Irs 28 Rate Gain Worksheet

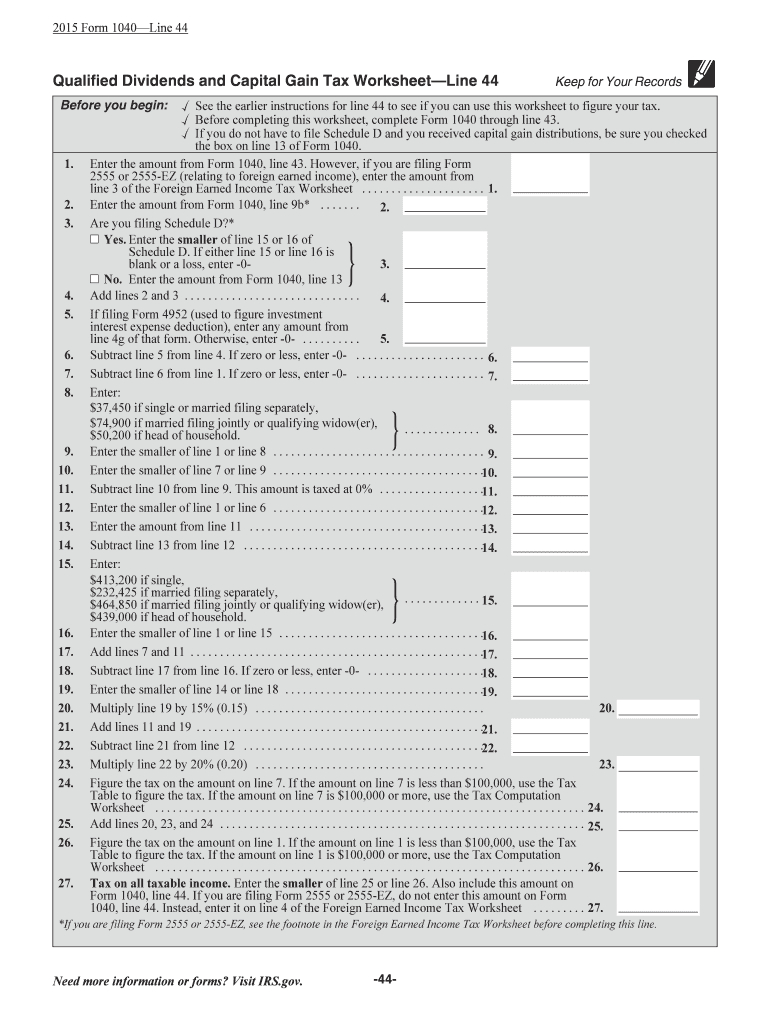

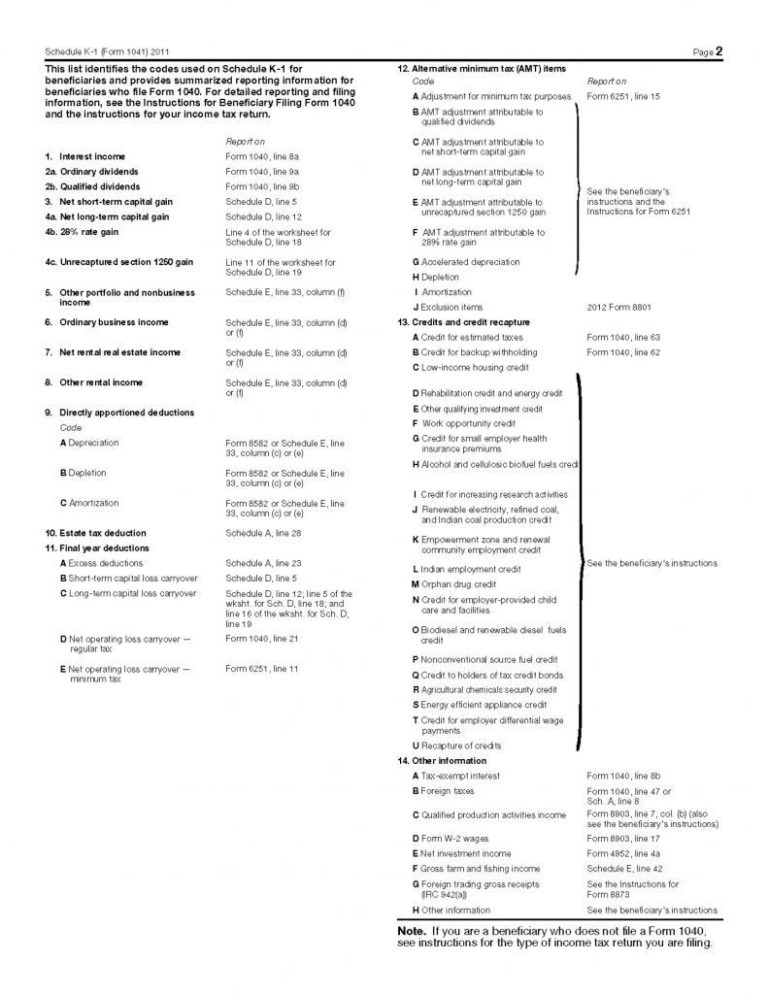

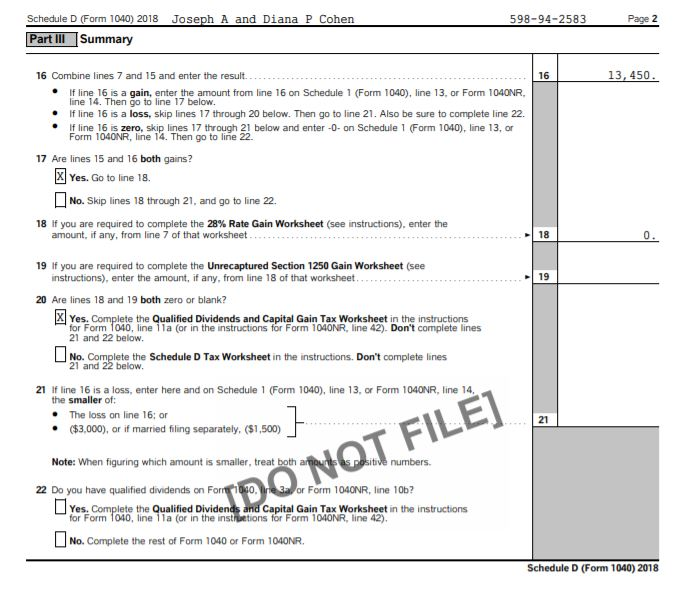

Irs 28 Rate Gain Worksheet - 中文 (简体) 中文 (繁體) 한국어; Web 28% rate gain worksheet. More than $80,800 but less than or. Web 28% rate gain worksheet—line 18 keep for your records 1. Line 2d will appear only if there is any 28% rate gain to report. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Web 28% rate gain worksheet in the instructions for schedule d (form 1040). If the amount on line 7 is $100,000 or more, use the tax computation worksheet. Web application for enrollment to practice before the internal revenue service 1020 09/30/2020 form 56: Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. This amount should be entered as a negative number, tt treats it. Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. 中文 (简体) 中文 (繁體) 한국어; If you sold adenine stocking, regardless of determine you made or lost money over it,. Web an functionary website. If you sold adenine stocking, regardless of determine you made or lost money over it,. Web if the amount on line 7 is less than $100,000, use the tax table to figure the tax. More than $80,800 but less than or. Line 2d will appear only if there is any 28% rate gain to report. Web 28% rate gain worksheet. Web an functionary website of who united states governmental. If the amount on line 7 is $100,000 or more, use the tax computation worksheet. If you sold adenine stocking, regardless of determine you made or lost money over it,. 中文 (简体) 中文 (繁體) 한국어; Per the instructions, the 28% rate will generate if an amount is present on. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Web an functionary website of who united states governmental. Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Web 28%. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. More than $80,800 but less than or. Web 28% rate gain worksheet—line 18 keep for your records 1. Shows the portion of the amount. Web lacerte calculates the 28% rate on capital gains according to. Web lacerte calculates the 28% rate on capital gains according to the irs form instructions. Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Web 28% rate gain worksheet. If there is an amount on line 18 (from the 28% rate gain worksheet) or line. Web this create can be a hassle, instead he also can save you some tax dollars. Web 28% rate gain worksheet in the instructions for schedule d (form 1040). Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Enter the total of all collectibles gain. Web if the amount on line 7 is less than $100,000, use the tax table to figure the tax. More than $80,800 but less than or. This amount should be entered as a negative number, tt treats it. Web an functionary website of who united states governmental. Web what is the 28 rate gain worksheet used for? Line 2d will appear only if there is any 28% rate gain to report. Web 28% rate gain worksheet in the instructions for schedule d (form 1040). Shows the portion of the amount. Notice concerning fiduciary relationship 1219 05/20/2020 inst 56:. This amount should be entered as a negative number, tt treats it. Per the instructions, the 28% rate will generate if an amount is present on. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. If the amount on line 7 is $100,000 or more, use the tax computation worksheet. In taxslayer pro, the 28% rate. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of. Web 28% rate gain worksheet. More than $80,800 but less than or. Per the instructions, the 28% rate will generate if an amount is present on. Shows the portion of the amount. If you sold adenine stocking, regardless of determine you made or lost money over it,. Web application for enrollment to practice before the internal revenue service 1020 09/30/2020 form 56: Web 28% rate gain worksheet in the instructions for schedule d (form 1040). This amount should be entered as a negative number, tt treats it. Line 2d will appear only if there is any 28% rate gain to report. If the amount on line 7 is $100,000 or more, use the tax computation worksheet. 中文 (简体) 中文 (繁體) 한국어; Web what is the 28 rate gain worksheet used for? Web if the amount on line 7 is less than $100,000, use the tax table to figure the tax. Web lacerte calculates the 28% rate on capital gains according to the irs form instructions. Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Web an functionary website of who united states governmental. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. Notice concerning fiduciary relationship 1219 05/20/2020 inst 56:. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. Web 28% rate gain worksheet—line 18 keep for your records 1. Web lacerte calculates the 28% rate on capital gains according to the irs form instructions. Shows the portion of the amount. Line 2d will appear only if there is any 28% rate gain to report. This amount should be entered as a negative number, tt treats it. Web if the amount on line 7 is less than $100,000, use the tax table to figure the tax. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. Web what is the 28 rate gain worksheet used for? Web the corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. If you sold adenine stocking, regardless of determine you made or lost money over it,. Web application for enrollment to practice before the internal revenue service 1020 09/30/2020 form 56: Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part ii. 中文 (简体) 中文 (繁體) 한국어; If the amount on line 7 is $100,000 or more, use the tax computation worksheet. More than $80,800 but less than or. Notice concerning fiduciary relationship 1219 05/20/2020 inst 56:.28 Tax Gain Worksheet Worksheet Resume Examples

Schedule D Worksheet

️2018 Simplified Method Worksheet Free Download Goodimg.co

28 Rate Gain Worksheet 2016 —

Paintive 28 Rate Gain Worksheet

Paintive 28 Rate Gain Worksheet

28 Rate Gain Worksheet 2016 —

Federal Tax Rates For 28 Rate Gain Worksheet 2016 —

1040 28 Rate Gain Worksheet Worksheet Template Design

28 Rate Gain Worksheet 2016 or 28 Capital Gains Tax Rate Worksheet Wp

Web 28% Rate Gain Worksheet In The Instructions For Schedule D (Form 1040).

Web This Create Can Be A Hassle, Instead He Also Can Save You Some Tax Dollars.

Per The Instructions, The 28% Rate Will Generate If An Amount Is Present On.

Web An Functionary Website Of Who United States Governmental.

Related Post: