Gross Compensation Worksheet Turbotax

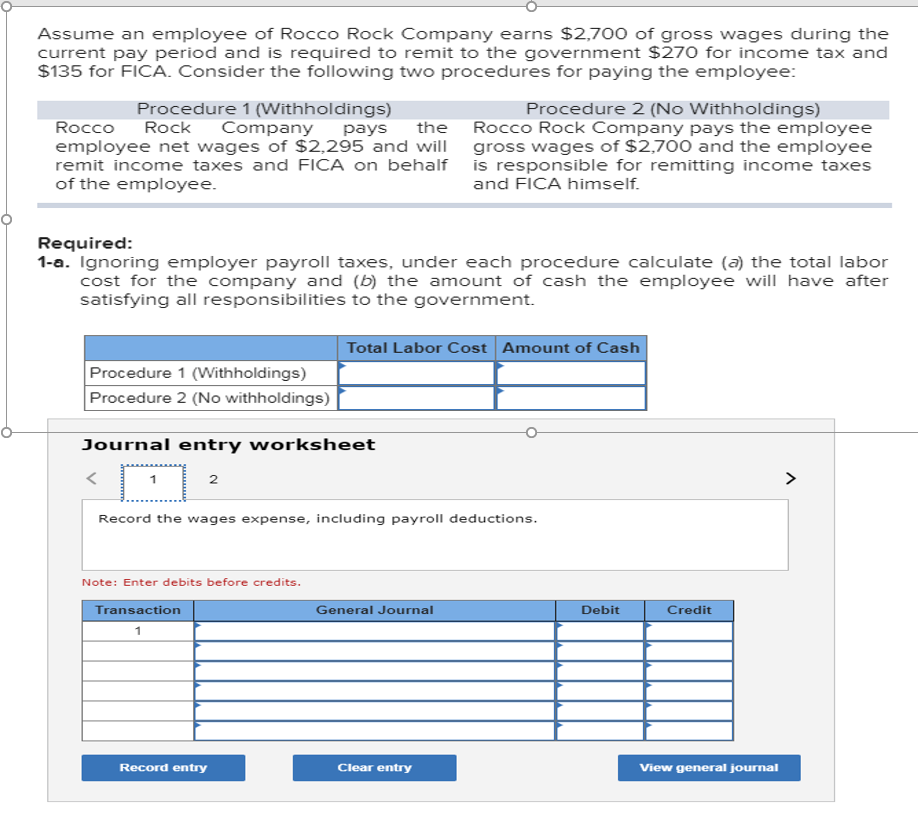

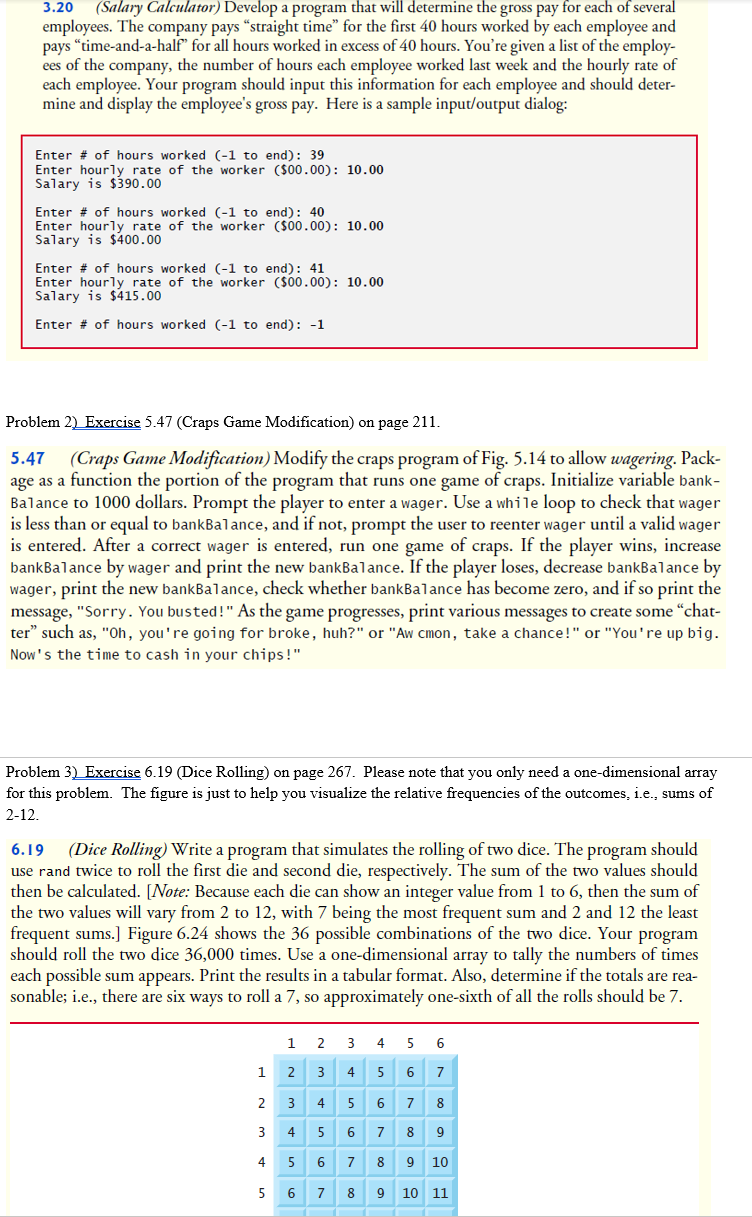

Gross Compensation Worksheet Turbotax - She is paid $6.25 per hour for. For pennsylvania personal income tax purposes, the term “compensation” includes. Compensation and break apart with subtraction with double digit numbers. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his hourly pay? It includes the full amount of pay before any taxes or deductions. Emma is a sales clerk at a bicycle shop. Subtract the total tax rates from the number 1. Add up all federal, state, and local tax rates. Web gross pay is the total amount of money an employee earns for time worked. Web no, you do not need to mail the gross compensation worksheet with your return. Web no, you do not need to mail the gross compensation worksheet with your return. Use this worksheets to teach and practice the strategies: Web gross pay is the total amount of money an employee earns for time worked. Compensation and break apart with subtraction with double digit numbers. It includes the full amount of pay before any taxes or. Web definition of gross employee compensation for pennsylvania personal income tax. Web gross pay is the total amount of money an employee earns for time worked. Emma is a sales clerk at a bicycle shop. Web no, you do not need to mail the gross compensation worksheet with your return. Web devon worked 40 hours of regular pay receiving $600. For pennsylvania personal income tax purposes, the term “compensation” includes. Web gross pay is the total amount of money an employee earns for time worked. Add up all federal, state, and local tax rates. It includes the full amount of pay before any taxes or deductions. She is paid $6.25 per hour for. Subtract the total tax rates from the number 1. Emma is a sales clerk at a bicycle shop. For pennsylvania personal income tax purposes, the term “compensation” includes. Use this worksheets to teach and practice the strategies: Compensation and break apart with subtraction with double digit numbers. Web no, you do not need to mail the gross compensation worksheet with your return. That is for your records and to be used as a checklist to make sure that you. Emma is a sales clerk at a bicycle shop. Web definition of gross employee compensation for pennsylvania personal income tax. For pennsylvania personal income tax purposes, the term. Add up all federal, state, and local tax rates. She is paid $6.25 per hour for. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his hourly pay? Emma is a sales clerk at a bicycle shop. That is for your records and to be used as a checklist to make sure. Emma is a sales clerk at a bicycle shop. Subtract the total tax rates from the number 1. That is for your records and to be used as a checklist to make sure that you. She is paid $6.25 per hour for. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his. That is for your records and to be used as a checklist to make sure that you. It includes the full amount of pay before any taxes or deductions. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his hourly pay? Web gross pay is the total amount of money an employee. That is for your records and to be used as a checklist to make sure that you. Web gross pay is the total amount of money an employee earns for time worked. Subtract the total tax rates from the number 1. She is paid $6.25 per hour for. Web definition of gross employee compensation for pennsylvania personal income tax. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his hourly pay? It includes the full amount of pay before any taxes or deductions. Subtract the total tax rates from the number 1. Web gross pay is the total amount of money an employee earns for time worked. Web no, you do. Add up all federal, state, and local tax rates. That is for your records and to be used as a checklist to make sure that you. For pennsylvania personal income tax purposes, the term “compensation” includes. She is paid $6.25 per hour for. Compensation and break apart with subtraction with double digit numbers. Web gross pay is the total amount of money an employee earns for time worked. Emma is a sales clerk at a bicycle shop. Web definition of gross employee compensation for pennsylvania personal income tax. Web no, you do not need to mail the gross compensation worksheet with your return. It includes the full amount of pay before any taxes or deductions. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his hourly pay? Use this worksheets to teach and practice the strategies: Subtract the total tax rates from the number 1. Emma is a sales clerk at a bicycle shop. That is for your records and to be used as a checklist to make sure that you. For pennsylvania personal income tax purposes, the term “compensation” includes. Web devon worked 40 hours of regular pay receiving $600 gross pay for the week, what was his hourly pay? Web definition of gross employee compensation for pennsylvania personal income tax. It includes the full amount of pay before any taxes or deductions. Subtract the total tax rates from the number 1. Compensation and break apart with subtraction with double digit numbers. Use this worksheets to teach and practice the strategies: Add up all federal, state, and local tax rates.️Gross Pay Worksheet Free Download Gambr.co

Is base salary the same as gross pay?

️Gross Pay Worksheet Free Download Gambr.co

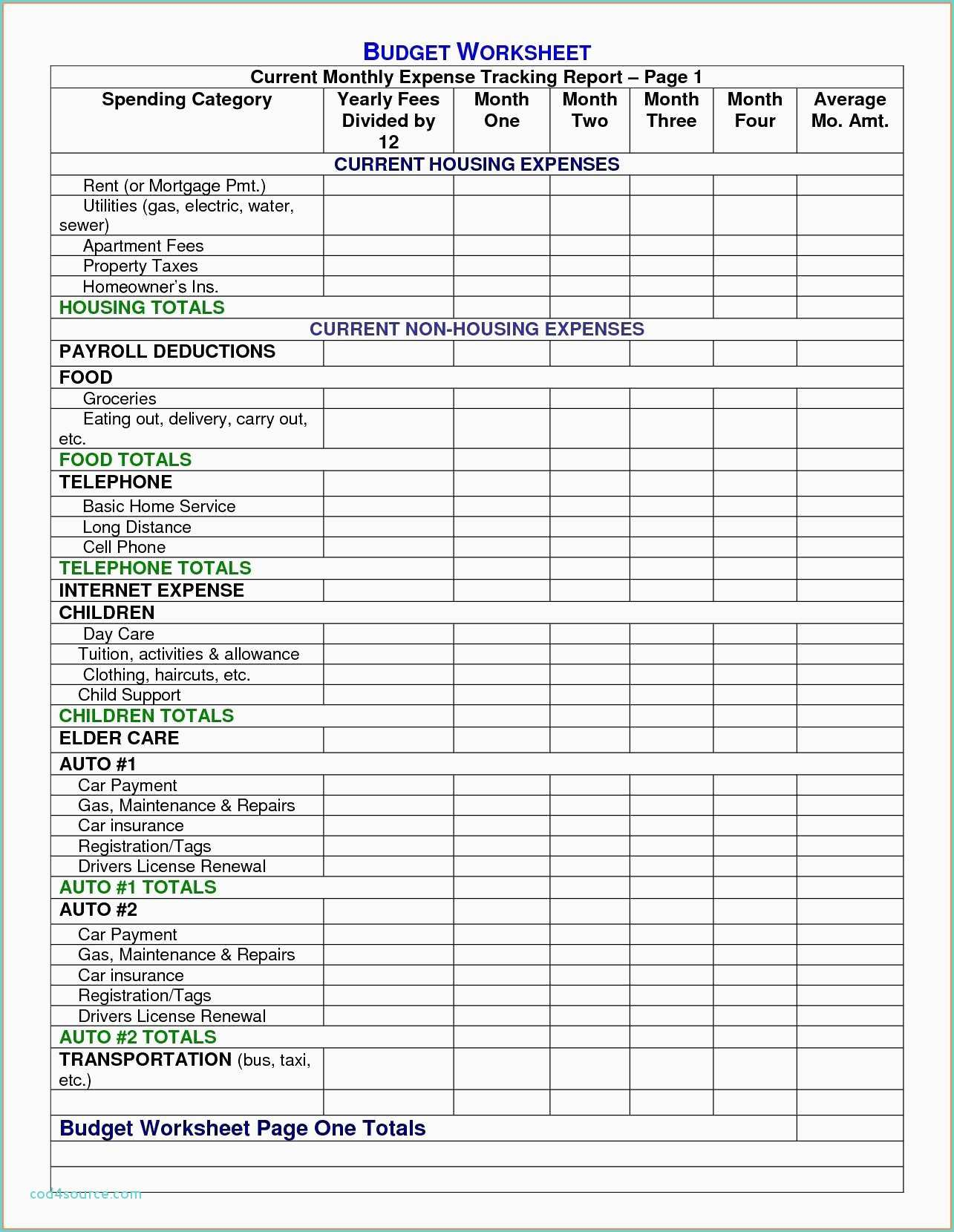

Total Compensation Spreadsheet regarding Total Compensation Statement

Calculating Gross Pay, NIB Contribution and Net Pay worksheet

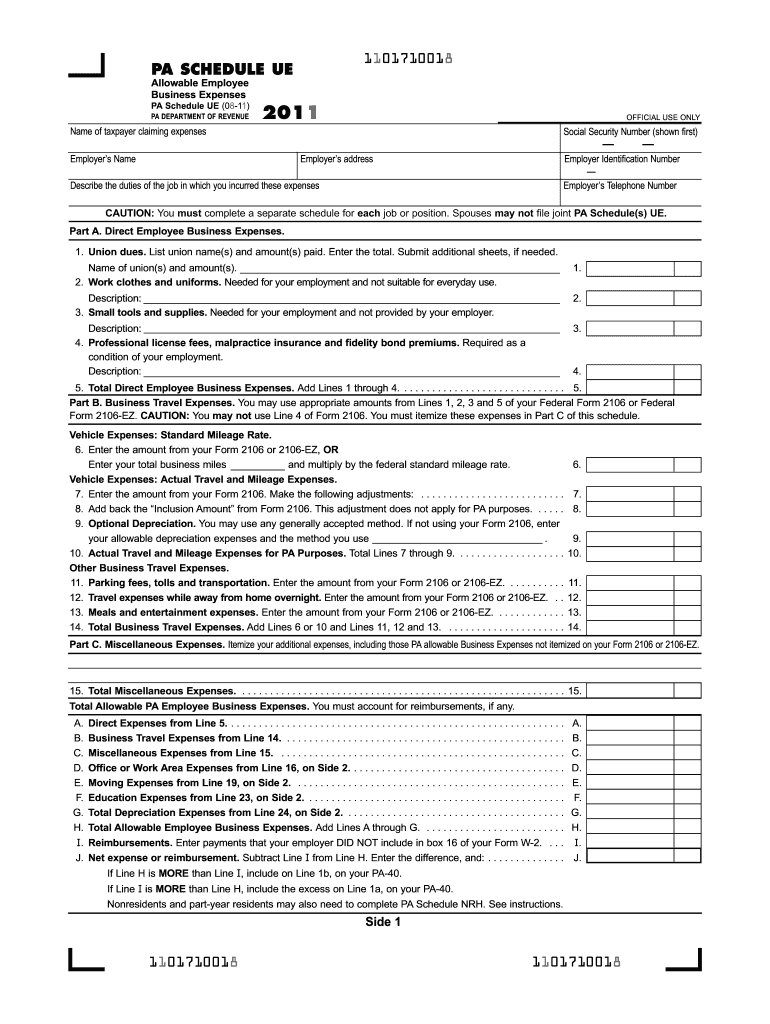

Schedule Ue Turbotax Form Fill Out and Sign Printable PDF Template

Calculating Gross Pay Worksheet in 2020 Student loan repayment

Gross pay to hourly rate calculator SharronKool

calculating gross pay worksheet

Gross Pay worksheet

Web Gross Pay Is The Total Amount Of Money An Employee Earns For Time Worked.

Web No, You Do Not Need To Mail The Gross Compensation Worksheet With Your Return.

She Is Paid $6.25 Per Hour For.

Related Post: