Hsa Value Smart Worksheet

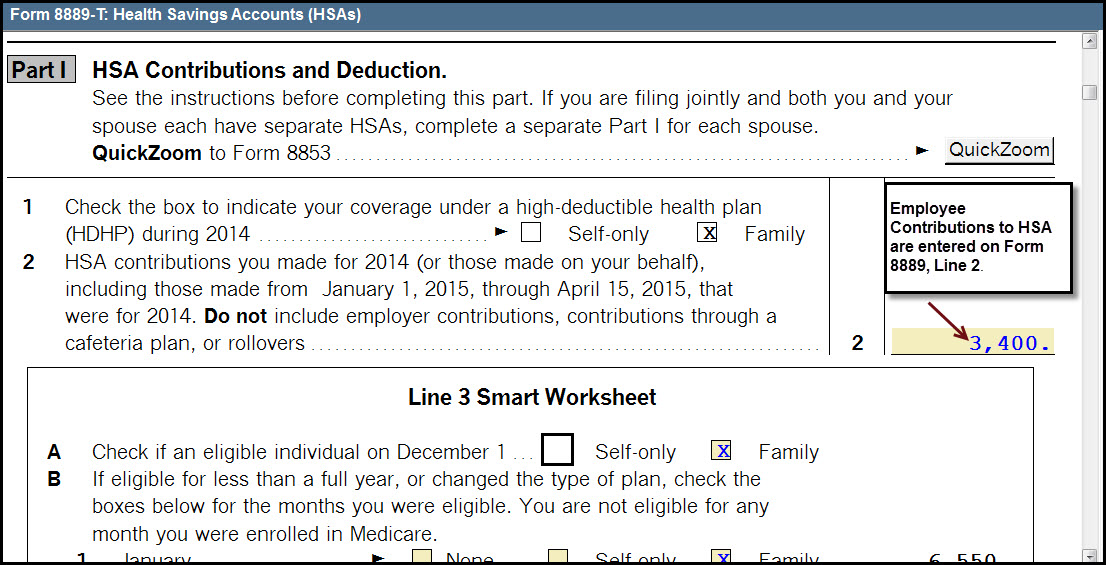

Hsa Value Smart Worksheet - Web solved•by intuit•99•updated july 19, 2022. Web discover how much money you can save with an hsa. Because it offers potential tax. Web if your organization offers an hsa as an employee benefit, your hr team should consideration educating employees about the tax advantages. Evaluate your 2023 contribution plan. Web 2023 hsa contribution limits. This article will help you: Sign the to the community button augury on to turbotax and start working on my taxes Web using the sliders or entry boxes, enter your hsa information. Web solved•by intuit•31•updated july 13, 2022. Web the maximum amount you're allowed to contribute to an hsa in 2023 is $3,850 if you participate in the high deductible health plan (hdhp) as an individual, or $7,750 if you. Sign the to the community button augury on to turbotax and start working on my taxes Web why sign in in the community? The hsa savings calculator should. The hsa savings calculator should only be used as a guide to measure hypothetical. Web using the sliders or entry boxes, enter your hsa information. Web solved•by intuit•31•updated july 13, 2022. Evaluate your 2023 contribution plan. Web discover how much money you can save with an hsa. Web contributing to your health savings account is easy. Web solved•by intuit•99•updated july 19, 2022. Web if your organization offers an hsa as an employee benefit, your hr team should consideration educating employees about the tax advantages. Understand the flow of health savings account (hsa) information throughout your. Web 2023 hsa contribution limits. High deductible health plans (hdhp) with a health savings account (hsa) allow you to set up a savings account in which you can accumulate additional money on. Web why sign in in the community? Web solved•by intuit•99•updated july 19, 2022. The hsa savings calculator should only be used as a guide to measure hypothetical. This article will help you: Web solved•by intuit•99•updated july 19, 2022. Web why sign in in the community? Web solved•by intuit•31•updated july 13, 2022. Learning center / calculators & tools. Those 55 and older can contribute an. You can save money in your hsa account before taxes and use the funds to pay for eligible health care expenses. Web contributing to your health savings account is easy. This article will help you: Web 2023 hsa contribution limits. Web solved•by intuit•99•updated july 19, 2022. Evaluate your 2023 contribution plan. Learning center / calculators & tools. Web using the sliders or entry boxes, enter your hsa information. Web why sign in in the community? You can save money in your hsa account before taxes and use the funds to pay for eligible health care expenses. Understand the flow of health savings account (hsa) information throughout your. Web discover how much money you can save with an hsa. Web the maximum amount you're allowed to contribute to an hsa in 2023 is $3,850 if you participate in the high deductible health plan (hdhp) as an individual, or $7,750 if you. Web solved•by intuit•31•updated july 13, 2022.. Web the maximum contribution for an individual hsa in 2022 was $3,650, while the contribution limit for a family hsa was $7,300. Learning center / calculators & tools. Those 55 and older can contribute an. Sign the to the community button augury on to turbotax and start working on my taxes This article will help you: You can save money in your hsa account before taxes and use the funds to pay for eligible health care expenses. Web using the sliders or entry boxes, enter your hsa information. Web the maximum amount you're allowed to contribute to an hsa in 2023 is $3,850 if you participate in the high deductible health plan (hdhp) as an individual,. Web solved•by intuit•31•updated july 13, 2022. Web the maximum contribution for an individual hsa in 2022 was $3,650, while the contribution limit for a family hsa was $7,300. Web 2023 hsa contribution limits. The hsa savings calculator should only be used as a guide to measure hypothetical. Web if your organization offers an hsa as an employee benefit, your hr team should consideration educating employees about the tax advantages. Web why sign in in the community? Web discover how much money you can save with an hsa. This article will help you: You can save money in your hsa account before taxes and use the funds to pay for eligible health care expenses. Learning center / calculators & tools. Web contributing to your health savings account is easy. Because it offers potential tax. Understand the flow of health savings account (hsa) information throughout your. High deductible health plans (hdhp) with a health savings account (hsa) allow you to set up a savings account in which you can accumulate additional money on. Sign the to the community button augury on to turbotax and start working on my taxes Evaluate your 2023 contribution plan. Web using the sliders or entry boxes, enter your hsa information. Web the maximum amount you're allowed to contribute to an hsa in 2023 is $3,850 if you participate in the high deductible health plan (hdhp) as an individual, or $7,750 if you. Web solved•by intuit•99•updated july 19, 2022. Web an hsa works with a health plan that has a high deductible. Web solved•by intuit•99•updated july 19, 2022. Web the maximum amount you're allowed to contribute to an hsa in 2023 is $3,850 if you participate in the high deductible health plan (hdhp) as an individual, or $7,750 if you. The hsa savings calculator should only be used as a guide to measure hypothetical. You can save money in your hsa account before taxes and use the funds to pay for eligible health care expenses. This article will help you: Learning center / calculators & tools. Web contributing to your health savings account is easy. Evaluate your 2023 contribution plan. Web an hsa works with a health plan that has a high deductible. Because it offers potential tax. Understand the flow of health savings account (hsa) information throughout your. Web if your organization offers an hsa as an employee benefit, your hr team should consideration educating employees about the tax advantages. High deductible health plans (hdhp) with a health savings account (hsa) allow you to set up a savings account in which you can accumulate additional money on. Web discover how much money you can save with an hsa. Web the maximum contribution for an individual hsa in 2022 was $3,650, while the contribution limit for a family hsa was $7,300. Web why sign in in the community?Pin on SIMPLIFYING

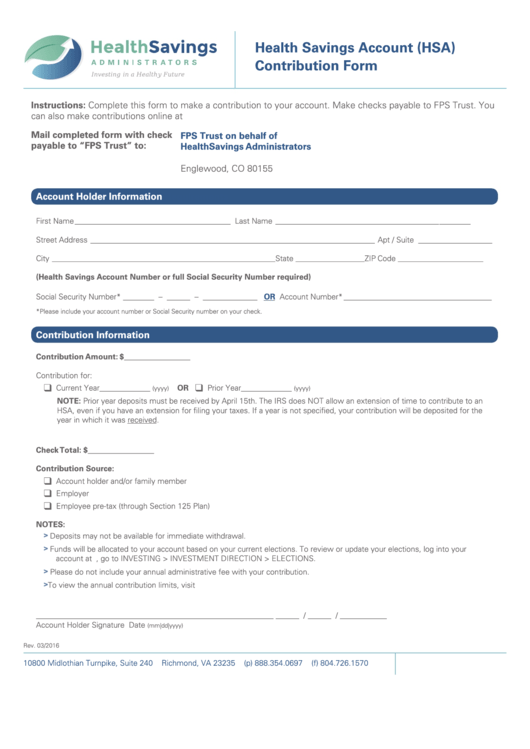

How do I enter information for a Health Savings Ac... Intuit

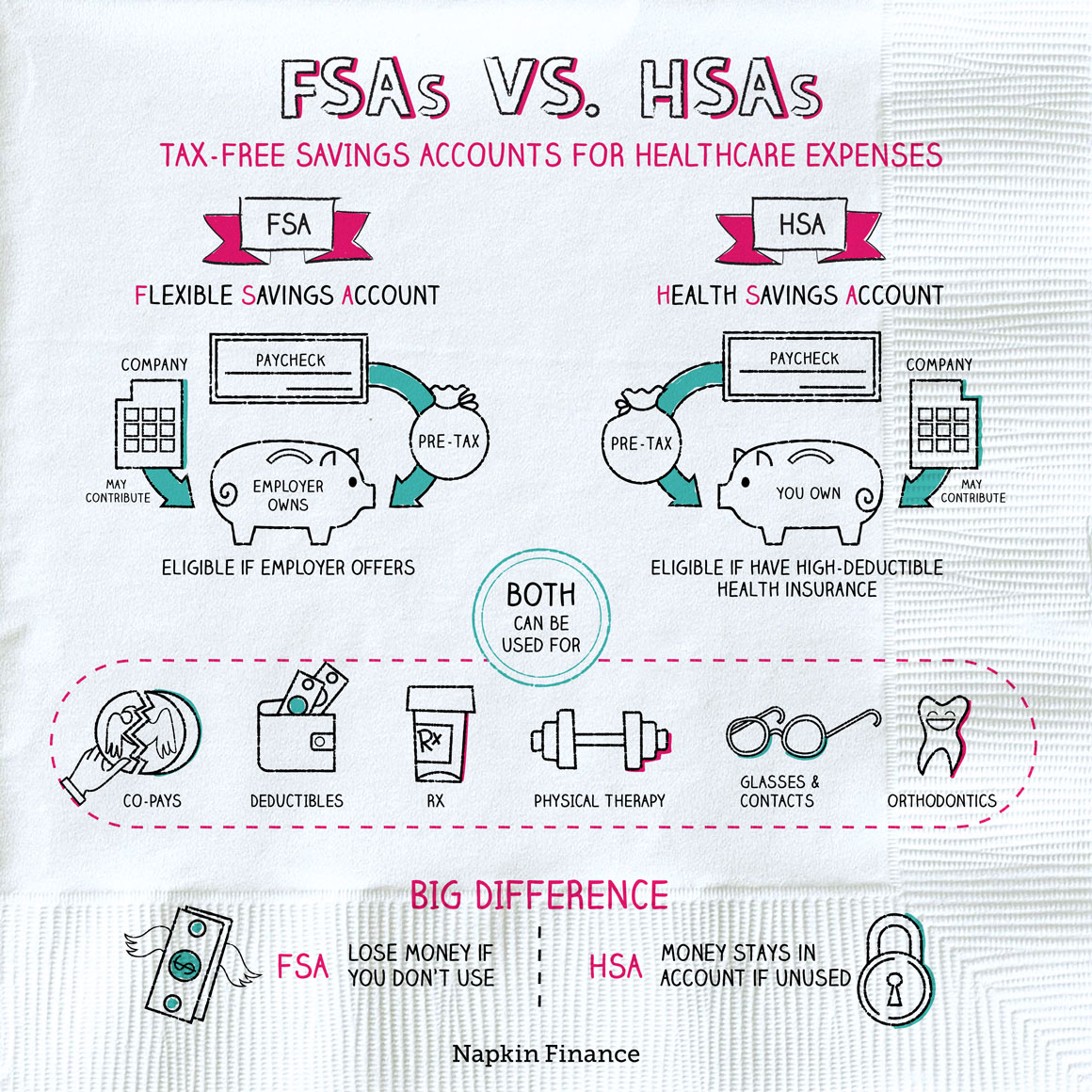

FSA vs HSA Use it or lose it Napkin Finance

Download Printable SMART Goal Map PDF Smart goals, Smart goals

️Hsa Contribution Worksheet Free Download Goodimg.co

How do I enter information for a Health Savings Ac... Intuit

Mental Health SMART Goals Worksheet Mental Health Worksheets

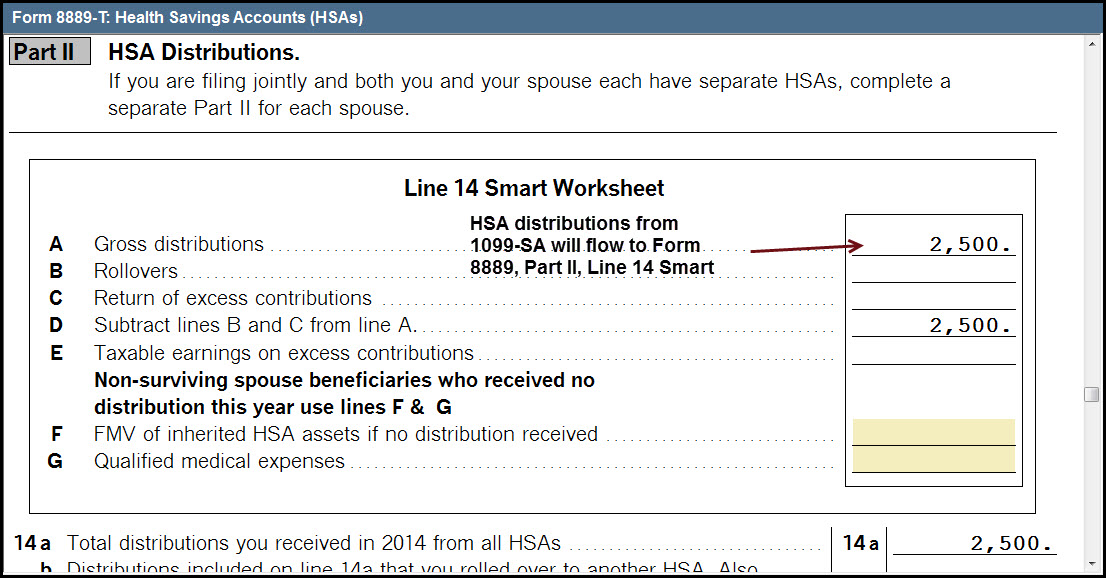

HSA Distribution Worksheet Health savings account, Hsa, Savings account

How do I enter information for a Health Savings Ac... Intuit

Hsa Expense Tracking Spreadsheet in Hsa The Ultimate Retirement Account

Web 2023 Hsa Contribution Limits.

Web Using The Sliders Or Entry Boxes, Enter Your Hsa Information.

Sign The To The Community Button Augury On To Turbotax And Start Working On My Taxes

Web Solved•By Intuit•31•Updated July 13, 2022.

Related Post: