Itemized Deduction Worksheet

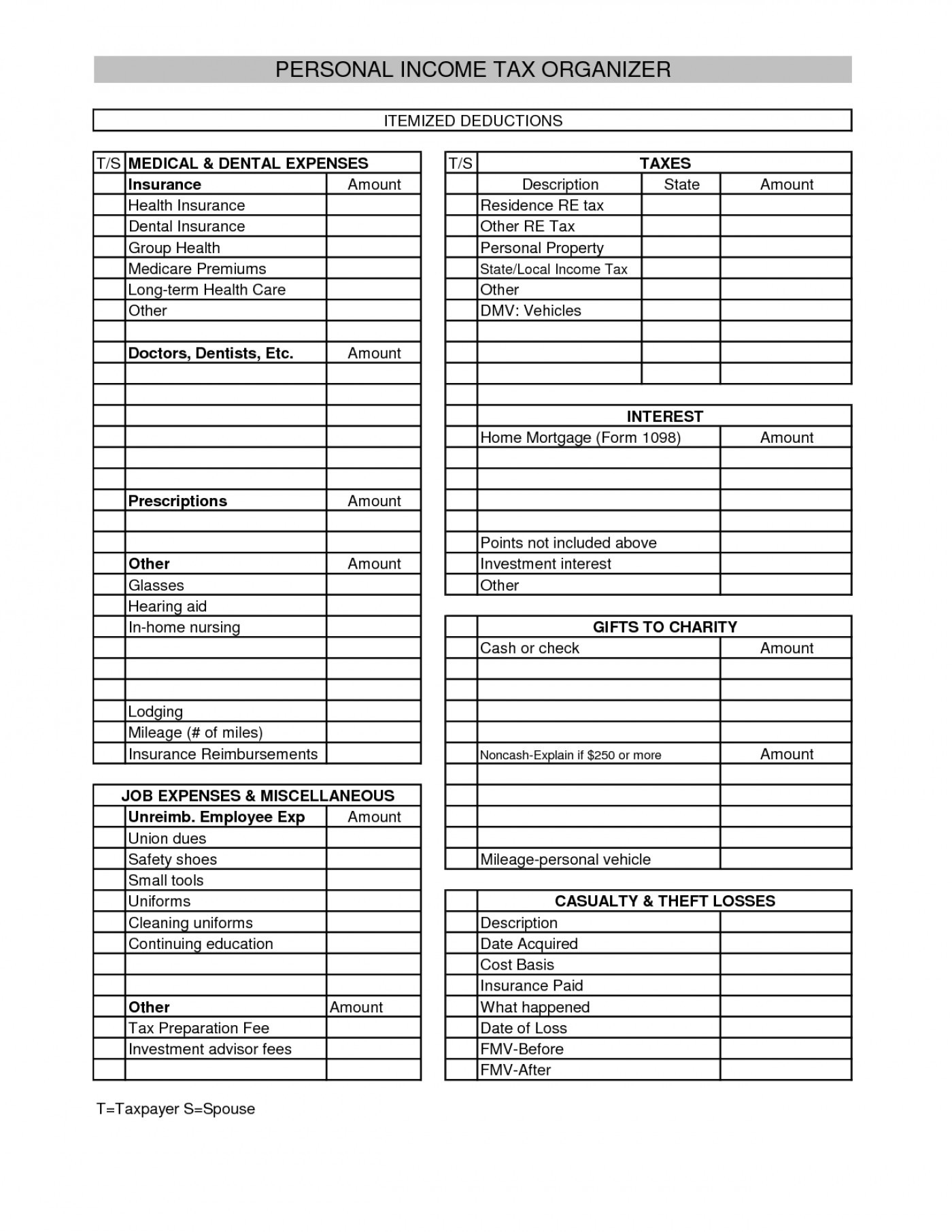

Itemized Deduction Worksheet - Web to figure your standard deduction, use the california standard deduction worksheet for dependents. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. Mortgage interest you pay on. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Must exceed 7.5% of income to be a benefit. Medical expenses paid by insurance. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. For virginia income tax purposes, federal itemized. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Mortgage interest you pay on. Types of itemized deductions include mortgage. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. Worksheets are schedule a itemized deductions, deductions form 1040 itemized,. Web enter your standard deduction on line 17 of form. Types of itemized deductions include mortgage. Must exceed 7.5% of income to be a benefit. (any one contribution of $250 or more needs written evidence) Which of these would generally be allowed as an itemized deduction? Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to. Web to figure your standard deduction, use the california standard deduction worksheet for dependents. Web limited itemized deduction worksheet as instructed on the worksheet. Web itemized deduction worksheet medical expenses. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Worksheets are schedule a itemized. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Mortgage interest you pay on. Web itemized deductions are specific types of expenses the taxpayer incurred that may. Mortgage interest you pay on. The value of a laptop. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web to figure your standard deduction, use the california standard deduction worksheet for dependents. Web limited itemized deduction worksheet as instructed on the worksheet. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): For virginia income tax purposes, federal itemized. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Worksheets are schedule a itemized deductions, deductions form 1040 itemized,. Reduction. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web limited itemized deduction worksheet as instructed on the worksheet. Types of itemized deductions include mortgage. Mortgage interest you pay on. (any one contribution of $250 or more needs written evidence) Web to figure your standard deduction, use the california standard deduction worksheet for dependents. For virginia income tax purposes, federal itemized. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web limited itemized deduction worksheet as instructed on the worksheet. Must exceed 7.5% of income to be a benefit. Mortgage interest you pay on. Medical expenses paid by insurance. For virginia income tax purposes, federal itemized. (any one contribution of $250 or more needs written evidence) Web itemized deduction worksheet medical expenses. Web to figure your standard deduction, use the california standard deduction worksheet for dependents. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. Medical expenses paid by insurance. Reduction for state and local income taxes. (any one contribution of $250. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Reduction for state and local income taxes. Web itemized deduction worksheet medical expenses. For virginia income tax purposes, federal itemized. Types of itemized deductions include mortgage. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Must exceed 7.5% of income to be a benefit. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web limited itemized deduction worksheet as instructed on the worksheet. Mortgage interest you pay on. Web to figure your standard deduction, use the california standard deduction worksheet for dependents. Web for federal purposes, your total itemized deduction for state and local taxes paid in 2022 is limited to a combined amount not to exceed $10,000 ($5,000 if married. (any one contribution of $250 or more needs written evidence) Worksheets are schedule a itemized deductions, deductions form 1040 itemized,. The value of a laptop. Medical expenses paid by insurance. Which of these would generally be allowed as an itemized deduction? Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Medical expenses paid by insurance. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web to figure your standard deduction, use the california standard deduction worksheet for dependents. Mortgage interest you pay on. For virginia income tax purposes, federal itemized. Which of these would generally be allowed as an itemized deduction? Web itemized deduction worksheet medical expenses. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Types of itemized deductions include mortgage. The value of a laptop. (any one contribution of $250 or more needs written evidence) Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Reduction for state and local income taxes.8 Tax Itemized Deduction Worksheet /

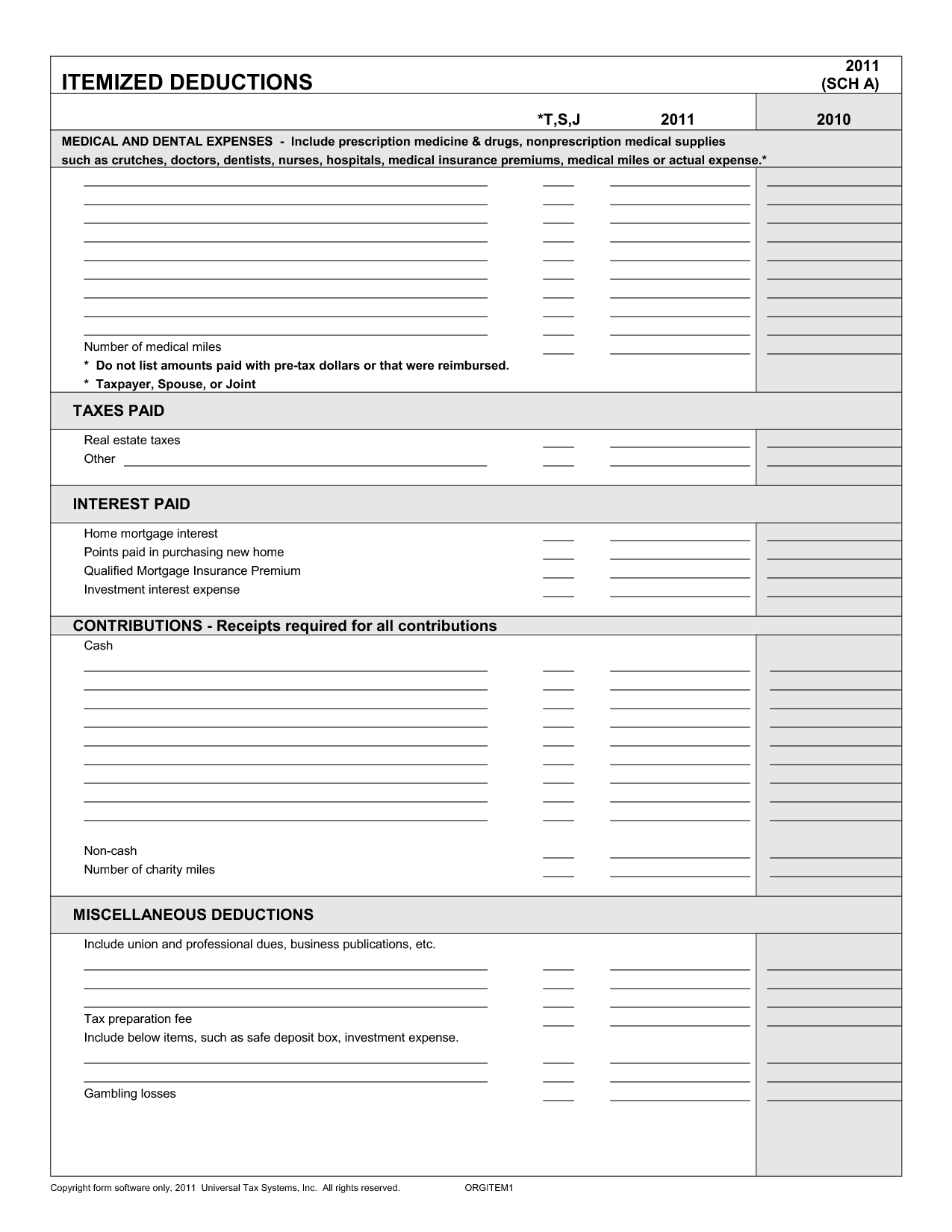

Itemized Deductions Worksheet 2018 Printable Worksheets and

Irs Tax Forms 2021 Itemized Deductions TAX

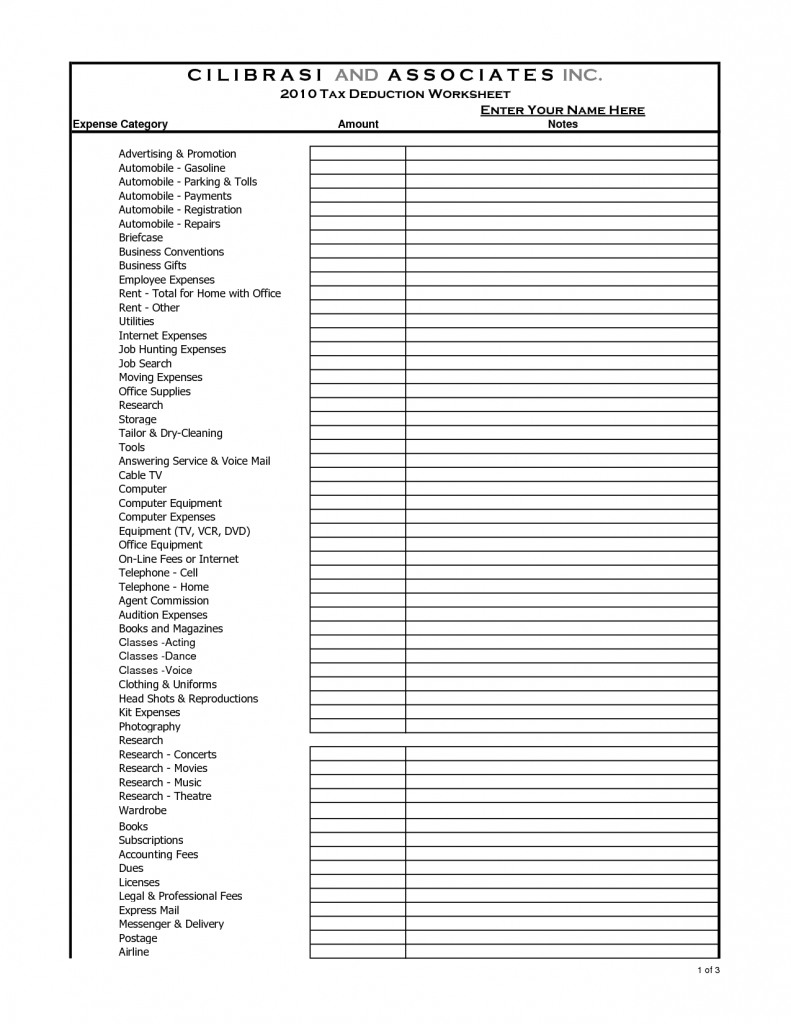

8 Tax Itemized Deduction Worksheet /

Irs Itemized Deductions Worksheet —

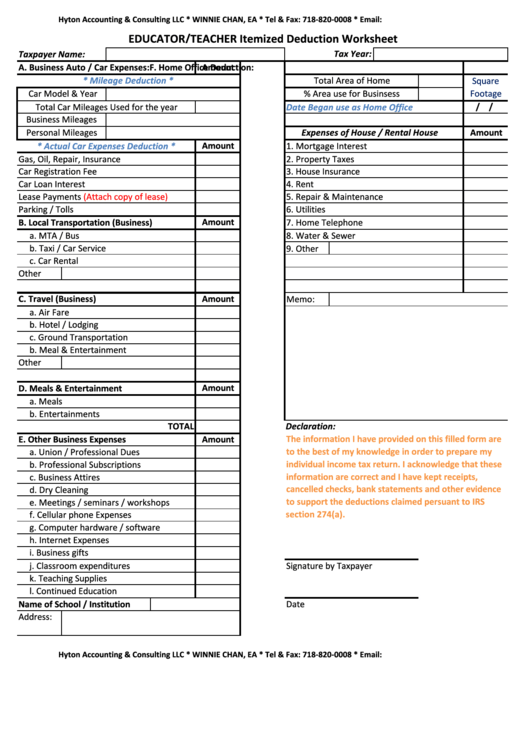

Fillable Educator/teacher Itemized Deduction Worksheet printable pdf

17 Schedule C Deductions Worksheet /

Printable Itemized Deductions Worksheet

Itemized Deductions Worksheet —

Itemized Deductions Worksheet 2017 Printable Worksheets and

Worksheets Are Schedule A Itemized Deductions, Deductions Form 1040 Itemized,.

Web Limited Itemized Deduction Worksheet As Instructed On The Worksheet.

Must Exceed 7.5% Of Income To Be A Benefit.

Web For Federal Purposes, Your Total Itemized Deduction For State And Local Taxes Paid In 2022 Is Limited To A Combined Amount Not To Exceed $10,000 ($5,000 If Married.

Related Post: