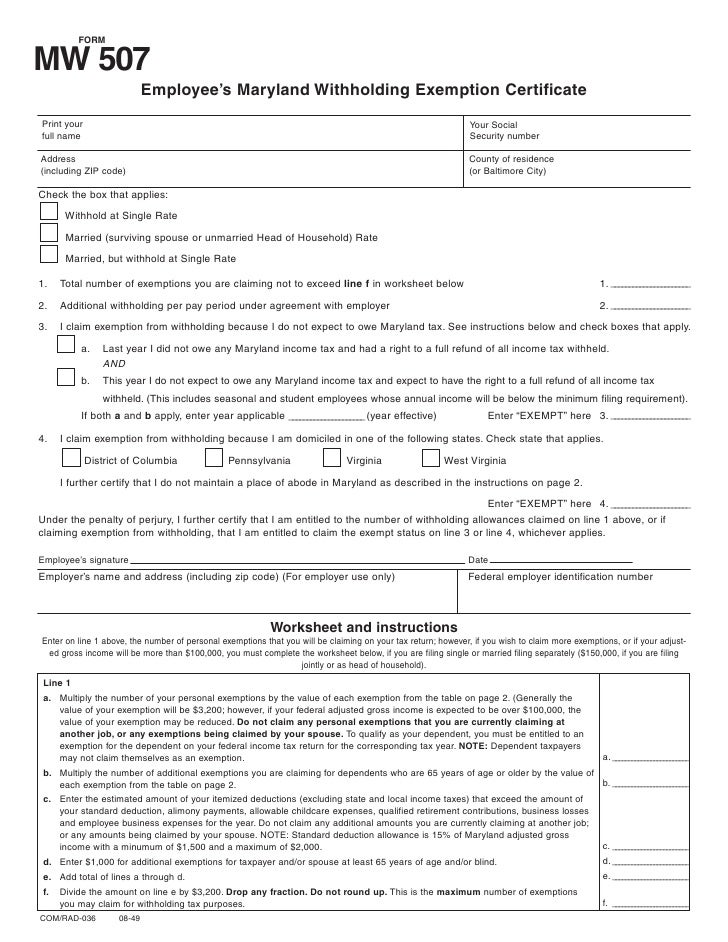

Maryland Personal Exemption Worksheet

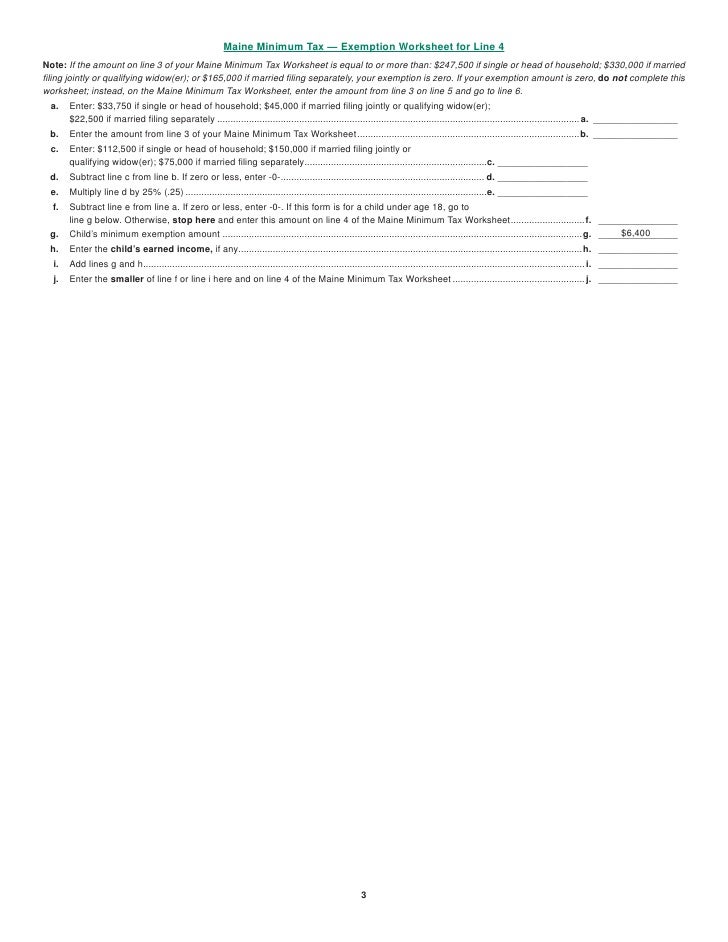

Maryland Personal Exemption Worksheet - Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. I claim exemption from maryland local tax because i live in a local pennsylvania jurisdiction that does not impose an. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. Web personal exemptions worksheet line 1 a. Web we last updated the employee's maryland withholding exemption certificate in january 2023, so this is the latest version of mw507, fully updated for tax year 2022. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately ($150,000, if you. State and local income taxes included in federal schedule a, line 5 (or from worksheet in instruction 14). Web exemption amount chart the personal exemption is $3,200. Web personal exemptions worksheet if you will file your tax return if your federal agi is single or married filing separately your exemption is joint, head of household or qualifying. Total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2. Multiply the number of your personal exemptions by the value of each exemption from the table below. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2.. Web enter exempt here and on line 4 of form mw507. Web tax return, you cannot claim exemption from withholding if your income exceeds $950 and includes more than $300 of unearned income (for example, interest and dividends). Total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2. Maryland worksheet is. State and local income taxes included in federal schedule a, line 5 (or from worksheet in instruction 14). Use this information on the pvw to complete the pv form. Web once you have submitted the information, this system will generate a pvw worksheet. County or baltimore city where you are employed. Web we last updated the employee's maryland withholding exemption. Additional withholding per pay period under. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately ($150,000, if you. Web enter exempt here and on line 4 of form mw507. I certify that i am a legal resident of thestate of and. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. State and local income taxes included in federal schedule a, line 5 (or from worksheet in instruction 14). Web exemption amount chart. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000. Maryland worksheet is available online at. Web form mw507 is the state of maryland’s withholding exemption certificate. Web enter exempt here and on line 4 of form mw507. Web we last updated the employee's maryland withholding exemption certificate in january 2023, so this is the latest version of mw507, fully updated for tax year 2022. Additional withholding per pay period under. Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete. State and local income taxes included in federal schedule a, line 5 (or from worksheet in instruction 14). This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000. Total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2. Web personal exemptions worksheet line 1 a. Web we. Web personal exemptions worksheet if you will file your tax return if your federal agi is single or married filing separately your exemption is joint, head of household or qualifying. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. Maryland worksheet is available online at. Web. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. State and local income taxes included in federal schedule a, line 5 (or from worksheet in instruction 14). Web tax return, you cannot claim exemption from withholding if your income exceeds $950 and includes more than $300. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web enter exempt here and on line 4 of form mw507. Total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2. Web personal exemptions worksheet if you will file your tax return if your federal agi is single or married filing separately your exemption is joint, head of household or qualifying. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. County or baltimore city where you are employed. Web tax return, you cannot claim exemption from withholding if your income exceeds $950 and includes more than $300 of unearned income (for example, interest and dividends). Additional withholding per pay period under. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or married filing separately ($150,000, if you are filing. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000. I claim exemption from maryland local tax because i live in a local pennsylvania jurisdiction that does not impose an. Web maryland adjusted gross income: Web personal exemptions worksheet line 1 a. Web once you have submitted the information, this system will generate a pvw worksheet. State and local income taxes included in federal schedule a, line 5 (or from worksheet in instruction 14). Web exemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing single or married filing separately ($150,000, if you. Maryland worksheet is available online at. Use this information on the pvw to complete the pv form. Multiply the number of your personal exemptions by the value of each exemption from the table below. Multiply the number of your personal exemptions by the value of each exemption from the table below. I claim exemption from maryland local tax because i live in a local pennsylvania jurisdiction that does not impose an. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web enter exempt here and on line 4 of form mw507. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. County or baltimore city where you are employed. Web exemption amount chart the personal exemption is $3,200. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000. Web we last updated the employee's maryland withholding exemption certificate in january 2023, so this is the latest version of mw507, fully updated for tax year 2022. Web maryland adjusted gross income: Web once you have submitted the information, this system will generate a pvw worksheet. Additional withholding per pay period under. Maryland worksheet is available online at. Total number of exemptions you are claiming not to exceed line f in personal exemption worksheet on page 2. Use this information on the pvw to complete the pv form.Minimum Tax worksheet

maryland personal exemption worksheet

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

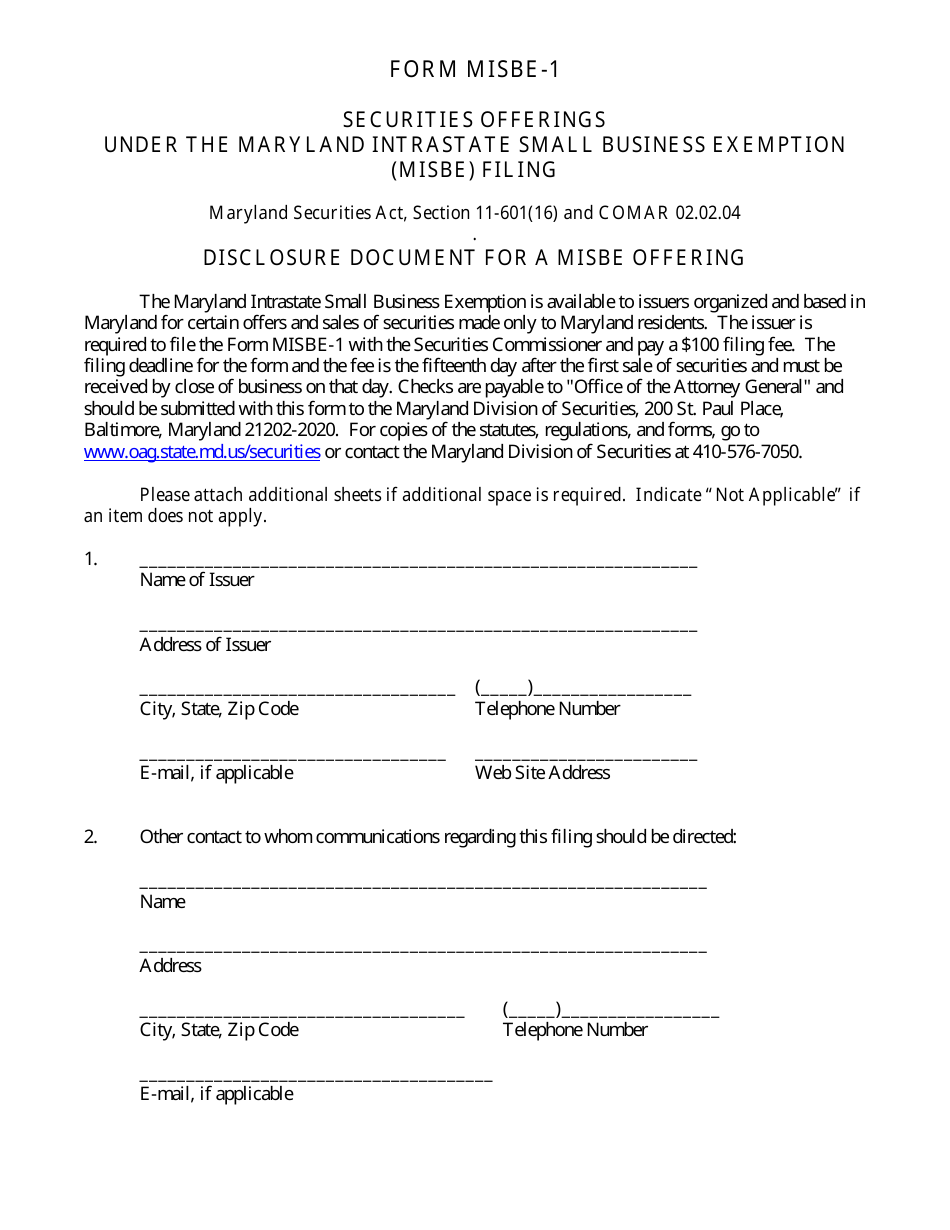

Form MISBE1 Download Printable PDF or Fill Online Notice of Maryland

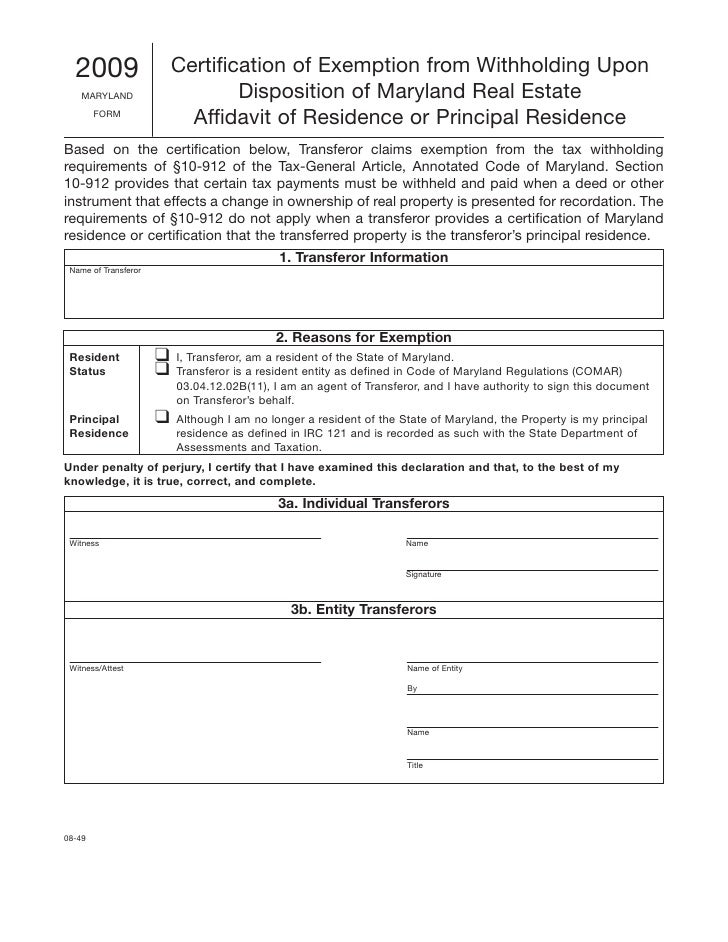

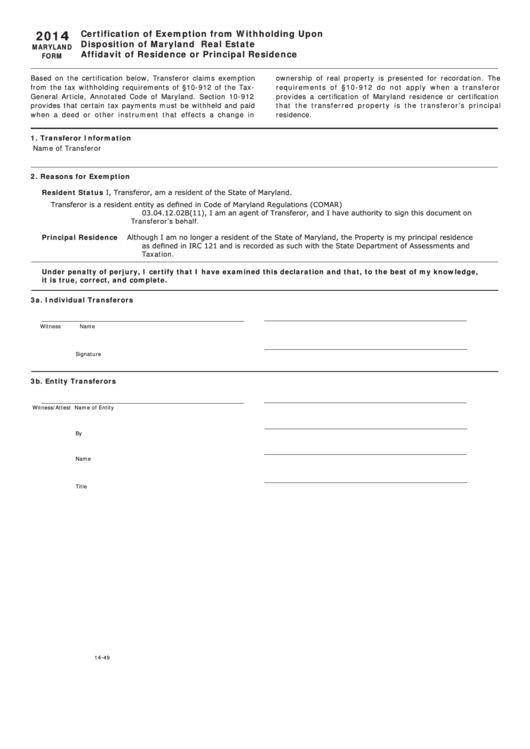

Certificate of Exemption from Withholding Upon Disposition of Marylan…

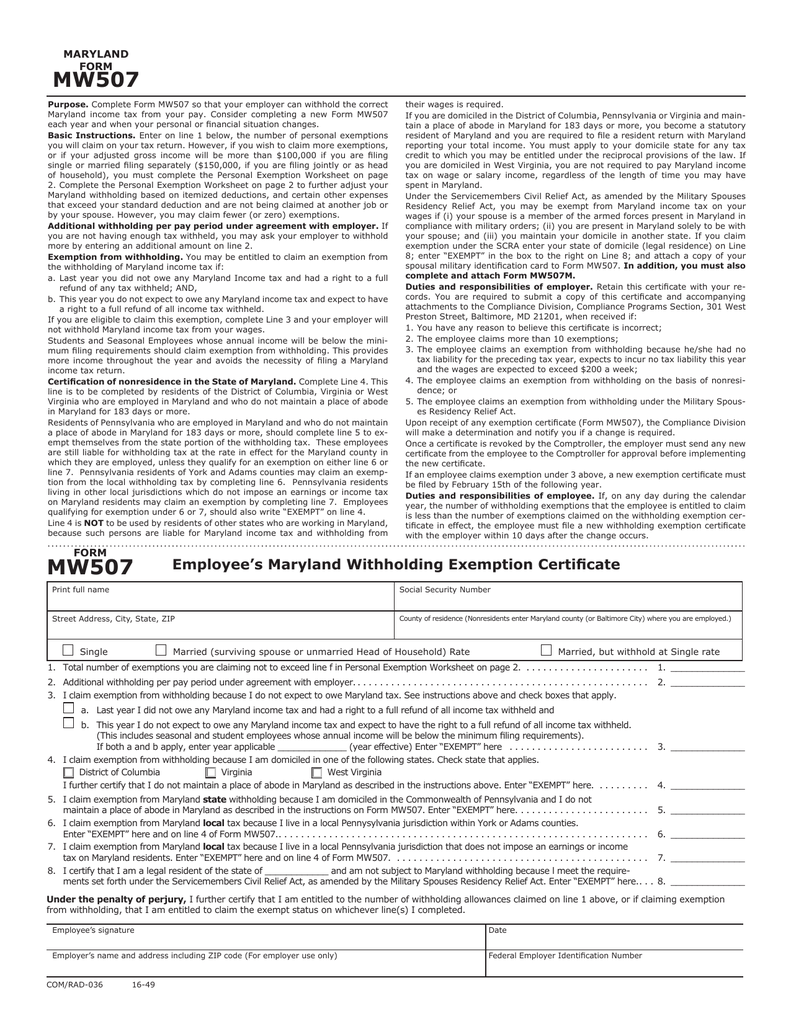

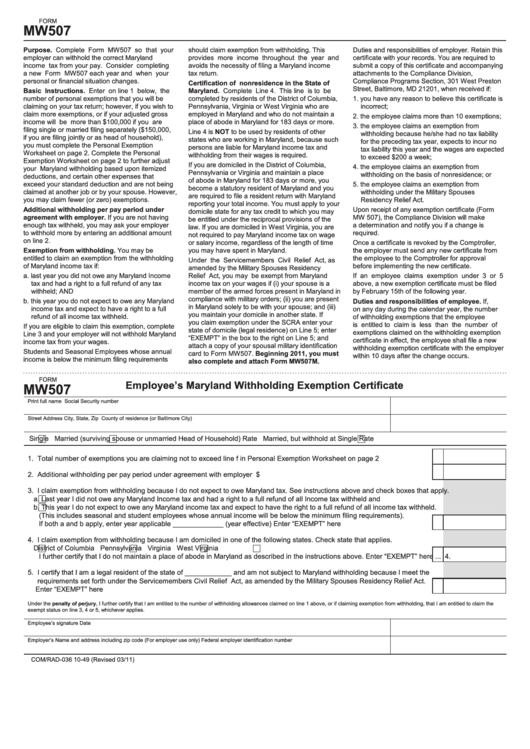

MW507 MARYLAND FORM

Form Mw507 Employee's Maryland Withholding Exemption Certificate

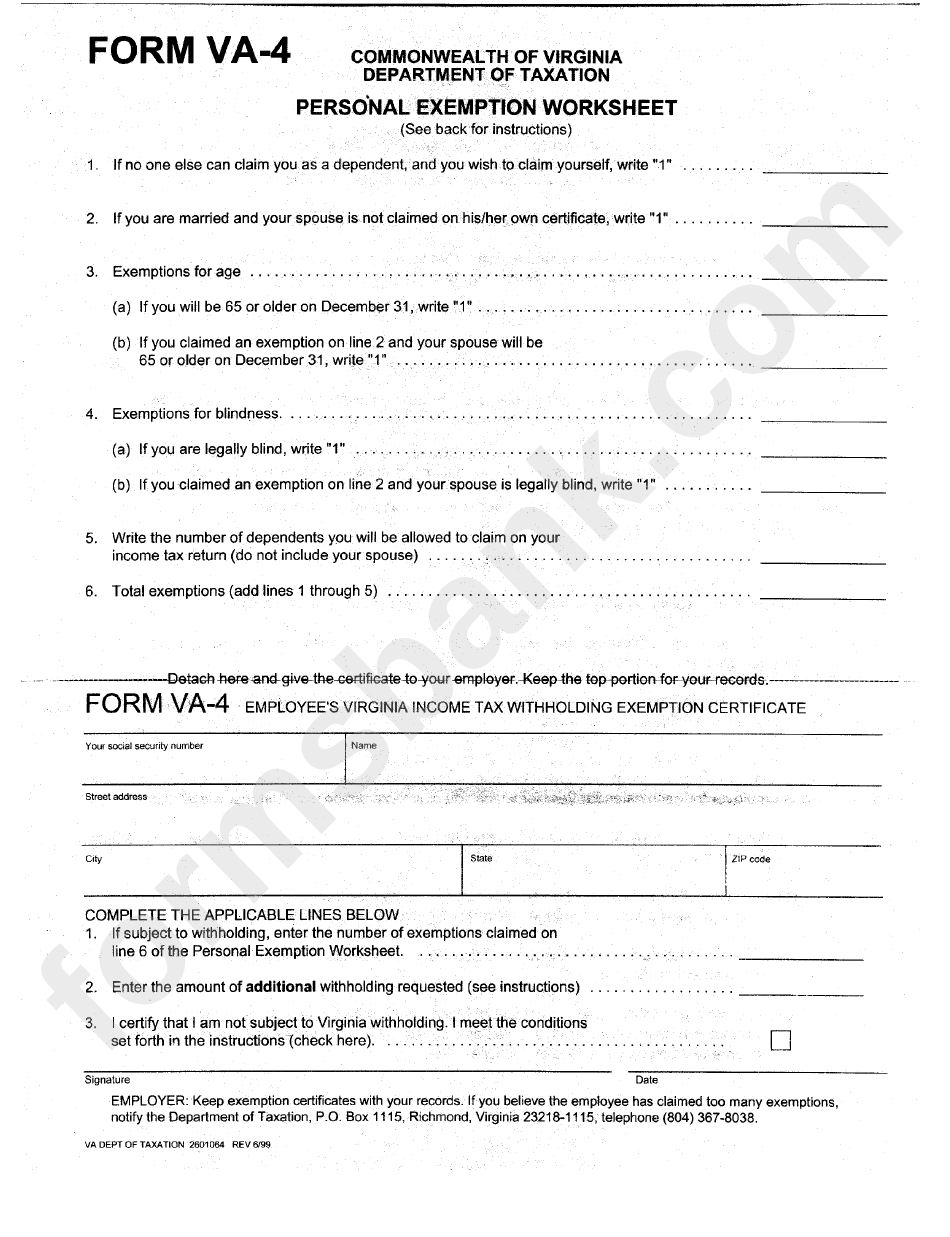

Form Va4 Personal Exemption Worksheet printable pdf download

maryland personal exemption worksheet

Fillable Certification Of Exemption From Withholding Upon Disposition

Web Personal Exemptions Worksheet If You Will File Your Tax Return If Your Federal Agi Is Single Or Married Filing Separately Your Exemption Is Joint, Head Of Household Or Qualifying.

State And Local Income Taxes Included In Federal Schedule A, Line 5 (Or From Worksheet In Instruction 14).

Web Personal Exemptions Worksheet Line 1 A.

Web Tax Return, You Cannot Claim Exemption From Withholding If Your Income Exceeds $950 And Includes More Than $300 Of Unearned Income (For Example, Interest And Dividends).

Related Post:

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://data.formsbank.com/pdf_docs_html/269/2691/269110/page_1_thumb_big.png)