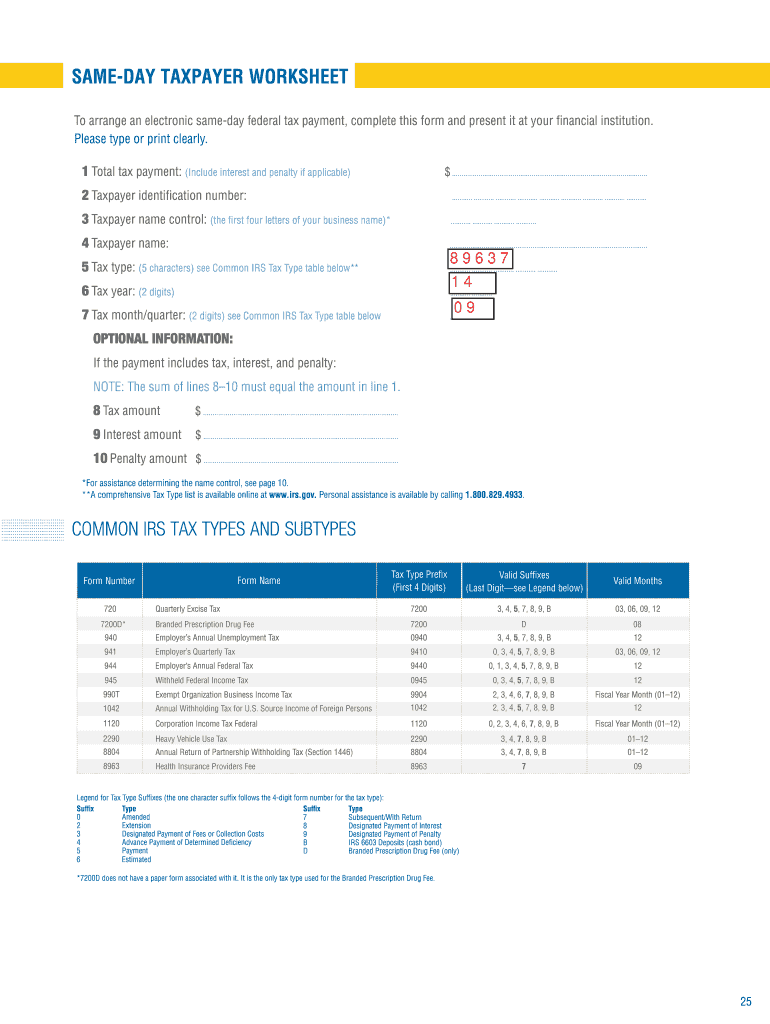

Irs Same Day Payment Worksheet

Irs Same Day Payment Worksheet - (include interest and penalty if applicable) $ 2 taxpayer identification number: Web 1 total tax payment: After you've enrolled and received your credentials,. You'll document your total tax. 1 payment is $1,000,000 or less and. (the first four letters of your business name) 4. 2 payment is submitted prior. My preparer told me to use 10 and i did but now i'm thinking it may. Web the electronic federal tax payment system® tax payment service is provided free by the u.s. Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: After you've enrolled and received your credentials,. My preparer told me to use 10 and i did but now i'm thinking it may. (include interest and penalty if applicable) $ 2 taxpayer identification number: Complete it and take it to your financial institution. 1 payment is $1,000,000 or less and. 1 payment is $1,000,000 or less and. (include interest and penalty if applicable) $ 2 taxpayer identification number: Web the electronic federal tax payment system® tax payment service is provided free by the u.s. Web 1 total tax payment: Complete it and take it to your financial institution. Web 1 total tax payment: After you've enrolled and received your credentials,. (include interest and penalty if applicable) $ 2 taxpayer identification number: (the first four letters of your business name) 4. Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: Complete it and take it to your financial institution. Web 1 total tax payment: You'll document your total tax. 2 payment is submitted prior. Web the electronic federal tax payment system® tax payment service is provided free by the u.s. Complete it and take it to your financial institution. You'll document your total tax. (include interest and penalty if applicable) $ 2 taxpayer identification number: Web the electronic federal tax payment system® tax payment service is provided free by the u.s. (the first four letters of your business name) 4. Web 1 total tax payment: (the first four letters of your business name) 4. Web the electronic federal tax payment system® tax payment service is provided free by the u.s. (include interest and penalty if applicable) $ 2 taxpayer identification number: Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: After you've enrolled and received your credentials,. Complete it and take it to your financial institution. My preparer told me to use 10 and i did but now i'm thinking it may. Web the electronic federal tax payment system® tax payment service is provided free by the u.s. (include interest and penalty if applicable) $ 2 taxpayer identification number: 2 payment is submitted prior. Complete it and take it to your financial institution. Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: (include interest and penalty if applicable) $ 2 taxpayer identification number: You'll document your total tax. (the first four letters of your business name) 4. Web 1 total tax payment: 2 payment is submitted prior. 1 payment is $1,000,000 or less and. Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: My preparer told me to use 10 and i did but now i'm thinking it may. You'll document your total tax. Web 1 total tax payment: After you've enrolled and received your credentials,. 1 payment is $1,000,000 or less and. (the first four letters of your business name) 4. 2 payment is submitted prior. (include interest and penalty if applicable) $ 2 taxpayer identification number: Web the electronic federal tax payment system® tax payment service is provided free by the u.s. You'll document your total tax. My preparer told me to use 10 and i did but now i'm thinking it may. 1 payment is $1,000,000 or less and. Web 1 total tax payment: Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: Complete it and take it to your financial institution. After you've enrolled and received your credentials,. Complete it and take it to your financial institution. Web 1 total tax payment: (the first four letters of your business name) 4. After you've enrolled and received your credentials,. 1 payment is $1,000,000 or less and. (include interest and penalty if applicable) $ 2 taxpayer identification number: Web eftps accepts same day payments for business and individual tax payments that meet the following criteria: You'll document your total tax.Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

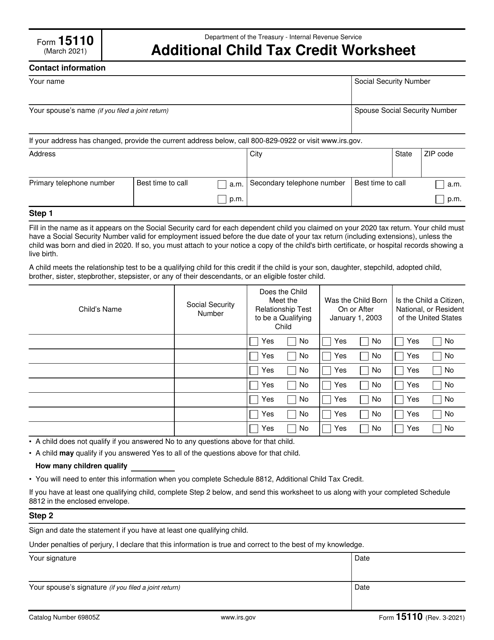

IRS Form 15110 Download Fillable PDF or Fill Online Additional Child

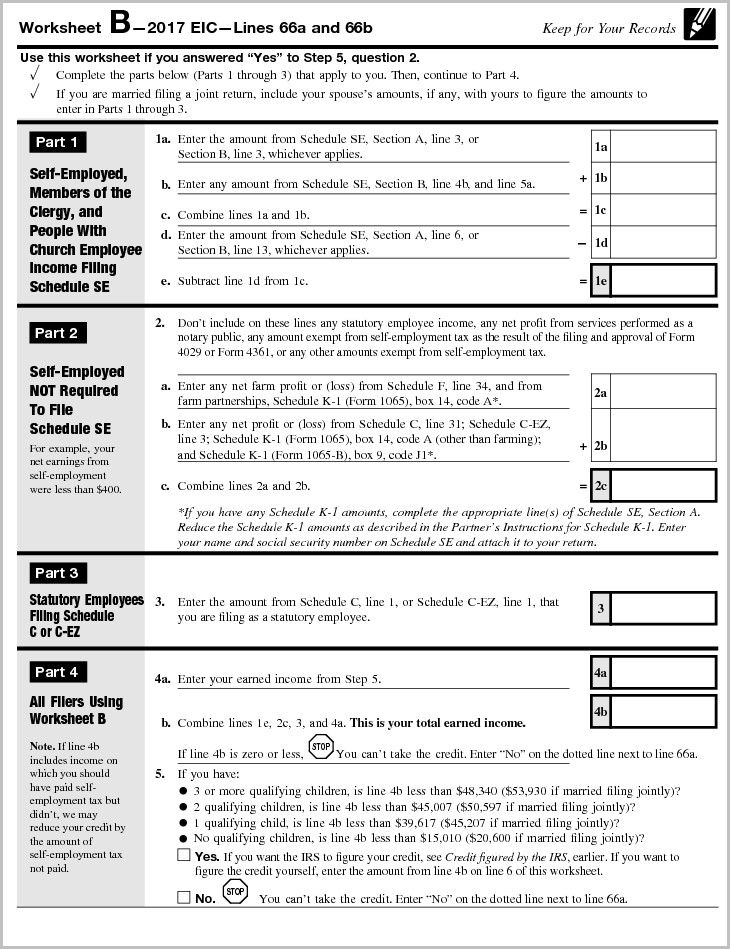

5 Best Images of Printable EIC Worksheet 2015 IRS Earned

SameDay_Worksheet_1010 Taxpayer Internal Revenue Service

Tax Payment Report Worksheet Appendix C Worksheet Resume Examples

Irs Social Security Worksheet / Irs social Security Worksheet

Form 8965, Health Coverage Exemptions and Instructions

Irs Forms 1040 Social Security Worksheet Form Resume Examples

Same Day Taxpayer Worksheet Example Fill Online, Printable, Fillable

2 Payment Is Submitted Prior.

My Preparer Told Me To Use 10 And I Did But Now I'm Thinking It May.

Web The Electronic Federal Tax Payment System® Tax Payment Service Is Provided Free By The U.s.

Related Post: