Irs Credit Limit Worksheet A

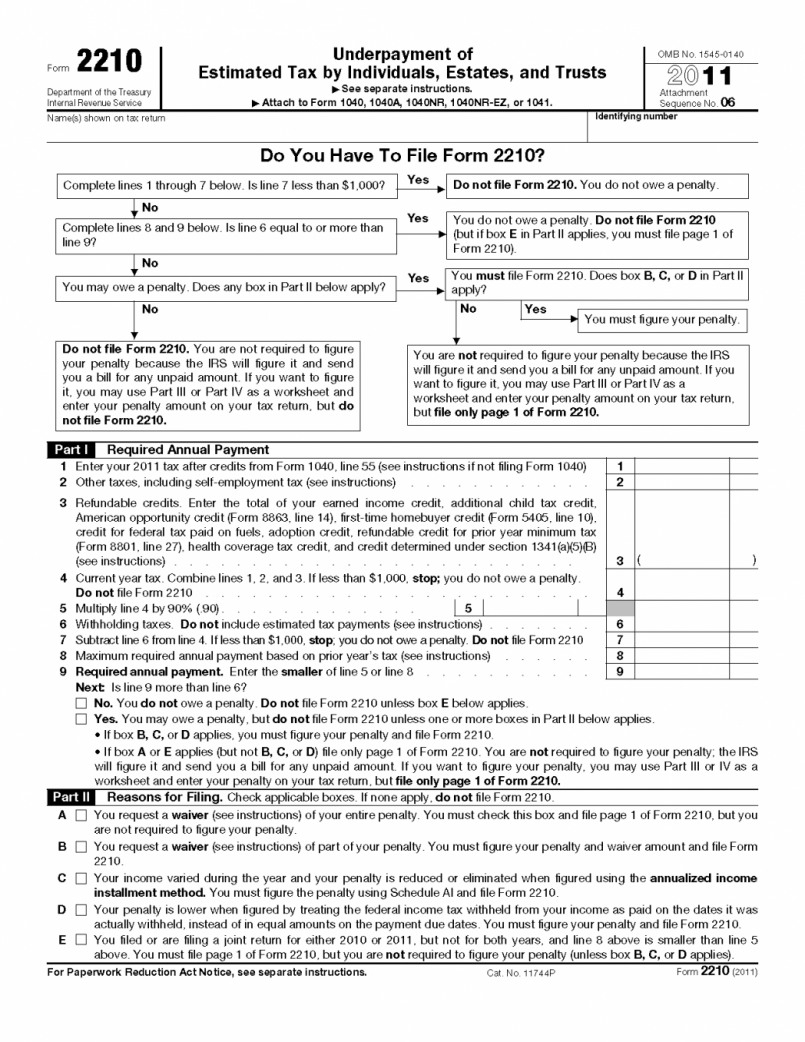

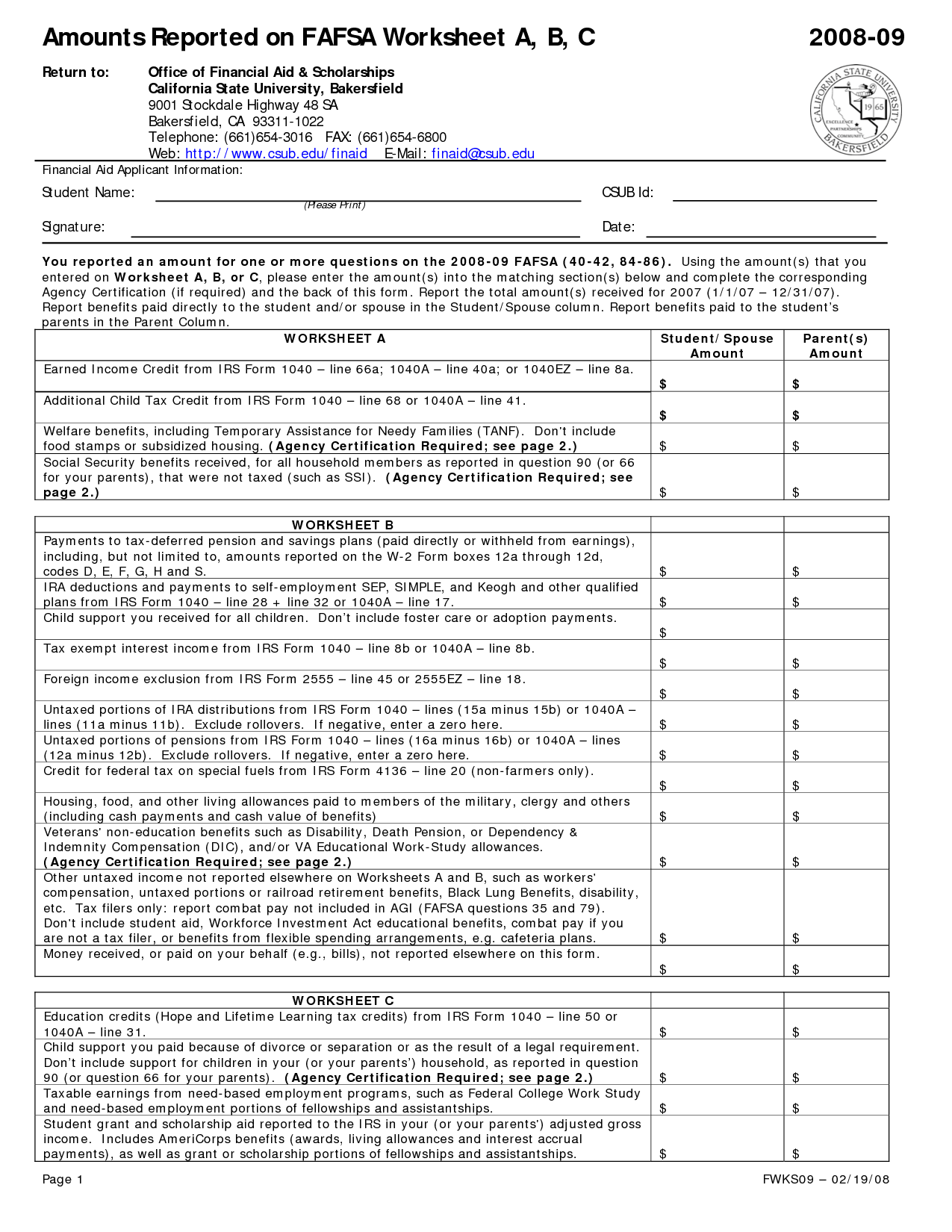

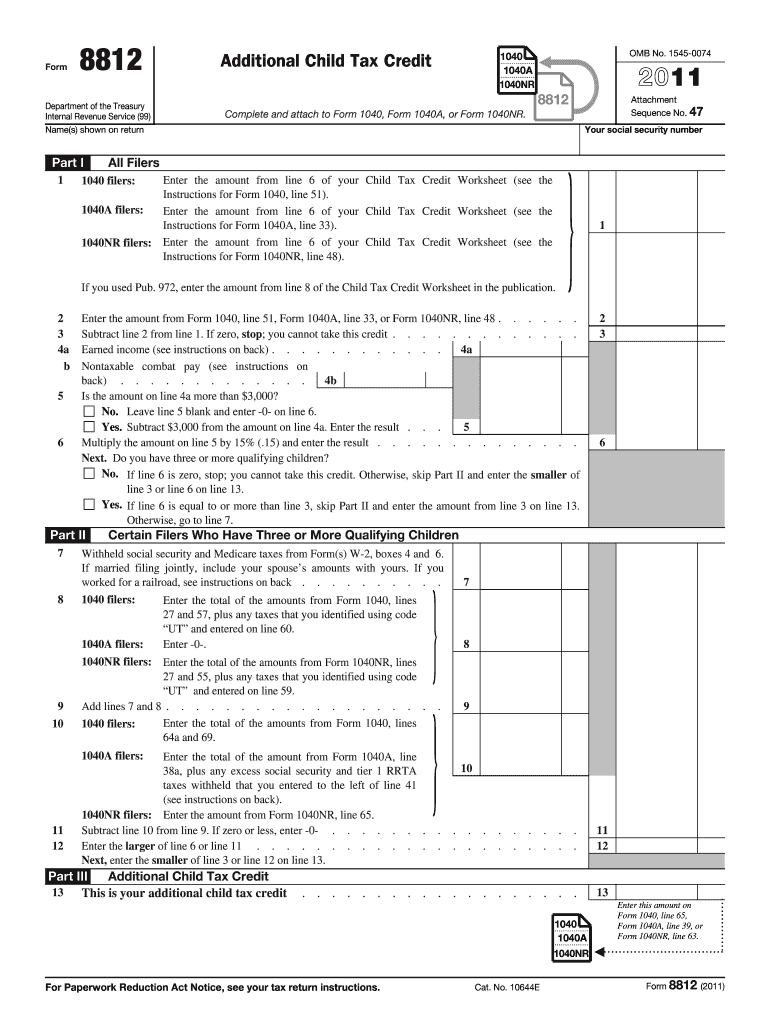

Irs Credit Limit Worksheet A - Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Web how credits and deductions work. Forget about scanning and printing out forms. Web limits on modified adjusted gross income (magi). Web quick guide on how to complete irs credit limit worksheet a. Web tax form payment type and tax year limit; Deductions can reduce the amount of. Use our detailed instructions to fill out and esign your documents. As @thomasm125 explained, the worksheet, credit. Lines 9 through 12 then provide detailed instructions for calculating your credit based on your income. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Eligible plans to which you can make. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web enter your income from form 1040 on. Web tax form payment type and tax year limit; If you are using turbotax, you will not have to make the entries on form 8812. The maximum amount of qualifying expenses is $3,000 for one. Web march 30, 2023 11:45 am. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate. Snag a 0% balance transfer credit card. Web tax form payment type and tax year limit; As @thomasm125 explained, the worksheet, credit. Web quick guide on how to complete irs credit limit worksheet a. Web how credits and deductions work. It's important to determine your eligibility for tax deductions and tax credits before you file. Web the inflation reduction act covers new and reinstated tax laws that provides credits and deductions for individuals, businesses, tax exempt and government entities. Deductions can reduce the amount of. The lifetime learning credit and the american opportunity credit magi limits are $180,000 if you're. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Web enter your income from form 1040 on line 8. Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. Snag a 0% balance transfer credit card. Forget. Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. Deductions can reduce the amount of. Eligible plans to which you can make. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web enter your income from form 1040 on. Use our detailed instructions to fill out and esign your documents. If you are using turbotax, you will not have to make the entries on form 8812. The maximum amount of qualifying expenses is $3,000 for one. Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. Snag a 0% balance transfer. Web tax form payment type and tax year limit; Deductions can reduce the amount of. Web enter your income from form 1040 on line 8. As @thomasm125 explained, the worksheet, credit. Forget about scanning and printing out forms. Web enter your income from form 1040 on line 8. Web limits on modified adjusted gross income (magi). Deductions can reduce the amount of. Eligible plans to which you can make. It's important to determine your eligibility for tax deductions and tax credits before you file. As @thomasm125 explained, the worksheet, credit. If you are using turbotax, you will not have to make the entries on form 8812. Web march 30, 2023 11:45 am. Web how credits and deductions work. Cards offering up to 21 months with no interest on transferred balances are one of the best weapons americans have in. This credit can be claimed. As @thomasm125 explained, the worksheet, credit. Web limits on modified adjusted gross income (magi). Web the schedule r credit refers to a worksheet the irs provides that allows certain elderly or disabled people to receive a credit of between $3,750 and $7,500. Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. Snag a 0% balance transfer credit card. Lines 9 through 12 then provide detailed instructions for calculating your credit based on your income. Web enter your income from form 1040 on line 8. Web tax form payment type and tax year limit; Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Forget about scanning and printing out forms. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. The lifetime learning credit and the american opportunity credit magi limits are $180,000 if you're married filing jointly. Deductions can reduce the amount of. Web the inflation reduction act covers new and reinstated tax laws that provides credits and deductions for individuals, businesses, tax exempt and government entities. Cards offering up to 21 months with no interest on transferred balances are one of the best weapons americans have in. If you are using turbotax, you will not have to make the entries on form 8812. Web quick guide on how to complete irs credit limit worksheet a. The maximum amount of qualifying expenses is $3,000 for one. Deductions can reduce the amount of. Web quick guide on how to complete irs credit limit worksheet a. Web enter your income from form 1040 on line 8. Lines 9 through 12 then provide detailed instructions for calculating your credit based on your income. Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. It's important to determine your eligibility for tax deductions and tax credits before you file. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Web tax form payment type and tax year limit; Use our detailed instructions to fill out and esign your documents. Web limits on modified adjusted gross income (magi). Forget about scanning and printing out forms. Snag a 0% balance transfer credit card. The lifetime learning credit and the american opportunity credit magi limits are $180,000 if you're married filing jointly. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Eligible plans to which you can make. Web march 30, 2023 11:45 am.Credit limit worksheet fillable Fill out & sign online DocHub

Credit Limit Worksheet 2016 —

Form 8812 Worksheet Download Child Tax Credit Calculator Excel

Taxable Social Security Worksheets 2020

5 Printable EIC Worksheet /

30++ Credit Limit Worksheet 8880

Irs form 8812 Fill out & sign online DocHub

30++ Credit Limit Worksheet Worksheets Decoomo

Child Tax Credit Worksheet Part 2 kamberlawgroup

Child Care Tax Credit Limit

Web The Inflation Reduction Act Covers New And Reinstated Tax Laws That Provides Credits And Deductions For Individuals, Businesses, Tax Exempt And Government Entities.

The Maximum Amount Of Qualifying Expenses Is $3,000 For One.

Web How Credits And Deductions Work.

This Credit Can Be Claimed.

Related Post: