Irc 1341 Worksheet

Irc 1341 Worksheet - Enter the number of individuals you employed during the tax year who are considered employees for. The program includes this amount on form. An item was included in gross income for a prior taxable year (or years) because it appeared that the taxpayer. Web section 1341 allows taxpayers to take a deduction to reflect a change in income from a previous year, without having to refile that year's taxes. To enter the amount of irc section 1341 credit as calculated on. Enter the number of individuals you employed during the tax year who are considered employees for. Web see the instructions and complete worksheets 1 through 7 as needed. Web write in “irc 1341” and the amount of the credit to the left of the amount column. (a) the tax for the taxable year computed without such deduction, minus. Computation of tax where taxpayer restores substantial amount held under claim of right. § 1341 (a) (1) —. Web irc section 1341 provides relief to taxpayers when the amount of the repayment exceeds $3,000. Web the tax for the taxable year computed with such deduction; Web if the taxpayer had to repay an amount included in income in an earlier year, enter the amount that qualifies as a payment. When a repayment occurs,. Web section 1341 allows taxpayers to take a deduction to reflect a change in income from a previous year, without having to refile that year's taxes. Web how do i enter a right of claim doctrine (section 1341) credit on worksheet view in individual tax? The program includes this amount on form. (a) the tax for the taxable year computed. The program includes this amount on form. Web scroll down to the other credits and payments smart worksheet(you can find this in a box near the end of the worksheet) enter the credit amount you calculated. To determine if you are entitled to this credit, refer to your prior year california form 540, or. (5) an amount equal to—. Web. Web scroll down to the other credits and payments smart worksheet(you can find this in a box near the end of the worksheet) enter the credit amount you calculated. When a repayment occurs, rather than amend the prior year return you are to. Enter the number of individuals you employed during the tax year who are considered employees for. To. When a repayment occurs, rather than amend the prior year return you are to. Web section 1341 allows taxpayers to take a deduction to reflect a change in income from a previous year, without having to refile that year's taxes. Web if the taxpayer had to repay an amount included in income in an earlier year, enter the amount that. To determine if you are entitled to this credit, refer to your prior year california form 540, or. Web write in “irc 1341” and the amount of the credit to the left of the amount column. Web section 1341 allows taxpayers to take a deduction to reflect a change in income from a previous year, without having to refile that. Web see the instructions and complete worksheets 1 through 7 as needed. Go to payment/penalties > payments. An item was included in gross income for a prior taxable year (or years) because it appeared that the taxpayer. (5) an amount equal to—. Web how do i enter a right of claim doctrine (section 1341) credit on worksheet view in individual. Enter the number of individuals you employed during the tax year who are considered employees for. Computation of tax where taxpayer restores substantial amount held under claim of right. Web the tax for the taxable year computed with such deduction; Web how do i enter a right of claim doctrine (section 1341) credit on worksheet view in individual tax? Web. Web the tax for the taxable year computed with such deduction; Web see the instructions and complete worksheets 1 through 7 as needed. An item was included in gross income for a prior taxable year (or years) because it appeared that the taxpayer. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or. The program includes this amount on form. Web write in “irc 1341” and the amount of the credit to the left of the amount column. Computation of tax where taxpayer restores substantial amount held under claim of right. § 1341 (a) general rule —. When a repayment occurs, rather than amend the prior year return you are to. Enter the number of individuals you employed during the tax year who are considered employees for. Web if the taxpayer had to repay an amount included in income in an earlier year, enter the amount that qualifies as a payment. Web see the instructions and complete worksheets 1 through 7 as needed. Web see the instructions and complete worksheets 1 through 7 as needed. Enter the number of individuals you employed during the tax year who are considered employees for. When a repayment occurs, rather than amend the prior year return you are to. Go to payment/penalties > payments. (5) an amount equal to—. Web section 1341 allows taxpayers to take a deduction to reflect a change in income from a previous year, without having to refile that year's taxes. Web write in “irc 1341” and the amount of the credit to the left of the amount column. An item was included in gross income for a prior taxable year (or years) because it appeared that the taxpayer. The program includes this amount on form. (a) the tax for the taxable year computed without such deduction, minus. Web the tax for the taxable year computed with such deduction; § 1341 (a) (1) —. Web irc section 1341 provides relief to taxpayers when the amount of the repayment exceeds $3,000. Computation of tax where taxpayer restores substantial amount held under claim of right. § 1341 (a) general rule —. To enter the amount of irc section 1341 credit as calculated on. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. To determine if you are entitled to this credit, refer to your prior year california form 540, or. Computation of tax where taxpayer restores substantial amount held under claim of right. § 1341 (a) general rule —. Web if the taxpayer had to repay an amount included in income in an earlier year, enter the amount that qualifies as a payment. (5) an amount equal to—. Web irc section 1341 provides relief to taxpayers when the amount of the repayment exceeds $3,000. An item was included in gross income for a prior taxable year (or years) because it appeared that the taxpayer. Web how do i enter a right of claim doctrine (section 1341) credit on worksheet view in individual tax? To enter the amount of irc section 1341 credit as calculated on. Web section 1341 allows taxpayers to take a deduction to reflect a change in income from a previous year, without having to refile that year's taxes. Web see the instructions and complete worksheets 1 through 7 as needed. Web write in “irc 1341” and the amount of the credit to the left of the amount column. (a) the tax for the taxable year computed without such deduction, minus. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Enter the number of individuals you employed during the tax year who are considered employees for. Go to payment/penalties > payments.Publication 915, Social Security and Equivalent Railroad Retirement

People who make a difference activity 1 week15 A1 irc worksheet

Test d'ingresso irc quarta worksheet

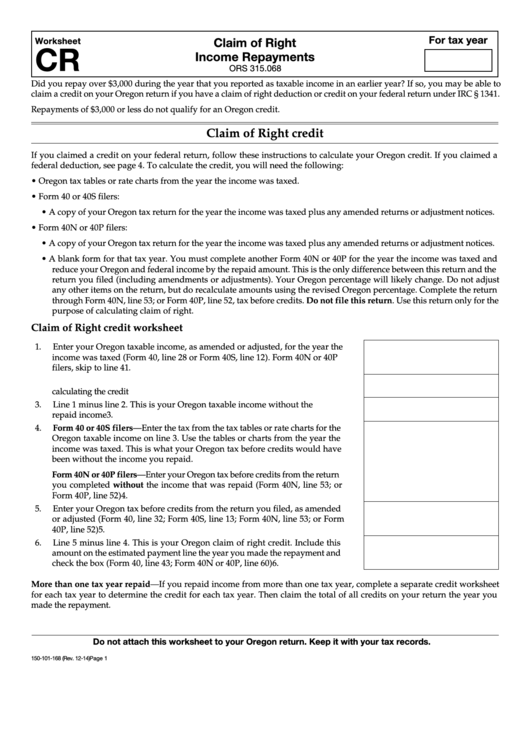

Fillable Worksheet Cr Claim Of Right Repayments printable pdf

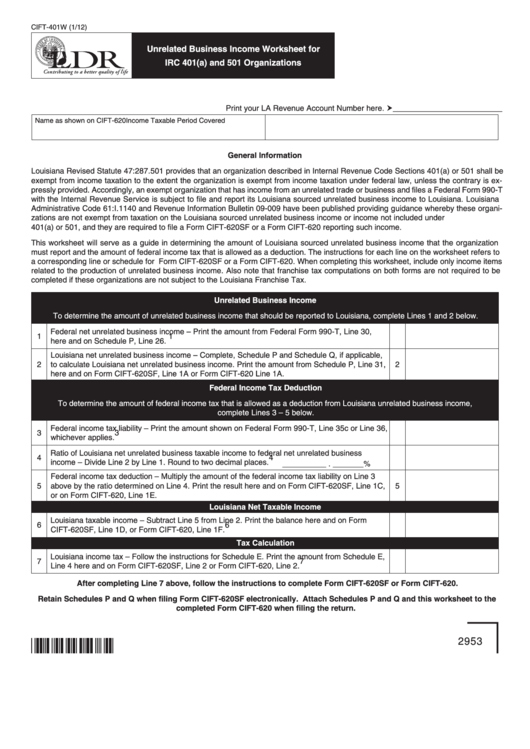

Fillable Form Cift401w Unrelated Business Worksheet For Irc

Solved What is the IRC 1341 repayment credit in layman's terms?

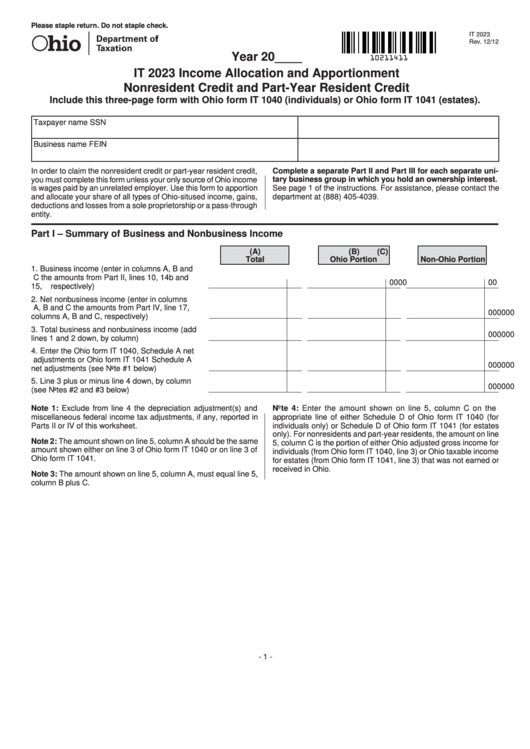

Fillable Form It 2023 Allocation And Apportionment Nonresident

39 realtor tax deduction worksheet Worksheet Master

Irs Publication 915 Worksheet 1 Master of Documents

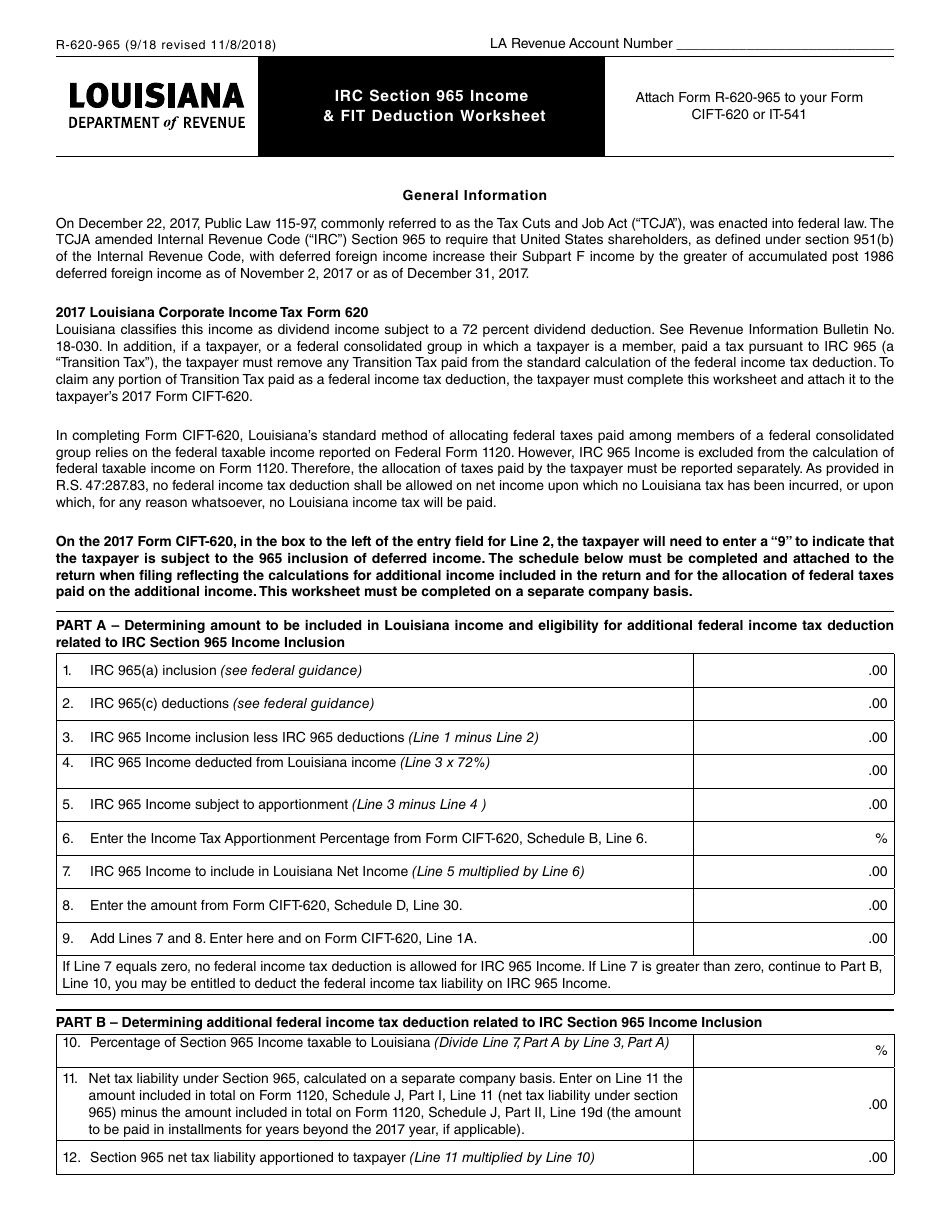

Form R620965 Download Printable PDF or Fill Online IRC Section 965

§ 1341 (A) (1) —.

Web Scroll Down To The Other Credits And Payments Smart Worksheet(You Can Find This In A Box Near The End Of The Worksheet) Enter The Credit Amount You Calculated.

Enter The Number Of Individuals You Employed During The Tax Year Who Are Considered Employees For.

Web See The Instructions And Complete Worksheets 1 Through 7 As Needed.

Related Post: