Itemized Deductions Worksheet

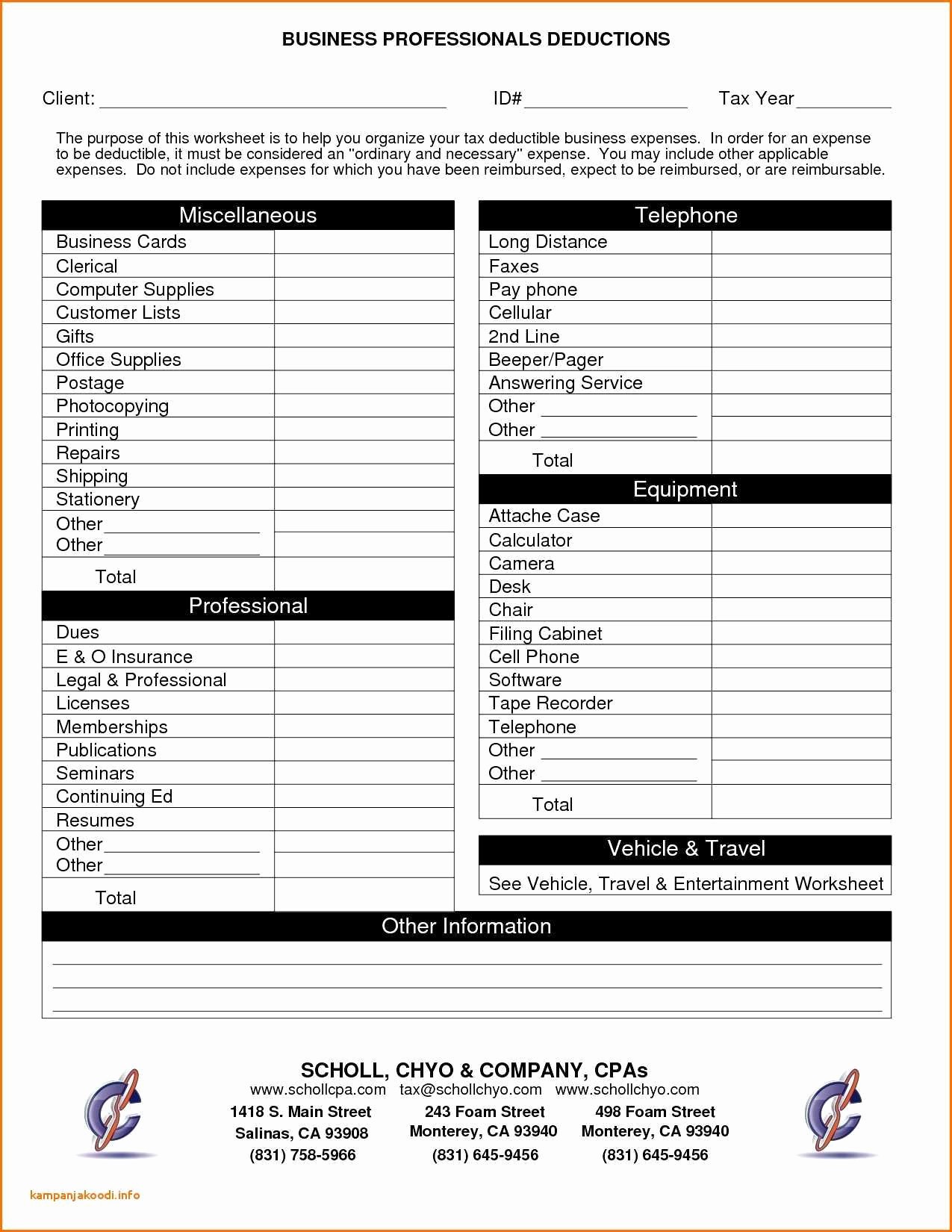

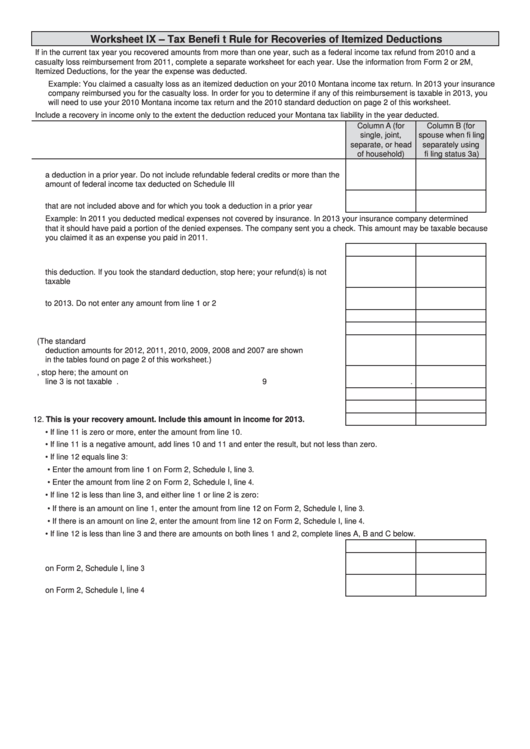

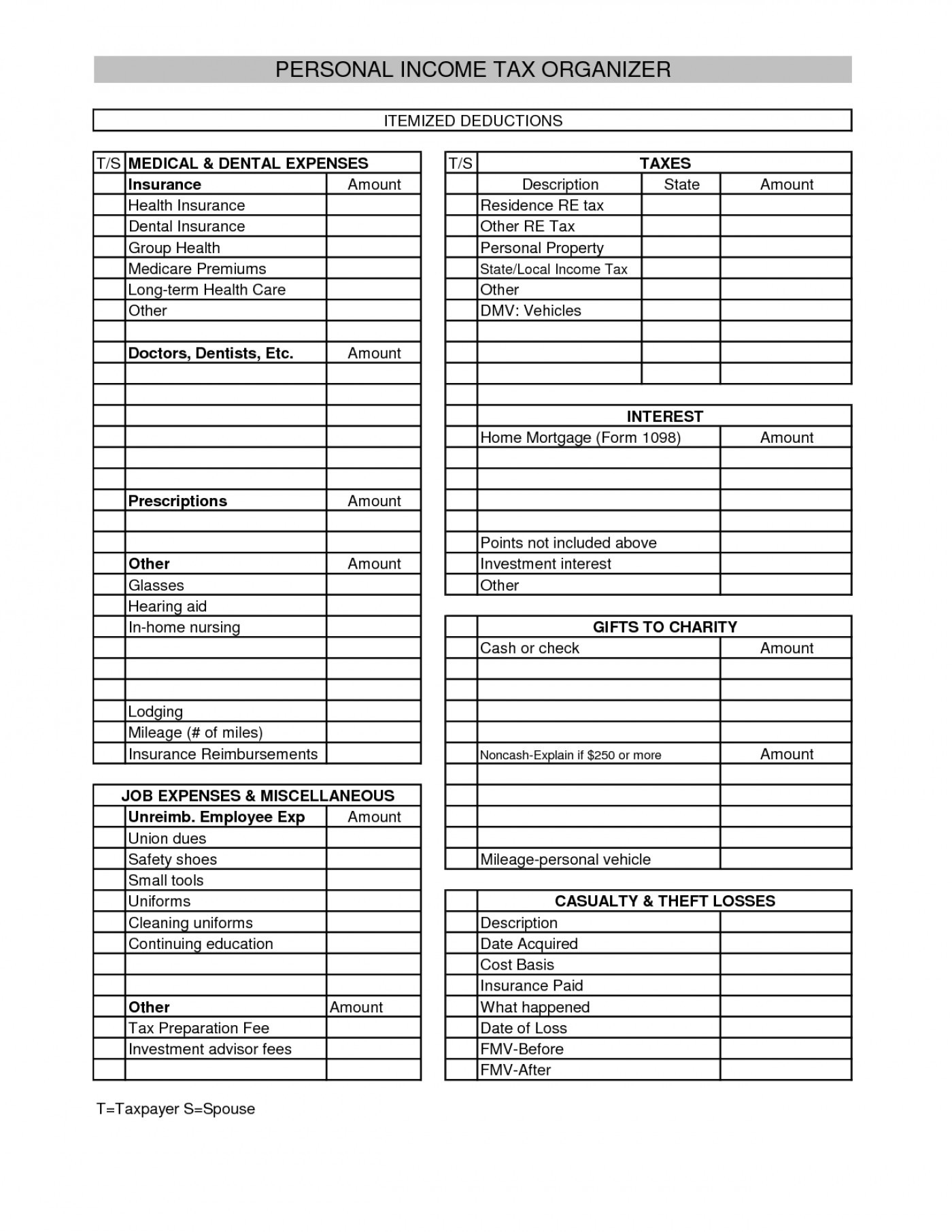

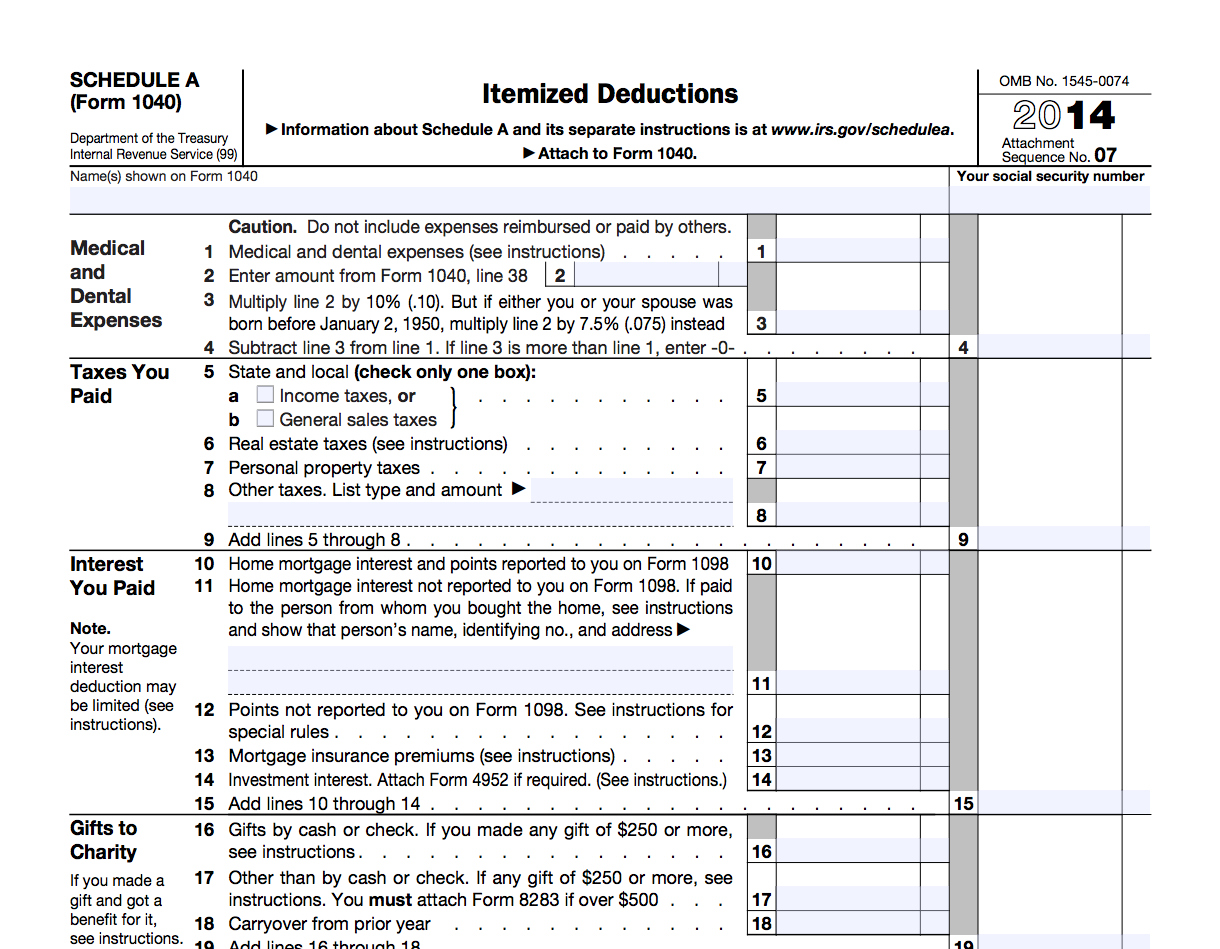

Itemized Deductions Worksheet - Web which deductions can be itemized? 30 enter the larger of the amount on line 29 or your standard deduction. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. Web itemized deductions (2022) beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax purposes whether. Which of these would generally be allowed as an itemized deduction? Mortgage interest you pay on. This deduction is perhaps the most difficult—and financially painful for which. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web an itemized deduction is a qualifying expense you can claim on your tax return to reduce your adjusted gross income. Web see the instructions for “california standard deduction worksheet for dependents” within the form 540 personal income tax booklet to figure your standard deduction. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. This deduction is perhaps the most difficult—and financially painful for which. The. Web an itemized deduction is a qualifying expense you can claim on your tax return to reduce your adjusted gross income. Medical expenses paid by insurance. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. Unreimbursed medical and dental expenses. Web itemized deductions include a. The value of a laptop. (any one contribution of $250 or more needs written evidence) Mortgage interest you pay on. Medical expenses paid by insurance. Web an itemized deduction is a qualifying expense you can claim on your tax return to reduce your adjusted gross income. The value of a laptop. Medical expenses paid by insurance. Web which deductions can be itemized? This deduction is perhaps the most difficult—and financially painful for which. (any one contribution of $250 or more needs written evidence) By lowering your adjusted gross income,. Web worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, itemized deduction work tax year, personal itemized. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web itemized deductions include a range of expenses. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. Web see the instructions for “california standard deduction worksheet for dependents” within the form 540 personal income tax booklet to figure your standard deduction. Mortgage interest you pay on. Unreimbursed medical and dental expenses. Web complete. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Mortgage interest you pay on. The value of a laptop. Web which deductions can be itemized? Medical expenses paid by insurance. By lowering your adjusted gross income,. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. This deduction is perhaps the most difficult—and financially painful for which. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Medical expenses paid by insurance. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. Web see the instructions for “california standard deduction worksheet for dependents” within the form 540 personal income tax booklet to figure your standard deduction. Web we’ll use your 2022 federal standard. The value of a laptop. By lowering your adjusted gross income,. Mortgage interest you pay on. (any one contribution of $250 or more needs written evidence) Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. This deduction is perhaps the most difficult—and financially painful for which. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. Web which deductions can be itemized? 30 enter the larger of the amount on line 29 or your standard deduction. Unreimbursed medical and dental expenses. Medical expenses paid by insurance. Mortgage interest you pay on. Web an itemized deduction is a qualifying expense you can claim on your tax return to reduce your adjusted gross income. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, itemized deduction work tax year, personal itemized. Which of these would generally be allowed as an itemized deduction? Web itemized deductions (2022) beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax purposes whether. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. By lowering your adjusted gross income,. The value of a laptop. Web see the instructions for “california standard deduction worksheet for dependents” within the form 540 personal income tax booklet to figure your standard deduction. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. (any one contribution of $250 or more needs written evidence) Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web unreimbursable employee expenses can be claimed on schedule a as an itemized deduction subject to the 2% adjusted gross income floor (agi) floor. Unreimbursed medical and dental expenses. This deduction is perhaps the most difficult—and financially painful for which. Which of these would generally be allowed as an itemized deduction? Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Web worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized deductions work, itemized deduction work tax year, personal itemized. Web itemized deductions (2022) beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax purposes whether. Medical expenses paid by insurance. Web an itemized deduction is a qualifying expense you can claim on your tax return to reduce your adjusted gross income. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): (any one contribution of $250 or more needs written evidence) Web see the instructions for “california standard deduction worksheet for dependents” within the form 540 personal income tax booklet to figure your standard deduction. By lowering your adjusted gross income,.Small Business Deductions Worksheet petermcfarland.us

Itemized Deductions Worksheet 2017 Printable Worksheets and

Itemized Deduction Worksheet How Many Tax Allowances Should You Claim

8 Tax Itemized Deduction Worksheet /

Itemized Deductions Worksheet 2018 Printable Worksheets and

Printable yearly itemized tax deduction worksheet Fill out & sign

itemized deductions worksheet 20212022 Fill Online, Printable

Printable Itemized Deductions Worksheet

Itemized Deductions Worksheet —

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

30 Enter The Larger Of The Amount On Line 29 Or Your Standard Deduction.

Web Which Deductions Can Be Itemized?

The Value Of A Laptop.

Mortgage Interest You Pay On.

Related Post: