Fuel Tax Credits Calculation Worksheet

Fuel Tax Credits Calculation Worksheet - Web you will reduce admin effort on making fuel tax credit claims; Web fuel tax credits step 1: Web fuel tax credits reinstated and extended. Web the alternative fuel credit. Work out the eligible quantity work out how much fuel (liquid or. Web fuel tax credit: Web download a printable version of fuel tax credits calculation worksheet (nat 15634,. Web taxpayers who wish to claim the credit must file form 8849, claim for. Work with specialists who know how to get the most out of tax credits and incentives. Web eligible fuel type total fuel acquistions (litres) business fuel use. Web you will reduce admin effort on making fuel tax credit claims; Work with specialists who know how to get the most out of tax credits and incentives. Web download a printable version of fuel tax credits calculation worksheet (nat 15634,. Web eligible fuel type total fuel acquistions (litres) business fuel use. Web fuel tax credits calculation worksheet business activity. Work with an experienced state and local tax team to leverage credits and incentives. Web the alternative fuel credit. Web fuel tax credits reinstated and extended. A federal subsidy that allows businesses to reduce their. Web you will reduce admin effort on making fuel tax credit claims; Web the alternative fuel credit. Work out the eligible quantity work out how much fuel (liquid or. Work with an experienced state and local tax team to leverage credits and incentives. Web you will reduce admin effort on making fuel tax credit claims; Work with specialists who know how to get the most out of tax credits and incentives. A federal subsidy that allows businesses to reduce their. Work out the eligible quantity work out how much fuel (liquid or. Work with an experienced state and local tax team to leverage credits and incentives. Web fuel tax credits step 1: Web fuel tax credits calculation worksheet business activity statement period to eligible fuel. Web fuel tax credits step 1: Web eligible fuel type total fuel acquistions (litres) business fuel use. A credit for certain nontaxable uses (or sales) of fuel during. Work with specialists who know how to get the most out of tax credits and incentives. Web taxpayers who wish to claim the credit must file form 8849, claim for. A federal subsidy that allows businesses to reduce their. Work out the eligible quantity work out how much fuel (liquid or. Web the alternative fuel credit. Web you will reduce admin effort on making fuel tax credit claims; A credit for certain nontaxable uses (or sales) of fuel during. Work with an experienced state and local tax team to leverage credits and incentives. A federal subsidy that allows businesses to reduce their. Web you will reduce admin effort on making fuel tax credit claims; Web fuel tax credit: Web eligible fuel type total fuel acquistions (litres) business fuel use. Web eligible fuel type total fuel acquistions (litres) business fuel use. Work with specialists who know how to get the most out of tax credits and incentives. Web the alternative fuel credit. Work with an experienced state and local tax team to leverage credits and incentives. Web fuel tax credits calculation worksheet business activity statement period to eligible fuel. Web taxpayers who wish to claim the credit must file form 8849, claim for. Work with an experienced state and local tax team to leverage credits and incentives. Web fuel tax credits reinstated and extended. Work out the eligible quantity work out how much fuel (liquid or. Web eligible fuel type total fuel acquistions (litres) business fuel use. Web download a printable version of fuel tax credits calculation worksheet (nat 15634,. Web taxpayers who wish to claim the credit must file form 8849, claim for. Web fuel tax credits reinstated and extended. Web the alternative fuel credit. A federal subsidy that allows businesses to reduce their. Web download a printable version of fuel tax credits calculation worksheet (nat 15634,. Work with an experienced state and local tax team to leverage credits and incentives. Web eligible fuel type total fuel acquistions (litres) business fuel use. Web you will reduce admin effort on making fuel tax credit claims; Web the alternative fuel credit. Work out the eligible quantity work out how much fuel (liquid or. Web fuel tax credits calculation worksheet business activity statement period to eligible fuel. Web fuel tax credits step 1: Web fuel tax credit: A federal subsidy that allows businesses to reduce their. Work with specialists who know how to get the most out of tax credits and incentives. A credit for certain nontaxable uses (or sales) of fuel during. Web taxpayers who wish to claim the credit must file form 8849, claim for. Web fuel tax credits reinstated and extended. A federal subsidy that allows businesses to reduce their. Work out the eligible quantity work out how much fuel (liquid or. Work with an experienced state and local tax team to leverage credits and incentives. Web taxpayers who wish to claim the credit must file form 8849, claim for. Web fuel tax credits reinstated and extended. Web fuel tax credits step 1: Web eligible fuel type total fuel acquistions (litres) business fuel use. A credit for certain nontaxable uses (or sales) of fuel during. Work with specialists who know how to get the most out of tax credits and incentives. Web you will reduce admin effort on making fuel tax credit claims; Web download a printable version of fuel tax credits calculation worksheet (nat 15634,.Calculating Fuel Tax Credit manually PS Support

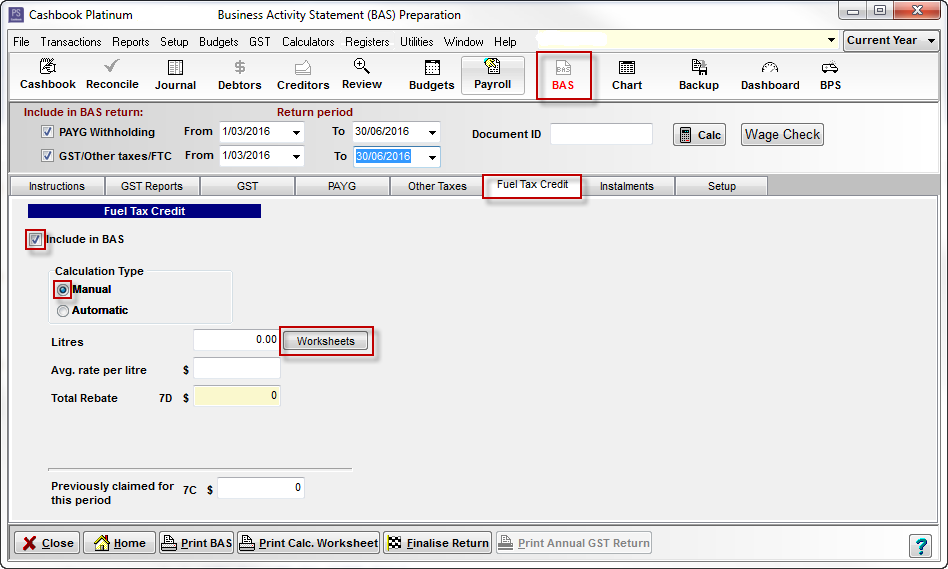

Calculating Fuel Tax Credit manually PS Support

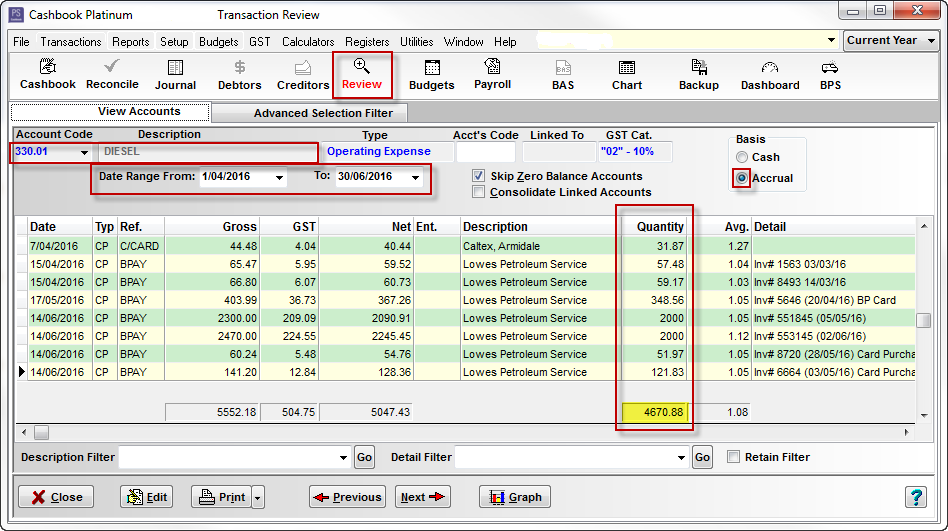

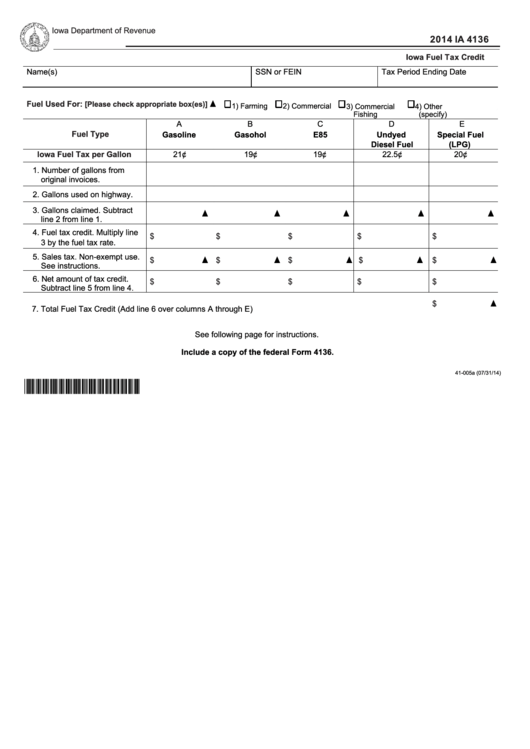

Fillable Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit

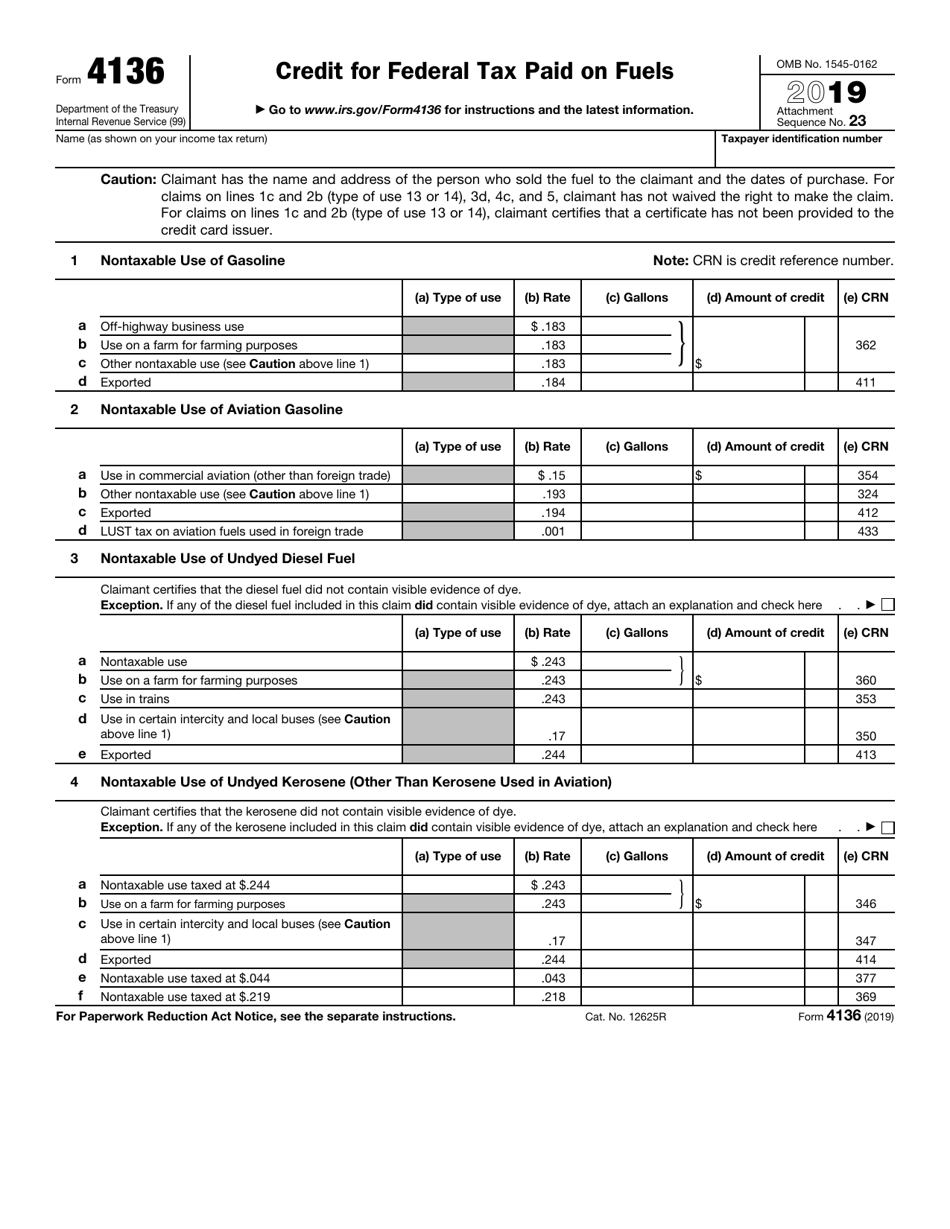

Fuel Tax Credit Calculator Worksheet TAXP

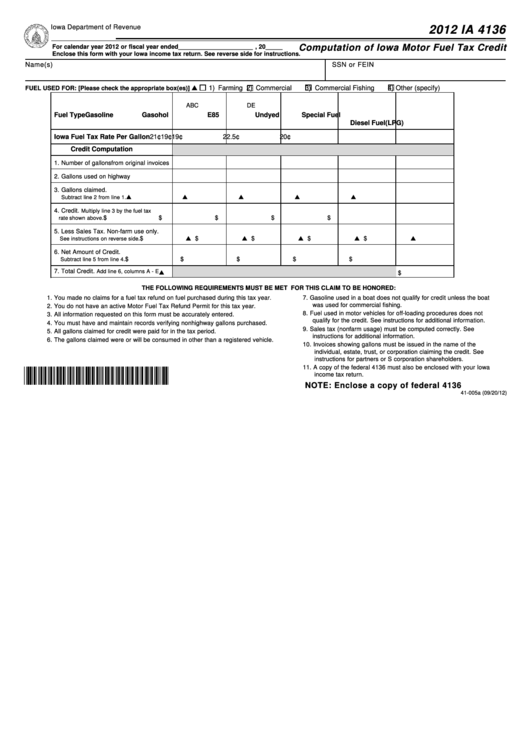

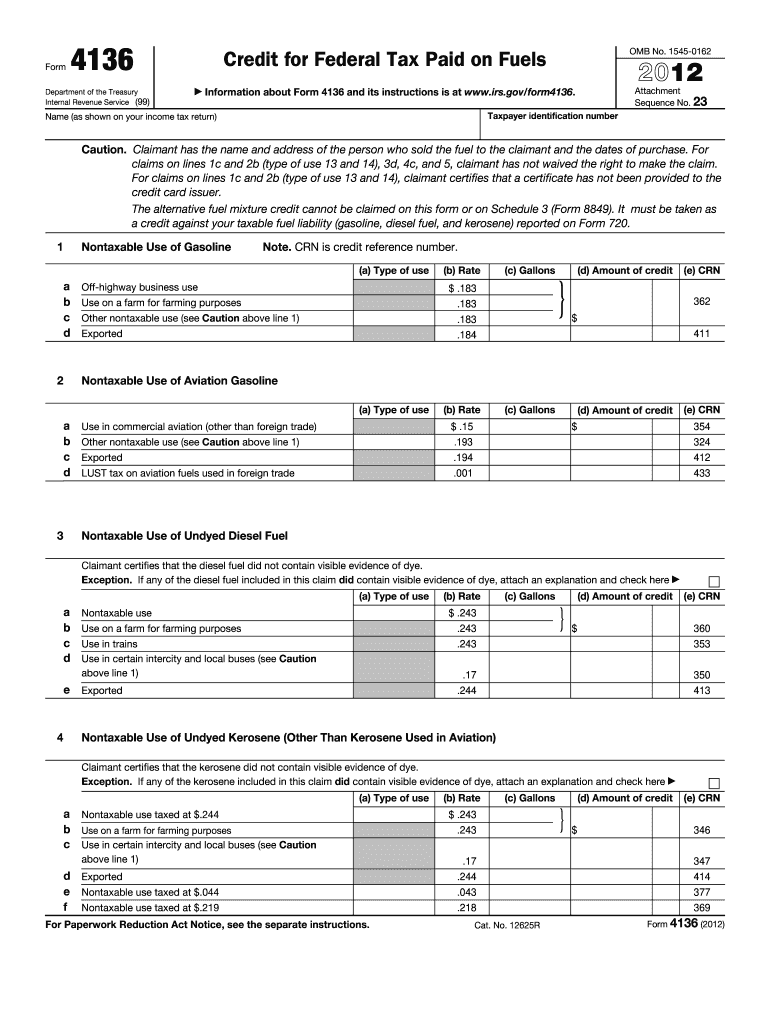

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

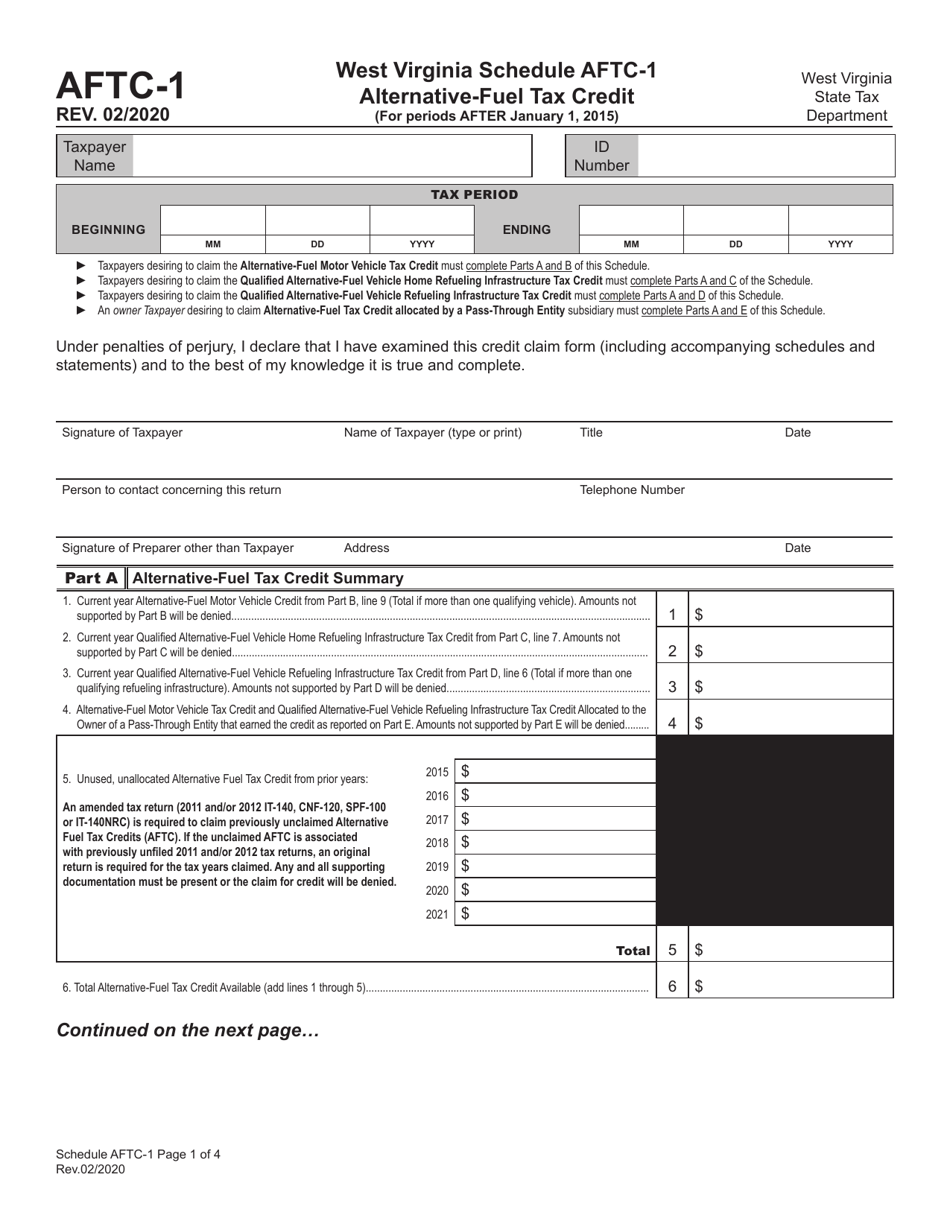

Schedule AFTC1 Download Printable PDF or Fill Online AlternativeFuel

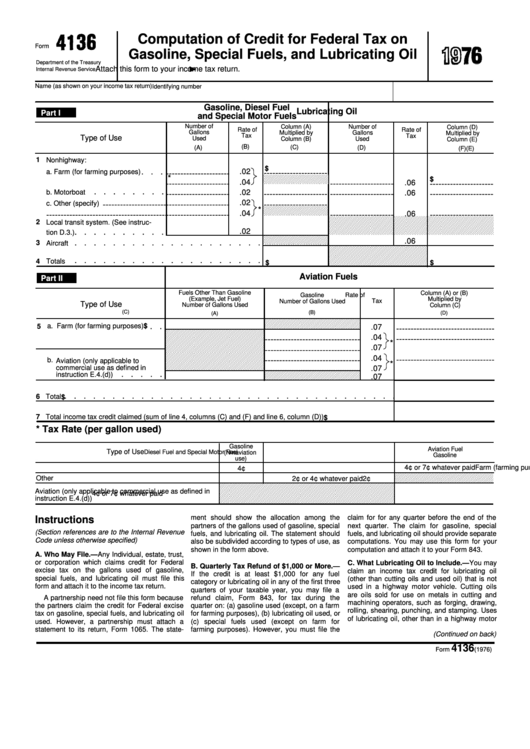

Form 4136 Computation Of Credit For Federal Tax On Gasoline, Special

Fillable Form Ia 4136 Iowa Fuel Tax Credit 2014 printable pdf download

Fuel Tax Credit Calculator Worksheet TAXP

Fuel Tax Credit Registration Tax Agent Portal

Web Fuel Tax Credit:

Web Fuel Tax Credits Calculation Worksheet Business Activity Statement Period To Eligible Fuel.

Web The Alternative Fuel Credit.

Related Post: