Irs 8812 Line 5 Worksheet

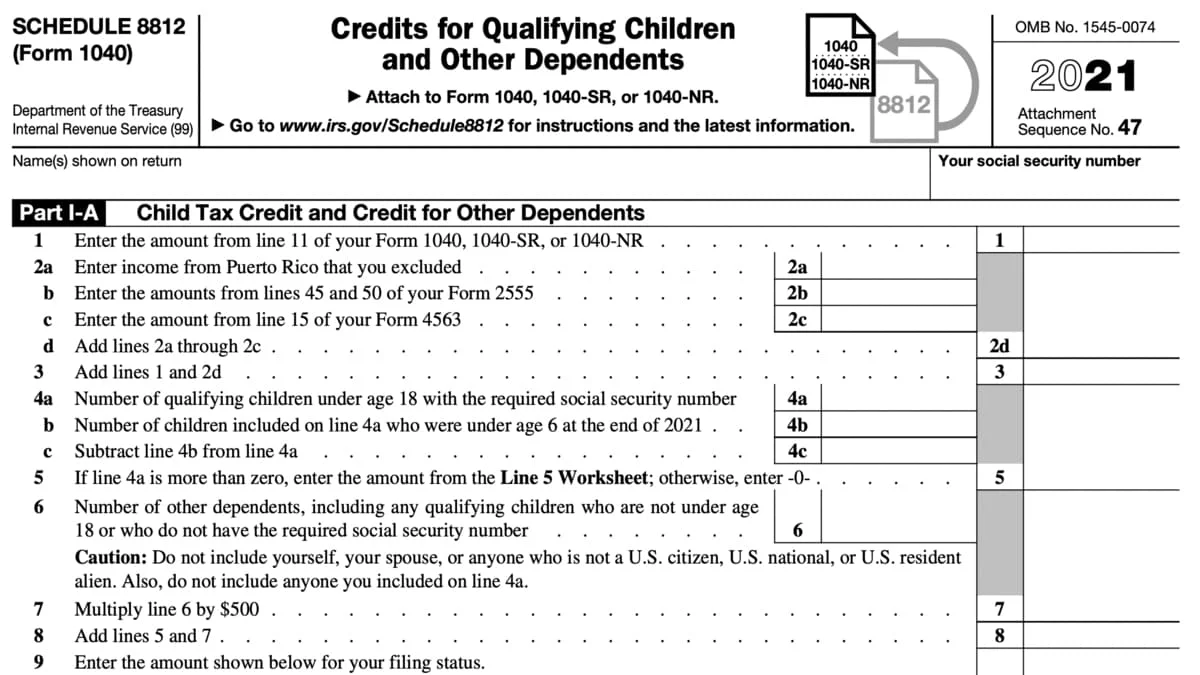

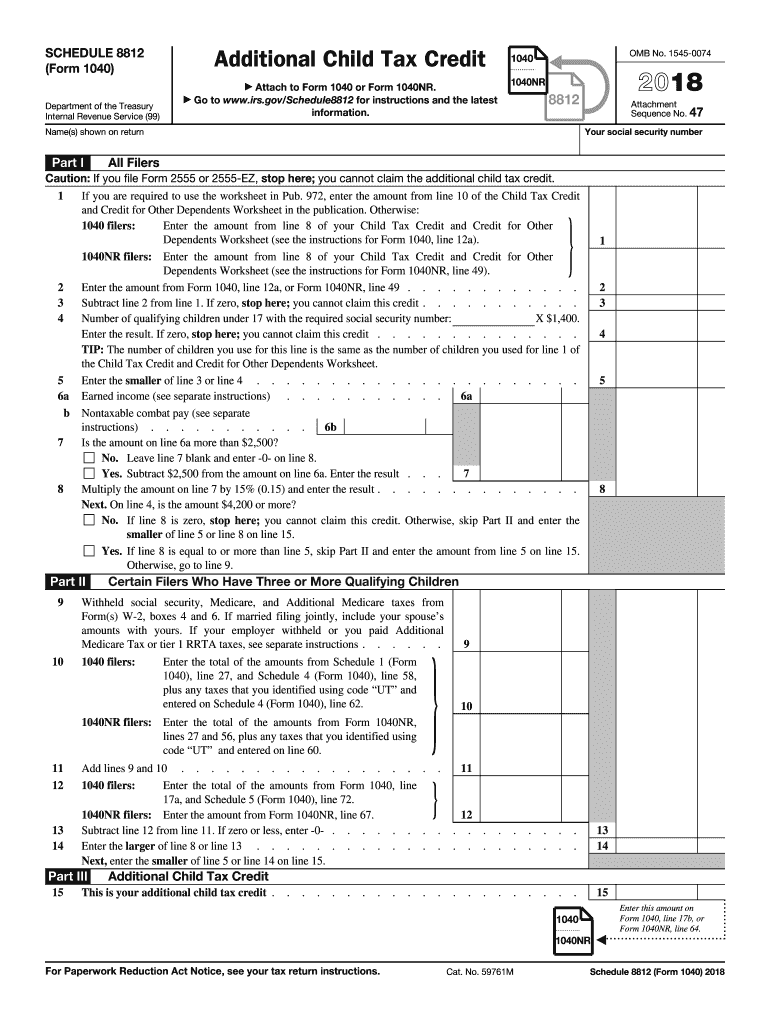

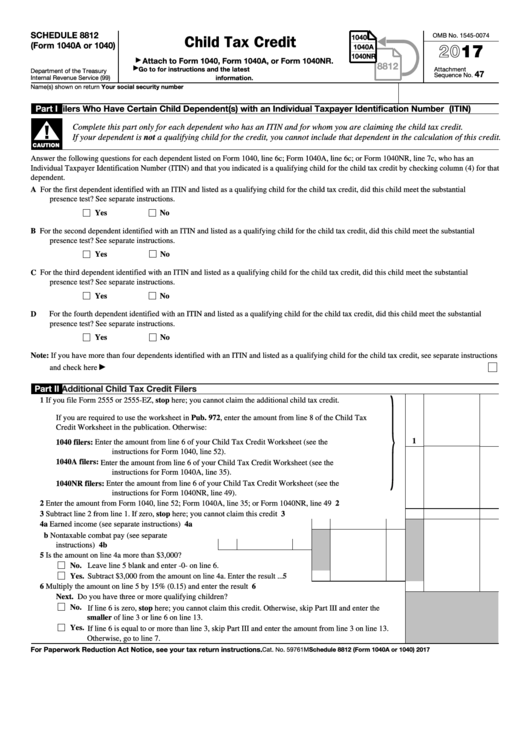

Irs 8812 Line 5 Worksheet - What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. For example, if the amount. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Child tax credit between 6 and 18 is $3,000. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Web where is the line 5 worksheet referred to in schedule 8812? Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. What they are entitled to minus what they got. Web where is the line 5 worksheet referred to in schedule 8812? Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child. Web where is the line 5 worksheet referred to in schedule 8812? For example, if the amount. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Unfortunately, turbotax. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. For example, if the amount. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web where is the line 5 worksheet referred to in schedule 8812? Use schedule 8812 (form 1040) to. For example, if the amount. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. What they. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. For example, if the amount. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Child tax credit. Child tax credit between 6 and 18 is $3,000. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Web where is the line 5 worksheet referred to in schedule 8812? What they are entitled to minus what they got = if there is any. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. Web where is the line 5 worksheet referred to in schedule 8812? For example, if. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Child tax credit between 6 and 18 is $3,000. For. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Child tax credit between 6 and 18 is $3,000. Web where is the line 5 worksheet referred to in schedule 8812? Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. Web where is the line 5 worksheet referred to in schedule 8812? Child tax credit between 6 and 18 is $3,000. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. For example, if the amount. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Child tax credit between 6 and 18 is $3,000. Web schedule 8812, which can be found on form 1040, is used to evaluate the additional repayable credit recognized as “the additional child tax credit.”. Web where is the line 5 worksheet referred to in schedule 8812? For example, if the amount. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”.Schedule 8812 2022 for Child Tax Credit File Online Schedules TaxUni

2015 form 8812 pdf Fill out & sign online DocHub

Irs Child Tax Credit Download Instructions for IRS Form 1040 Schedule

IRS Schedule 8812 Child Tax Credit Form Guide Credit Cadabra

Publication 972 Child Tax Credit; Child Tax Credit Worksheet

Form 8812, Additional Child Tax Credit printable pdf download

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

Form 8812 Line 5 Worksheet ideas 2022

2022 Form IRS 1040 Schedule 8812 Instructions Fill Online, Printable

Form 8812 Worksheet Download Child Tax Credit Calculator Excel

Unfortunately, Turbotax Does Not Show The Line 5 Worksheet For Their Calculations.

What They Are Entitled To Minus What They Got = If There Is Any More To Get, And There Is A Box To Checkmark That They Lived In The Us.

Related Post: