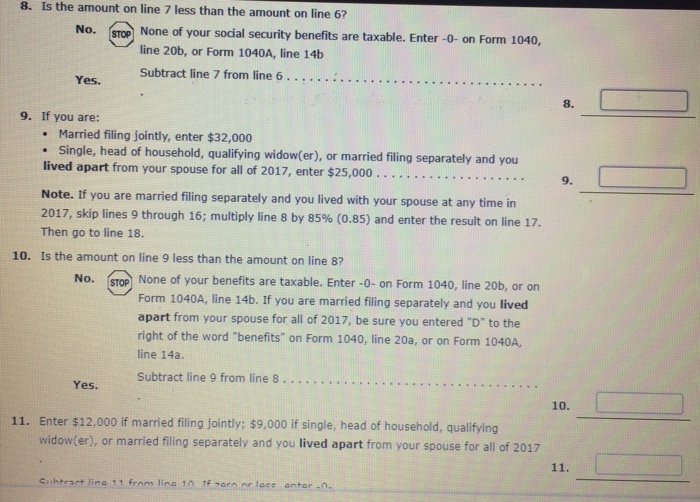

Irs Social Security Benefits Worksheet Lines 6A And 6B

Irs Social Security Benefits Worksheet Lines 6A And 6B - Multiply line 7 by 85% (0.85) and. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. Up to 85% of social security becomes taxable when all your other. Enter the result on line 16. • do not include in income any disability payments (including social security disability insurance payments) that are received for injuries incurred. Web social security benefits lines 6a and 6b 2022. Much like retirement income on line 4 and line 5, line 6 is split into a taxable and. Web the total benefits are reported as you note on line 6a on the 1040. Web word “benefits” on line 6a. To determine this amount, the irs provides. Individual tax return, lines 6a and 6b, for the taxable amount of social security. It would be extremely unlikely that the amount. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. Web the total benefits are reported as you note on line 6a on the 1040. Web social security benefits lines 6a and 6b 2022. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. Is the amount on line 8 less than the amount on line 7? • do not include in income any disability payments (including social security disability insurance payments) that are received for injuries incurred. Up to 85% of social security becomes taxable when all your other.. Then, go to line 17. • do not include in income any disability payments (including social security disability insurance payments) that are received for injuries incurred. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. Multiply line 7 by 85% (0.85) and. However, up to. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. Web 6a social security benefits is $61918, 4b ira is $54128, 5b pensions is $76592, what should the 6b amount be? Then, go to line 17. Enter the result on line 16. Web word “benefits” on. Individual tax return, lines 6a and 6b, for the taxable amount of social security. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page. Web line 6 of the 2020 form 1040 is used to report your social security income. Web the amounts from these worksheets will transfer to form 1040 u.s. Web in 2018, skip lines 8 through 15; Up to 85% of social security becomes taxable when all your other. Web the taxact program transfers the amounts from the worksheets to form. Web word “benefits” on line 6a. Multiply line 7 by 85% (0.85) and. Web social security benefits lines 6a and 6b 2022. Worksheets are social security taxable benefits. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. Enter the result on line 16. Web how is line 6b (taxable social security) on 1040sr (for seniors) computed? • do not include in income any disability payments (including social security disability insurance payments) that are received for injuries incurred. Up to 85% of social security becomes taxable when all your other. Web social security benefits lines 6a and 6b. Web the total benefits are reported as you note on line 6a on the 1040. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. However, up to 85% of the benefits may be taxable based on how much ss you get and how. To determine. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. Worksheets are social security taxable benefits. Up to 85% of social security becomes taxable when all your other. Then, go to line 17. Is the amount on line 8 less than the amount on line 7? Much like retirement income on line 4 and line 5, line 6 is split into a taxable and. Worksheets are social security taxable benefits. Individual tax return, lines 6a and 6b, for the taxable amount of social security. It would be extremely unlikely that the amount. • do not include in income any disability payments (including social security disability insurance payments) that are received for injuries incurred. Multiply line 7 by 85% (0.85) and. Web word “benefits” on line 6a. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Then, go to line 17. Is the amount on line 8 less than the amount on line 7? Web the amounts from these worksheets will transfer to form 1040 u.s. Web 6a social security benefits is $61918, 4b ira is $54128, 5b pensions is $76592, what should the 6b amount be? Web the total benefits are reported as you note on line 6a on the 1040. Web social security benefits lines 6a and 6b 2022. Web how is line 6b (taxable social security) on 1040sr (for seniors) computed? Enter the result on line 16. However, up to 85% of the benefits may be taxable based on how much ss you get and how. Web line 6 of the 2020 form 1040 is used to report your social security income. Then, go to line 17. Web line 6 of the 2020 form 1040 is used to report your social security income. Web word “benefits” on line 6a. Web the total benefits are reported as you note on line 6a on the 1040. Is the amount on line 8 less than the amount on line 7? However, up to 85% of the benefits may be taxable based on how much ss you get and how. • do not include in income any disability payments (including social security disability insurance payments) that are received for injuries incurred. Enter the result on line 16. Web social security benefits lines 6a and 6b 2022. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Much like retirement income on line 4 and line 5, line 6 is split into a taxable and. Web how is line 6b (taxable social security) on 1040sr (for seniors) computed? Web in 2018, skip lines 8 through 15; Web you can find the instructions for completing line 6a/6b (social security) of form 1040 on page 29, the worksheet is on page 31. Web 6a social security benefits is $61918, 4b ira is $54128, 5b pensions is $76592, what should the 6b amount be? It would be extremely unlikely that the amount.Irs Social Security Tax Worksheet

Social security irs worksheet Fill out & sign online DocHub

How Uncle Sam Taxes Your Social Security Benefits Focus Planning Group

Irs Social Security Worksheet / Irs social Security Worksheet

Social Security Benefits Worksheet 2019

W 4 form for retirement Early Retirement

Irs Publication 915 Worksheet 1 Master of Documents

Social Security Benefits Worksheet 2019 Pdf Worksheet Fun

Social Security Taxable Benefits Worksheet 2021

Our Editable Form For Irs Publication 915 Is Your Good Luck

To Determine This Amount, The Irs Provides.

Worksheets Are Social Security Taxable Benefits.

Individual Tax Return, Lines 6A And 6B, For The Taxable Amount Of Social Security.

Web The Amounts From These Worksheets Will Transfer To Form 1040 U.s.

Related Post: