Irs Line 5 Worksheet

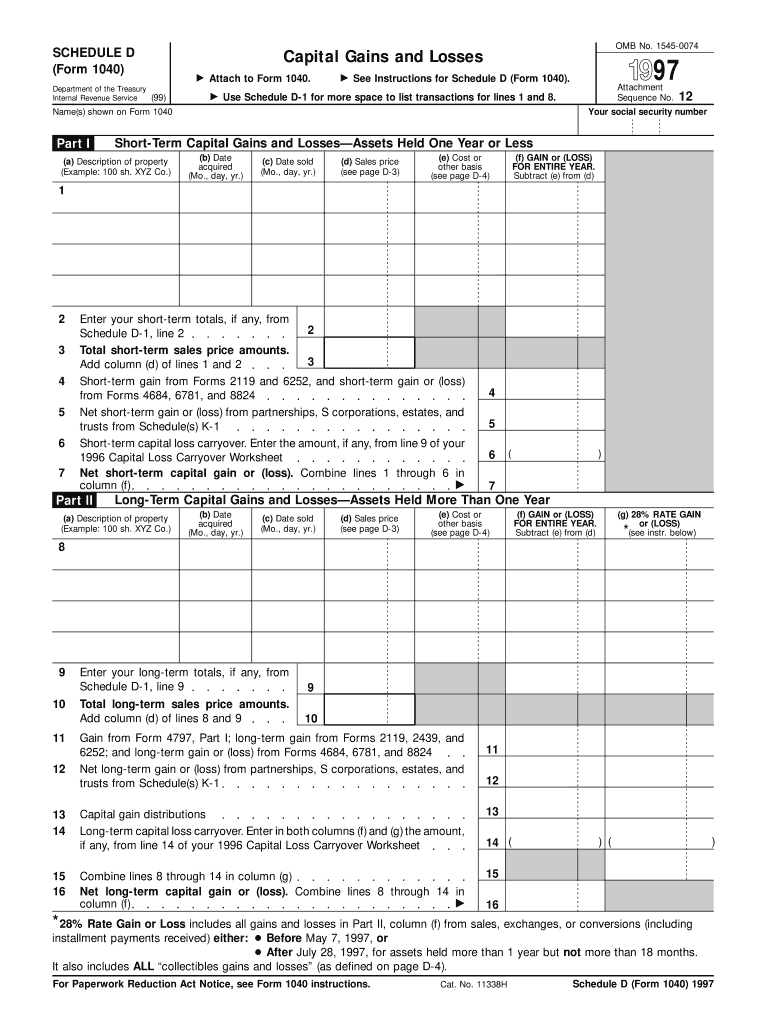

Irs Line 5 Worksheet - Web april 18, 2022 9:09 pm. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. You no longer want to get advance payments. What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. • no qualifying children, is the amount on line 3 less than $8,800 ($14,700 if married filing. The irs announces the increase, if any, in a news release, in the internal. Enter the result, but not less than zero. Subtract line 8 from line 1. Electing to apply a 2020 return. Web this is the amount for 2012. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Subtract line 8 from line 1. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You no longer want to get advance payments. Enter the result, but not less than zero. Enter the result, but not less than zero. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. You can manually fill out the worksheet from the. Also, enter this amount on form 1040, line 4b. You no longer want to get advance payments. You can manually fill out the worksheet from the. Web this is the amount for 2012. Web april 18, 2022 9:09 pm. Enter the result, but not less than zero. The irs announces the increase, if any, in a news release, in the internal. Also, enter this amount on form 1040, line 4b. Enter the result, but not less than zero. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Electing to apply a 2020 return. You can manually fill out the worksheet from the. Enter the amount from line 2 on line 6. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. Web april 18, 2022 9:09 pm.. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. The irs announces the increase, if any, in a news release, in the internal. Enter the result, but not less than zero. • no qualifying children, is the amount on line 3 less than $8,800 ($14,700. • no qualifying children, is the amount on line 3 less than $8,800 ($14,700 if married filing. Web april 18, 2022 9:09 pm. Web this is the amount for 2012. Also, enter this amount on form 1040, line 4b. Enter the amount from line 2 on line 6. Web april 18, 2022 9:09 pm. Enter the amount from line 2 on line 6. Enter the result, but not less than zero. Subtract line 8 from line 1. Web this is the amount for 2012. Web this is the amount for 2012. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web april 18, 2022 9:09 pm. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Also, enter this amount on form 1040, line 4b. Web 8.enter the smaller of line 5 or line 7 8. The irs announces the increase, if any, in a news release, in the internal. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. You no longer want to get advance payments. You can manually fill out the worksheet from the. • no qualifying children, is the amount on line 3 less than $8,800 ($14,700 if married filing. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Web april 18, 2022 9:09 pm. The irs announces the increase, if any, in a news release, in the internal. You no longer want to get advance payments. Web 8.enter the smaller of line 5 or line 7 8. Enter the amount from line 2 on line 6. Electing to apply a 2020 return. Subtract line 8 from line 1. Also, enter this amount on form 1040, line 4b. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Web this is the amount for 2012. Enter the result, but not less than zero. What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. What they are entitled to minus what they got = if there is any more to get, and there is a box to checkmark that they lived in the us. Electing to apply a 2020 return. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Web april 18, 2022 9:09 pm. Enter the amount from line 2 on line 6. Also, enter this amount on form 1040, line 4b. Web 8.enter the smaller of line 5 or line 7 8. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. • no qualifying children, is the amount on line 3 less than $8,800 ($14,700 if married filing. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Enter the result, but not less than zero. Web this is the amount for 2012.1997 Form 1040 (Schedule D). Capital Gains and Losses irs Fill out

Irs Social Security Tax Worksheet kamberlawgroup

Printables. 1040ez Line 5 Worksheet. Messygracebook Thousands of

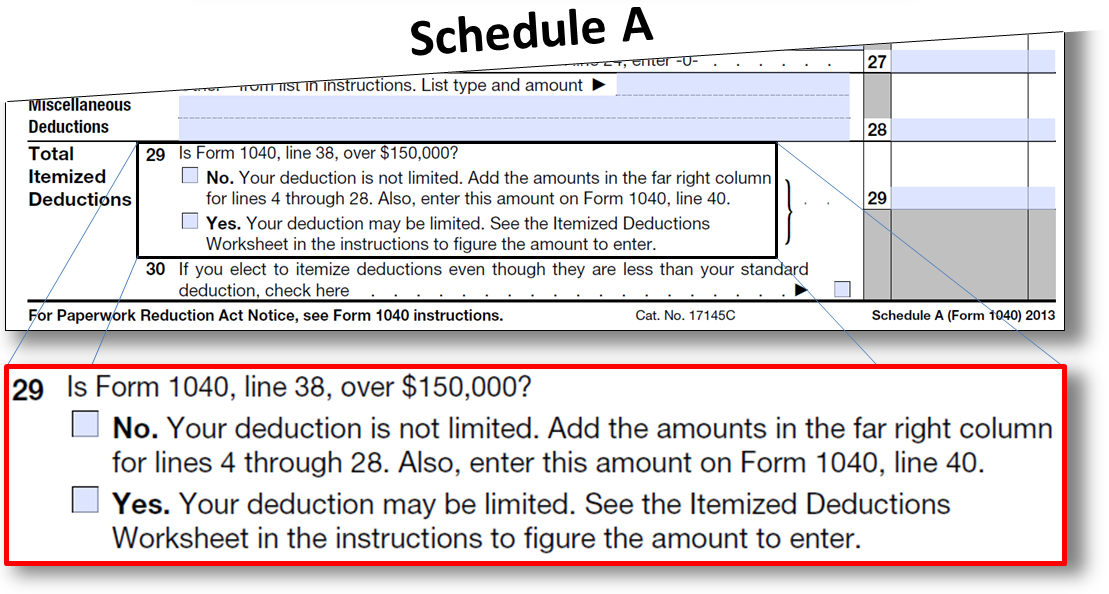

Form 1040 Schedule A Line 5a 1040 Form Printable

30++ Child Tax Credit Worksheet 2019

Get Free 1040ez line 5 worksheet (PDF) vcon.duhs.edu.pk

Irs Tax Worksheet Line 44 Worksheet Resume Examples

1040 (2021) Internal Revenue Service

1040 (2017) Internal Revenue Service

Social security irs worksheet Fill out & sign online DocHub

You Can Manually Fill Out The Worksheet From The.

The Irs Announces The Increase, If Any, In A News Release, In The Internal.

Subtract Line 8 From Line 1.

You No Longer Want To Get Advance Payments.

Related Post: