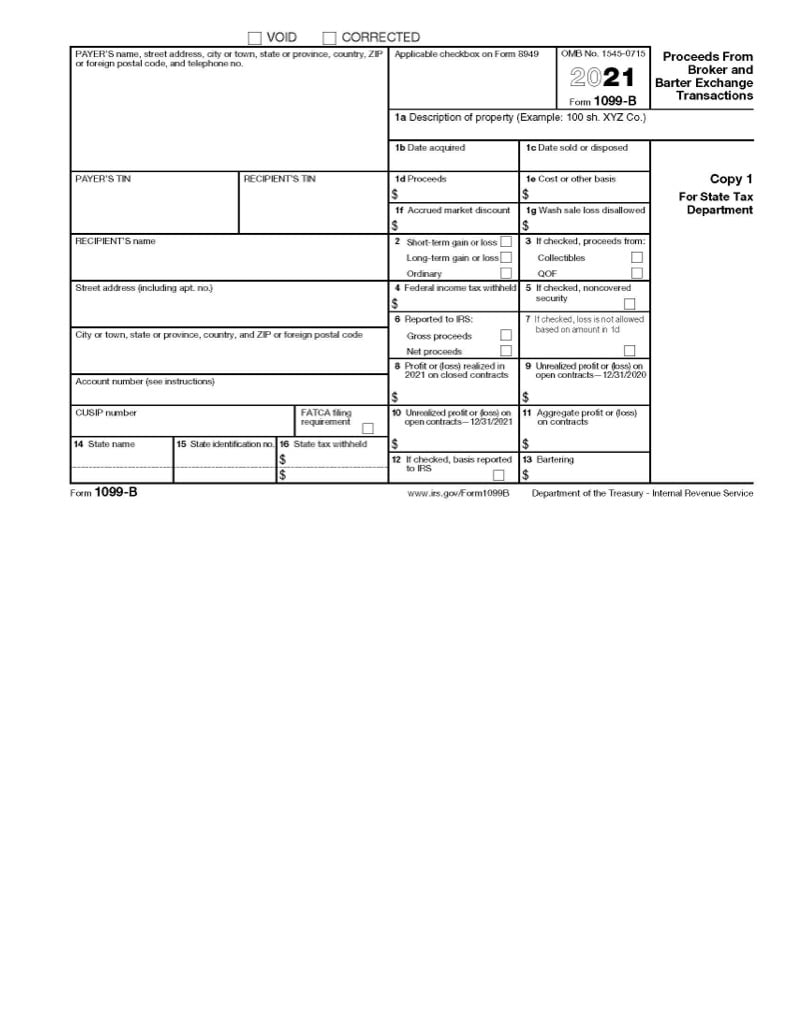

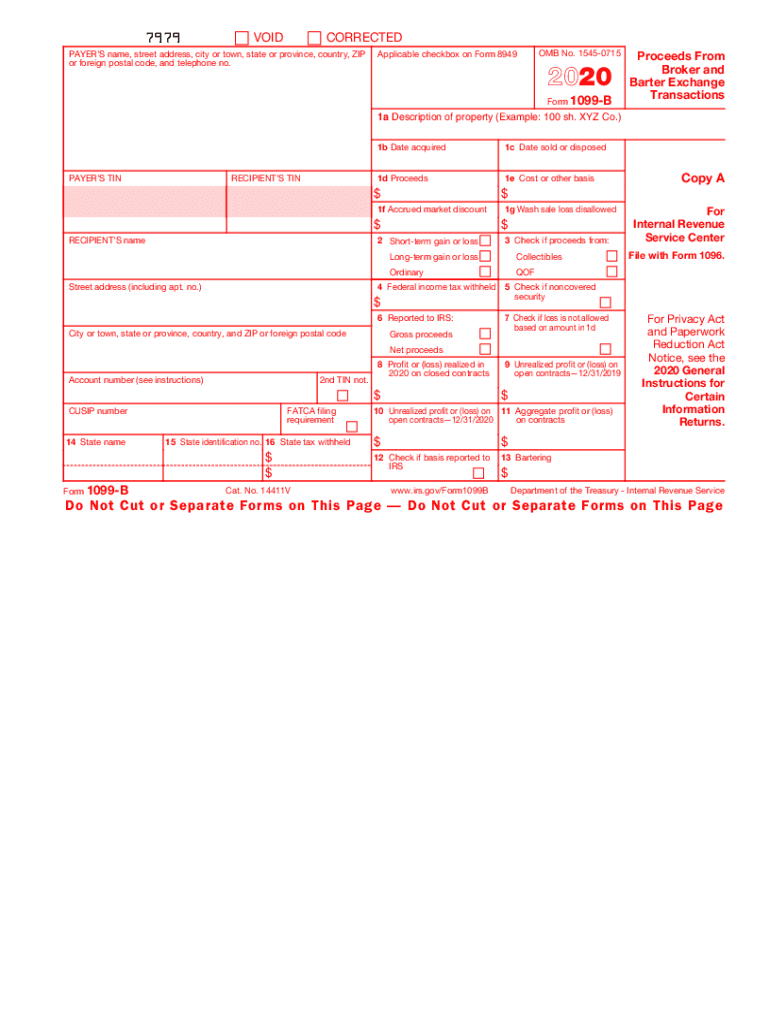

Form 1099B Proceeds from Broker and Barter Exchange Transactions

2020 Form IRS 1099B Fill Online, Printable, Fillable, Blank pdfFiller

Form 1099B Proceeds from Broker and Barter Exchange Definition

Tax Form 1099 B Instructions Universal Network

FDX/QR

Capital Gains Tax

Form 1099B, Interest Recipient Copy B

IRS Form 1099B.

Form 1099B Proceeds from Brokered and Bartered Transactions Jackson

Statement Of Specified Financial Assets.

Profit Or Loss From Business.

See The Instructions For Form.

Related Post:

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)