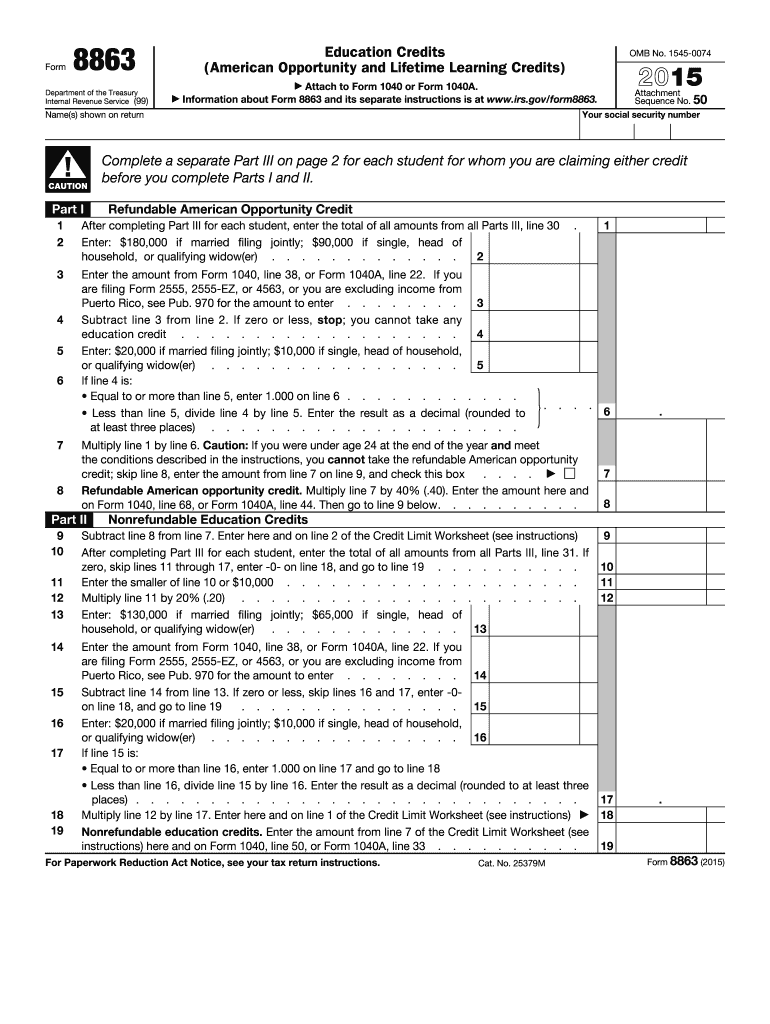

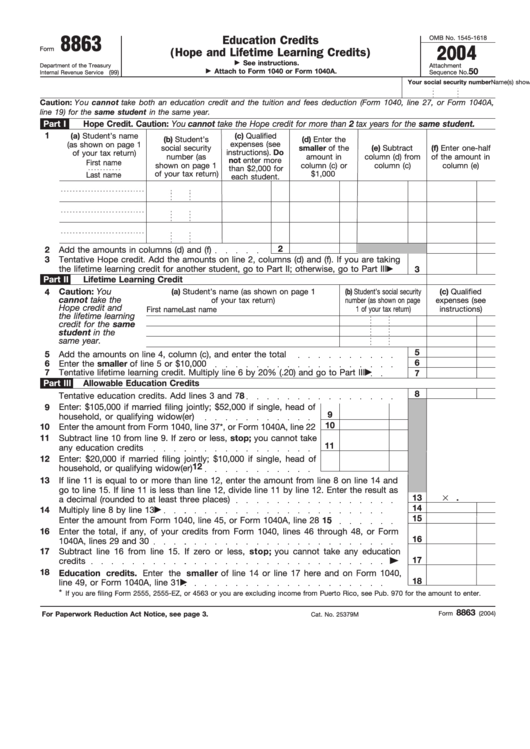

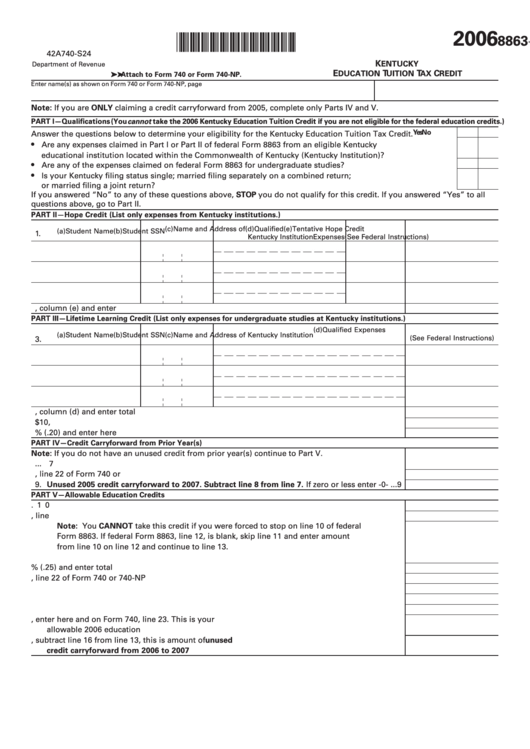

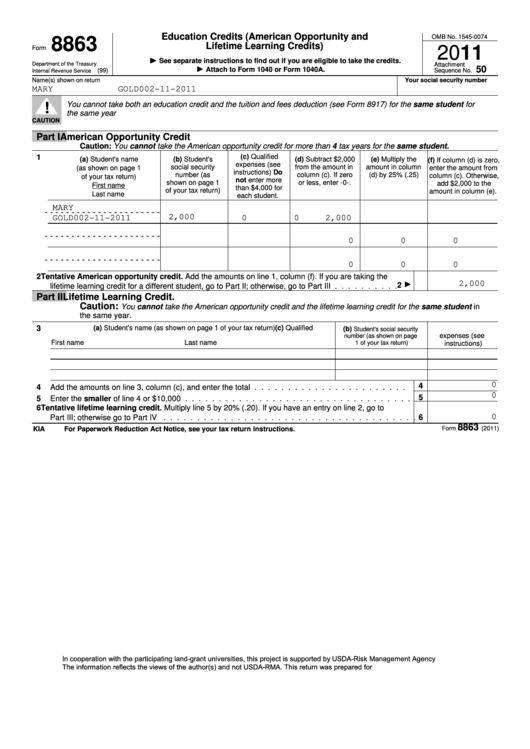

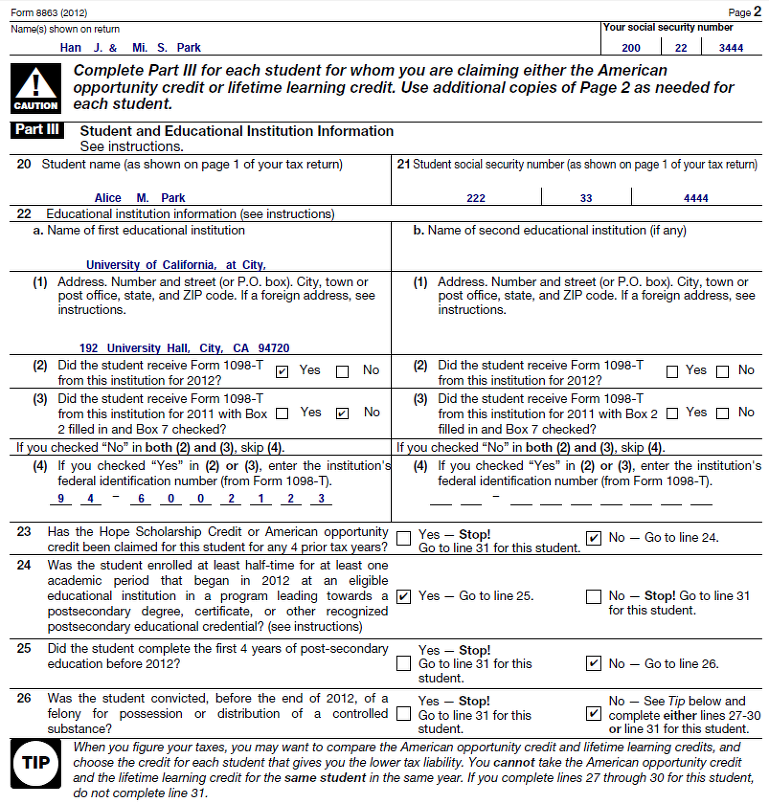

Form 8863 Credit Limit Worksheet

Form 8863 Credit Limit Worksheet - Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs). You can use this form to get a tax credit for qualifying postsecondary education costs. Web the credit limit worksheet is a part of form 8863. Web our website 8863taxform.net provides helpful materials for taxpayers seeking to fill out the credit limit worksheet of form 8863. Taxpayers can access this form on the irs website, either filling it out electronically or printing a blank copy. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Enter the total of all amounts from all parts iii, line 31. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Web form 8863 credit limit worksheet is a tool used to calculate education credits. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web our website 8863taxform.net provides helpful materials for taxpayers seeking to fill out the credit limit worksheet of form 8863. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. The website offers. You can use this form to get a tax credit for qualifying postsecondary education costs. Web the credit limit worksheet is a part of form 8863. Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs). Web 6 rows the credit limit worksheet of form 8863 is a section of the form. Web the federal 8863 form purpose & using terms. Web the credit limit worksheet is a part of form 8863. Enter the total of all amounts from all parts iii, line 31. Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. Taxpayers can access this form on the irs website, either filling it out electronically or. Web our website 8863taxform.net provides helpful materials for taxpayers seeking to fill out the credit limit worksheet of form 8863. Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. Web the credit limit worksheet is a part of form 8863. Web 6 rows the credit limit worksheet of form 8863 is a section of the form. Enter the total of all amounts from all parts iii, line 31. Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Web how can i view the credit limit worksheet on line 19 of form 8863 to determine why. The website offers comprehensive instructions on. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. Web how can i view the credit limit worksheet on line 19 of form 8863 to determine why i'm receiving the. Taxpayers can access this form on the irs website, either filling it out electronically or printing a blank copy. Web form 8863 credit limit worksheet is a tool used to calculate education credits. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. The website offers comprehensive instructions on. Use. Enter the total of all amounts from all parts iii, line 31. Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. Web our website 8863taxform.net provides helpful materials for taxpayers seeking to fill out the credit limit worksheet of form 8863. Web 6 rows the credit limit worksheet of form 8863 is a section of the. Enter the total of all amounts from all parts iii, line 31. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web our website 8863taxform.net provides helpful materials for taxpayers seeking to fill out the credit limit worksheet of form 8863. Web 6 rows. Enter the total of all amounts from all parts iii, line 31. Taxpayers can access this form on the irs website, either filling it out electronically or printing a blank copy. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web form 8863 credit. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Web our website 8863taxform.net provides helpful materials for taxpayers seeking to fill out the credit limit worksheet of form 8863. Enter the total of all amounts from all parts iii, line 31. Taxpayers can access this form on the irs website, either filling it out electronically or printing a blank copy. Enter the amount from form 8863, line 18 1. The website offers comprehensive instructions on. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs). Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. You can use this form to get a tax credit for qualifying postsecondary education costs. Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for. Web how can i view the credit limit worksheet on line 19 of form 8863 to determine why i'm receiving the credit when the irs is saying its an error. Web the credit limit worksheet is a part of form 8863. Web the federal 8863 form purpose & using terms. Web see form 8862 and its instructions for details. Web form 8863 credit limit worksheet is a tool used to calculate education credits. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs). Enter the amount from form 8863, line 18 1. Taxpayers can access this form on the irs website, either filling it out electronically or printing a blank copy. Web see form 8862 and its instructions for details. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web the federal 8863 form purpose & using terms. Web the credit limit worksheet computes the allowable nonrefundable education credits line 10. Web the credit limit worksheet is a part of form 8863. Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for. You can use this form to get a tax credit for qualifying postsecondary education costs. Web form 8863 credit limit worksheet is a tool used to calculate education credits.IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Credit Limit Worksheet 2020

Form 8863 Fill Out and Sign Printable PDF Template signNow

Read PDF form 8863 credit limit worksheet (PDF) vcon.duhs.edu.pk

Form 8863 Edit, Fill, Sign Online Handypdf

Fillable Form 8863 Education Credits (Hope And Lifetime Learning

Form 8863K Education Tuition Tax Credit printable pdf download

Sample Form 8863 Education Credits (American Opportunity And Lifetime

Education Credit 2 Form 8863 American Opportunity Credit Non

Read PDF form 8863 credit limit worksheet (PDF) vcon.duhs.edu.pk

The Website Offers Comprehensive Instructions On.

Enter The Total Of All Amounts From All Parts Iii, Line 31.

Web How Can I View The Credit Limit Worksheet On Line 19 Of Form 8863 To Determine Why I'm Receiving The Credit When The Irs Is Saying Its An Error.

Web Our Website 8863Taxform.net Provides Helpful Materials For Taxpayers Seeking To Fill Out The Credit Limit Worksheet Of Form 8863.

Related Post: