How To Fill Out Mw507 Personal Exemptions Worksheet

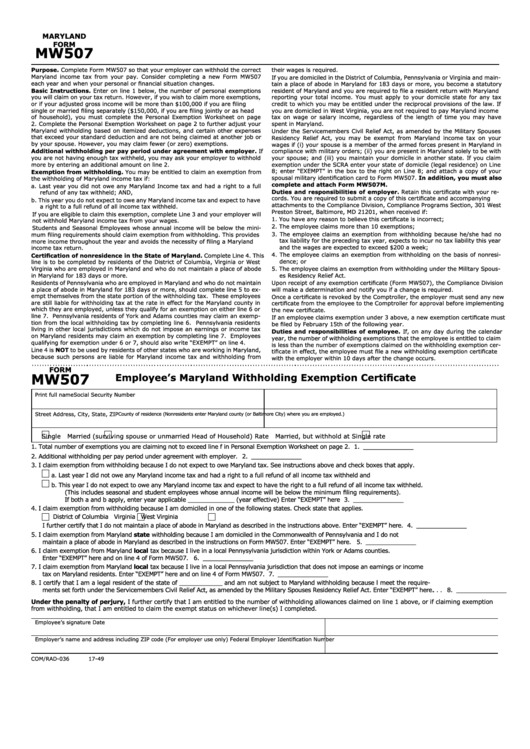

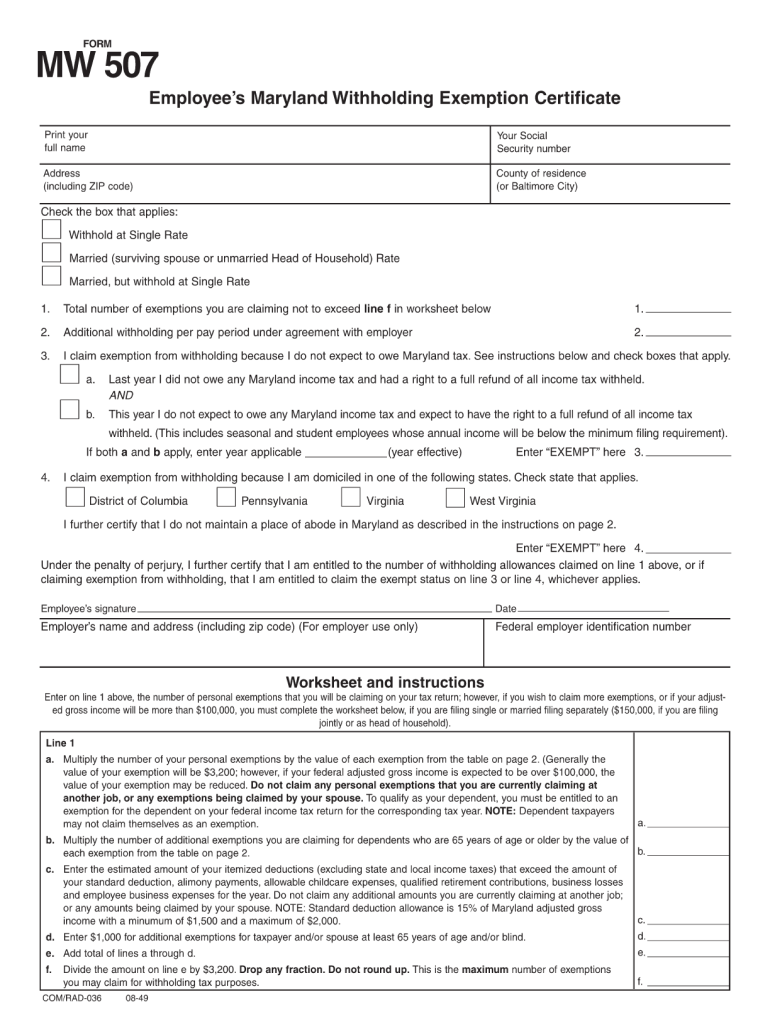

How To Fill Out Mw507 Personal Exemptions Worksheet - Number of additional exemptions for dependents over 65. Additional deduction of $3,200 for each. Just enter exempt on line 5 of the form. I claim exemption from maryland local tax because i live in a local pennysylvania jurisdiction within york or adams counties. Open it using the online editor and start. Web in this post, i will show you how to fill out mw507 form. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did not ow any md income and/or i. Web how to determine the number of exemptions to claim. Web you don't have to fill out any exemptions on mw507. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web i can't fill out the form for you, but here are the instructions for the mw507. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did not ow any md income and/or i. Consider completing a new form mw507. Web in this post, i will show you how to fill out mw507 form. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately. Web i can't fill out the form for you, but here are the instructions for the mw507. Multiply. Web how to determine the number of exemptions to claim. I claim exemption from withholding because i am domiciled in the following state. Web mw 507 personal exemptions worksheet line 1 a. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately.. If you have only one job, no dependents and take the standard deduction all you need to do is complete step 1 and. Web how to fill out form mw507 personal exemptions worksheet the second page of form mw507 is the personal exemptions worksheet. Multiply the number of your personal exemptions by the value of each exemption from the table. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did not ow any md income and/or i. Learn how to fill out mw507 personal exemptions worksheet without making any mistake. Enter exempt here and on line 4 of form. Number. Learn how to fill out mw507 personal exemptions worksheet without making any mistake. Number of additional exemptions for dependents over 65. Since you are a resident of pa, you don't have to have md taxes. Web this is the worksheet form that your employee will need to fill out so that you can calculate the estimated income tax to withhold. Multiply the number of your personal exemptions by the value of each exemption from the table below. Open it using the online editor and start. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did not ow any md income. Consider completing a new form mw507 each year and when your. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. Virginia i further certify that i do not maintain a place of abode in maryland as described in the. Web exemptions, or if your adjusted gross income will be more. Web in this post, i will show you how to fill out mw507 form. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately. Virginia i further certify that i do not maintain a place of abode in maryland as described in. Additional deduction of $3,200 for each. Consider completing a new form mw507 each year and when your. I claim exemption from withholding because i am domiciled in the following state. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did. I claim exemption from withholding because i am domiciled in the following state. Web this is the worksheet form that your employee will need to fill out so that you can calculate the estimated income tax to withhold from the employee’s paycheck based on their. Web fill online, printable, fillable, blank form mw507 employee withholding exemption certificate 2021: Enter exempt here and on line 4 of form. Virginia i further certify that i do not maintain a place of abode in maryland as described in the. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as. Number of additional exemptions for dependents over 65. Open it using the online editor and start. Web how to fill out form mw507 personal exemptions worksheet the second page of form mw507 is the personal exemptions worksheet. Additional deduction of $3,200 for each. I claim exemption from maryland local tax because i live in a local pennysylvania jurisdiction within york or adams counties. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did not ow any md income and/or i. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. If you have only one job, no dependents and take the standard deduction all you need to do is complete step 1 and. Web you don't have to fill out any exemptions on mw507. Web mw 507 personal exemptions worksheet line 1 a. Web i can't fill out the form for you, but here are the instructions for the mw507. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately. Learn how to fill out mw507 personal exemptions worksheet without making any mistake. Enter exempt here and on line 4 of form. I claim exemption from maryland local tax because i live in a local pennysylvania jurisdiction within york or adams counties. Web how to fill out form mw507 personal exemptions worksheet the second page of form mw507 is the personal exemptions worksheet. Consider completing a new form mw507 each year and when your. Web in this post, i will show you how to fill out mw507 form. Web fill online, printable, fillable, blank form mw507 employee withholding exemption certificate 2021: Learn how to fill out mw507 personal exemptions worksheet without making any mistake. Since you are a resident of pa, you don't have to have md taxes. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. Web this line says i claim exemption from withholding because i do not expect to owe md tax and says to check the boxes that apply last year i did not ow any md income and/or i. Multiply the number of your personal exemptions by the value of each exemption from the table below. Additional deduction of $3,200 for each. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web this is the worksheet form that your employee will need to fill out so that you can calculate the estimated income tax to withhold from the employee’s paycheck based on their. I claim exemption from withholding because i am domiciled in the following state. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately.California W4 Form 2022 W4 Form

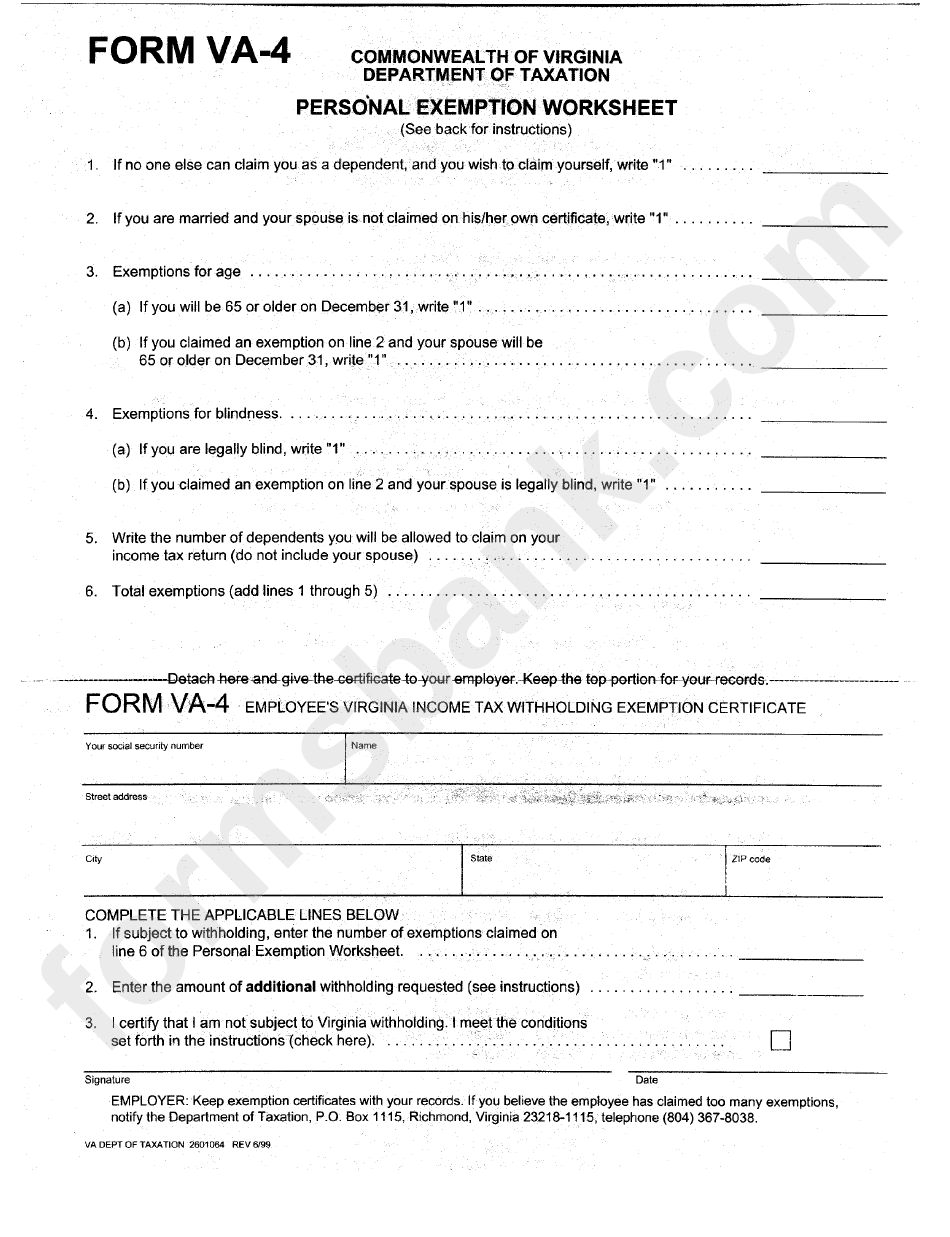

Form Va4 Personal Exemption Worksheet printable pdf download

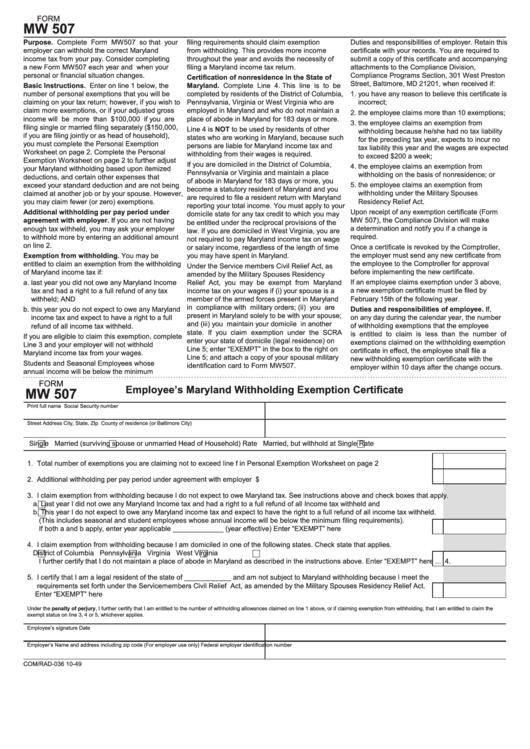

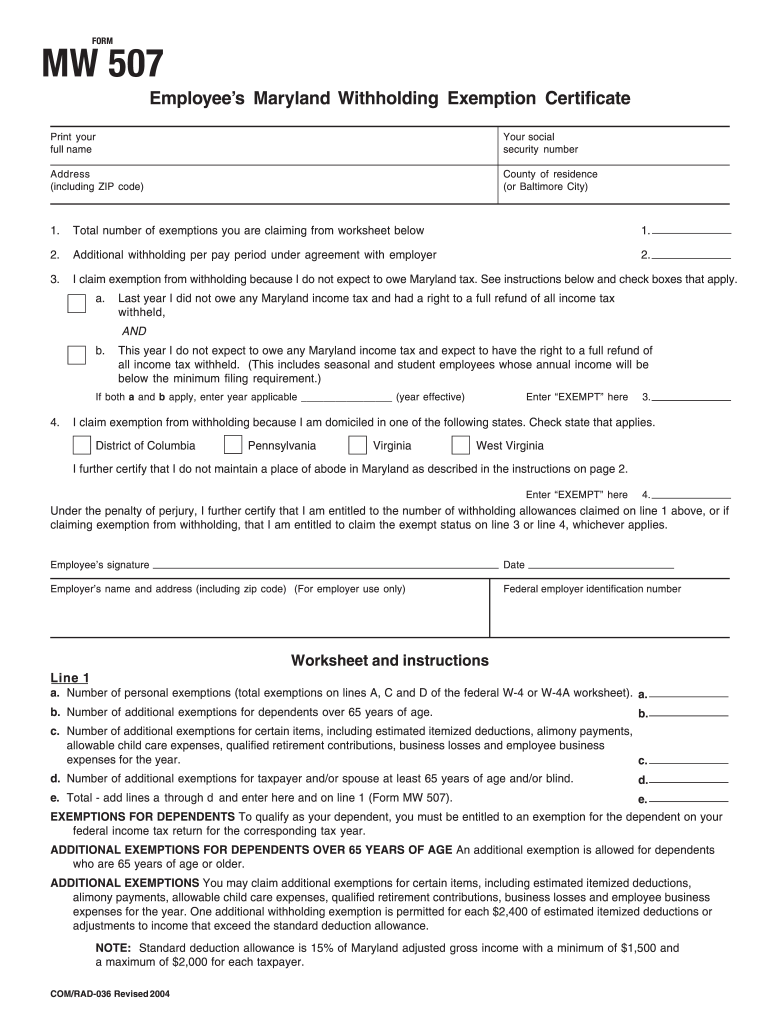

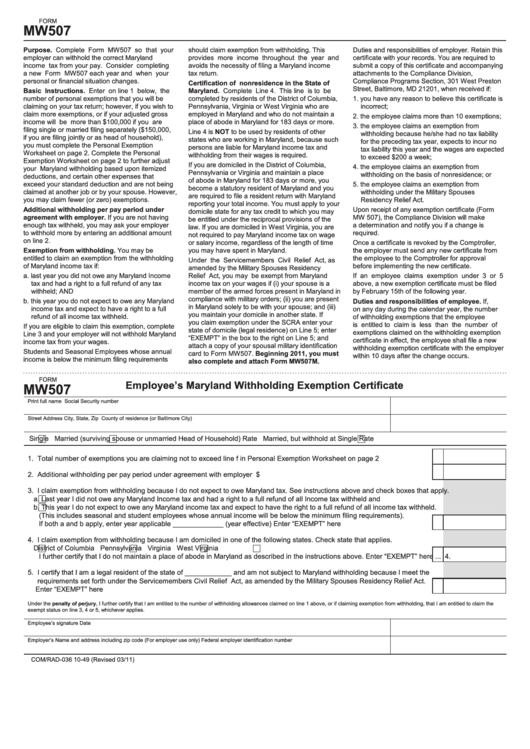

Fillable Form Mw507 Employee'S Maryland Withholding Exemption

Fill Free fillable forms Comptroller of Maryland

Mw507 Tutorial Fill Out and Sign Printable PDF Template signNow

mw507 Withholding Tax Personal Exemption (United States)

Top 6 Mw507 Form Templates free to download in PDF format

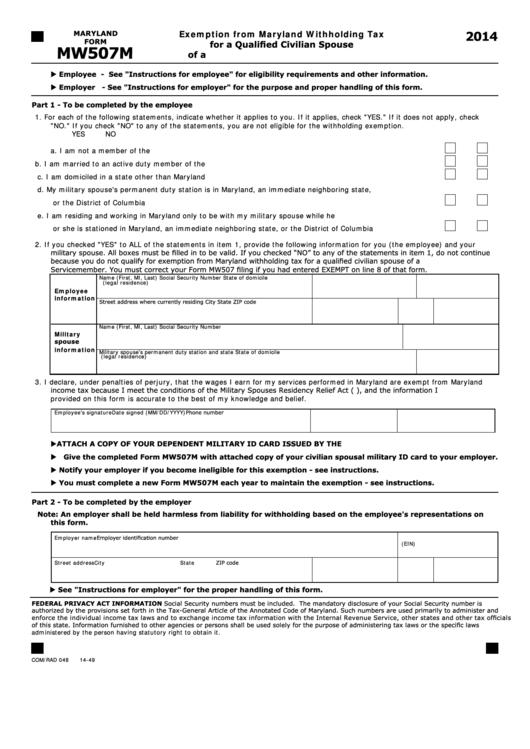

Fillable Maryland Form Mw507m Exemption From Maryland Withholding Tax

Form Mw507 Example Fill Out and Sign Printable PDF Template signNow

Form Mw507 Employee's Maryland Withholding Exemption Certificate

Web Mw 507 Personal Exemptions Worksheet Line 1 A.

If You Have Only One Job, No Dependents And Take The Standard Deduction All You Need To Do Is Complete Step 1 And.

Web How To Determine The Number Of Exemptions To Claim.

Just Enter Exempt On Line 5 Of The Form.

Related Post: