Form 8582 Worksheet Example

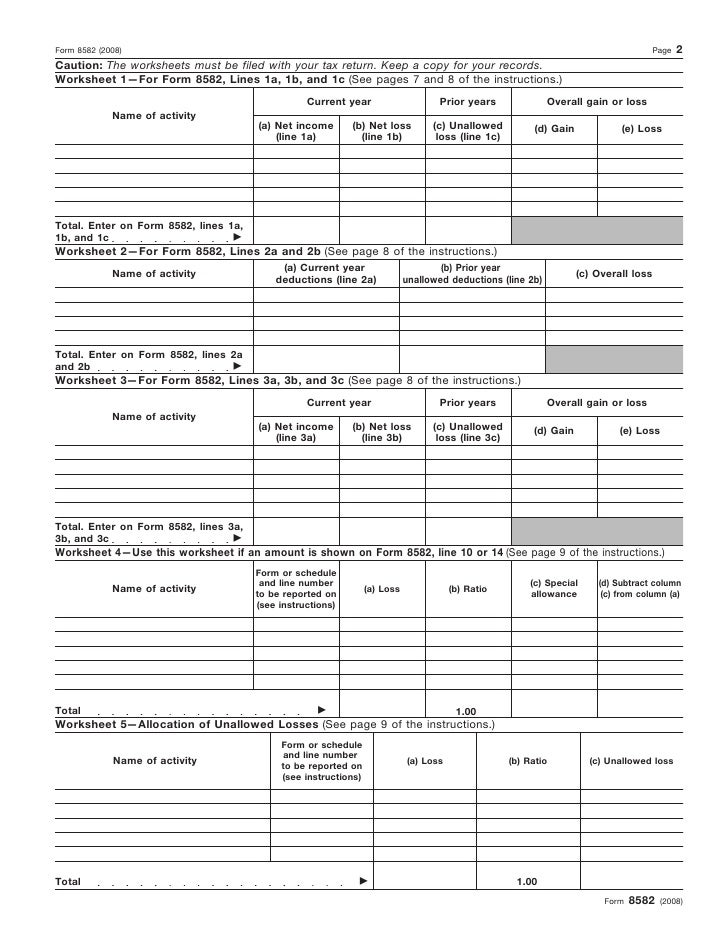

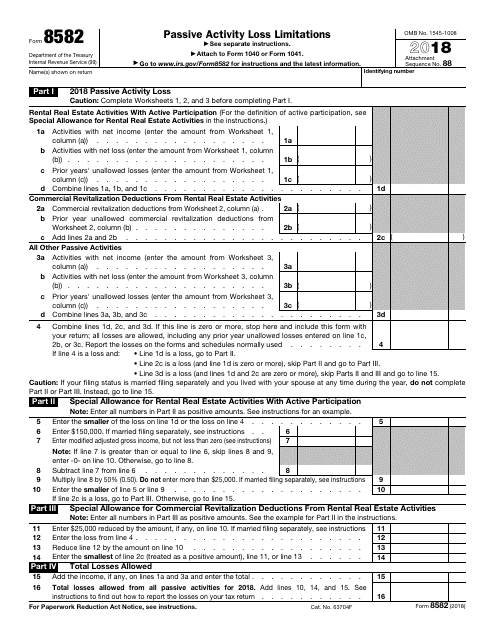

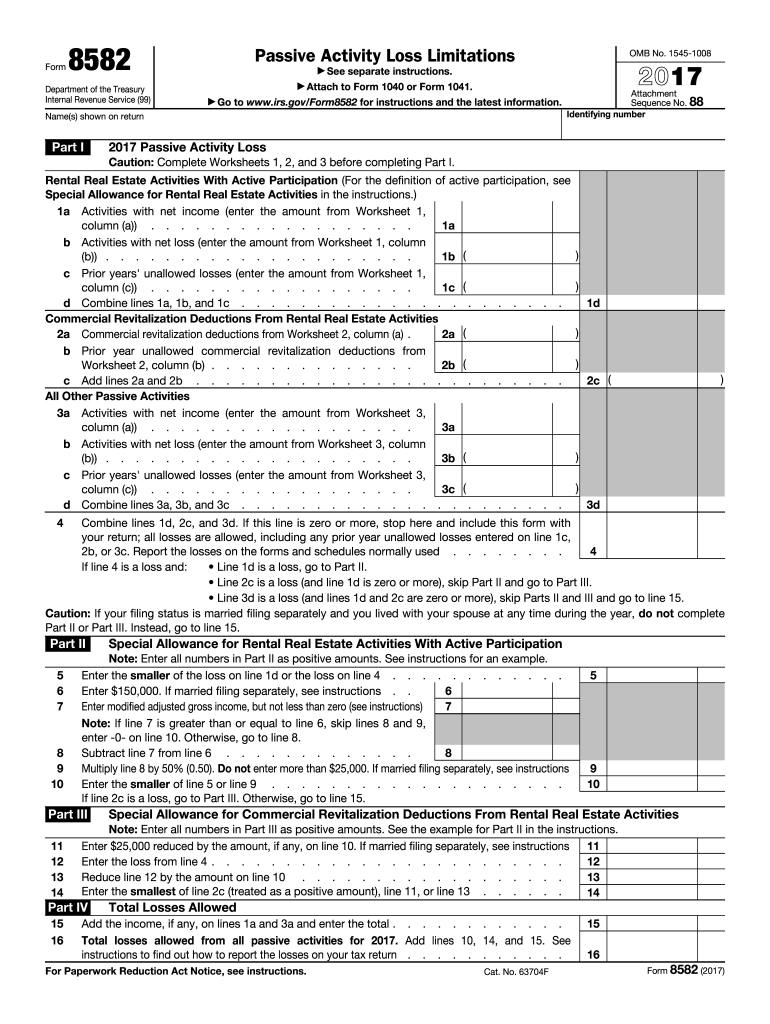

Form 8582 Worksheet Example - Web how to fill in form 8582? If line 3 shows income, all. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. If you actively participated in a passive rental real estate activity, you may. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions.) name of activity. Web worksheet 3—for form 8582, lines 3a, 3b, and 3c (see page 8 of the instructions.) current year prior years overall gain or loss (a) net income (line 3a) (b) net loss (line. I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change. Get federal form 8582 for specific line instructions and examples. Overall gain or loss (a) net income (line 1a) (b) net loss. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. If you actively participated in a passive rental real estate activity, you may. Web the only data entry point for form. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. If you actively participated in a passive rental real estate activity, you may. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. Web how to. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Get federal. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions.) name of activity. Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need. Get federal form 8582 for specific line instructions and examples. Web if you're a u.s. Overall gain or loss (a) net income (line 1a) (b) net loss. Web how to fill in form 8582? If line 3 shows income, all. If line 3 shows income, all. Web organization does not have to file form 8282 if, at the time the original donee signed section b of form 8283, the donor had signed a statement on form 8283 that the. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Overall gain or loss (a) net income (line 1a) (b) net loss. Web how to fill in form 8582? Get federal form 8582 for specific line instructions and examples. Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. Overall gain or loss (a) net income (line 1a) (b) net loss. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures. Get federal form 8582 for specific line instructions and examples. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. Web worksheet 3—for form 8582, lines 3a, 3b, and 3c (see. Web worksheet 3—for form 8582, lines 3a, 3b, and 3c (see page 8 of the instructions.) current year prior years overall gain or loss (a) net income (line 3a) (b) net loss (line. If line 3 shows income, all. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. Web. If line 3 shows income, all. If you actively participated in a passive rental real estate activity, you may. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. Overall gain or loss (a) net income (line 1a) (b) net loss. Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. Web organization does not have to file form 8282 if, at the time the original donee signed section b of form 8283, the donor had signed a statement on form 8283 that the. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions.) name of activity. Web how to fill in form 8582? Web if you're a u.s. Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Get federal form 8582 for specific line instructions and examples. Web worksheet 3—for form 8582, lines 3a, 3b, and 3c (see page 8 of the instructions.) current year prior years overall gain or loss (a) net income (line 3a) (b) net loss (line. Web worksheet 3—for form 8582, lines 3a, 3b, and 3c (see page 8 of the instructions.) current year prior years overall gain or loss (a) net income (line 3a) (b) net loss (line. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions.) name of activity. If you actively participated in a passive rental real estate activity, you may. Get federal form 8582 for specific line instructions and examples. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. Web enter the amounts from form ftb 3801, side 3, worksheet 1 and worksheet 2. I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Web organization does not have to file form 8282 if, at the time the original donee signed section b of form 8283, the donor had signed a statement on form 8283 that the. Web how to fill in form 8582?Form 8582Passive Activity Loss Limitations

Publication 925 Passive Activity and AtRisk Rules; Comprehensive Example

Form 8582 Passive Activity Loss Limitations (2014) Free Download

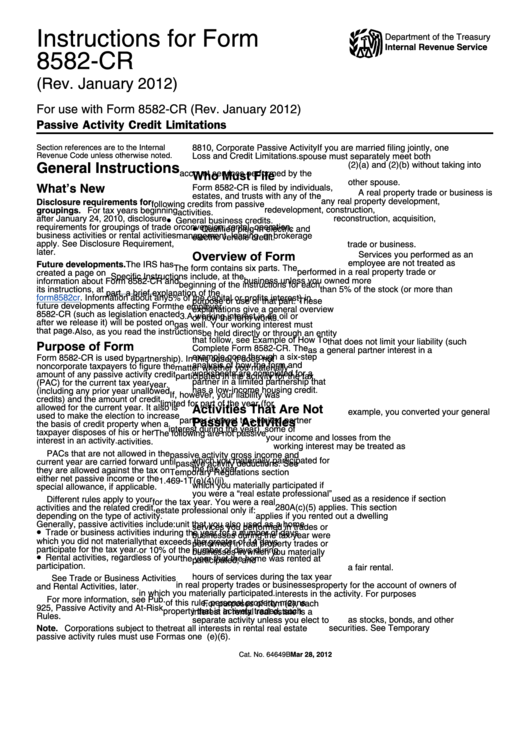

Instructions for Form 8582CR (12/2019) Internal Revenue Service

IRS Form 8582 Download Fillable PDF or Fill Online Passive Activity

Form 8582Passive Activity Loss Limitations

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Form 8582 Fill Out and Sign Printable PDF Template signNow

Instructions For Form 8582Cr Passive Activity Credit Limitations

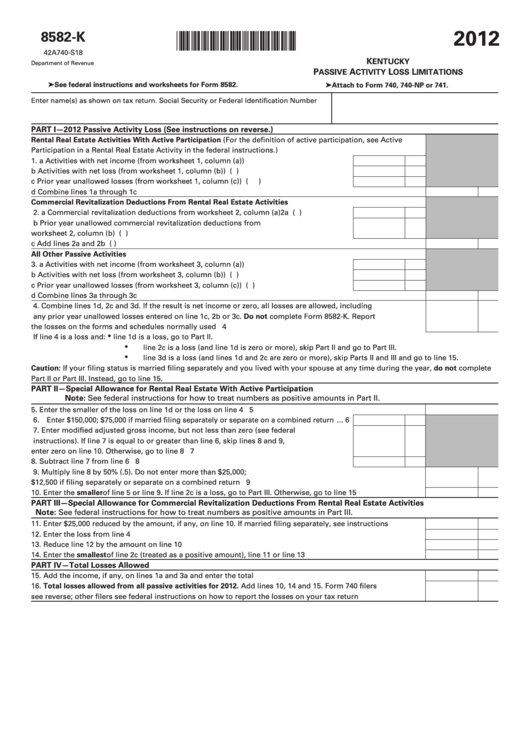

Fillable Form 8582K Kentucky Passive Activity Loss Limitations

If Line 3 Shows Income, All.

Overall Gain Or Loss (A) Net Income (Line 1A) (B) Net Loss.

Web If You're A U.s.

Related Post: