Low Income Credit Worksheet

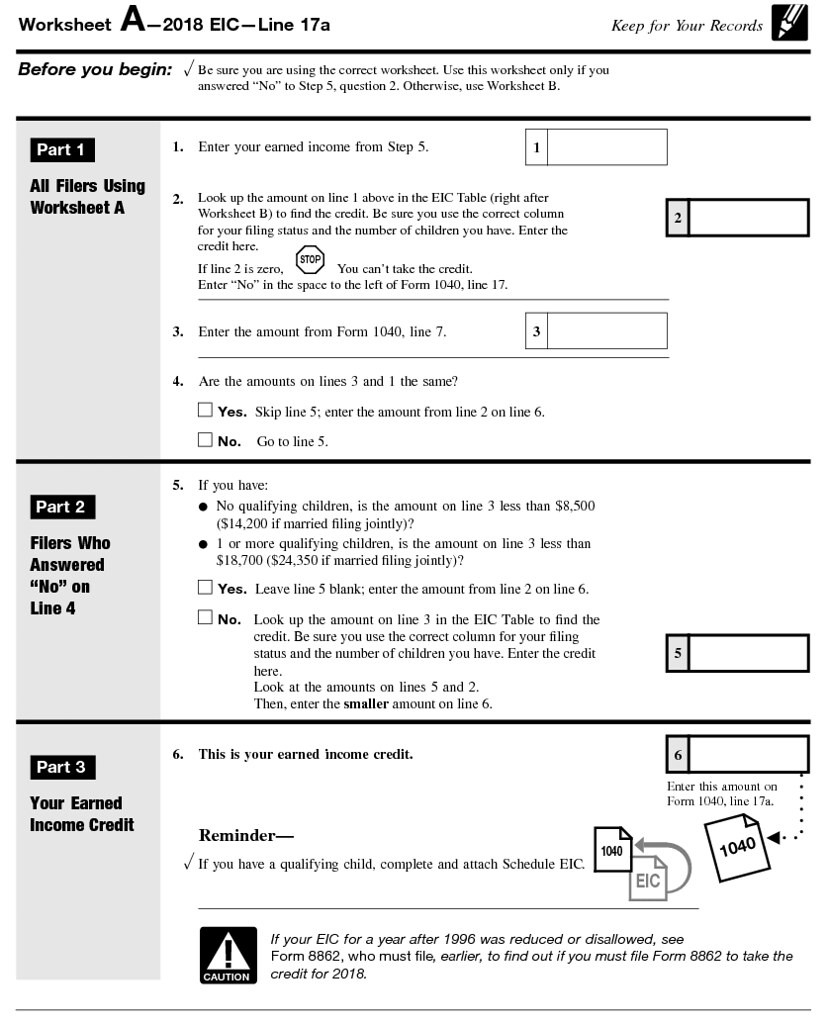

Low Income Credit Worksheet - Web low income credit worksheet the close of the tax year for which the credit may be claimed. Federal adjusted gross income credit under $6,000 $26 $6,000 but not more than $7,999 $20 $8,000 but not more than $9,999 $14 $10,000 but not more than. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. Web you will need the information to claim the credit. Web the rent & income limit calculator can calculate income and rent limits for the following programs: Web the following sections provide information on the various rent calculations that the pha provides to applicants or participants at voucher issuance: Below is an extract from the. Enter the amount from line 6 of the worksheet on the form. Section 42 low income housing tax credits. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh. New virginia earned income tax credit (refundable) credit for low income individuals. Below is an extract from the. Click here for more information on the low income credits available in va. Enter the amount from line 6 of the worksheet on the form. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh. Section 42 low income housing tax credits. Web file taxes with no income; Web you will need the information to claim the credit. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh. Web low income credit worksheet the close of the tax year for which the credit may be claimed. New virginia earned income tax credit (refundable) credit for low income individuals. This program will calculate irc. Web the following sections provide information on the various rent calculations that the pha provides to applicants or participants at voucher issuance: Complete the low. New virginia earned income tax credit (refundable) credit for low income individuals. Complete the low income credit worksheet on page 20 to determine your credit amount. Web the low income credit is a nonrefundable credit. Web the rent & income limit calculator can calculate income and rent limits for the following programs: (qwhu wkh dprxqw iurp )rup /lqh ru )rup. Web the following sections provide information on the various rent calculations that the pha provides to applicants or participants at voucher issuance: This program will calculate irc. Web low income credit worksheet the close of the tax year for which the credit may be claimed. The ncua developed a series of frequently asked. Complete the low income credit worksheet on. Web the low income credit is a nonrefundable credit. Complete the low income credit worksheet on page 20 to determine your credit amount. This program will calculate irc. Web the rent & income limit calculator can calculate income and rent limits for the following programs: Web low income credit worksheet the close of the tax year for which the credit. This program will calculate irc. Below is an extract from the. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh. Web low income credit worksheet the close of the tax year for which the credit may be claimed. Web you will need the information to claim the credit. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. Web the following sections provide information on the various rent calculations that the pha provides to applicants or participants at voucher issuance: Web the low income credit is a nonrefundable credit. This program will calculate irc. Web file taxes with no income; Click here for more information on the low income credits available in va. Web low income credit worksheet the close of the tax year for which the credit may be claimed. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. Web the rent & income limit calculator can calculate income and rent limits for the following programs:. Web the rent & income limit calculator can calculate income and rent limits for the following programs: The ncua developed a series of frequently asked. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. Web you will need the information to claim the credit. Web low income credit worksheet the close of the tax year for which. Below is an extract from the. Web low income credit worksheet the close of the tax year for which the credit may be claimed. Web low income credit worksheet the close of the tax year for which the credit may be claimed. Section 42 low income housing tax credits. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh. Web the following sections provide information on the various rent calculations that the pha provides to applicants or participants at voucher issuance: Enter the amount from line 6 of the worksheet on the form. Web file taxes with no income; New virginia earned income tax credit (refundable) credit for low income individuals. Web you will need the information to claim the credit. Web the low income credit is a nonrefundable credit. Click here for more information on the low income credits available in va. Complete the low income credit worksheet on page 20 to determine your credit amount. Federal adjusted gross income credit under $6,000 $26 $6,000 but not more than $7,999 $20 $8,000 but not more than $9,999 $14 $10,000 but not more than. The ncua developed a series of frequently asked. Web the rent & income limit calculator can calculate income and rent limits for the following programs: This program will calculate irc. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. Web the following sections provide information on the various rent calculations that the pha provides to applicants or participants at voucher issuance: Web file taxes with no income; Complete the low income credit worksheet on page 20 to determine your credit amount. The ncua developed a series of frequently asked. This program will calculate irc. Section 42 low income housing tax credits. Web the low income credit is a nonrefundable credit. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh. Web you will need the information to claim the credit. Federal adjusted gross income credit under $6,000 $26 $6,000 but not more than $7,999 $20 $8,000 but not more than $9,999 $14 $10,000 but not more than. Click here for more information on the low income credits available in va. (qwhu wkh dprxqw iurp )rup /lqh ru )rup (= /lqh (qwhu wkh. Web the rent & income limit calculator can calculate income and rent limits for the following programs: Web low income credit worksheet the close of the tax year for which the credit may be claimed.1040 Eic Worksheet Kidz Activities Via Blogger Bitly2Ury… Flickr — db

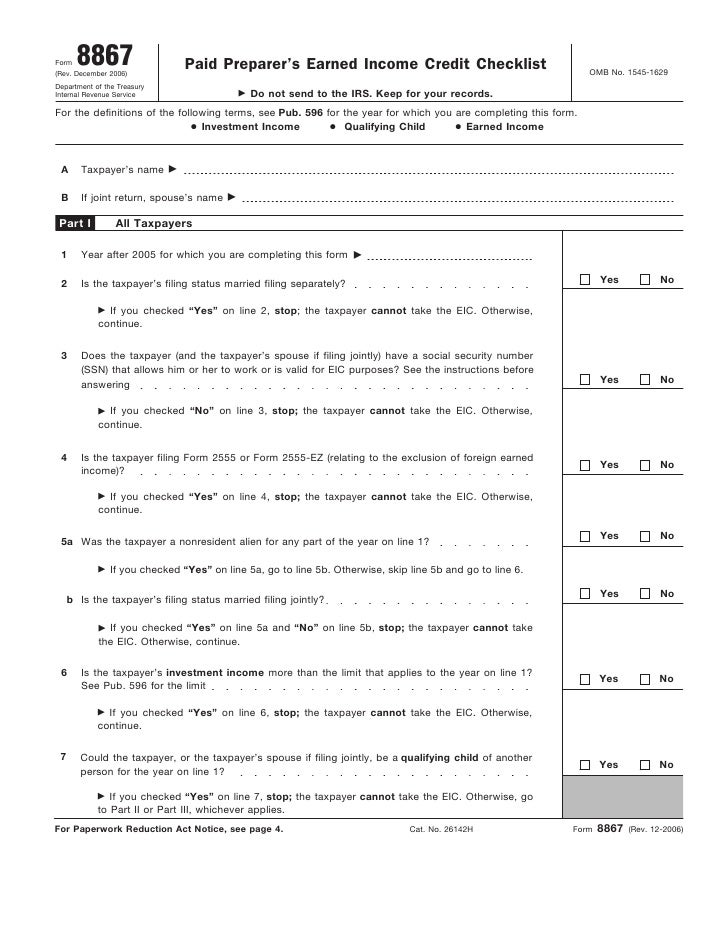

36 Irs Form 886 A Worksheet support worksheet

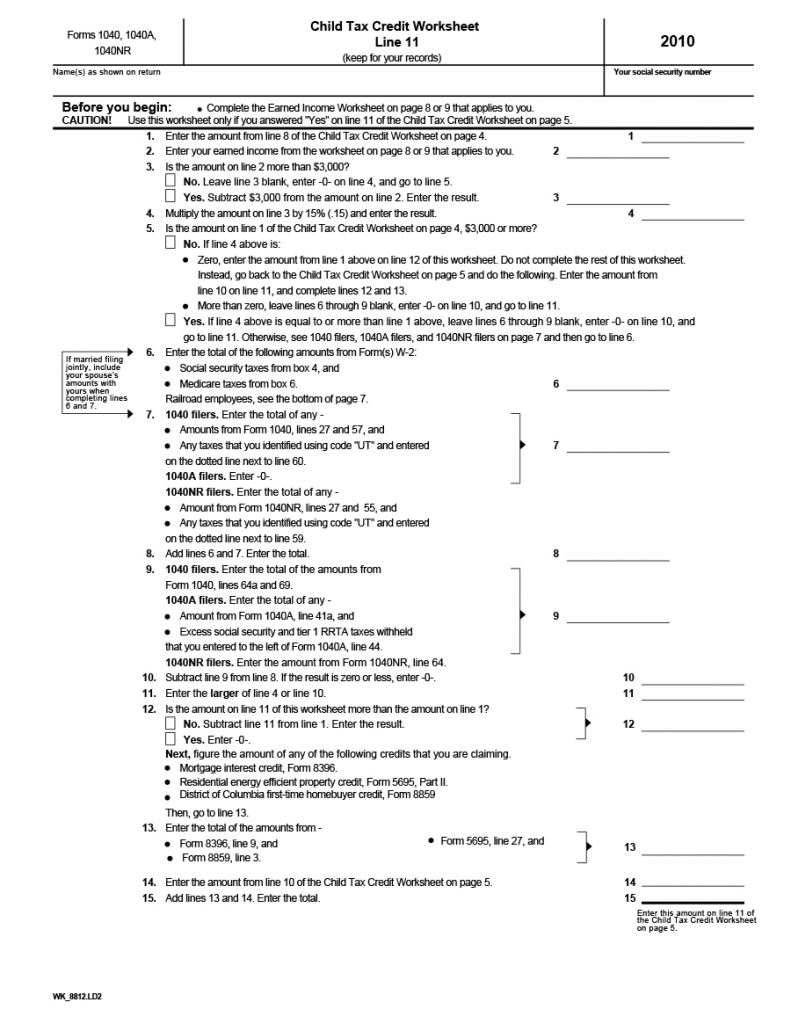

Child Tax Credit Worksheet And Calculator 2015 Child Tax Credit

5 Printable EIC Worksheet /

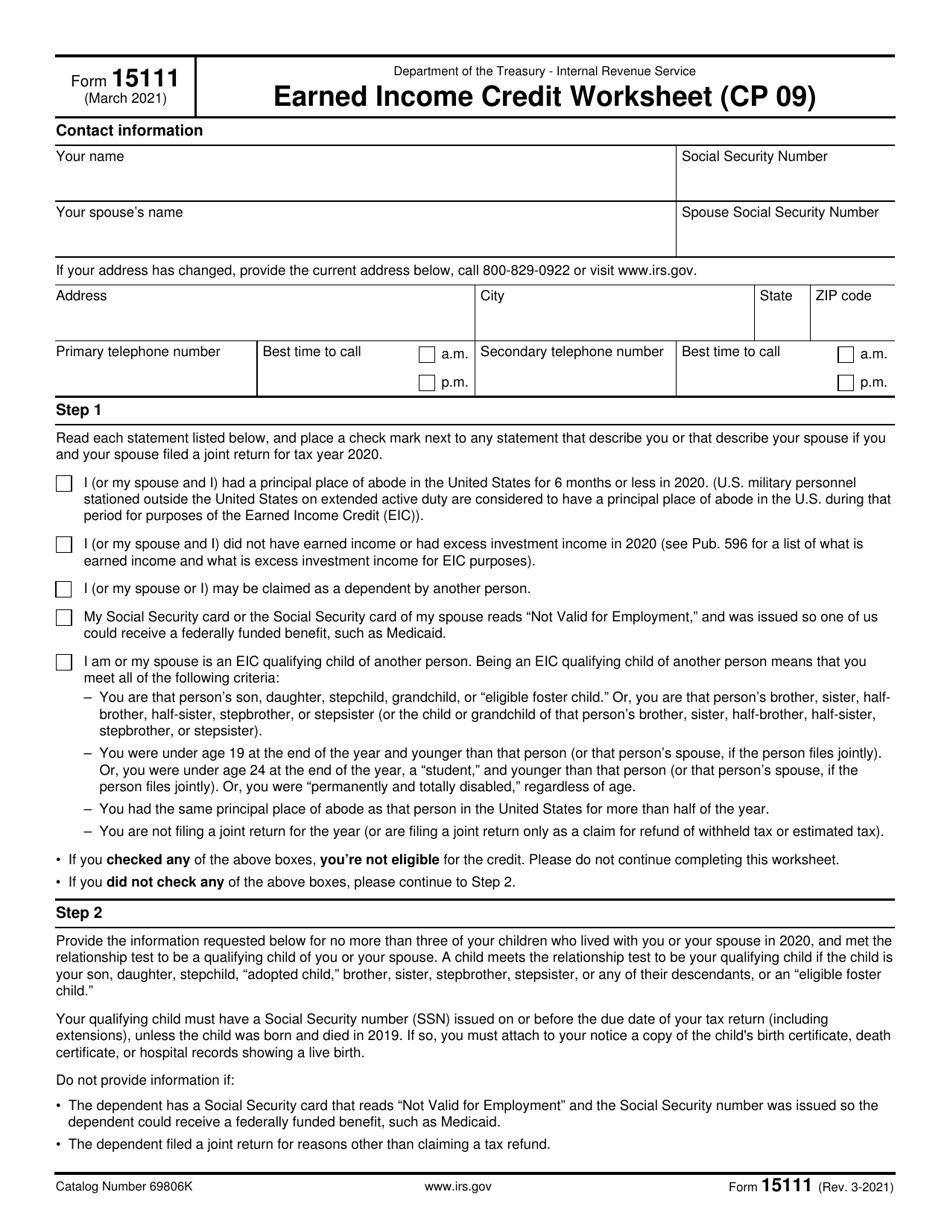

IRS Form 15111 Download Fillable PDF or Fill Online Earned

Worksheet For Filing Taxes Master of Documents

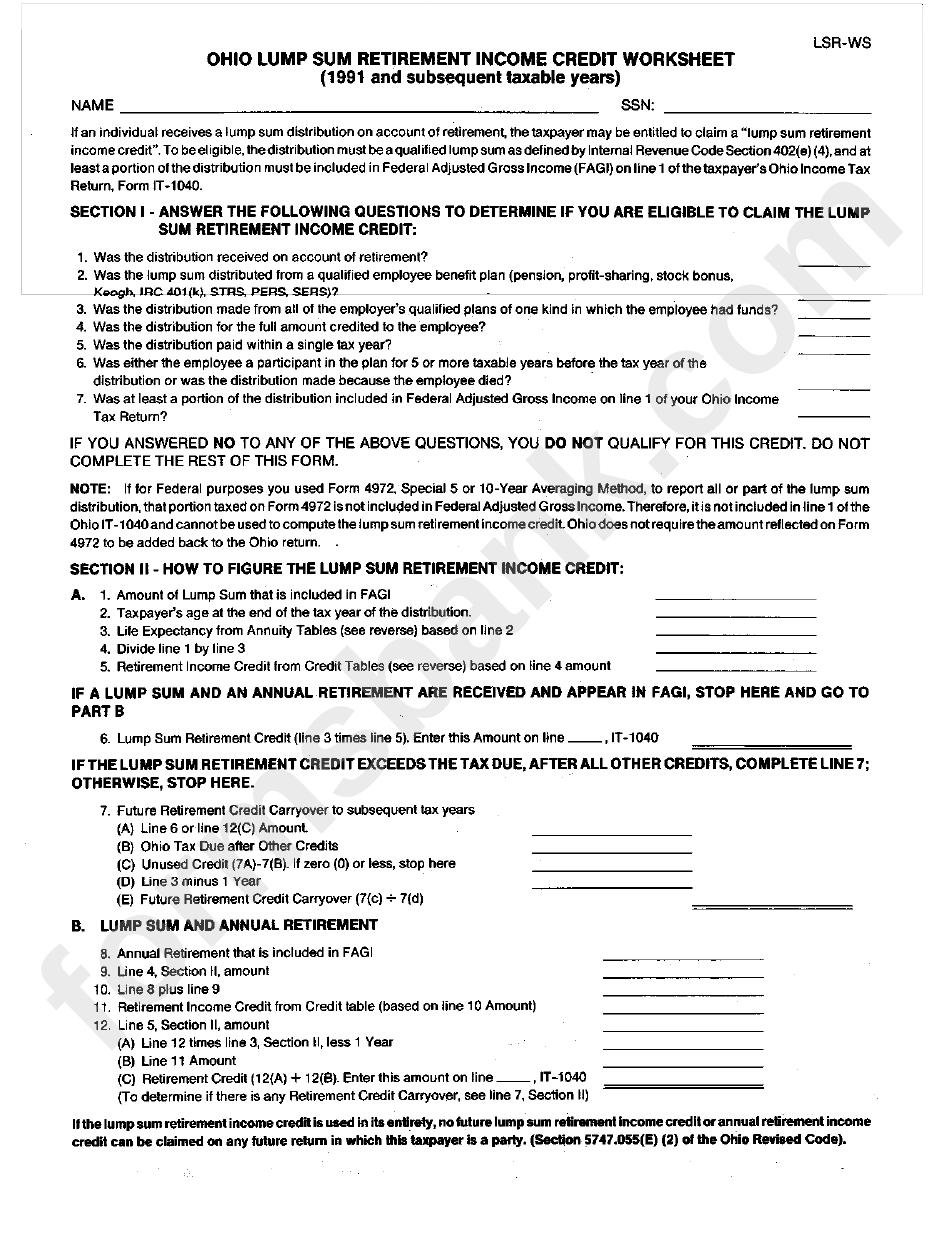

Form LsrWs Ohio Lump Sum Retirement Credit Worksheet

Mary Kay Tax Worksheet Worksheet Resume Examples

Worksheet B Earned Credit Eic Uncategorized Resume Examples

Child Tax Credit Worksheet Qualified Business Deduction Tom

Below Is An Extract From The.

Enter The Amount From Line 6 Of The Worksheet On The Form.

New Virginia Earned Income Tax Credit (Refundable) Credit For Low Income Individuals.

Web Low Income Credit Worksheet The Close Of The Tax Year For Which The Credit May Be Claimed.

Related Post: