Form 8812 Credit Limit Worksheet A

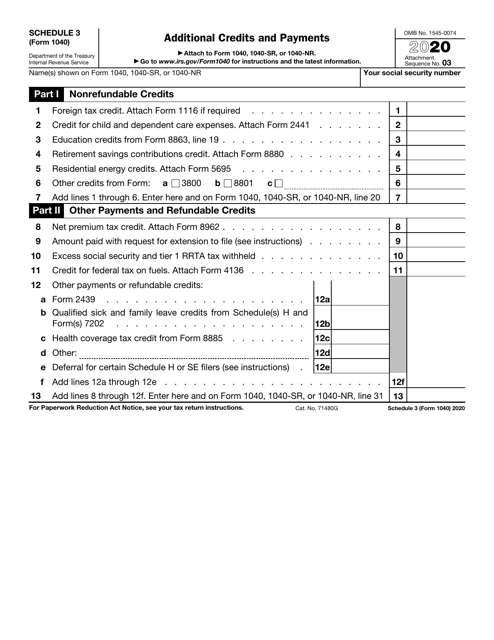

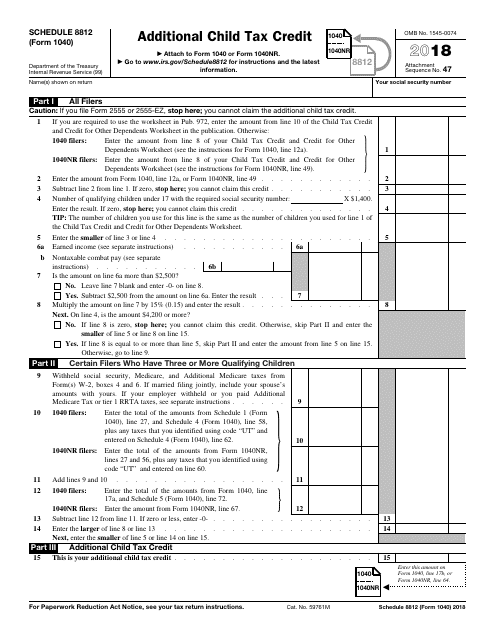

Form 8812 Credit Limit Worksheet A - Should be completed by all filers to claim the. Web you might need to calculate other credits first to properly apply the credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. March 30, 2023 11:45 am. As @thomasm125 explained, the worksheet,. See the instructions for form 1040, line 51, form 1040a, line 33, or form 1040nr,. Web who should use form 8812 first, complete the child tax credit worksheet that applies to you. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. Web the software automatically calculates the amount of additional child tax credit (actc) and produces form 8812 on a qualifying return. Why isn't the child tax credit calculating? Web who should use form 8812 first, complete the child tax credit worksheet that applies to you. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web you might need to calculate other credits first to properly apply the credit. Usually, you can connect. As @thomasm125 explained, the worksheet,. Web you might need to calculate other credits first to properly apply the credit. Web you'll use form 8812 to calculate your additional child tax credit. Why isn't the child tax credit calculating? Web form 8812 refers to line 5 worksheet and credit limit worksheet a. Enter the amount from form 8863, line 18. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. If you are using turbotax, you will not have to make the entries on form 8812. Web you'll use form 8812 to calculate your additional child tax. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. Usually, you can connect to the referenced worksheets by clicking on the amount there will be a link to the. Web form 8812 refers to line 5 worksheet and credit limit worksheet a. March 30, 2023 11:45 am.. Web your additional child tax credit will be computed for you using the following formula: March 30, 2023 11:45 am. The additional child tax credit is only available to. Why isn't the child tax credit calculating? Should be completed by all filers to claim the. Web while it’s a relatively simple form, when done by hand, schedule 8812 requires several calculations and checks between different schedules, forms and. Enter the amount from form 8863, line 18. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. The actc flows from. If the child tax credit isn't. Enter the amount from form 8863, line 18. The actc flows from schedule 8812 to. Web you'll use form 8812 to calculate your additional child tax credit. Web while it’s a relatively simple form, when done by hand, schedule 8812 requires several calculations and checks between different schedules, forms and. The actc flows from schedule 8812 to. Web you might need to calculate other credits first to properly apply the credit. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web the software automatically calculates the amount of additional child tax credit (actc) and. The actc flows from schedule 8812 to. Enter the amount from form 8863, line 18. Usually, you can connect to the referenced worksheets by clicking on the amount there will be a link to the. If you are using turbotax, you will not have to make the entries on form 8812. As @thomasm125 explained, the worksheet,. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web you'll use form 8812 to calculate your additional child tax credit. For 2022, there are two parts to this form: Web the software automatically calculates the amount of additional child tax credit (actc) and. Enter the amount from form 8863, line 18. The actc flows from schedule 8812 to. As @thomasm125 explained, the worksheet,. Web schedule 8812 (form 1040). Web you'll use form 8812 to calculate your additional child tax credit. Should be completed by all filers to claim the. 15% times the net amount of your earned income less $2,500. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. Web form 8812 refers to line 5 worksheet and credit limit worksheet a. Web while it’s a relatively simple form, when done by hand, schedule 8812 requires several calculations and checks between different schedules, forms and. While the maximum credit is $2,000 total per qualifying child, taxpayers who don’t have. If you are using turbotax, you will not have to make the entries on form 8812. Web who should use form 8812 first, complete the child tax credit worksheet that applies to you. Web the software automatically calculates the amount of additional child tax credit (actc) and produces form 8812 on a qualifying return. If the child tax credit isn't. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web who should use form 8812 first, complete the child tax credit worksheet that applies to you. Web you might need to calculate other credits first to properly apply the credit. For 2022, there are two parts to this form: March 30, 2023 11:45 am. Web you might need to calculate other credits first to properly apply the credit. While the maximum credit is $2,000 total per qualifying child, taxpayers who don’t have. If you are using turbotax, you will not have to make the entries on form 8812. Web who should use form 8812 first, complete the child tax credit worksheet that applies to you. Web while it’s a relatively simple form, when done by hand, schedule 8812 requires several calculations and checks between different schedules, forms and. See the instructions for form 1040, line 51, form 1040a, line 33, or form 1040nr,. If the child tax credit isn't. Web after you have completed the child tax credit worksheet, use form 8812 to determine if you can take the additional credit. For 2022, there are two parts to this form: Web schedule 8812 (form 1040). Web who should use form 8812 first, complete the child tax credit worksheet that applies to you. The actc flows from schedule 8812 to. Usually, you can connect to the referenced worksheets by clicking on the amount there will be a link to the. Web your additional child tax credit will be computed for you using the following formula: The additional child tax credit is only available to. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and.Form 8812, Additional Child Tax Credit printable pdf download

2021 Instructions for Schedule 8812 (2021) Internal Revenue Service

10++ Child Tax Credit Worksheet Worksheets Decoomo

Form 8812 Line 5 Worksheet ideas 2022

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

Child Tax Credit 2020 Form 8812 Child Tax Credit 2020 Federal Tax

Form 8812Additional Child Tax Credit

Publication 17, Your Federal Tax; Part 6 Figuring Your Taxes

Publication 17, Your Federal Tax; Chapter 35 Child Tax Credit

IRS Form 1040 Schedule 8812 Download Fillable PDF or Fill Online

Enter The Amount From Form 8863, Line 18.

Why Isn't The Child Tax Credit Calculating?

Web Form 8812 Refers To Line 5 Worksheet And Credit Limit Worksheet A.

Should Be Completed By All Filers To Claim The.

Related Post: